A gift of property is giving ownership of one’s property to anyone through a gift deed. Gifting a property through a gift deed to a near and dear one, has certain monetary implications that you should consider first. This guide covers most asked queries about gift deed including format of gift deed, house gift deed, gift deed rules etc.

What is a gift deed 2025?

A gift deed is an agreement that is used, when a person wishes to gift his property or money to someone else. The person who gifts the movable property, immovable property is known as the donor and person who receives it is known as the donee.

Benefits of gift deed

- A registered gift deed is an evidence.

- Unlike in the case of a will, the transfer of property is instant and you will not be required to go to the court of law for execution of gift deed. Hence, deed of gift also saves time.

See also: What is a title deed?

What gifts should be in a gift deed format?

A movable property, or immovable property, or an existing property that is transferable, can be gifted and require a gift deed. Having a registered gift deed, will help you avoid any litigation that comes up thereafter.

See also: Coparcener meaning in HUF context

Gift deed rules to be followed

Before gifting a property through gift deed, keep a note of the following points.

Sound health

The donor while executing the gift deed should be in sound mental and physical health so that the gift deed is transferred willfully and not by force.

Non-future property

The property that has to be gifted should exist and should not be something that will come up in future.

Encumbrance free

The property that is planned to be gifted should be free of any encumbrances like legal disputes, mortgages or liens. The donor should verify this by doing a thorough title search and then only proceed with executing the gift deed.

What is the format of gift deed 2025?

- Place and date on which the gift deed is to be executed.

- Relevant information on gift deed regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures.

- Complete details about the property for which you draft a gift deed.

- Two witnesses.

- Depending on the value determined by the state government, the gift deed must be printed on stamp paper after paying the required amount and the gift deed should be registered at the registrar or sub-registrar’s office.

What are the clauses to be mentioned in property gift deed format?

There’s no money or force involved

Make sure that you add this consideration clause to the gift deed. It must be indicated that there is no exchange of money and that the gift deed is made solely out of love and affection and not due to money or coercion.

You are the owner of your property when you gift

Only the owner can gift a property. If you are not the owner (title holder) of the property, you cannot give a property as gift deed it to someone else, even in anticipation.

Describe the property

All information pertaining to the property, such as the structure, type of property, address, area, location, etc., must be mentioned in the property gift deed format.

Relationship between the donor and the donee

If the donor and donee are blood relatives, some state governments may offer a concession on stamp duty. Even otherwise, it is important to establish the relationship between the donor and done in the property gift deed format.

Mention liabilities

If there are rights or liabilities attached to the gift, such as whether the donee can sell or lease the property, etc., such clauses should be mentioned in the gift deed.

Delivery clause

This on the gift deed mentions the expressed or implied action of delivery of possession of the property.

Revocation of the gift

The donor can also mention clearly if he/she wants a revocation clause to be adhered to the gift deed by the donee. Both, the donor and donee, must agree on this gift deed clause.

Maintenance Clause

According to a recent Supreme Court judgment, parents who gift their property in return of being cared for, must insert the maintenance clause in the gift deed. If this is not done, the gift deed becomes irrevocable even if the children don’t care for the parents.

See also: What is conveyance deed meaning

Disadvantages of property gift deed

Mentioned are disadvantages of the property gift deed.

Irrevocable

Once executed, it is very difficult to revoke the gift deed, unless there is a strong evidence for the need of it. For things like change of mind etc. this is not possible and hence one has to be sure before executing the gift deed.

No control on property

Once the gift deed has been executed, the donor will have no control on the property gifted with the donee gaining full authority.

Can be misused

A donee can misuse the established system to avoid paying taxes.

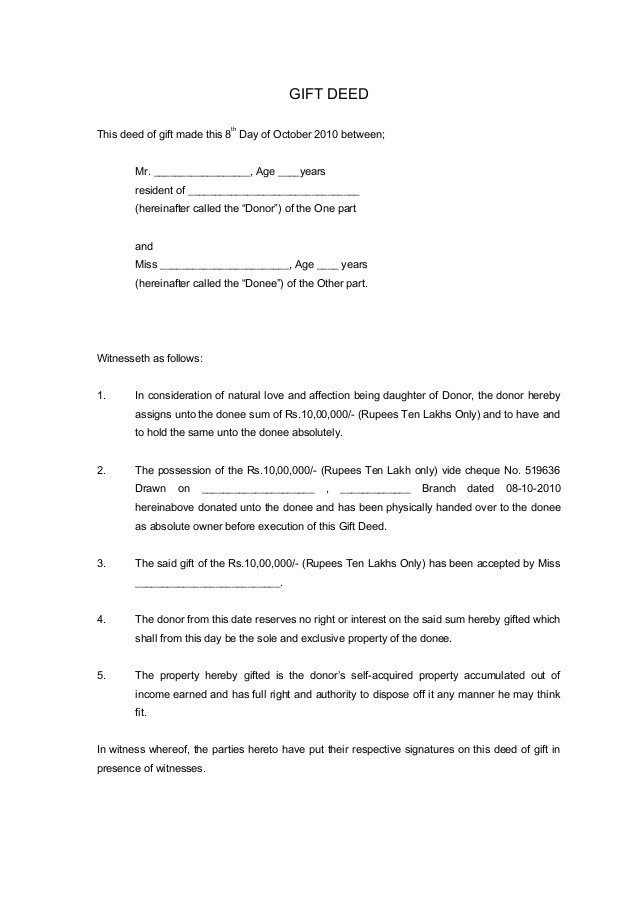

Gift deed format

Gift deed registration

As per the transfer of property Act 1882, only when it is registered is a Gift Deed valid. The Gift Deed registration includes the donor’s signature and the donee and attestation by two witnesses.

Gift deed registration: Documents required

Apart from the aforementioned documents, you will need to produce the original gift deed, as well as ID proof, PAN card, Aadhaar card, the sale deed of the property, as well as other documents pertaining to other agreements regarding this property.

Stamp duty on gift deed registration

| State | Stamp duty for gift deed |

| Delhi | Men: 6%

Women: 4% |

| Gujarat | 4.9% of the market value |

| Karnataka | Family members: Rs 1,000- 5,000

Non-family: 5.6% of the land value |

| Maharashtra | Family members: 3%

Other relatives: 5% Agricultural land/ residential property: Rs 200 |

| Punjab | Family members: NIL

Non-family: 6% |

| Rajasthan | Men: 5%

Women: 4% and 3% SC/ST or BPL: 3% Widow: None To wife: 1% Immediate family: 2.5% |

| Tamil Nadu | Family members: 1%

Non-family: 7% |

| Uttar Pradesh | Rs 5,000 for property exchange among blood relatives + Rs 1, 000 processing fee

5% for others |

| West Bengal | Family members: Rs 1,000

Non-family: 6% Above Rs 40 lakh: Surcharge of 1% |

For gift deed registration, you will be required to pay the stamp duty, which varies from state to state. You can also pay the stamp duty online or at the registrar’s office.

See also: Partition deed: Everything you need to know

How to calculate approximate stamp duty on gift deed registration?

- You can calculate the stamp duty on gift deed by visiting the official website of the stamp and registration department of a state.

- Click on stamp duty calculator and choose gift as the option.

- Enter details and you will get an approximate value of the stamp duty to be paid for gift deed registration.

Income tax on gift deed

Gift deed have to be declared in the Income Tax Returns (ITR). In 1998, the Gift Tax Act of 1958 was abolished, only to be reintroduced in 2004. Therefore, in case you have been gifted an immovable property as a gift deed, you will have to pay tax, if its stamp duty value exceeds Rs 50,000 and if the property is received without necessary consideration. For example, if the consideration is Rs 1.5 lakh while the stamp duty was Rs 4 lakh, the difference between the two exceeds Rs 50,000.

Tax exemptions for gift deed

If the property has been received from any of the following, then, the above clause shall not apply and the donee will not be taxed:

- If gift deed received from relatives by an individual and from a member by a HUF.

- If gift deed received on the occasion of the marriage of the individual.

- If gift deed received under a will or by way of inheritance.

- If gift deed received in contemplation of death of the payer or donor.

- If gift deed received from a local authority (as defined in Explanation to Section 10(20) of the Income-tax Act).

- If gift deed received from any fund, foundation, university, other educational institution, hospital or other medical institution, any trust or institution referred to in Section 10(23C).

- If gift deed received from a trust or institution registered under Section 12AA.

What if you want to gift property after demise?

If you want to gift a property after demise, you can do that through a will.

What if gift deed is not accepted?

If the recipient doesn’t accept the gift deed till the time the donor is alive, the gift deed is considered void.

Gift Deed versus Will: The difference

| Gift deed | Will |

| Gift deed are functional even during the lifetime of the donor. | Operates only after the death of the testator. |

| Gift deed cannot be revoked/ can be revoked only under specified circumstances. | Can be revoked many times. |

| Property gift deed format is required to be registered under Section 123 of Transfer of Property Act, 1882 and Section 17 of the Registration Act, 1908. | Need not be registered. |

| For registered gift deed, charges include stamp duty and registration charges. | A will is comparatively cheaper. |

| Gift deed falls under the ambit of Income Tax. | Governed by the Law of Succession. |

Also know all about release deed

Can a property gift deed be revoked?

After the property has been gifted, lawfully, it becomes the donee’s and cannot be revoked easily. However, according to Section 126 of the Transfer of Property Act, 1882, revoking of a gift deed may be allowed under certain circumstances:

- If the gift deed was made due to coercion or fraud.

- If it is determined that the grounds of gift deed were immoral, illegitimate or reprehensible.

- If it was agreed upon from the beginning that the gift deed is revocable under certain circumstances.

In such cases, even in the event of the death of the donor, his legal heirs can go ahead with the gift deed revocation.

Can a gift deed be revoked through mutual agreement?

In case a condition is not fulfilled and is not part of the gift deed but a separate mutual agreement form that is part of the gift transaction, the gift deed can be revoked by mutual agreement.

However, note that a gift deed will not be cancelled if the same wasn’t based on misinterpretation or fraud. An individual cannot cancel a gift deed unilaterally. It has to be challenged in the court. Note that anyone who tries to challenge the Gift deed must prove that execution was not acknowledged by the donor and done by a fraud practice.

See also: Can gift deed be revoked

User queries regarding Gift deed stamp duty

Q: I want to gift my flat located in Mumbai to my mother which is under construction with 90% completion and possession due in next 6 months. Agreement for sale is done on my name and I am ready to register gift to registrar office. Also there is home loan which is going on same property on me. Is it possible that I gift property to my mother?

Advocate Neelam Mayuresh Pawar says, “You can gift the property to your mother even if there is an ongoing home loan, but there are additional legal and procedural steps involved. The key issue lies in the bank’s interest in the property due to the mortgage.

- Obtain bank’s consent:

The home loan lender (bank) holds a lien on the property as security for the loan. Without the bank’s consent, you cannot transfer ownership of the property.

Visit your bank and explain your intent to gift the property to your mother.

The bank may:

Allow the gift while keeping the loan in your name.

Require your mother to take over the loan (a process known as “loan transfer” or “home loan takeover”).

- Builder/Developer NOC:

Since the property is under construction, you will also need a No Objection Certificate (NOC) from the builder/developer to confirm that they approve of the transfer.

A gift deed must be drafted with a clear mention of the property being mortgaged and the loan repayment terms.

It should specify whether you will continue repaying the loan or if your mother will assume responsibility after the transfer.

Option 1: Loan in your name:

The loan remains in your name, and you continue repaying it.

Your mother becomes the owner but subject to the bank’s lien on the property.

Option 2: Loan transfer to mother:

Your mother takes over the loan if she meets the bank’s eligibility criteria (age, income, credit score).

This requires a novation agreement between you, your mother, and the bank.

If the bank or builder is hesitant about the transfer during the under-construction phase, you might consider waiting until possession to simplify the process. However, if you are determined to proceed, ensure all consents are documented.

Housing.com POV

Gift deed stamp duty is important because it validates the legal transfer of the property. So, when a donor gifts a property to the donee, the donee should ensure that it is registered legally so as to avoid any kind of property related disputes going forward. Note that gift deed should be accepted by the donee when the donor is alive, else it will become invalid.

FAQs

What is the rule of gift deed?

The rule of gift deed is that the donor should be legally able to gift. The donor should be in sane mind and should be above 18 years.

What are the benefits of a gift deed?

With the gift deed, you can easily transfer the property from one person to another within the family or outside.

When will be the gift deed invalid?

If the donee doesn't accept the gift during the lifetime of the donor, the gift deed will be invalid.

What is the validity of a gift deed?

Whenever a donor gives an immovable property through gift deed to a donee, then the validity of the gift is forever.

What is a gift deed?

It is a legal document using which a person voluntarily gifts a movable/immovable property to another person.

Is a gift deed considered as a legal document?

Yes, a gift deed is a legal document.

What works better for immediate transfer of property- a will or a gift?

For immediate property transfer, a gift deed works.

Can a donor cancel a gift deed?

A gift deed cannot be canceled unilaterally and has to have consent of the donee too.

Who will pay stamp duty on gift deed?

The receiver or the donee has to pay the stamp duty on the gift deed.

What clause should parents insert before gifting property through gift deed to children?

In usual cases, gifting a property to an NGO or charity centre does not incur any stamp duty. However, you must check with your state authority, regarding the rules. Also, in many cases, NGOs may not be allowed to accept property as a gift. It is advisable that you hire the services of an advocate, to find this out.

What if property is gifted to NGO?

Can a property be gifted to a minor?

In case the property as a gift deed is being gifted to a minor, his/her legal guardian must accept it on the minor’s behalf. The minor may also accept or return the gift if he/she chooses to do so, after attaining the legal age.

Will I have to pay something in return for the property I receive as gift?

No, a gift is a gift by all means. The only charges paid by the donor, is the stamp duty and registration charges and other nominal charges that crop up because of legalities attached to gift deed. However, if the value of property/gift exceeds Rs 50,000, you may have to show it in your ITR depending, upon whom you received it from.

Can a property received as a gift be sold?

If there were no conditions attached to your gift deed and provided you have a registered the gift deed, you can sell the property.

Will the donee be liable to pay dues on the gifted property?

Yes, the donee becomes the legal owner and will then need to pay all dues and charges, such as electricity and maintenance charges, municipal taxes, etc. while giving the gift deed.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |