Ahmednagar is a town in Maharashtra. The Ahmednagar Municipal Corporation is the municipal authority responsible for providing various services to the citizens. It collects taxes, including property taxes, from property owners and the amount forms a major part of its revenue, which is utilised for the development of infrastructure and other public facilities. The Ahmednagar Municipal Corporation provides an online portal for Ahmednagar property tax online payment and various other services. In this article, we explain the process of property tax payment in Ahmednagar.

Property tax in Ahmednagar

Property tax in Ahmednagar refers to the annual tax that must be paid to the municipal authority by residential and non-residential property owners. The municipal authority fixes the property tax rates based on various factors, including the property type. Property owners can pay property tax in Ahmednagar online through debit card, credit card, net banking or UPI or NagarMseva mobile application, or it can be paid offline by visiting the local office.

How to pay property tax in Ahmednagar online?

Property tax in Ahmednagar can be paid through the official Ahmednagar Municipal Corporation website or NagarMseva mobile application.

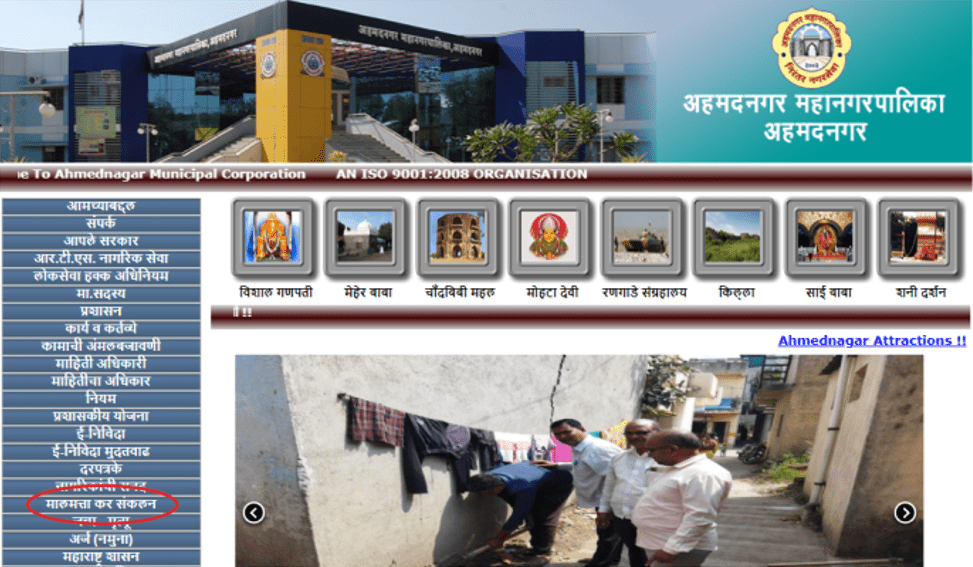

- Go to the official website of the Ahmednagar Municipal Corporation at https://amc.gov.in/.

- Click on ‘Collection of Property Tax’.

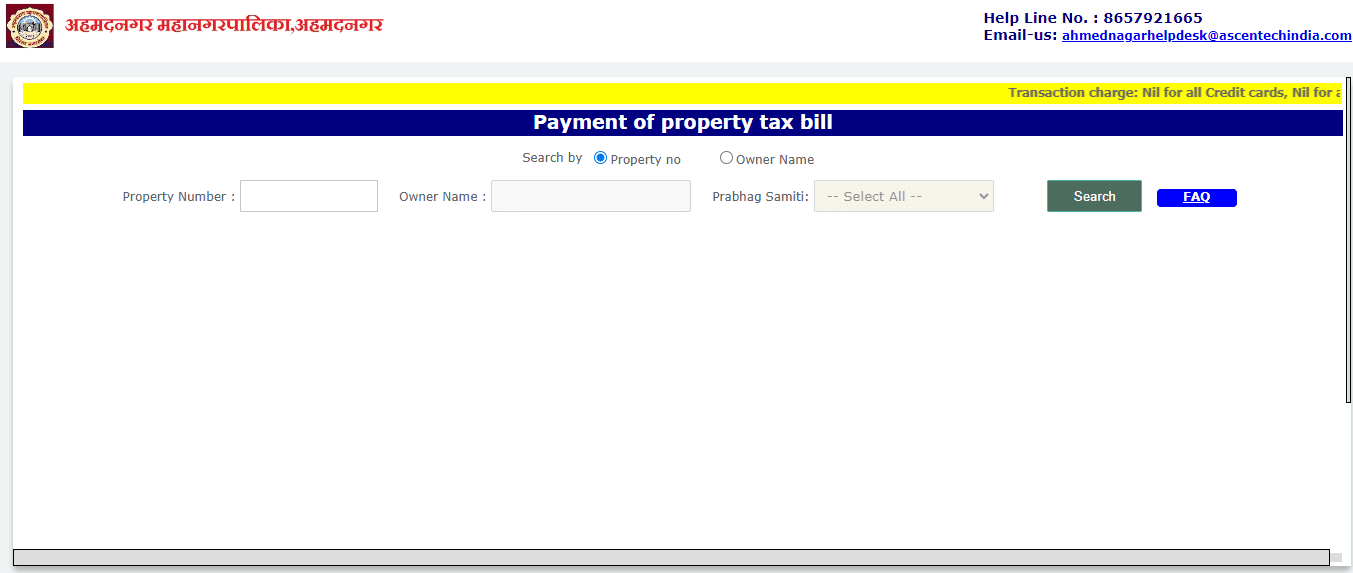

- Users will be redirected to the property tax page at ahmednagarcorporation.in.

- Enter the property number or owner name and all the other required details. Click on ‘Search’.

- The property tax details will be displayed on the screen.

- Proceed to pay the property tax using debit card, credit card, net banking or UPI.

- A confirmation message will be sent to your mobile number and a receipt will be mailed to the registered email address.

In case taxpayers pay at the municipal corporation office, they can check and download the payment receipt on the Nagar Mseva mobile application.

Advance property tax payment in Ahmednagar

The advance property tax payment time is specified by the municipal authority for residents to pay their property tax in Ahmednagar. According to the Maharashtra Municipal Corporation Act, the property tax in Ahmednagar must be paid in advance in semi-annual instalments in April and October.

If taxpayers fail to pay the property tax on or before the due date, a penalty of 2% of the tax amount every month is levied until the full amount is paid. If the authority increases the property tax rate during the term of the specified bill or if the annual taxable amount is increased, used or changed due to construction, residents must pay the additional amount.

How to change the name in the property tax in Ahmednagar?

- To change your name in property tax in Ahmednagar, visit the nearest Ahmednagar Municipal Corporation office.

- Fill out the application form.

- Submit the application form along with all the required documents.

- Pay the requisite fee through the prescribed payment mode.

- The authority will verify the application and the attached documents.

- If it is approved by the officials, an acknowledgement receipt will be sent to the applicant.

How to pay property tax in Ahmednagar offline?

To pay property tax in Ahmednagar offline, visit the nearest Ahmednagar Municipal Corporation office along with the required documents. Approach the official concerned and pay the property tax. Open the Nagar Mseva mobile application on your phone to view and download the payment receipt.

Property tax in Ahmednagar: Documents required

No documents are required except the property tax bill, which is delivered to the address of the property owner. One can carry identity proof when visiting the municipal authority’s office.

Ahmednagar Municipal Corporation: Contact information

Helpline number: 8757921665

Email: [email protected]

Housing.com News Viewpoint

The online facility provided by the Ahmednagar Municipal Corporation simplifies the payment of property tax in Ahmednagar and eliminates the need to visit the authority’s office. The portal allows citizens to check their property tax dues online and download the receipt for future reference.

FAQs

What is the last date for paying the property tax in Ahmednagar?

The last date to pay the property tax in Ahmednagar is April and October of every year.

How to download property tax payment receipts in Ahmednagar?

After the payment process is completed, the payment receipt will be sent to the registered email ID. Open the document and download it.

What is the penalty for late payment of property tax in Ahmednagar?

A penalty of 2% of the tax amount every month is levied until the full amount is paid.

How to pay property tax in Ahmednagar online?

Visit the official website of the Ahmednagar Municipal Corporation to pay the property tax online.

How is property tax calculated in Maharashtra?

Property tax in Maharashtra is calculated at 20% of the annual rental amount based on the capital value-based property tax system or based on Rs 10 per square foot of the total carpet area, whichever is higher.

Who must pay property tax in Ahmednagar?

The owners of a property in Ahmednagar, whether residential or commercial, must pay property tax annually to the Ahmednagar Municipal Corporation.

How to check property tax dues in Ahmednagar?

Visit the official website of the Ahmednagar Municipal Corporation. Click on the ‘Collection of Property Tax’. Enter the required information to view the property tax dues.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.