Chandigarh, the capital of Punjab and Haryana, is one of the sought-after Tier-2 cities for property investment. Those owning a residential or commercial property in the city must pay the Municipal Corporation Chandigarh (MCC) property tax. The civic body is responsible for collecting property taxes, a major source of revenue utilised to develop infrastructure in the city. Property owners can pay their property taxes online through the official portal of the MCC.

Property tax in Chandigarh

All property owners must pay property tax annually to the MCC. The property tax is determined based on the type of property and the valuation method decided by the MCC.

MCC property tax rates in Chandigarh in 2024

Residential property tax rates

| Zones | Residential property tax rates |

| I | Rs 2.5 per sq yd on vacant plot areas plus Rs 1.25 per sq ft on the total covered area on all floors. |

| II | Rs 2 per sq yd on vacant plot areas plus Re 1 per sq ft on the total covered area on all floors. |

| III | Rs 1.5 per sq yd on vacant plot areas plus Rs 0.75 per sq ft on the total covered area on all floors. |

See also: Zirakpur property tax: Online payment, tax rates and rebates

Commercial property tax rates

| Zones | Commercial property tax rates |

| I, II, III and IV | Rs 3 to Rs 20 per sqft |

The MCC has categorised commercial properties based on different zones. The commercial property tax rates in Chandigarh are calculated based on several factors, such as property type, usage, and location.

How to pay property tax in Chandigarh?

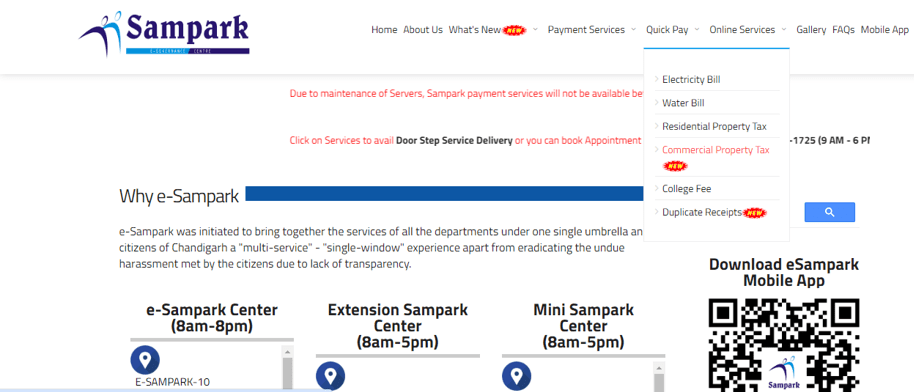

- Visit the official website of Chandigarh Administration, Sampark https://sampark.chd.nic.in/Epayment/index.aspx.

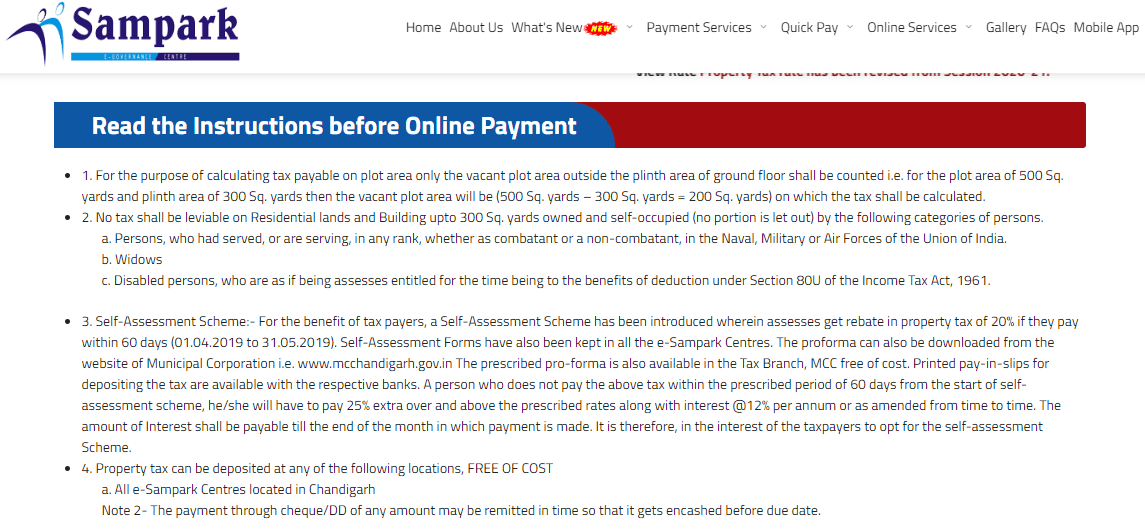

- Go to ‘Quick Pay’ option on the top menu bar. Choose Residential Property Tax or Commercial Property Tax from the options. Read the instructions and click on ‘Proceed’.

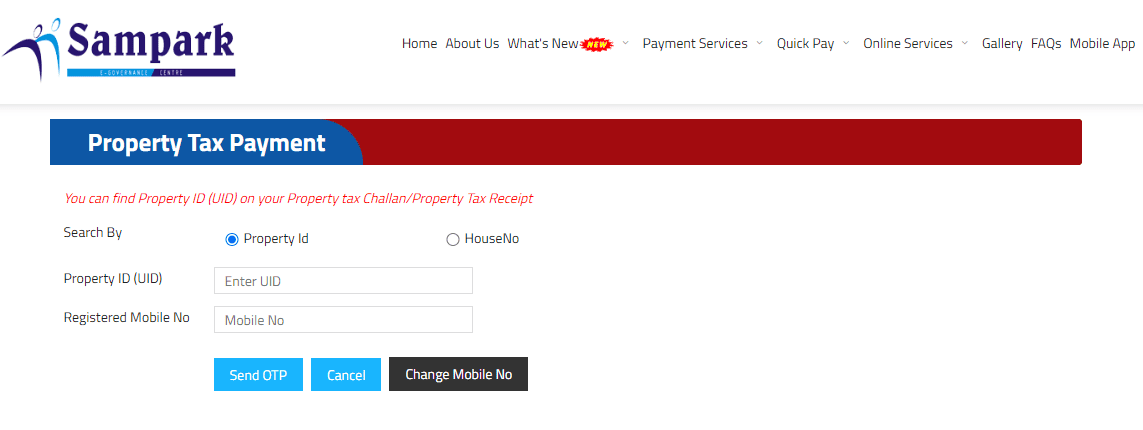

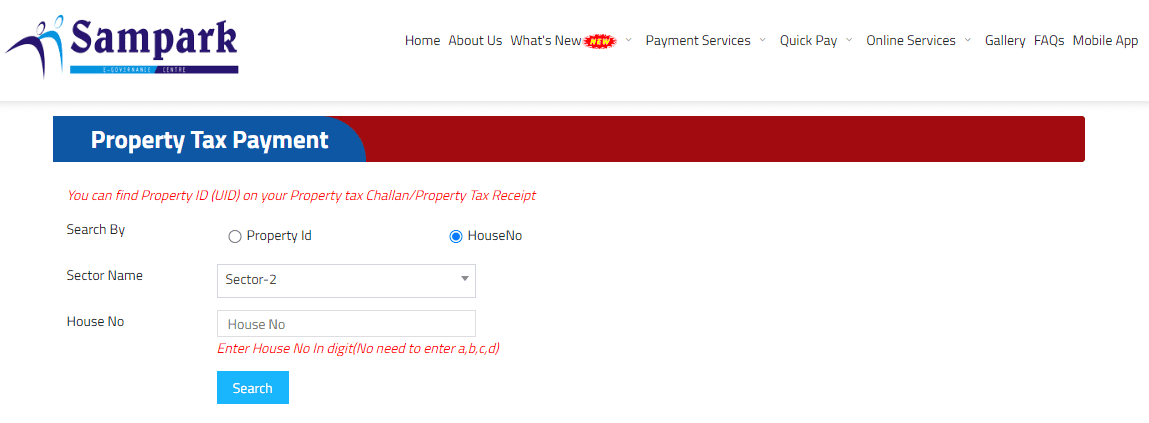

- On the next page, click on one of two options – Search by Property ID or House Number.

- Enter details, such as Property ID and mobile number.

- In case of search by Property ID, enter the One Time Password (OTP) sent to the registered mobile number.

- In case of search by House Number, enter the sector name and house number.

- A list of property details will be displayed on the screen. Click on the relevant property details, the property ID (UID) will appear on screen. Click on Send OTP, which will be sent to your registered mobile number to complete the online payment.

How to download property tax payment receipt in Chandigarh?

- Visit the official property tax payment website, https://sampark.chd.nic.in.

- Click on ‘View Property Tax’ under ‘Online Services’ from the right corner.

- On the next page, provide your valid property ID or house number to view the property tax payment receipt.

- Click on ‘View Bill’ to download the property tax payment receipt.

How to change name in property tax in Chandigarh?

To change name in the property tax in Chandigarh, one should approach the respective district commissioners. Fill out and submit the application form with relevant details along with the requisite documents. Make the payment of the required fee.

Property tax calculator in Chandigarh

The property tax in Chandigarh is calculated separately for residential and commercial properties.

Residential properties

- Assess the annual rental value (ARV) of the property based on location, type, and other facilities.

- Follow the self-assessment process or visit the municipal corporation for ARV assistance.

- The prescribed tax rate is 3% for properties up to 125 sq yd and 5% for properties above 125 sq yd.

- Calculate property tax using the following formula:

Property tax: annual property tax = ARV x rate of tax x rebate

Commercial properties

- Assess the property’s category using the property tax assessment register.

- Calculate property tax by multiplying the ARV with the prescribed tax rate (10% to 20% based on the category).

- Additional charges or penalties applicable must be added.

Advance property tax payment in Chandigarh

Advance property tax refers to the payment of tax in advance instead of paying it at the end of a financial year. One should pay advance property tax between April and May. Paying advance tax before the prescribed time makes taxpayers eligible for a 10% rebate, while paying after the specified period attracts a 25% penalty on the total amount.

FAQs

How to add a mobile number to property details?

Visit the Municipal Corporation, Chandigarh Sector-17 office to register your mobile number in property details.

What is the last date for property tax payment in Chandigarh?

The last date for property tax payment in Chandigarh is March 31 of the financial year.

How to download property tax payment receipts in Chandigarh?

Go to MCC's official website and click on the property tax option in ‘Quick Pay’ section. Enter your property ID and house number to view the property tax payment receipt in Chandigarh.

How to pay property tax online in Chandigarh?

One can pay his property tax in Chandigarh online through the official portal of the Municipal Corporation Chandigarh.

How is property tax calculated in Chandigarh?

Property tax in Chandigarh is calculated based on the property type and other factors determined by the Municipal Corporation Chandigarh.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.