Property is an asset that not only provides you with a roof over your head throughout its life but also acts as a saviour in times of need. For example, a property owner who desperately needs cash, need not apply for expensive personal loans. Instead, s/he can use a loan against property (LAP) to tide over the monetary emergency. A loan against property is a unique instrument, to utilise the full monetary potential of one’s immovable asset while still holding its title.

Loan against property: Meaning

A home loan that you take against a property that you own, is defined as a ‘LAP’ in India’s housing finance world. Owing to the comparatively longer tenure and lower interest rates, it has emerged as a popular form of long-term loan, especially among the self-employed in India.

Loan against property: Purpose

A Loan Against Property (LAP) is designed to offer substantial financial support for various personal and business needs. Common uses include:

- Covering medical emergencies

- Financing a child’s wedding

- Funding a long-awaited vacation

- Expanding or growing a business

- Supporting higher education expenses

LAP provides a flexible way to leverage property assets for essential financial requirements.

Can you take loan against your house?

A LAP could be taken against residential, industrial and commercial properties. In case of residential property, it could be a rented out property or a self-occupied property, including apartments, flats, individual homes, etc. Commercial property includes office buildings, shops, malls, complexes, etc. You could also get a LAP if you own a land parcel or a plot.

“LAPs are given on freehold property and the owner must have a clear title to it,” says Rajan Ahuja, director, Realty & Verticals, a Gurgaon-based real estate consultancy.

Loan against property: Amount

Banks only offer a certain percentage of your property’s market value as LAP. Depending on the bank from where you are taking the mortgage, the LAP amount could vary between 90% and 70% of the property’s market value. Most lenders keep a 70:30 loan-to-value ratio, in case of LAP and LAP-OD. To reduce risk, most banks offer loans of up to 50%-65% of the value of the property, while some non-banking financial companies (NBFCs) go up to 75%.

If the technical assessment by the bank shows the market value of the house is Rs 1 crore and the loan-to-value ratio has been kept at 70:30 by the bank, it would be willing to lend you Rs 70 lakhs as loan. Do note that the bank would send its own technical valuators, to physically examine the property and arrive at its market value.

As is true of home loans, your personal financial standing is another factor when the bank decides the loan amount. So, apart from the property’s market value, your credit history, repayment capacity, stability of business and income, experience, age, number of assets and liabilities, etc., would be considered while deciding on the LAP-OD loan amount.

Loan against property: Eligibility

There are certain age and income specifications that borrowers have to meet, to mortgage their property. Financial institutions mostly offer LAP to the below mentioned category of borrowers:

Salaried applicants

Age: 33 to 58 years

Employer: Private company, public company, multi-national company.

Residency status: India

Self-employed applicants

Age: 25 to 70 years

Income: Regularity of income.

Residency status: India

Note: Loans are approved only when the self-employed can show an earning track record of three years, usually via income tax returns.

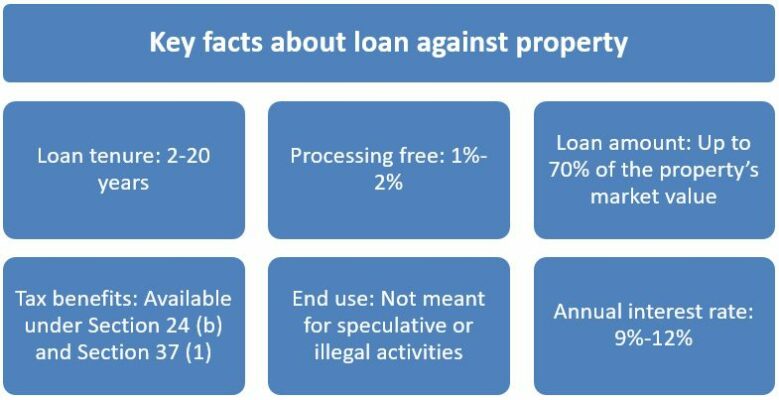

LAP processing fee: Most banks, including public lender SBI, charge 1% of the loan amount as processing fee, which could go as high as 3% too. Apart from the processing fee, the borrower also has to pay several small expenses, including documentation charges, commitment fee, valuation fee, stamp duty charges and GST.

When does a bank offer loan against property?

LAP is provided for a wide range of customer needs. However, all banks have specific instructions that the capital thus borrowed should not be used in speculative activities in the market.

“People often take a LAP, because it is cheaper and deploy it in avenues that are risky,” points out Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors.

The bank would ask you the specific purpose for which you are taking the loan and would approve your request if you plan to use the capital for healthcare and medical issues, higher education, wedding, down payment of a high-value purchase, business expansion, marketing and promotion, etc.

How much time do banks take to process LAP requests?

As this is a secured loan, banks are quite forthcoming on approving LAP requests. Most banks process your LAP request within a week’s time.

Loan against property: Documents required

Self-employed and salaried individuals are asked to submit different sets of documents, along with their LAP application. While the number and type or documents may vary, depending on the bank from where you take the loan, financial institutions typically asked for papers mentioned below to process your LAP application:

Salaried applicants

- Six months’ salary slips.

- Bank account statements of the previous three months.

- PAN card.

- Aadhaar card.

- Address proof.

- Copy of the title documents of the property.

- Income tax returns.

Self-employed applicant

- Bank account statements of the previous six months.

- PAN Card.

- Aadhaar Card.

- Address proof.

- Copy of the title documents of the property.

Loan against property: Prepayment

On pre-payment of your loan against property, the banks will not charge any penalty, if the loan is linked with a floating rate of interest. However, if you have taken the mortgage on a fixed rate of interest, the bank may levy a penalty as stated in the LAP agreement.

Loan against property: Tenure

The loan tenure could be as short as two years and can go up to 20 years, based on your requirement. Depending on your age, the bank may provide a longer tenure. LAP-OD is mostly given for a maximum period of 24 months. The limit might get renewed at different intervals.

Loan against property: Interest rates

Different banks offer different rates of interest on LAP. Mentioned below are the prevalent interest rates on LAP in some leading banks.

| Bank | Annual LAP interest* |

| SBI | 9.45-11% |

| HDFC | 9.75-10-50% |

| ICICI Bank | 11.35% |

| AXIS Bank | 11-12.10% |

| LIC HFL | 11% |

| Bajaj Finserv | 10.20% |

| Kotak Mahindra | 9.60% |

| Standard Chartered | 9.25% |

| IDBI Bank | 9.80-12% |

| Bank of India | 10.30-10.80% |

*Interest rates are subject to periodic change.

See also: Home loan interest rates and EMI in top 15 banks

Home loan vs loan against property: What’s the difference?

While both loans involve property, a home loan is taken to buy a house while a LAP is taken against a property you already own. However, there are certain similarities between the two products, because property is an integral part of these two products.

Secure loan: Home loan, as well as LAP, are categorised as secured loans. The bank has the house as collateral and is entitled to sell the asset to recover losses, in case the debt goes bad.

Lower interest rates: As the two products are secure loans, the interest rates on both the products are lower, when compared to personal loans, which are categorised and unsecured debt.

Long tenure: The tenure of a LAP is longer and you can also get a larger amount, as compared to a personal loan, which cannot exceed Rs 10 lakhs.

Tax benefit: Borrowers can claim tax benefit on the interest component of a loan against property, as well as home loan. However, borrowers cannot claim any tax benefit on the principal repayment of loan against property.

Loan against property overdraft

Loan against property overdraft (LAP-OD) is a short-term loan that is provided to the borrowers against a property. Under this facility, after approving your LAP request, the bank will open an overdraft account for you, in which you will be assigned the approved LAP-OD amount. You can withdraw the amount from this overdraft account, as and when you need. You will be liable to make the interest payment (EMIs) from the time this LAP-OD is availed of.

If you expect some cash flows soon, take the loan as an overdraft facility and not as a term loan. Whatever surpluses you get, can be parked in the overdraft account. This will enable you to lower your interest cost.

Can I avail of LAP against uninsured property?

The borrower will have to buy mortgage insurance to get his application approved. The bank would insist on this, to cut its losses in case of a default by the borrower.

See also: Home insurance versus home loan insurance

Loan against property: Tax benefits

You can avail of tax benefits on loan against property. However, the benefits would be extended, depending upon the usage of the loan amount.

“Under Section 37(1) of Income Tax (IT) Act, the interest paid and associated costs, such as processing fee and documentation charges, can be claimed as business expenditure. The funds have to be clearly identifiable as having been deployed for the expansion of the business, to be able to avail of the tax deduction,” informs Dhawan.

If the loan is used for buying another house property, you can claim an annual rebate of Rs 2 lakhs under Section 24(b). Borrowers cannot claim any tax benefit on the principal repayment of a loan against property.

See also: All about home loan tax benefits

Loan against property: Risk

The key risk in a LAP is that you could lose the property you have borrowed against, if you default on the loan payment. Also, unlike a home loan, there is no tax benefit to the salaried individual, on the principal amount. Moreover, if you default, your credit score will be affected, a penalty will be charged and in the worst-case scenario, you could lose the property.

See also: All about the applicability of SARFAESI Act on home loan default

Loan against property: How to choose the right lender?

To get the most benefits from your loan with minimal costs, consider these key factors:

- Simplified application process: The loan application should be straightforward, with minimal paperwork and reasonable processing time and costs.

- Loan eligibility and amount: Ensure the lender offers the required loan amount. Some lenders consider ‘surrogate income,’ which can enhance borrowing capacity for individuals with limited direct income sources.

- Total cost of borrowing: Apart from the interest rate, factor in additional charges like processing fees, administrative costs, and prepayment penalties, which can impact the overall cost of the loan.

- Convenience of transactions: A lender with an extensive branch network and online access to loan accounts makes it easier to manage repayments and track dues.

- Flexible repayment options: Opt for a lender that allows customization of repayment schedules based on your income flow, ensuring you can meet your obligations without financial strain.

Alternatives to loan against property

A Loan Against Property (LAP) can be an excellent way to access large funds at competitive interest rates, but it isn’t the only route available. Depending on your urgency, asset availability, and loan requirement, there are several alternatives that might suit your needs better. Here’s a look at some of the most common ones:

- Top-up home loan: If you already have an existing home loan with a good repayment track record, you can consider applying for a top-up loan. This allows you to borrow an additional amount over and above your current home loan without having to mortgage a new property. These loans are usually sanctioned at similar or slightly higher interest rates than home loans and involve minimal documentation since the bank already holds your property documents. The funds can be used for any purpose, making it a flexible and cost-effective option for existing borrowers.

- Personal loan: For those who need funds quickly and don’t want to pledge assets, a personal loan is a viable alternative. These are unsecured loans with relatively higher interest rates compared to LAP but are easier to avail and have quicker disbursal timelines. Most personal loans come with a tenure of up to 5 years and can be used for any personal purpose like medical emergencies, weddings, or travel. However, due to the lack of collateral, approval largely depends on your credit score and income level.

- Gold loan: A gold loan allows you to pledge your gold jewelry or coins and borrow funds against their value. These loans are secured but require much less paperwork and processing time compared to LAP. They also offer flexible repayment options and can be repaid in lump sum or EMIs. Since gold is widely accepted as collateral, many banks and NBFCs process these loans quickly. It’s a suitable option for short-term needs, especially if you already have gold assets readily available.

- Loan against fixed deposits: If you have a fixed deposit with a bank, you can take a loan against it without breaking the FD. This type of loan comes with very low interest rates, typically just 1% to 2% above the interest being earned on the FD. Moreover, the documentation is minimal, and there are usually no processing fees. The FD continues to earn interest, making it a smart option if you’re in need of short-term liquidity without affecting your savings.

- Business loans (for entrepreneurs): Business owners or self-employed professionals looking to raise funds for business-related expenses may opt for a business loan. These can be secured or unsecured and offer greater flexibility in terms of usage. Lenders evaluate the business’s cash flow, credit history, and financial documents before approving the loan. While unsecured business loans may come at a higher interest rate, they don’t require pledging personal property, making them a safer choice for entrepreneurs.

Housing.com POV

A loan against property (LAP) offers property owners a valuable financial tool by leveraging their immovable assets for substantial loans at lower interest rates compared to unsecured loans. Whether for personal needs, business expansion, or other financial requirements, LAP provides flexibility with longer tenures and significant borrowing limits. However, borrowers must weigh the benefits against risks, such as potential loss of property upon default. Understanding the nuances of LAP, including eligibility criteria, documentation requirements, and interest rates across various financial institutions, empowers individuals to make informed decisions when applying for this secured loan product.

FAQs

What is a loan against property (LAP)?

A loan against property, commonly known as LAP, is a type of secured loan where you pledge your property—whether residential, commercial, or land—as collateral to secure a loan from a bank or financial institution. This loan allows you to leverage the market value of your property to meet diverse financial needs, such as funding business expansion, education expenses, medical emergencies, or even consolidating high-interest debts. LAP offers lower interest rates compared to unsecured loans like personal loans because the property acts as security, reducing the risk for lenders.

How much loan can I get against my property?

The amount of loan you can secure against your property typically depends on its market value and the loan-to-value (LTV) ratio set by the lender. Banks usually offer loans ranging from 50% to 70% of the property's market value, although some non-banking financial companies (NBFCs) may extend up to 75%. For instance, if your property is valued at ₹1 crore and the lender offers a 60% LTV ratio, you could potentially borrow up to ₹60 lakhs. The actual loan amount sanctioned also considers factors such as your income, repayment capacity, credit history, and the purpose of the loan.

Who is eligible to apply for a loan against property?

Eligibility criteria for LAP typically vary between salaried individuals and self-employed professionals. Salaried applicants generally need to be between 33 to 58 years old, employed by a recognized organisation, and show a stable income history. Self-employed individuals, on the other hand, are required to demonstrate a regular income for at least three consecutive years through income tax returns and other financial documents. Additionally, the property against which LAP is sought must have clear ownership title and be free from legal disputes.

What are the documents required to apply for a LAP?

To apply for a loan against property, you will need to submit specific documents depending on whether you are a salaried employee or self-employed professional. Salaried individuals typically need to provide documents such as six months' salary slips, three months' bank statements, PAN card, Aadhaar card, address proof, and property title documents. Self-employed applicants are required to furnish six months' bank statements, PAN card, Aadhaar card, address proof, property title documents, and income tax returns for the last three years. These documents help lenders assess your financial stability and eligibility for LAP.

Can I prepay a loan against property?

Yes, you can prepay a loan against property without incurring any penalty if the loan is linked to a floating rate of interest. Prepayment allows you to reduce the overall interest burden and close the loan earlier than the originally agreed tenure. However, if your LAP was availed at a fixed interest rate, the lender may levy prepayment charges as stipulated in the loan agreement. It's advisable to check with your lender regarding prepayment terms and conditions before deciding to make a lump-sum repayment.

What is loan against property overdraft (LAP-OD)?

LAP-OD is a facility provided by banks to acquire short-term funds against an asset or a property.

How much loan can I get against property?

The LAP amount varies from 70%-90% of the property’s market value. Most banks offer 50%-65% of the property value, while NBFCs may offer up to 75%.