Owners of residential, commercial, industrial properties in Mahabubnagar, Telangana should pay the property tax every year. The Mahabubnagar Municipality is the local body that collects property tax. The government offers rebates on paying property tax on time that significantly reduces the property tax amount. One can easily pay the property tax Mahabubnagar online by entering his PTIN number of his door number. For those who are not comfortable online, have the option to pay the property tax offline. Check out both the methods here.

Check how to pay Sangareddy Municipality property tax

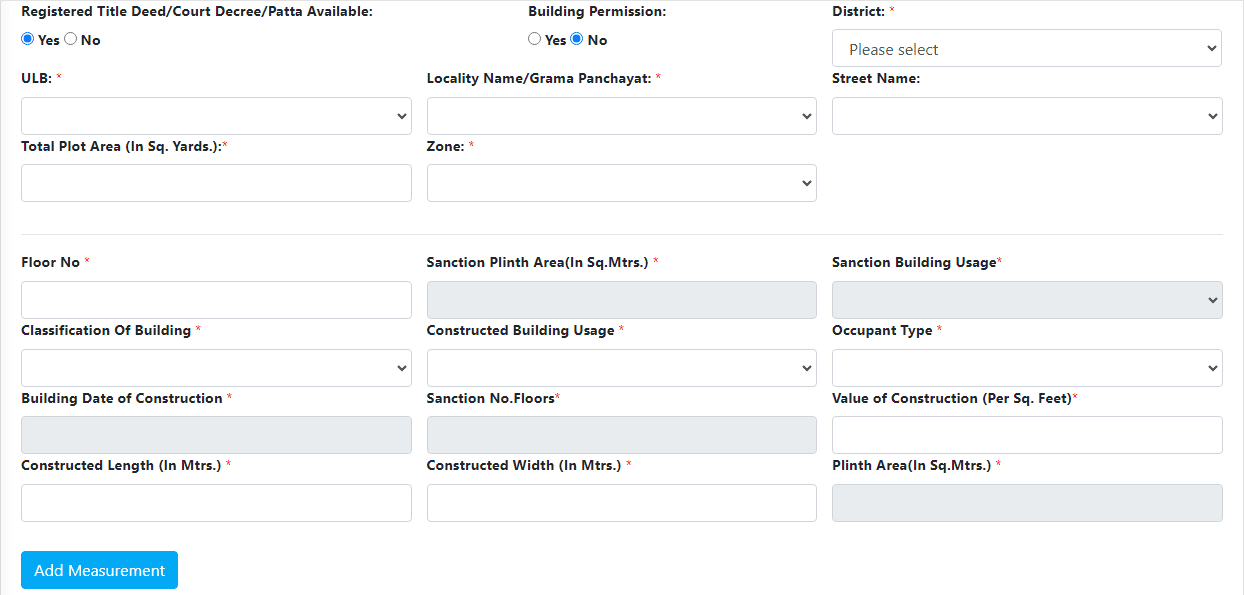

Mahabubnagar Property Tax: Factors influencing calculation

The factors based on which the property tax is calculated are given below.

- Title deed

- Permission of the building

- District

- Locality name

- ULB

- Street name

- Zone

- Total plot area

- Number of floors

- Building usage

- Type of building

- Plinth area

- Type of occupant

- Age of building

- Annual Rental Value (ARV)

How to calculate Mahabubnagar Property Tax online?

You can use the tax calculator to calculate the Mahabubnagar Property Tax.

- Visit https://cdma.cgg.gov.in/cdma_arbs/CDMA_PG/PTMenu

- Click on ‘Property Tax Calculation’ and enter details. Click on add measurement.

Mahabubnagar Property Tax: What is PTIN number?

PTIN number is a 10 digit unique property number associated with your property. With this number, you will get all details related to your property and this is also used to pay your property tax.

How to pay Mahabubnagar Property Tax online?

- Visit https://mahabubnagarmunicipality.telangana.gov.in/ and under citizen services click on ‘Pay Property Tax Online’.

- You will reach here https://cdma.cgg.gov.in/cdma_arbs/CDMA_PG/PTMenu

- Click on ‘Property Tax Payment’.

Enter ‘PTI Number’ and click on ‘Know Property Tax Dues’ and proceed with payment.

Alternatively you can pay property tax using door number. For this click on ‘Property Tax Payment’ by Door Number. Enter details, such as district, ULB, PTIN number, Door number and click on ‘Get Property Details’ and proceed with payment.

How to check your payment status?

On https://cdma.cgg.gov.in/cdma_arbs/CDMA_PG/PTMenu , click on payment status. You will reach here:

Select Payment Type as Property Tax. Enter PTIN/Assessment number and click on ‘Get Details’.

What are online services related to Mahabubnagar Property Tax on online portal?

- Apply self-assessment of structured properties

- Property tax exemption

- Download assessment exemption certificate

- Reassessment application

- Apply SA deemed certificate with digital signature

- Mutation

- Vacancy remission

- Revision petition

- Appeal petition

- Property tax calculation

- Assessment cancellation

- Check assessment status

- Download assessment certificate

- Download assessment certificate old

- Download mutation certificate

- Feedback report

- Feedback

- Mutation payment receipt

- View assessment details

- Download assessment revision certificate

How to pay Mahabubnagar Property Tax offline?

- You can pay the Mahabubnagar Property Tax offline by visiting the ward office.

- Fill in the application form and submit it with supporting documents.

- Make the payment and get an acknowledgment certificate.

What is the last date to pay the Mahabubnagar Property Tax?

April 30 of every financial year is the last date to pay the Mahabubnagar Property Tax.

What is the rebate offered for paying the Mahabubnagar Property Tax on time?

Property owners can get a rebate of 5% on timely payment of property tax in Mahabubnagar.

What is the penalty for late payment of the Mahabubnagar Property Tax?

A penalty of around 2% on total amount paid will be levied on paying the Mahabubnagar Property Tax late.

Mahabubnagar Property Tax: Mutation

If the property is transferred to another one, then mutation process should be followed to replace the new name in the municipal records.

Documents required

- Sale deed

- Will deed

- Legal heir copy

- Partition deed

- Gift deed

- Release deed

- Revocation deed

- Cancel deed

- Settlement deed

What is the Mahabubnagar Property Tax mutation process?

- Click on ‘Mutation’ on the CDMA website.

- Enter mobile number and click on OTP.

- Fill in the form, upload supporting documents and click on submit.

- You will see the application ID and the application will be forwarded to the revenue inspector for verification.

- Once approved, it will be sent to RO for approval.

- After this, it will be sent to the municipal commissioner for approval.

- The property owner should make payment and the mutation process is complete.

Mahabubnagar Property Tax: Contact details

E-mail id: cdmasupport@cgg.gov.in

Technical support: 040 2312 0410 (10 AM to 5 PM on all working days)

Housing.com POV

Payment of the Mahabubnagar Property Tax within the deadline is very important as one can use the rebate offered by the state government. If you delay the payment, you may pay a penalty or lose your property which may be attached and auctioned.

FAQs

Who collects the Mahabubnagar Property Tax?

The Mahabubnagar Municipality collects the Mahabubnagar Property Tax.

What is the penalty for late payment of the Mahabubnagar Property Tax?

A penalty of 2% on the pending amount should be charged for the late payment of the tax.

What are the various ways of property tax payment in Mahabubnagar?

One can pay the Mahabubnagar Property Tax through the online portal or by visiting the nearby ward office.

Is there any charge associated for paying property tax online in Mahabubnagar?

There is no charge associated for paying property tax online in Mahabubnagar.

How can you check the property tax to be paid in Mahabubnagar?

You can check the property tax to be paid in Mahabubnagar through the PTIN number.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at Jhumur Ghosh |