Govt launches revamped National Pension System website

July 28, 2023: Pension Fund Regulatory & Development Authority (PFRDA) chairman Deepak Mohanty today launched the revamped National Pension System (NPS) Trust website. The new website accessible at https://npstrust.org.in marks a significant milestone in NPS Trust’s commitment to enhancing user experience and providing seamless access to information related to the National Pension System (NPS) and the Atal Pension Yojana (APY).

On the landing page itself, three important tabs — Open NPS Account, Plan your retirement (pension calculator) and View my NPS holdings—are placed for the convenience of the subscribers. On the home page, the subscribers can view the scheme returns in a simple, understandable graphical representation.

The menu structure is organised and standardised into six simpler categories, for both NPS and APY: Features and Benefits, Online Services, Returns and Charts, NPS Calculator, Grievances and Exit.

NPS calculator

The NPS calculator allows one to know the amount of pension per month under the government’s National Pension Scheme, rechristened as the National Pension System or the NPS scheme.

The NPS calculator illustrates the tentative pension and lump-sum amount an NPS subscriber can expect at 60 years of age or on maturity, based on one’s regular monthly contributions, percentage of the corpus that is reinvested for purchasing an annuity and assumed rates in respect of returns on investment and annuity.

For the uninitiated, the NPS scheme is a voluntary retirement scheme managed by the Pension Fund Regulatory and Development Authority (PFRDA). Available to all Indian citizens aged between 18 and 65 years, the NPS scheme gives an individual an option to build a retirement fund.

See also: Step-wise guide to using the official income tax calculator

NPS calculator: Step-wise process to use it online

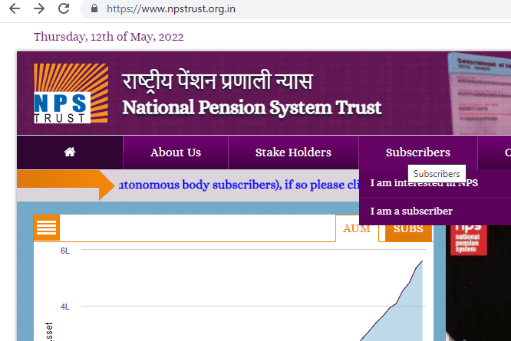

Step 1: Visit the National Pension System Trust’s (NPS Trust) official website at www.npstrust.org.in.

Step 2: Click on ‘Subscriber’ and the ‘I am interested in NPS’ option.

Step 3: Click on the ‘Calculate the Pension Need’ option to reach the NPS calculator.

Step 4: The next page will show the NPS calculator with standard calculations. Input your details for your calculation.

Step 5: At this stage, provide the following details for the NPS calculator to calculate your pension savings:

- Date of birth: Based on this, the NPS calculator will reflect the number of years you will be able to contribute to the NPS.

- Investment amount: Enter your monthly contribution towards the NPS scheme.

- Expected return on investment: Choose the expected return on investment.

- Percentage of annuity to be purchased: The percentage of an annuity cannot be less than 40%.

- Expected annuity rate: Enter the expected rate of the annuity.

See also: What is a mutual fund calculator

Once all the details are entered, the NPS calculator would show the details of your NPS account value at maturity.

See also: Lumpsum calculator: Know how to use an online lumpsum investment plan calculator

How the NPS calculator computes your monthly pension?

Let us assume that Sunaina, 38, is a private sector worker. She has decided to invest in the NPS scheme now and plans to contribute Rs 2,000 monthly till she is 60. She expects a return on investment of 9% annually. She is buying an annuity for 40% and expects a 7% rate of return on the annuity.

Total years of contribution: 37

Total investment: Rs 8,88,000

Total corpus generated: Rs 71,44,746

Lump-sum value: Rs 42,86,848

Annuity value: Rs 28,57,898

Expected monthly pension: Rs 14,289

FAQs

What is the NPS scheme?

The NPS scheme is a voluntary retirement scheme managed by the Pension Fund Regulatory and Development Authority. The scheme gives an individual an option to build a retirement fund.

What is the age cut-off to start investing in the NPS scheme?

One can start an NPS account from 18 to 60 and continue to contribute to this account till they are 70 years old.

What is an annuity?

An annuity is a financial instrument that offers you a periodic - monthly/quarterly/annual - pension at a guaranteed rate for a period you choose.

How does annuity work in the NPS scheme?

At the time of exit from the NPS scheme upon maturity (at the age of 60), all subscribers are supposed to use at least 40% of the whole NPS corpus to buy an annuity. (This condition is not applicable in cases where the total corpus accumulated does not exceed Rs 5 lakhs.) They are free to withdraw the remaining 60% corpus, which happens to be tax-free. The other 40% is used as an investment in typically an insurance company, which offers the subscriber returns at fixed intervals. Note that those exiting prematurely before the age of 60 have to use 80% of the corpus to buy an annuity and can withdraw only 20% lump-sum amount.

What are the different types of annuities in the NPS scheme?

Annuity service providers offer the following type of annuities to NPS subscribers: 1. Pension (annuity) payable at a uniform rate for life, to the policyholder. 2. Pension (annuity) payable for five, or 10, or 15, or 20 years certain and thereafter, for as long as the pensioner is alive. 3. Pension (annuity) for life and return of purchase price upon the policyholder’s death. 4. Pension (annuity) payable for life and increasing at a simple rate of 3% per annum. 5. Pension (annuity) for life with a provision for paying 50% of the annuity to the spouse during his/her lifetime, upon the policyholder’s death. 6. Pension (annuity) for life with a provision for paying 100% of the annuity to the spouse during his/her lifetime, upon the policyholder’s death. 7. Pension (annuity) for life with a provision for paying 100% of the annuity to the spouse during his/her lifetime, upon the policyholder’s death and the return of the purchase price to the nominee.

Which companies offer annuity to NPS subscribers?

Life insurance companies, which are licensed by the Insurance Regulatory and Development Authority (IRDA) are empanelled by the PFRDA to act as annuity service providers. Some of the ASPs are Life Insurance Corporation of India, SBI Life Insurance, ICICI Prudential Life Insurance, Star Union Dai-ichi Life Insurance and HDFC Standard Life Insurance.