The Municipal Corporation of Gorakhpur, also referred to as the Nagar Nigam Gorakhpur, is responsible for collecting property tax from the city’s residents. To streamline the process, the corporation has introduced a user-friendly portal for house tax payments in Gorakhpur. Timely payment of house tax is essential for getting attractive rebates and discounts on the payable amount. So, read on to learn when and how to pay Nagar Nigam Gorakhpur house tax.

Check how to pay Nagar Nigam Aligarh house tax

Nagar Nigam Gorakhpur house tax rates

The city’s municipal corporation has fixed the house tax in Gorakhpur at 12% of the taxable annual valuation. This property tax rate is fixed for all residential properties in the city.

How to calculate house tax Gorakhpur?

Nagar Nigam Gorakhpur house tax represents the annual payment made by taxpayers to the municipal corporation in their area. Calculating the house tax in Gorakhpur involves determining the annual valuation of the building, subject to a discount of either 25%, 32.5% or 40%, based on the building’s age. Factors influencing the assessment include the number of buildings on the plot, total plot area, location, ward name, nature of the building and ward expansion.

The carpet area is computed by adding the full internal dimensions of all rooms and covered verandas, half the dimensions of corridors, balconies, kitchens and storage rooms, and one-fourth of the internal dimensions of the entire garage. The annual assessment of the building is then calculated by multiplying the per square foot tax rate by the carpet area and multiplying the monthly rate by 12 yields the annual valuation. Then, house tax is determined as 12% of the taxable annual valuation.

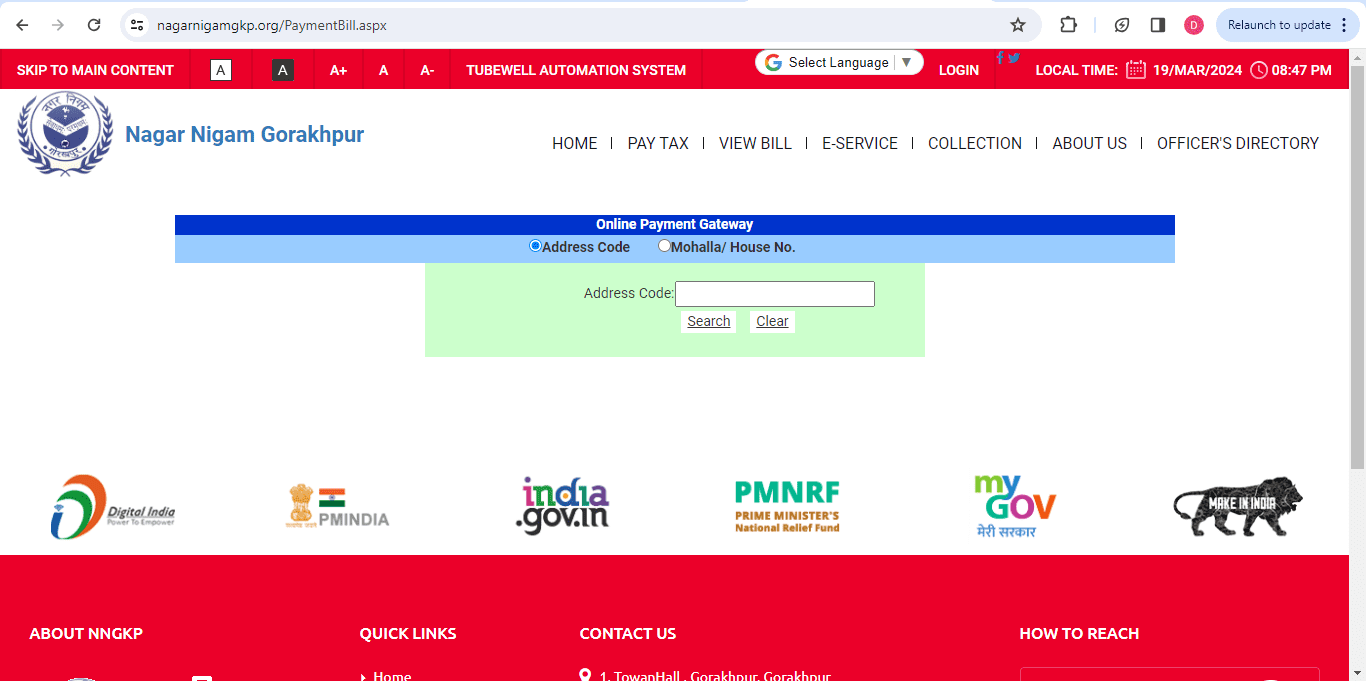

Nagar Nigam Gorakhpur house tax online payment

To pay the Nagar Nigam Gorakhpur house tax online within the stipulated deadline, residents should follow these simple steps.

- Visit the official website of the Municipal Corporation of Gorakhpur. Locate and click on ‘Pay Tax’ link available on the homepage.

- Enter the address code or mohalla/house number in the designated fields.

- Click on ‘Search’ to proceed with the online payment of house tax in Gorakhpur.

Nagar Nigam Gorakhpur house tax offline payment

Residents can also choose to pay their house tax offline by visiting the Municipal Corporation of Gorakhpur and using the provided payment gateway. Below are the contact details of the Nagar Nigam Gorakhpur.

- Phone Number: +91-0551-2333015

- Toll-free phone number: 1533

- Address: 1, Town Hall, Gorakhpur, Gorakhpur Uttar Pradesh – 273001, India

- E-mail addresses: [email protected], [email protected], and [email protected]

When to pay house tax Gorakhpur?

The deadline to pay Gorakhpur house tax for a specific fiscal year without incurring a penalty is January 31. Residents who pay their house tax on or before this date will receive a 10% rebate on the amount payable. Taxpayers who do not pay their Nagar Nigam Gorakhpur house tax within the specified deadline will be subjected to a penalty for late payment.

How to change name in Nagar Nigam Gorakhpur house tax bill?

Here are the steps for changing the name in Nagar Nigam Gorakhpur house tax bill.

- Visit the official Municipal Corporation of Gorakhpur website.

- Click on ‘Mutation’ under the ‘e-service’ tab on the homepage.

- Proceed to ‘Applicant Registration’ tab and fill in your name, mobile number, e-mail, password, and father, or husband’s name. Then, click on ‘Register’.

- Now, access ‘Applicant Login’ tab and enter your Login ID and password.

- Next, complete the application form and make the necessary payment for the mutation fees to finalise the process smoothly.

Housing.com POV

Paying Nagar Nigam Gorakhpur house tax has been made convenient through the introduction of a user-friendly online portal by the Municipal Corporation of Gorakhpur. Timely payment is crucial for getting rebates and discounts offered by the corporation. The house tax rate in Gorakhpur is fixed at 12% of the taxable annual valuation for all residential properties. Calculating house tax involves assessing the building’s age and various factors, such as plot area, location, and nature of the building. Residents can pay their house tax online through the official website or opt for offline payment by visiting the Municipal Corporation. The deadline for payment without penalties is January 31, with a 10% rebate available for timely taxpayers. Taxpayers who miss the deadline will be subjected to penalties.

FAQs

How is house tax Gorakhpur calculated?

House tax in Nagar Nigam Gorakhpur is calculated based on the annual valuation of the building. This valuation is determined by factors, such as the building's age, plot area, location, and nature. The tax rate is fixed at 12% of the taxable annual valuation.

Can I pay Nagar Nigam Gorakhpur house tax online?

Yes, residents can conveniently pay their house tax online through the official website of the Municipal Corporation of Gorakhpur. Simply visit the website, enter the necessary details, and proceed with payment.

What is the deadline for paying house tax in Gorakhpur?

The deadline for paying house tax in Gorakhpur for a specific fiscal year without penalties is January 31. Those who pay on or before this date are eligible for a 10% rebate on the payable amount.

How can I change the name on my Nagar Nigam Gorakhpur house tax bill?

To change the name on your house tax bill, visit the official Municipal Corporation of Gorakhpur website and follow the steps outlined under 'Mutation' in the 'e-service' tab. Complete the application form, make necessary payment for mutation fees, and finalise the process.

Is there an offline option for paying Nagar Nigam Gorakhpur house tax?

Yes, residents can also choose to pay their house tax offline by visiting the Municipal Corporation of Gorakhpur and using the provided payment gateway. Contact details for offline payment options are available on the Municipal Corporation's website.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Dhwani is a content management expert with over five years of professional experience. She has authored articles spanning diverse domains, including real estate, finance, business, health, taxation, education and more. Holding a Bachelor’s degree in Journalism and Mass Communication, Dhwani’s interests encompass reading and travelling. She is dedicated to staying updated on the latest real estate advancements in India.

Email: [email protected]