A homebuyer can withdraw money from their EPF account for:

- House construction or purchase

- House repairs

- Home loan repayment

You can withdraw money to repay your home loan only once in your lifetime. Those who have completed 3 years of service are eligible to withdraw up to 90% of the saved amount if the house is registered in their name/name of their spouses/jointly. The EPF subscriber will be able to withdraw this money for home loan repayment even if the loan is not sanctioned under their name.

Tax on PF withdrawal for home loan repayment

PF withdrawal is not subject to a tax deduction in case the EPF withdrawal takes place after five years of service. If PF withdrawal takes place before five years of service, 10% TDS (tax deducted at source) will be deducted from the PF balance. However, if the EPF withdrawal is up to Rs 50,000, there will be no tax applicability.

PF withdrawal process for home loan repayment

Step 1: Go to the official EPFO member portal.

Step 2: Select the ‘Service’ option and ‘For Employees’ from the dropdown menu.

Step 3: Select the ‘Member UAN/Online Services (OCS/OTCP)’ option.

Step 4: Provide your UAN, password and captcha details.

Step 5: Go to the ‘Manage’ option and select ‘KYC’ from the dropdown menu.

Step 6: Check that the KYC details are correct as it has your account details where the PF withdrawal money would be credited by the EPFO.

Step 7: After making sure that the KYC details are correct, go to the ‘Online Service’ tab. Click on the ‘Claim (Form-31, 19 & 10C)’ option from the dropdown menu.

Step 8: Check all the details on the screen and verify your bank account number to which the PF withdrawal money will be credited.

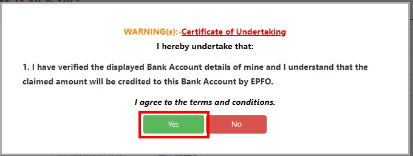

Step 9: A ‘Certificate of Undertaking’ is generated. Click ‘Yes’ on the certificate to proceed.

Step 10: Click on ‘Proceed for Online Claim’.

Step 11: On the claim form, under the ‘I Want To Apply For’ option, select the claim you require – complete EPF settlement, EPF part withdrawal (loan/advance) or pension withdrawal. If you are not eligible for any of these services, these options will not be shown in the dropdown menu.

Step 12: Select ‘PF Advance (Form 31)’ to withdraw your PF. Provide the purpose of such advance, the amount required and your address. Check the box asking for a self-declaration.

Step 13: Your application for PF withdrawal is now submitted. Your EPF withdrawal application will be approved by the employer for it to be processed.

FAQs

Can I withdraw all the money from my PF account?

PF withdrawal in full is possible when you reach the retirement age of 58 years. Even if you retire early, you must be at least 55 years of age to be able to make a full PF withdrawal. PF withdrawal in full is possible if you have been out of work for two months or more. In the latter scenario, the employee will have to declare unemployment in their PF withdrawal request form.

What is the prerequisite to apply for PF withdrawal?

For PF withdrawal, your UAN and Aadhaar must be linked and your UAN must be activated.

Do I need approval from my employer to withdraw EPF money?

On the EPFO website, you can apply for PF withdrawal without any approval from your employer.

How much time does it take for the money to arrive in your account?

It may take 3-4 weeks for your PF withdrawal request to process. Your PF money will reach your account within 20-30 days.

What documents/details are needed for PF withdrawal?

You will need the following details to initiate PF withdrawal: Universal Account Number or UAN Bank account details of the PF holder (PF is not transferred to a third party until the PF holder’s demise) Employer’s submission of employee’s exit from the company

Which form is to be filled out to apply for PF withdrawal?

Form 19 is used to apply for advance or withdrawal from a PF account if you still work with the company.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |