Movement in real estate prices in seven key cities across India, have remained largely lacklustre, despite a fall in the interest rates and important announcements like the Real Estate Regulation Act.

Ashutosh Limaye, national director – research, JLL India, sums up the performance of the residential property markets in Delhi-NCR, Pune and Kolkata.

“Delhi-NCR realty market

Delhi’s real estate market continued to remain lackluster in Q1 of 2016. In spite of a fall in prices and interest rates, the demand for residential apartments witnessed a steep decline, by almost 25%-30%. On the contrary, some sectors in Dwarka, such as Sector 14, 12 and 7, witnessed a quarterly increase of 2%-3%, despite the huge inventory.

See also: Should You Buy a House Now or Wait for a Price Correction?

Pune realty market

Pune’s residential market saw a year-on-year (YOY) appreciation in its property prices, to the tune of 7.9% last year. Property prices could further rise by 4%-6%. Given the positive investment scenario and demand for office space in Pune, residential real estate uptake in the city has remained healthy over the years.

Kolkata realty market

Affordable housing projects (i.e., apartments priced up to Rs 25 lakh) in Kolkata, witnessed growth in the first quarter of 2016. Supply in this segment grew, by almost 3%-4% during Q1 2016. Kolkata’s real estate market is end-user driven and affordable housing is evolving as the most popular segment, with developers like Tata Housing, Shapoorji Pallonji, etc., focusing on this segment.

Experts add that while the property markets in Kolkata and Delhi would remain under pressure, Pune will perform better in the coming quarters.

Surabhi Arora, senior associate director – research, at Colliers International, offers her projections on residential real estate in Mumbai, Bengaluru, Chennai and Hyderabad.

Mumbai realty market

In the last quarter, the city has seen increased traction in the residential segment, with home seekers preferring the affordable and mid-segments of housing. However, there was limited traction in the high-end segment as well, and the luxury segment is likely to remain under pressure, due to high price points.

Bengaluru realty market

Locations near employment hubs, which have quality residential products, will continue to see steady demand from end-users and investors. The booming office market and upbeat employment scenario, will augur well for the residential sector in 2016.

Chennai realty market

Demand for residential real estate is expected to pick up, as Tamil Nadu’s assembly elections are over and the political scenario is now clear. The city may witness a revival in demand, owing to the impending budget and positive macro-economic indicators.

Hyderabad realty market

With the office market picking up and a number of companies like Google and Apple aiming to start operations in the city, the job market in the city is likely to grow. Consequently, the demand for residential realty could also increase, in the coming months.

Expected growth corridors

- Pune: Strong uptake of office space from the IT/ITeS sector in the last year (2015), could generate more employment in the city and result in demand for residential properties.

- Delhi- NCR: Infrastructure growth, including the extension of the metro line to Greater Noida and relatively affordable property prices, will work in favor of Noida and Greater Noida.

- Kolkata: This end-user-driven market, will flourish near the employment hubs like Rajarhat.

- Mumbai: Absorption in the pre-launch stage and the mid and low segments of housing, is likely to increase in the primary market.

- Bengaluru: Emerging micro-markets, such as Hebbal and Thanisandra Road in north Bengaluru and Panathur-Varthur Road in the eastern quadrant of the city, are expected to lead the influx of new residential supply.

- Chennai: Expansion by corporate occupiers and greater leasing of office properties, along with progress on the construction of phase 2 of the metro rail, may give a fillip to residential pockets along these corridors.

- Hyderabad: Recently-launched projects in the western part of the city, are expected to cater to the housing demand over the next two to three years, which is likely to be created by heavy employment generation.

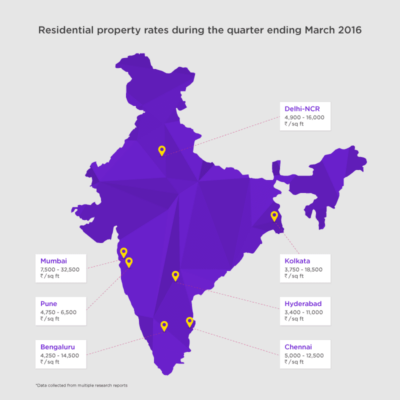

Residential property rates during the quarter ending March 2016

| Cities | Price range (in Rs/sq ft) |

| Mumbai | 7,500-32,500 |

| Pune | 4,750-6,500 |

| Delhi-NCR | 4,900-16,000 |

| Kolkata | 3,750-18,500 |

| Bengaluru | 4,250-14,500 |

| Hyderabad | 3,400-11,000 |

| Chennai | 5,000-12,500 |

*Data collected from multiple research reports

Amit Sethi is an accomplished professional with a distinguished background, holding an MBA in Finance. As an Independent Journalist and Data Provider with 20 years of invaluable experience, his expertise lies in meticulously covering stories on Real Estate, Personal Finance, Business and Banking. He writes journalistic content for leading media publications in India and also provides analytical data to real estate and fintech companies. Amit is driven by a purpose to disseminate insightful narratives, using verified information to empower individuals with financial literacy. Through his work, he aims to assist people in staying aware and making informed decisions that positively impact their financial well-being. Amit is a fitness freak, a marathoner and likes trekking.