Those who own residential, commercial, and industrial properties in Moga, Punjab should pay property tax every year. This can be done by visiting the urban local body (ULB) portal and entering the property details. To avoid interests on late payments and penalties, it is advisable to pay the Moga Property Tax on time. Check out how to pay the Moga Property Tax online here.

Check how to pay property tax in Patiala

What are the factors that determine the Moga Property Tax?

- Title deed of property

- Permission for building

- District

- Locality name

- ULB

- Street name

- Zone

- Total plot area

- Number of floors

- Building usage

- Type of building

- Plinth area

- Type of occupant

- Age of building

- Annual Rental Value (ARV)

How to pay Moga Property Tax online?

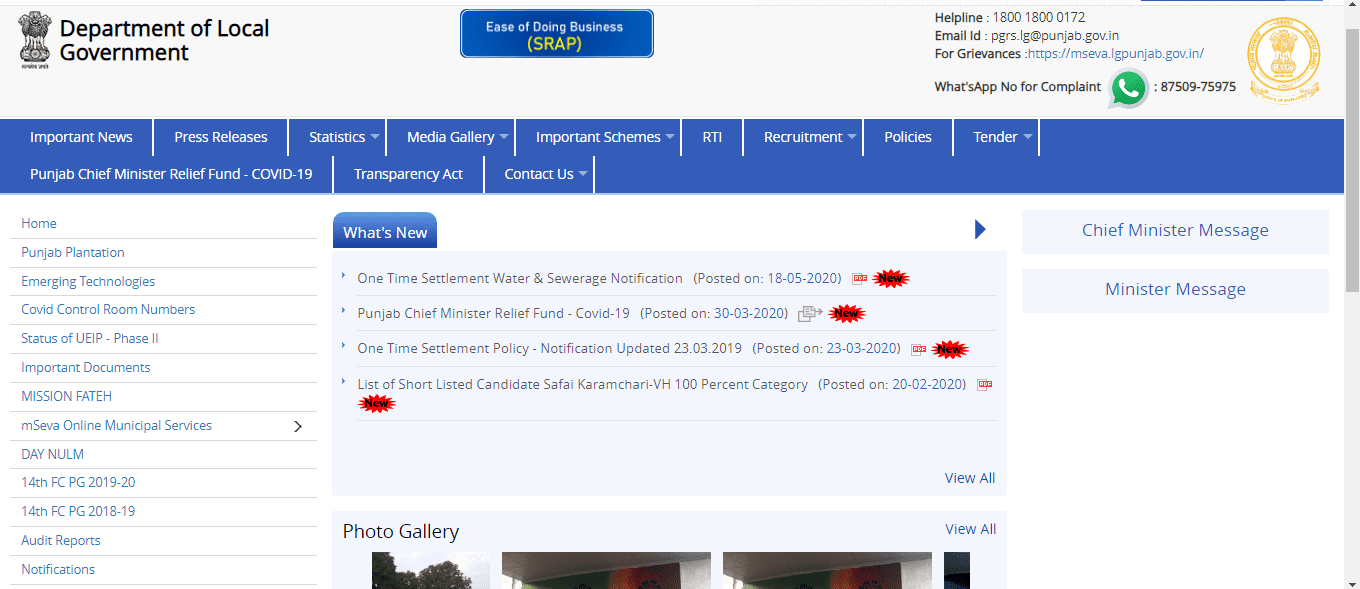

- Under mSeva Online Municipal Services, select pay your property tax.

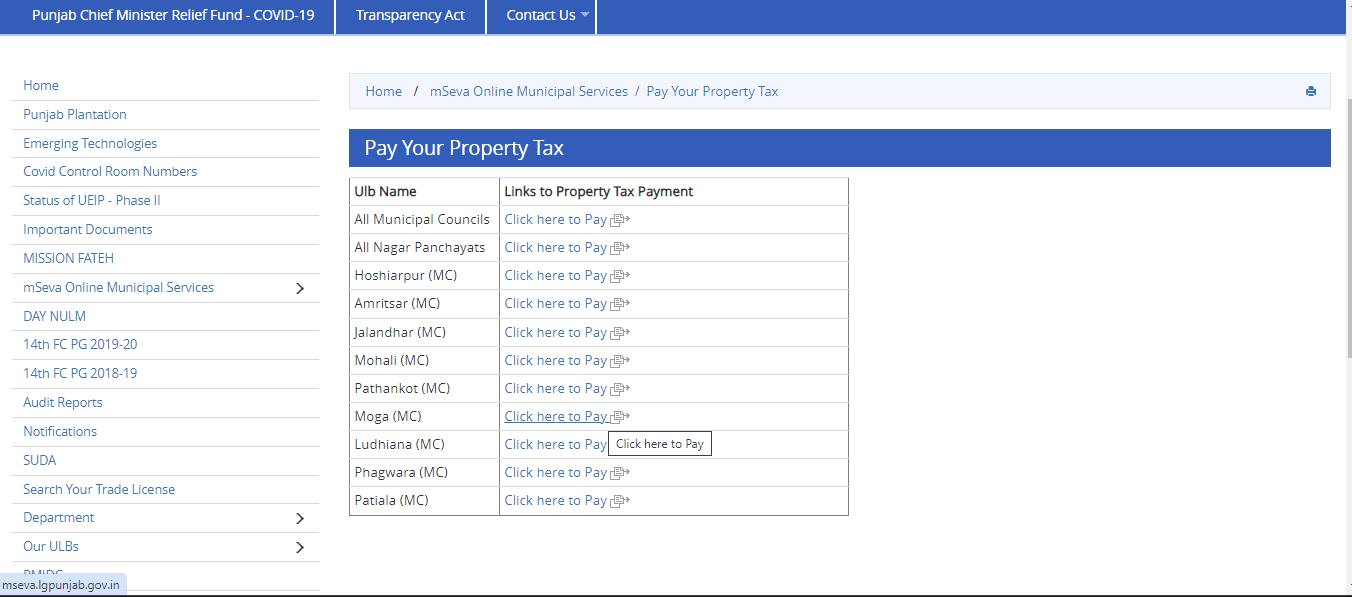

- You will reach the following page.

- Choose Moga (MC)

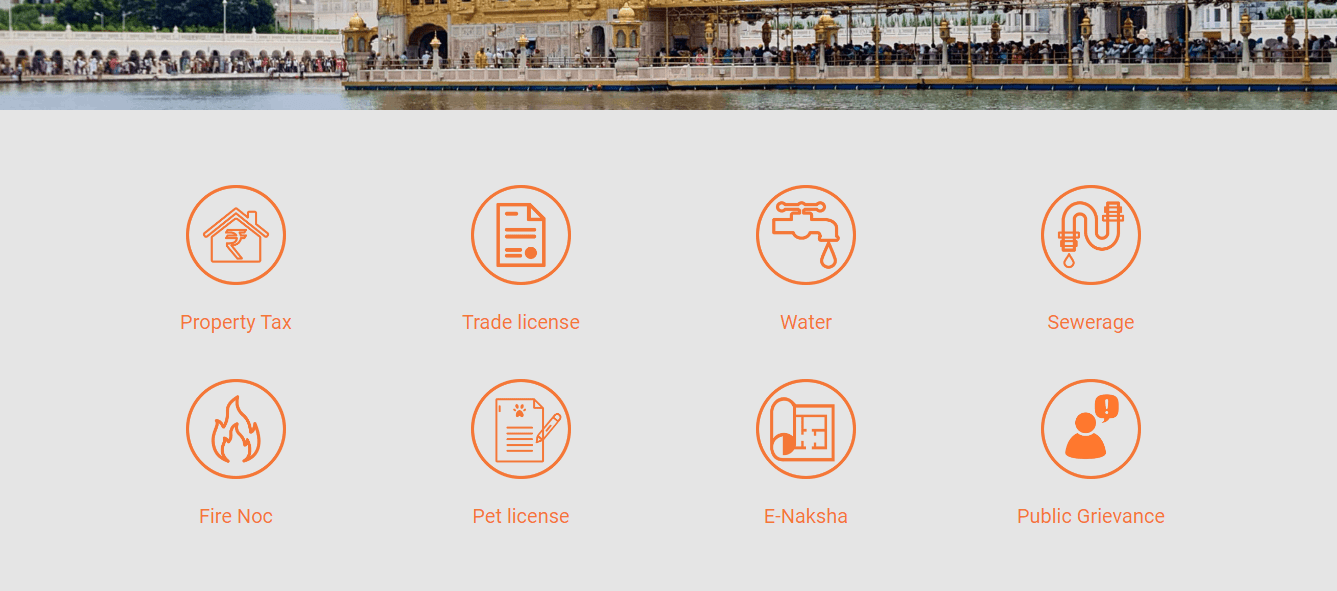

- You will reach https://mseva.lgpunjab.gov.in/common-screen. Choose property tax.

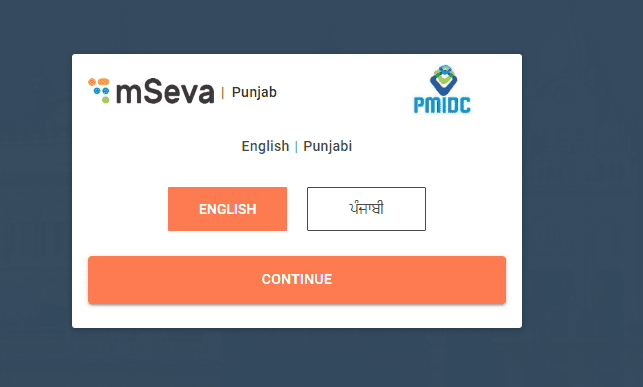

- Choose language between Hindi and Punjabi.

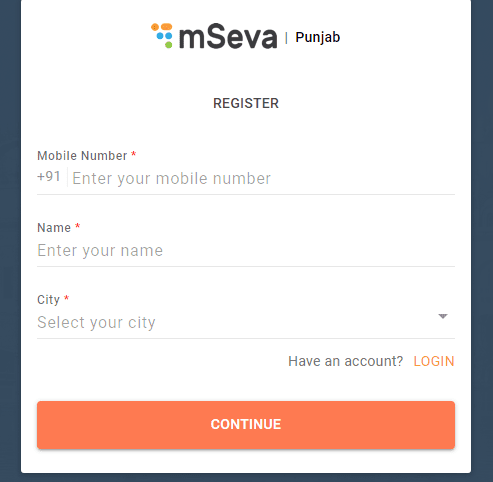

- Enter mobile number, name, and city. Click on ‘continue’ to pay Moga Property Tax.

How to pay Moga Property Tax offline?

- Visit any ward office in Moga.

- Fill in the property tax payment form and attach the supporting documents.

- Pay Moga Property Tax and get receipt.

What is the last date to pay Moga Property Tax?

The last date to pay Moga Property Tax is September 30 of every year.

What is the rebate offered for paying the Moga Property Tax on time?

Property owners can get a rebate of 10% on timely payment of Moga Property Tax.

How much is the penalty for late payment of the Moga Property Tax?

A penalty of around 1%-2%, on the total amount, is charged for the late payment of Moga Property Tax.

How to change the name of the owner in Moga Property Tax documents?

If a property in Moga is being transferred to another person, then mutation process should be followed to replace the name in the municipal records.

Documents required

- Sale deed

- Will deed

- Legal heir copy

- Partition deed

- Gift deed

- Released deed

- Revocation deed

- Cancel deed

- Settlement deed

What is the Moga Property Tax mutation process?

- You can visit the ULB office and collect the mutation form.

- Enter details, attach supporting documents, and make the required payment.

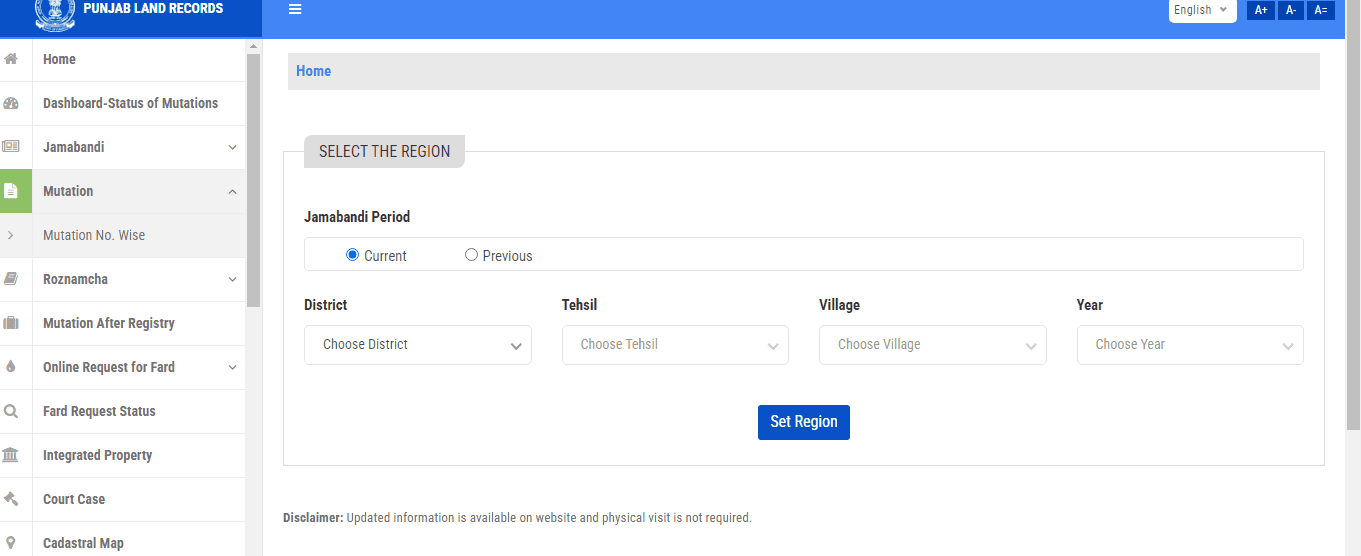

- You can also change the name online by visiting https://jamabandi.punjab.gov.in/.

- Select all details and click on set region.

- Click on mutation and select mutation number.

Moga Property Tax: Contact details

Punjab Municipal Bhawan,

3, Dakshin Marg, 35-A,

Chandigarh – 160022

Helpline: 1800 1800 0172

Email: egovdolg@gmail.com for any online payment issues.

Housing.com POV

The Moga Property Tax is used for the development of Moga. The Moga Municipal Corporation has made it easy to pay property tax online. It is the responsibility of the property owners to take advantage of this service and pay the taxes on time and avail of rebates.

FAQs

Who collects the Moga Property Tax?

The Moga Municipal Corporation collects Moga Property Tax.

What is the penalty for late payment of Moga Property Tax?

A penalty of 1%-2% on the total amount should be paid for the late payment of Moga Property Tax.

What are the various ways to pay property tax in Moga?

You can pay the Moga Property Tax through online or offline mode.

Is there any charge for paying property tax online in Moga?

No, there is no charge for paying property tax online in Moga.

When is the last date for paying property tax in Moga?

Property tax in Moga should be paid by September 30 every year.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |