January 4, 2024: Curated in collaboration with Investmentz.com by Asit C Mehta Investment Intermediates Limited, the Pantomath Financial Services Group released a 2023 performance and 2024 outlook report highlighting the global economy updates and outlook, Indian economy outlook, key economic indicators, key sectors that will grow in 2024, key policy reforms and the IPO market update from the perspective of Investment Bankers, Fund Managers, Venture Capitalists and Investment Interrmediates.

The report states that the Indian equity market has emerged as one of the best-performing market in the last two years. Moreover, the domestic Systematic Investment Plan (SIP) inflows emerged as a key source of retail inflows in equities, reaching Rs 130 billion in FY2023 and is projected to reach Rs 153 billion in FY 24.

In 2023, the Indian equity market witnessed a phenomenal performance with the Nifty and Sensex having scaled milestones of 21,000 and 70,000 mark, respectively. Indian equity emerged as one of the best-performing markets in the last two years. Indian market fell relatively much lesser in CY 2022 compared to other global Markets. On the other hand, broader indices outperformed, the NSE Midcap 100 and NSE Small-cap 250 advanced 40.9% and 42%, respectively in CY 2023. India’s market cap is up 26% in the current calendar year to $4.2 Tn. India added $900 Bn in market cap in 2023, equivalent to the entire market cap of countries such as Brazil, Sweden and Netherlands.

Mahavir Lunawat, managing director, Pantomath Capital Advisors said, “The Indian corporate earnings began showing improvement, with companies benefiting from a softening in commodity prices, leading to enhanced profitability and margins. Companies are expected to continue strong performance in the upcoming quarters, driven by a robust domestic demand environment, positive macroeconomic factors and private capex revival. Visible revival in private capex along with sustained pick up in govt capex bodes well. A record capex of Rs 26 lakh crore vis-à- vis INR 10-12 lakh CR four years back will continue to foster momentum”

Devang Shah, head of retail research, Asit C Mehta Investment Interrmediates Limited (ACMIIL), said, “The year witnessed robust Industrial Production (IIP) growth and favourable PMI data, indicating an expansion in output at an above-trend pace. The manufacturing sector sustained its growth momentum, driven by a consistent inflow of new orders. Many companies experienced a notable uptick in sales during the festival season. While the Consumer Price Index (CPI) started to moderate from its peak levels, it remained above the Reserve Bank of India’s comfort range of 2% to 4%. Concerns about inflation persist, particularly in relation to the risk of an increase in food inflation, according to the RBI. The government aims to address supply issues proactively to prevent any sharp spikes in food and vegetable prices.”

Similarly, with an eye toward overall growth and development, the Indian central government pushed policies and initiatives in 2023 to strengthen a number of important economic sectors. Special emphasis on manufacturing, fintech, green growth, and new technologies, the government is actively building both digital and physical infrastructure for businesses across sectors. As a result, sectors such as agriculture, railway, automobile, defence, telecom, infrastructure, capital goods, renewable energy, electronics manufacturing services (ems) and real estate have become priority sectors. Government investment and policy reforms will be used to support these priority sectors in the coming years.

Key policy reforms in 2023

- Production Linked Incentive for 14 key sectors to enhance India’s manufacturing capabilities and Exports.

- Over 1,14,000 startups spread across all 36 states and UTs of the country create more than 12 lakh jobs.

- Alternative Investment Funds (AIFs) invest 17,272 crores in 915 startups.

- More than 2,55,000 approvals facilitated through National Single Window System.

- Make in India 2.0 focusing on 27 sectors to make India a Manufacturing Hub

- PM Gati Shakti becomes mainstream across Government.

- Unified Logistics Interface Platform successfully integrates with 35 systems of 8 Ministries covering 1800+ fields.

- Growth in real-estate in 2023: Revival in property cycle to sustain, driven by a time correction in prices, better afford ability, reasonable interest rates and need to have bigger houses. This has a positive impact on many industries (such as steel, cement, building materials and other related sectors) and generates employment across income strata.

Indian Economy Outlook for 2024

As per the report, the momentum achieved during the CY 2023 with strategic measures by the government is indicating medium- to long-term GDP growth of India. As per S&P global Ratings, India is set to become the third-largest economy by 2030, and the paramount test for the country would be to become the next global manufacturing hub. The country’s robust economic trajectory is underpinned by resilient growth and favourable demographics. India is the most populous country in the world and where the median age is 28.2 years. Recovery in domestic demand, particularly in private consumption and household spending, after a prolonged pandemic, should facilitate business expansion plans. Feeding into this is India’s large consumer base, rising urban incomes, and the aspirations of the world’s largest young population.

“The public capex push by the government is ultimately now achieving its aim of beginning the private capex revival of Indian companies. The balance sheet of Indian companies also shows less or moderate leverage. The proactive policies of the RBI are beneficial for banks for any kind of un-expected domestic and global financial risk. Banks are also at comfortable levels, with constantly falling NPA levels and a pick-up in credit growth. The companies are also in a sound position to boost investments”, said Lunawat.

India’s digital economy will continue to attract investors as technology-based solutions are sought to transform people’s lives, governance, and enterprise operations. The rapid growth in demand for online products and services is also a reflection of the increasing spending power of India’s non-metropolitan (Tier-2 and Tier-3) cities. The digital economy accounted for 4-4.5 percent of the total GDP in 2014 and is currently at 11%. The government projects the digital economy to make up more than 20 percent of Indian GDP by 2026.

“Key industries beckoning foreign investors in India in 2024 include healthcare and insurance, fintech, renewable energy and climate tech, electric vehicles and automobiles, IT and services, real estate and infrastructure, fast-moving consumer goods (FMCG), and R&D, tech innovation, and artificial intelligence (AI). These have all been on a hot streak in 2023, as foreign direct investment (FDI) policies have relaxed in recent years, and production-linked incentive (PLI) schemes have promoted. Listing down a select industry” said Shah.

Increasing India’s participation in global value chains is a top target for both government and domestic market stakeholders. It’s what has contributed to various policymaking efforts to improve the business environment and streamline compliance on one hand, as well as cultivate local competencies in niche sectors on the other.

Deena Mehta, group managing director, Asit C. Mehta Investment Interrmediates Limited (ACMIIL) highlighted that, “Emerging industries poised for investment-led growth in 2024 are battery energy storage solutions, green hydrogen, biotechnology, AVGC (animation, visual effects, gaming, comics), and semiconductor chip manufacturing, assembly, and design. Foreign companies looking at the Indian market are at an advantage as state governments are flexible and offer competitive sops to attract cutting-edge technology and generate large scale employment”.

As per the report, so far, export performance of the mobile industry is a first step in the direction of deeper supply chain engagement. Furthermore, India has intensified its decarbonization initiatives amid shifts towards renewable energy, and aims to achieve 500GW renewables capacity by 2030.

In the corporate sector, sustainability and ESG is on the radar of top organisations and manufacturing enterprises as green tech skills will influence hiring decisions to key roles in 2024. The top sought skills are in renewable energy, environmental health safety, solar energy, corporate social responsibility, and sustainability.

“Sustainability entails a commitment to diminish the carbon footprint across enterprise operations, including buildings, production and service processes, transportation, waste treatment, etc. India will be seeking greater global collaboration in the realm of technology, resource management, and green skilling to grow its domestic expertise in these critical areas. Bridging knowledge gaps, however, will not be limited to manufacturing and corporate sectors as farming and agriculture which serve as India’s economic backbone also require long-term investment in sustainability skills, green tech, and data application”, emphasised Madhu Lunawat, CIO of impact investing Fund, India Inflection Opportunity Fund.

Global IPO market update

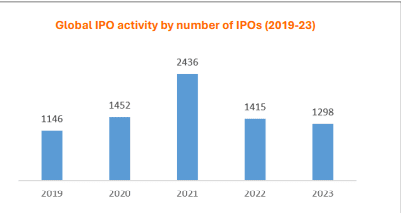

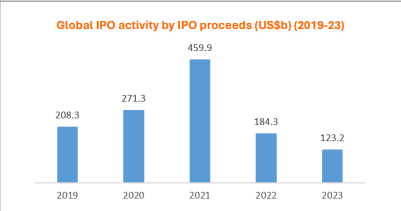

The global IPO market landscape shifted in 2023, with subdued western market sentiment and China’s cool-down, as well as a contrast between hot emerging market small-cap deals and lackluster large offerings. The global IPO market ended 2023 with 1,298 IPOs raising US$123.2 Bn. When comparing to 2022, IPO proceeds lagged last year’s tepid pace by roughly a third, although deal volumes have picked up in both the Americas and EMEIA.

Despite a strong equity market rally and low volatility, public offerings have remained muted in many developed markets, with the exception of a brief September window in the US. Extraordinarily aggressive monetary policies have become a major factor affecting IPO activity, superseding the influence of stock market performance. The US and Europe have both seen 10 or more rate hikes since 2022, sending IPO volume down in larger mature markets. As global inflation has eased substantially this year, the expectation of interest rate reductions could encourage investors by offering a more reliable return on investment in IPOs, which should boost activity.

The year has seen new IPO hotspot markets emerge, outpacing traditional IPO powerhouses. Benchmarking against 5-year average IPO activity, highlights include Indonesia, Malaysia and Turkey notching increases in deal volume and proceeds. Meanwhile India, Saudi Arabia and Thailand have recorded an increase in the number of IPOs. In contrast, Hong Kong’s IPO market experienced a 20-year low in proceeds this year and the pace of IPO issuance in Mainland China slowed in the latter half of 2023.

Indian Primary Market Update and Outlook for 2024

India concludes the year 2023 with optimism despite worldwide uncertainties. Festival Cheers’ high demand environment is expected to last, offering optimism for a prosperous 2024 as well. Leading credit rating agency Fitch stated that robust growth in domestic demand is anticipated to place India among the fastest-growing nations in the world, with robust GDP growth of 6.5% in the fiscal year 2024–2025.

Rising demand and easing input cost pressure should boost margins of the corporates in the FY24- FY25. India’s total market cap reached at $4.3 Tn. with main indices trading at their life time high levels. India’s forex reserve stood at $615 Bn. as on December 15, 2023.

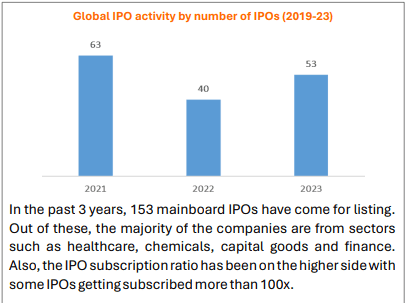

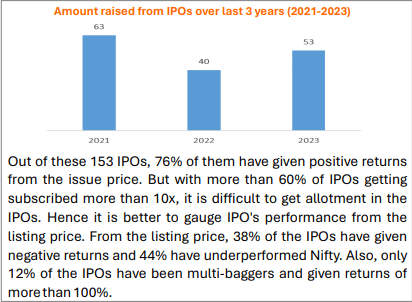

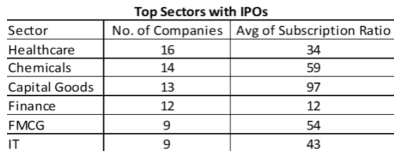

The market environment has been extremely robust, Although the start of the year was tepid amid global headwinds. Since the start of January 2023, 53 companies have completed IPOs, raising more than Rs 44,469 crore.

Expressing his views on the 2024 outlook for India’s primary market, Mahavir Lunawat said, “India’s current IPO market trend showcases its immense potential and has witnessed a remarkable surge in recent years. India must continue to focus on enhancing regulatory frameworks, improving corporate governance practices, and fostering investor education. In the forthcoming months, there is anticipated to be significant momentum in the Indian IPO market, encompassing both the main and SME market segments. The market environment has been extremely buoyant and is likely to witness a robust capital raise FY24-25 as well”.

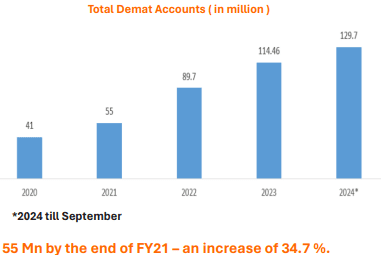

The number of demat accounts increased to 129.7 mn in September, a surge of 26 percent on a yearly basis, primarily on the back of attractive returns from local equities. Over 3.06 million demat accounts were opened during the month, slightly down from 3.1 million in August, according to data from NSDL and CDSL. This marks the second consecutive month with incremental additions surpassing 30 lakh. According to data released by depositories, National Securities Depository Limited (NSDL) and Central Securities Depository Limited (CSDL), from just 40.9 mn in March 2020 before the Covid-19 outbreak, the number of demat accounts in India doubled to 100.5 Mn crossing the 100 Mn mark for the first time in August 2022.

“On regulatory front, SEBI has taken a significant step to enhance the efficiency of Initial Public Offerings (IPOs) by halving the timeline for listing shares on stock exchanges after the IPO closure. This move aims to provide substantial benefits to both investors and issuers in the capital markets”, pointed Mahavir Lunawat.

Under the revised guidelines, IPOs will now be mandated to list within three working days (T+3 days) after the closure of the IPO, in contrast to the previous requirement of six working days (T+6 days). The ‘T’ symbolizes the issue closing date, which serves as the starting point for the new timeline. There are more than 65 IPO documents filed with SEBI. Of these, 25 have already received approval.

Lunawat further stated that “SEBI has introduced various amendments to enhance the capital markets’ transparency and practices. These amendments include disclosure of Key Performance Indicators (KPIs), introduction of pre-filing of draft offer documents (confidential filing), the establishment of the Social Stock Exchange, changes in monitoring agency functions and the definition of SMP to make it more inclusive”.

A reduced timeline means that investor money would be blocked for a shorter duration of time while for a company. Investors will have the opportunity for having early credit and liquidity for their investment, which would enable investors to analyse and participate in a greater number of IPOs opening parallel, as India gears for bigger capital formation.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]