When you purchase a property in Andhra Pradesh, it is mandatory to pay the stamp duty and registration charges on it for the property to be legally recognised. These compulsory taxes to be paid to the state government are calculated on the basis of the market value of the property in Andhra Pradesh. Market Value Andhra Pradesh are based on research conducted by the state government and are essentially scientific. They represent the lowest price at which property in a given location should be sold. This guide focuses largely on the IGRS AP market value of land.

What is market value Andhra Pradesh 2025?

The market value AP is the price at which a property in Andhra Pradesh is sold in the open market in normal conditions. While the market value of non-agricultural land in Andhra Pradesh (AP) is revised every August in the urban areas, the market value in AP is modified every two years for agricultural land in the rural areas. The market value Andhra Pradesh is set by the AP Registration & Stamps Department.

Why you should check market value AP before buying or selling property?

Mentioned are the importance of Market Value 2025

To avoid overpaying or underselling the property in Andhra Pradesh

With the help of market value in Andhra Pradesh, buyers can ensure that they don’t pay more than the property’s actual worth, the sellers get a good deal and don’t undersell the property and the investors can check IGRS AP and compare it with market trends and then make a deal accordingly.

Understand stamp duty and registration charges to be paid

The stamp duty and registration charges in Andhra Pradesh are based on the market value set by the Andhra Pradesh state government.

1) Under pay stamp duty

2) Miss out on paying stamp duty and then getting penalised

3) Over paying stamp duty and applying for a stamp duty refund

Appreciation

For sellers, the market value Andhra Pradesh helps you in identifying future prospects of your property. For home buyers, you can also identify growth areas specifically and accordingly plan your property investment.

Note that property owners should update their property documents regularly so that there is no possibility of any cash transaction or black money transactions as this will affect the state exchequer’s revenue. Additionally, by updating property value regularly, its value will also rise.

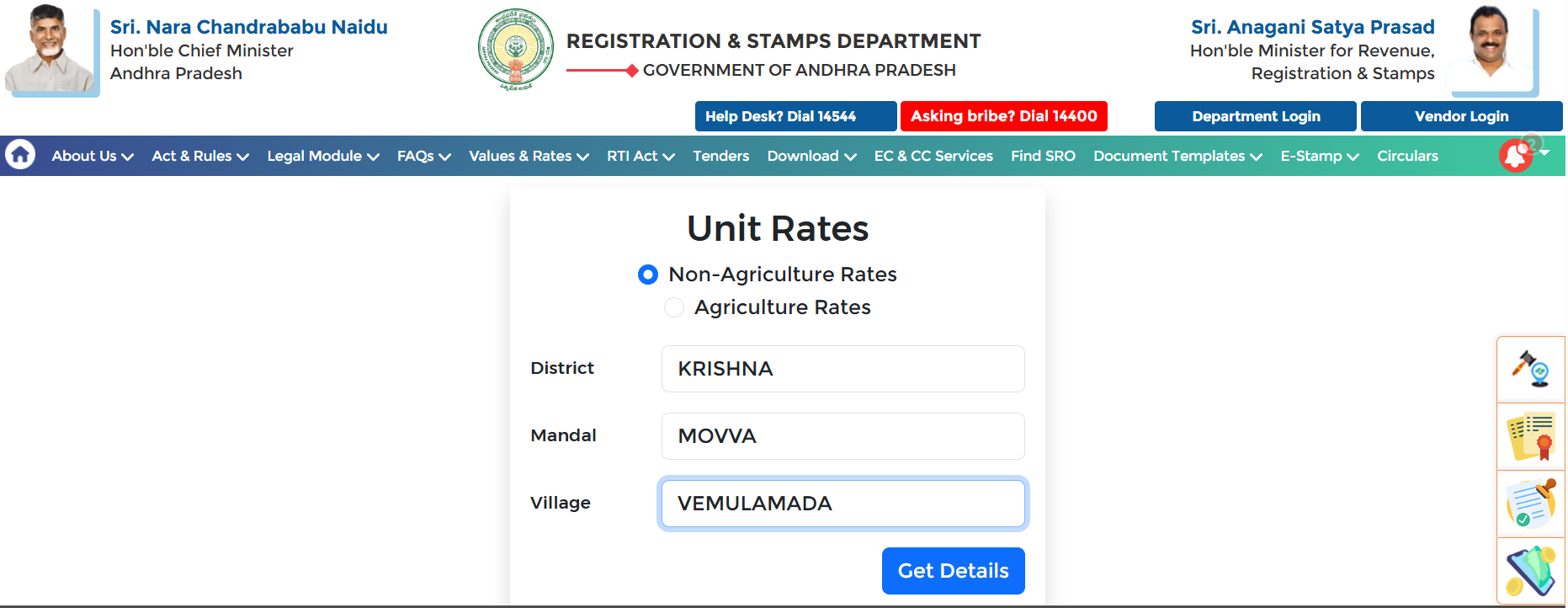

How to check market value 2025 on IGRS AP?

- To check the market value in AP in 2025, click on property value on the IGRS AP Portal. You will reach the following page.

- Select non-agriculture rates, district, mandal and village and click on get details.

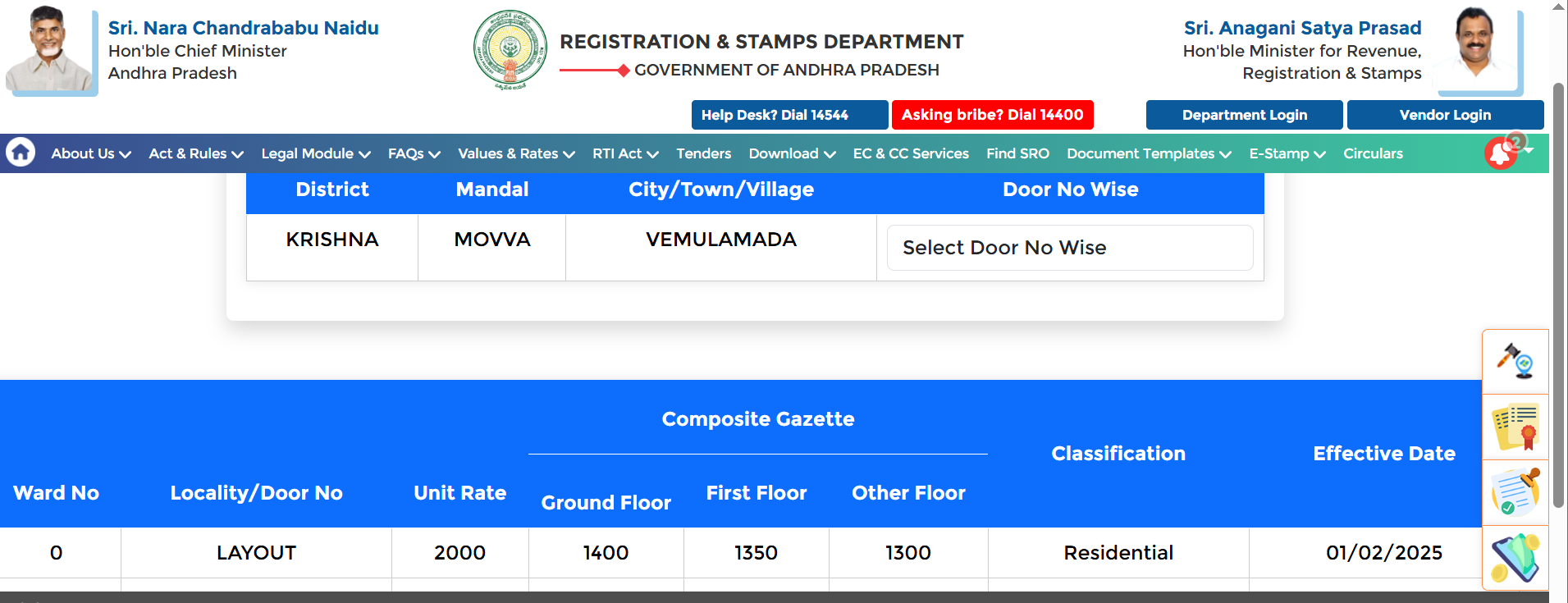

- You will see the following:

Click on ‘select door number wise’ and you will see ward no, locality/door no, unit rate, ground floor, first floor, other floor, classification and effective date from.

How to check the market value AP of a locality offline?

On application by the party, the Jr/Sr assistant at the sub registrar office of the concerned district issues a computer-generated value slip within one hour time against a fee of Rs 10.

Market value for AP land registration in 2025

The Andhra Pradesh government hiked the property registration charges in the state by 15-20% effective February 1, 2025. With this, the structural values in the state also underwent a revision. As part of this exercise, there are places where the market value has been reduced since property prices are less than the market value.

Some of the areas that have seen a revision in the market value AP are mentioned below:

Under the new rule change, in Vishakhapatnam district, the municipal corporation of Pedawaltair habitation and MVP sector -1, Rs 4,500 is the existing per sqft whereas the prevailing market value is Rs 7,000. The proposed value is around Rs 5,300 with an 18% increment. Similarly, in Ananthapur district, the municipal corporation of Tadipatri, Rs 2,700 is the existing per sqft whereas the proposed value is Rs 2,900.

Market value of lands around 158 villages have been reduced as these were on the higher side, market value of lands at 68 villages remained unchanged and the land market values of the remaining villages in Andhra Pradesh was increased.

Market value AP 2025: What is the importance of land value certificate?

Mentioned are reasons why it is important to get land value certificate.

To know the updated market value of land in AP

The land value certificate will include the latest updated market value.

Verification

With the land value certificate, you may know that the land value is correct and the seller has been fairly paid for with the money.

Loan

You can get various loans against the agricultural land by showing the land value certificate.

Legal aspects

According to land acquisition Act, a land valuation certificate has to be renewed every 3-5 years for any land acquisition that you are exploring.

How to get market value certificate in Andhra Pradesh?

The market value certificate is presented at the moment of sale by either the seller or the buyer. This market value certificate is available online and offline.

How to get market value certificate offline?

To get this offline, you should have photo identification such as Aadhaar Card, Voter Identity Card

With this, you should go to the nearest SRO and sign the deed before the registrar after receiving your appraisal.

- Because the registration process can be time-consuming, an online calculator is a good option. The SRO can check the calculation and update the document.

- The legitimate copy of the appraisal is needed to get the certificate.

- One can pay the registration fee in cash or online.

How to get market value certificate online ?

- Go to the IGRS AP and login with username and password.

- Select the new initiatives option to find online EC.

- Enter the user ID and password to get an AP market value certificate online.

See also: Webland in AP: All about the centralised land records management system in Andhra Pradesh

Formation of new district and increase in land value AP

| District | District HQ |

| Parvathipuram Manyam | Parvathipuram |

| Anakapalli | Anakapalli |

| Konaseema | Amalapuram |

| NTR | Vijayawada |

| Palnadu | Narasaraopet |

| Sri Satya Sai | Puttaparthi |

| Sri Balaji | Tirupathi |

| Alluri Sitharama Raju | Paderu |

| Kakinada | Kakinada |

| Eluru | Eluru |

| Bapatla | Bapatla |

| Nandyal | Nandyal |

| Annamayya | Rayachoti |

Based upon parliamentary constituencies, Andhra Pradesh’s government has doubled up the number of districts in the state to 26 under the Andhra Pradesh District Formation Act, Section 3 (5). A list of the new districts along with their respective headquarters are given above:

A total of 13 new districts in the state were inaugurated on April 4, 2022.

A special revision of market values of lands from a minimum of 5% to a maximum of 75% in newly set up 13 district headquarters and neighbouring suburban and rural areas came into effect in Andhra Pradesh in April 2022.

Check out: Vizianagaram pin code

According to the registration and stamps department, market values have been revised between 15% and 25% on an average across all the permitted areas. The maximum of revisions of 75% of the market value were done in some cases only, in the newly identified commercial areas.

How is land market value AP determined?

Market values are based on research conducted by the state government and are essentially scientific, they represent the lowest price at which property in a given location should be sold.

Market value AP 2025: Property in prominent locations

Mentioned are some of the market value of properties in Visakhapatnam district AP effective 2025

| No | Locality/Door No | Unit Rate | Composite Gazette | Classification | Effective Date | ||

| Ground Floor | First Floor | Other Floor | |||||

| 1 | HARIJANA CLNY/LANDA GARUVU/OLD ADIVIVARAM | 13000 | 2300 | 2300 | 2300 | Residential | 01/02/2025 |

| 2 | VIJAYA RAMPURAM AGRAHARAM | 9000 | 2000 | 2000 | 2000 | Residential | 01/02/2025 |

| 3 | GOSALA JN. TO ADAVIVARAM BRTS STC 1 AND 2 | 20000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 4 | VIJINIGIRIPALEM/MMTC COLONY | 13000 | 2300 | 2300 | 2300 | Residential | 01/02/2025 |

| 5 | SATHAKAMPATTU/CHANDRANAGAR/YETHAPETA | 12000 | 2200 | 2200 | 2200 | Residential | 01/02/2025 |

| 6 | KAPUDIBBA/KAPU VEEDHI/GANTLA STREET/RAJA STRE | 13000 | 2300 | 2300 | 2300 | Residential | 01/02/2025 |

| 7 | RAMA MANDIRAM/MADYA VEEDI/POST OFFICE STREET/ | 13000 | 2300 | 2300 | 2300 | Residential | 01/02/2025 |

| 8 | SAINAGAR/PRIYAGARDENS/CHAKIREVU KONDA/PUSHKAR | 19000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 9 | SWAMY KALYANAMANDAPAM/BANGARAMMA TEMPLE AREA/ | 19000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 10 | BANGARAMMA TEMPLE AREA/PYDITHALLAMA TEMPLE/KO | 19000 | 2500 | 2500 | 2500 | Residential | 01/02/2025 |

| 11 | DEVASTHANAM KALYANA MANDAPAM AREA/OIL MILL AR | 19000 | 2500 | 2500 | 2500 | Residential | 01/02/2025 |

| 12 | AMG AREA | 12000 | 2200 | 2200 | 2200 | Residential | 01/02/2025 |

| 13 | GHATROADOVER ADIVIVARAM PANCHAYAT/BHOLOKNAGAR | 13000 | 2300 | 2300 | 2300 | Residential | 01/02/2025 |

| 14 | DOORDARSHAN TRANSMITTER AREA/SIMHACHALAM KOND | 16000 | 2400 | 2400 | 2400 | Residential | 01/02/2025 |

| 15 | DEVASTHANAM QUECOMPLEX AREA/TVTOWERCLNY/ZP GU | 19000 | 2500 | 2500 | 2500 | Residential | 01/02/2025 |

| 16 | LAKSHMINAGAR / INDRANAGAR | 27000 | 3000 | 3000 | 3000 | Residential | 01/02/2025 |

| 17 | LAKSHMINAGAR / PRAHLADAPURAM | 27000 | 3000 | 3000 | 3000 | Residential | 01/02/2025 |

| 18 | R AND B OFICEAREA/SRAMIKNAGAR DLB/DURGAKAILAS | 20000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 19 | SINGALAMMA CLNY/UP HILL/SLUM AREA | 20000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 20 | SIMHAGIRI COLONY | 23000 | 2700 | 2700 | 2700 | Residential | 01/02/2025 |

| 21 | SATYA SAI NAGAR/VARAHAGIRI COLONY-I | 23000 | 2700 | 2700 | 2700 | Residential | 01/02/2025 |

| 22 | VARAHAGIRI COLNY II/GANESH SEVA SNGAM | 23000 | 3400 | 3400 | 3400 | Residential | 01/02/2025 |

| 23 | SEETHAMMADHARA NORTH EXT/ADARSHNAGAR COLONY O | 40000 | 3700 | 3700 | 3700 | Residential | 01/02/2025 |

| 24 | YUVAJANA CHAITANYA SEVASANGAM/BILLAL CLNY HIL | 40000 | 3700 | 3700 | 3700 | Residential | 01/02/2025 |

| 25 | SIMHADRIPURAM HILL AREA/ HB COLONY | 23000 | 3500 | 3500 | 3500 | Residential | 01/02/2025 |

| 26 | DURGANAGAR / HB COLONY | 23000 | 3500 | 3500 | 3500 | Residential | 01/02/2025 |

| 27 | DINADAYALPURAM/BC CLNY/RAMA LAKSHMANAPURAM | 20000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 28 | MUTYALAMMA CLNY/SANTHAPALEM/SALIPETA/CHINAGAD | 20000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 29 | RAMALAKSHMANAPURAM | 20000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 30 | PEDAGADILI / SALIPETA | 20000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 31 | SIMHAGIRI COLONY/ PEDAGADILI | 20000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 32 | PANDULA FARM/SANJAY COLONY | 20000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

| 33 | HANUMANTHAWAKA HILL OPP TO PANDULA FARM | 20000 | 2600 | 2600 | 2600 | Residential | 01/02/2025 |

Know about: Kurnool (Andhra Pradesh)

What is the implication of Market value AP 2025 on property tax?

The Guidance Value is the lowest price at which a property can be registered in a given area. Hence, the property will not be sold for less than the market value. This ensures that the seller receives a minimum selling price.

Even if a property is purchased for a value less than the state government’s Guidance Value, the owner must register the property at the government’s market value and pay property taxes based on the locality’s market value in AP.

Suppose the buyer paid more for the property than the state government’s market worth. In that case, the individual is responsible for registering the property at its actual value and paying taxes on the purchase price.

Why does the market value AP change according to locality?

Guidance Values can be used for various attributes in a given area. Agribusiness land, an apartment in a housing complex, a standalone villa, a plotted development project, and so on are all possibilities.

The development stage of a property will determine the guidance values. A property in a well-established neighbourhood will have a higher Guidance Value than one in a less developed locality or one in the early phases of development.

While the state government determines market value in AP of land based on studies and other factors, a seller has complete control over the price at which he sells a property. A buyer cannot compel a seller to sell their property at the Guidance Value, AP land or property’s market value determined by the government. The stamp paper duty, registration fees, and property taxes on a property are all based on the guidance value, and comprise a major chunk of a state’s revenue.

How to find the previous landowner of a place in AP online?

- Visiting the official Meebhoomi website https://www.meebhoomi.ap.gov.in.

- Click on land conversion details. Then select district, zone, village name and survey number.

- Finally, click Submit and you can access the owner detail of the respective plot.

Also read all about Andhra Pradesh Meebhoomi

How can I see my AP plot details?

- To search for your land records in AP and check your plot details, you must log on to the official website – www.meebhoomi.ap.gov.in.

- Once you are on the official website, you will find the main menu bar, from where you can select the respective village whose plot details you wish to see.

- After selecting, enter the owner’s details like name, survey number, Aadhar card number, account information, account number, district name, village title and finally enter the captcha code provided.

Know about: Nellore (Andhra Pradesh)

Who controls market value AP?

The market value in Andhra Pradesh is controlled by the IGRS AP. These rates are regularly revised so that optimised registration charges are levied on a property transaction that will help in revenue generation for the state.

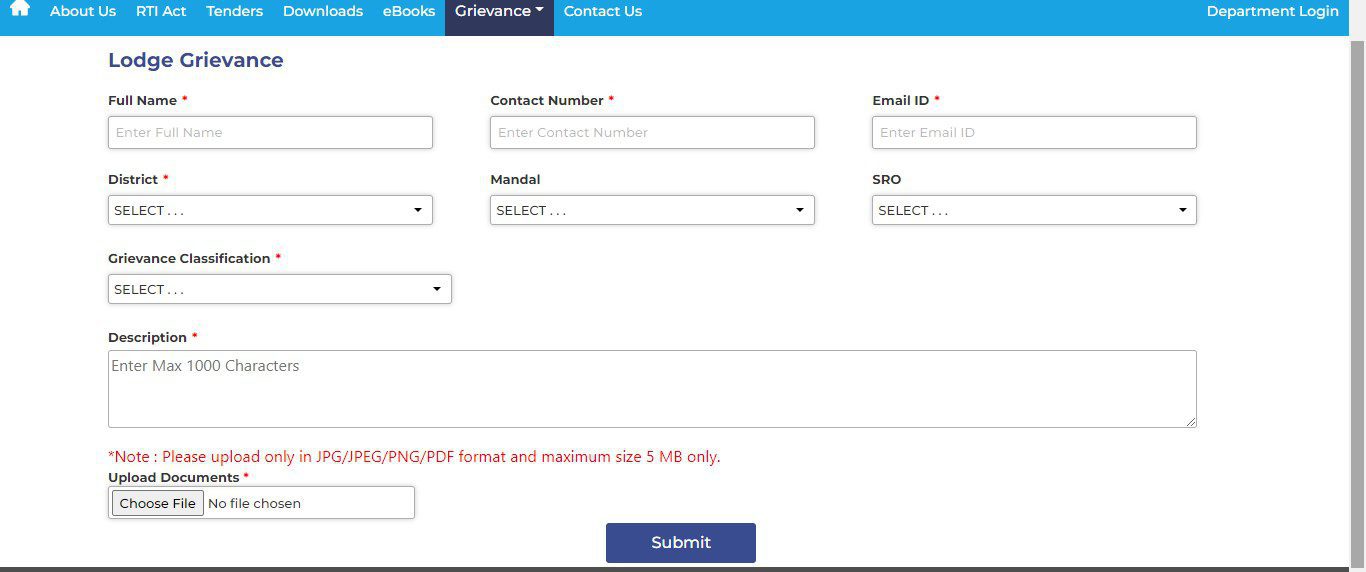

How to file grievances regarding market value on IGRS AP?

Online method

To file grievances, click on http://grievancers.ap.gov.in/grievance. Click on Lodge grievance and you will reach

Enter Full name, contact number, email id, district, mandal, SRO, grievance classification, description and if need be supporting documents that can be uploaded on the website. Once done, click on submit. A government official will be sent for physical examination of the property. This will be compared to other properties. Based on the findings, the market value may be revised or rejected. This entire process will take a few weeks to complete.

Offline method

In case the guideline value that a home buyer has been told doesn’t match with what the place commands, the home buyer can appeal to the Andhra Pradesh Department of Stamps and Registration. This can be done by filing the complaint along with supporting documents such as recent sale deeds, property valuation report etc. with the sub registrar.

Housing.com POV

It is important to know the market value AP as this has an implication on the stamp duty and registration charges of property in the state. You can easily get this information using the user-friendly IGRS AP portal that provides you with latest market value of a location in AP that you seek for. This information can be accessed from anywhere anytime, thereby adding to the convenience. For people not comfortable with the online process can also access these offline.

FAQs

How to check market value in Andhra Pradesh?

To check market value in Andhra Pradesh, click on Market Value assistance on IGRS AP.

How do I get a market value certificate in AP?

You can search, get and check the AP market value certificate on the IGRS AP website. Further if you need encumbrance certificate, you can get it by visiting the Meeseva centres or the SRO where the property was registered.

What is the market value of a property?

It is the price at which a property can be sold by a seller to buyers. Market value is calculated by dividing the average selling price with the size of other properties in a particular locality.

What is the registration value in Andhra Pradesh?

Registration value is 1% in Andhra Pradesh and the stamp duty is 5% of the total property value.

How is the market value of land calculated?

The market value of a particular piece of land is calculated depending on the price of a similar property that was recently sold in the same locality.

When was the property registration charges in Andhra Pradesh revised?

The Andhra Pradesh government hiked the property registration charges in the state by 15-20% effective February 1, 2025.

Can the market value in AP of two properties registered at the same locality be different?

Yes, it can be different based upon the nature of construction and its size.

| Got any questions or point of view on our article? We would love to hear from you.Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |