New Town, a satellite city of Kolkata, is emerging as a promising destination for investors and home buyers. This city enjoys proximity to Kolkata and is witnessing infrastructure development, with an upcoming metro line set to boost its connectivity. In recent years, New Town has also witnessed a transformation, thanks to the efforts of the New Town Kolkata Development Authority (NKDA) in leading eco-friendly initiatives for the city.

The NKDA is responsible for undertaking planned development and providing civic services for the residents in New Town. Before the New Town Kolkata Development Authority (Amendment) Act, 2016, the NKDA served as the local civic body and was later entrusted with the functions of a municipality, including the collection of NKDA property tax.

See also: Everything about PCMC property tax bill 2021-22

What is NKDA in West Bengal?

The NKDA, the full form of which is New Town Kolkata Development Authority. It is a development authority responsible for planning, implementing and coordinating development activities in the satellite city of New Town. The NKDA was established under The New Town Kolkata Development Authority Act, 2007, for providing a number of civic services and amenities within New Town and it came into effect from November 2008.

The NKDA, along with the Housing Infrastructure Development Corporation (HIDCO), has been steering numerous initiatives for making New Town into an eco-friendly, sustainable township.

How to download NKDA mutation certificate?

Mutation of property is a mandatory legal procedure that new buyers have to undertake to attain complete ownership of the property. So, mutation of flat in New Town Kolkata is a necessary step once the new flat is registered in your name.

The website nkdamar.org allows a person to apply for the issuance of the Record of Title (Mutation) by NKDA. The applicant (citizen, CSC, or kiosk operator) can also download the certificate through this online facility.

Here are the steps to get the NKDA mutation certificate:

Step 1: Log in to the website. On the home page, click on ‘Approved Application’.

Step 2: The ‘List of Approved Applications’ page will appear. Select the service name.

Step 3: After selecting the service name ‘Issuance of Record of Title (Mutation) by NKDA’, click on the search button. The list of approved applications for the service appears on the screen.

Step 4: Click on the icon ‘Certificate’ for the particular application, to download the ‘Issuance of Record of Title (Mutation) by NKDA’.

Property mutation mandatory in New Town, non-mutated properties ineligible for tax payment

According to the latest regulation by NKDA, property mutation will become mandatory in New Town. Non-mutated properties will be ineligible for tax payment. The NKDA recently modified its payments portal so that owners of non-mutated properties cannot pay property tax. Property owners cannot pay their taxes if they do not complete the mutation procedure. However, the NKDA has not set a deadline by which owners have to complete the process. A mutation fee must be paid by the applicants, which is based on factors like location and the size of the property.

What is NKDA area?

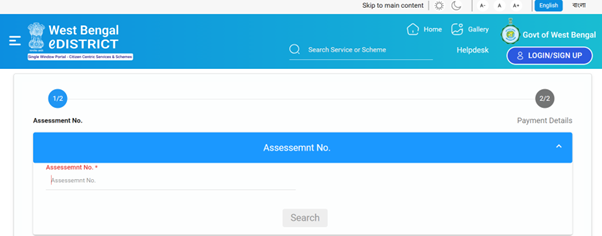

- Users will be directed to the West Bengal e-District page.

- Enter the assessment number in the given field. Click on ‘Search.’

- The property tax dues will be displayed. Check the details and proceed for payment.

- Users must choose the online payment mode and complete the payment.

- The NKDA property tax e-receipt will be generated. Download and save it for future reference.

Online services available on NKDA Website

Some of the online services that citizens can avail online through the NKDA official website include:

- Property tax payment

- Record of Title (Mutation)

- Conversion of Use of Building

- Building Plan Sanction

- Occupancy Certificate

- Birth & Death Registration

- Water Connection

About New Town Kolkata

New Town is a rapidly-developing city situated on the eastern outskirts of Kolkata. It is emerging as the new central business district and a favourable residential destination for home seekers and the migrant population.

New Town provides ample property options for home buyers, including ready-to-move-in apartments and under-construction properties. The average price of a 1BHK home in New Town can range from Rs 12 lakhs to Rs 50 lakhs and above, depending on the project, location, and other factors. Similarly, the price of 2BHK apartments can range from Rs 35 lakhs to Rs 60 lakhs and above and may vary on the basis of the project, location, etc.

In terms of connectivity, the city’s infrastructure is fast developing. With the upcoming New Garia-Airport Metro line, the connectivity in this location is likely to see tremendous improvement. Currently, the transportation facilities include buses, taxis and rickshaw services. There are many healthcare facilities, schools, and shopping malls.

Also read all about the Kolkata Metro East West corridor

Housing.com News Viewpoint

The NKDA, through its official websites, enables citizens to avail a wide range of services, including property tax payment. In addition, the NKDA also shares notifications, advisory and public information on its portal. If you are planning to buy a property in Kolkata’s New Town, it is important to understand your responsibilities, such as payment of property tax. Timely property tax payment is necessary to avoid penalties. Moreover, applying for property mutation is equally important to avoid legal hassles pertaining to ownership. The NKDA is the authority responsible for sanctioning building plans and approving the conversion of building use. So, property owners must be aware of the application procedures.

FAQs

What is the full form of HIDCO?

The West Bengal Housing Infrastructure Development Corporation Ltd (WBHIDCO) is also known as HIDCO.

Is New Town and Rajarhat same?

Rajarhat is a locality situated near Kolkata. New Town was developed into an integrated city from two villages - Rajarhat and Bhangar, by the Housing Infrastructure Development Corporation (HIDCO).

What is a mutation certificate?

Mutation certificate is a document required during the sale or transfer of property. It enables the new property owner to record his/her name in the land revenue department records and apply for utility connection.