Those having a property in Kakinada, a city in Andhra Pradesh, must pay property tax to the local authority. The Commissioner & Director of Municipal Administration of the Government of Andhra Pradesh (CDMA) is responsible for collecting property taxes in the city and utilising the revenue to develop infrastructure and other public facilities. Residents can pay their property tax online in Kakinada through the official portal of the CDMA. In this article, we would explain the online process to pay and calculate property tax in Kakinada.

See also: How to pay property tax in Vijayawada?

Property tax in Kakinada

Property tax in Kakinada is an annual tax that owners of any residential or commercial property must pay to the Kakinada Municipal Corporation. The property tax is determined based on factors, such as property type, location, corporation name, etc.

Property tax rate in Kakinada in 2024

| Criteria | Residential property | Commercial property |

| General tax | 0.025 | 0.09 |

| Water tax | 0.005 | 0.0175 |

| Drainage tax | 0.006 | 0.0225 |

| Lighting tax | 0.004 | 0.014 |

| Conservancy tax | 0.01 | 0.036 |

| Total residential tax | 0.05 | 0.018 |

| Vacant land tax per year | – | 0.5 |

Source: CDMA

How to pay property tax online in Kakinada?

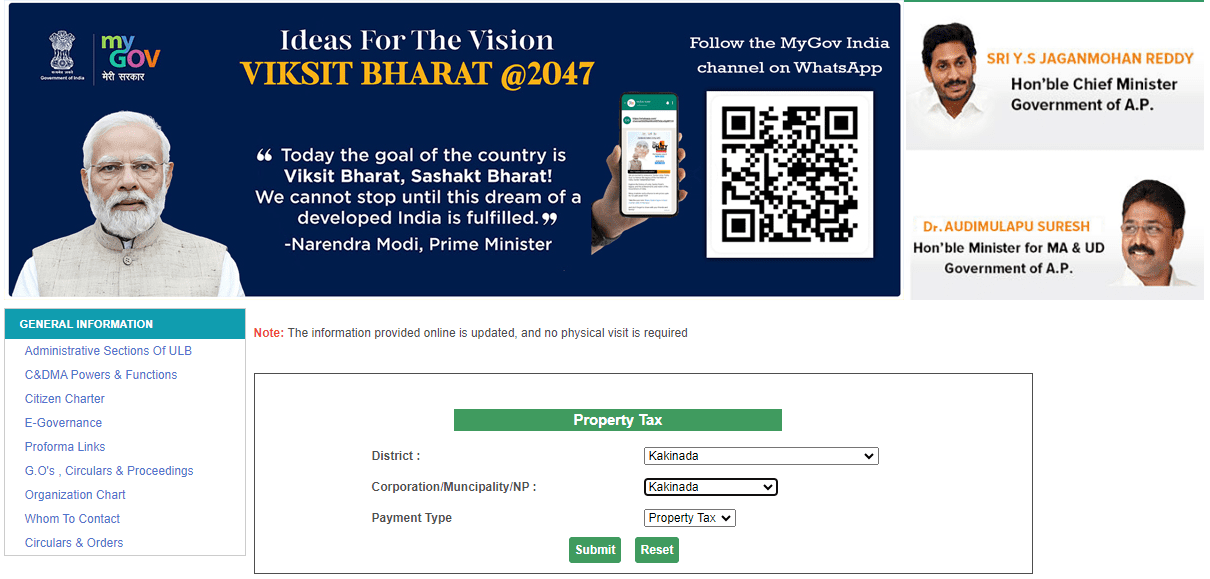

- Go to the official website of the Commissioner & Director of Municipal Administrations, Government of Andhra Pradesh (CDMA) https://cdma.ap.gov.in/ .

- Click on ‘Property Tax’ under the ‘Online Payment’ section on the homepage.

- Users will be directed to the next page. Select the district, corporation, and payment type from the dropdown menu. Click on ‘Submit’.

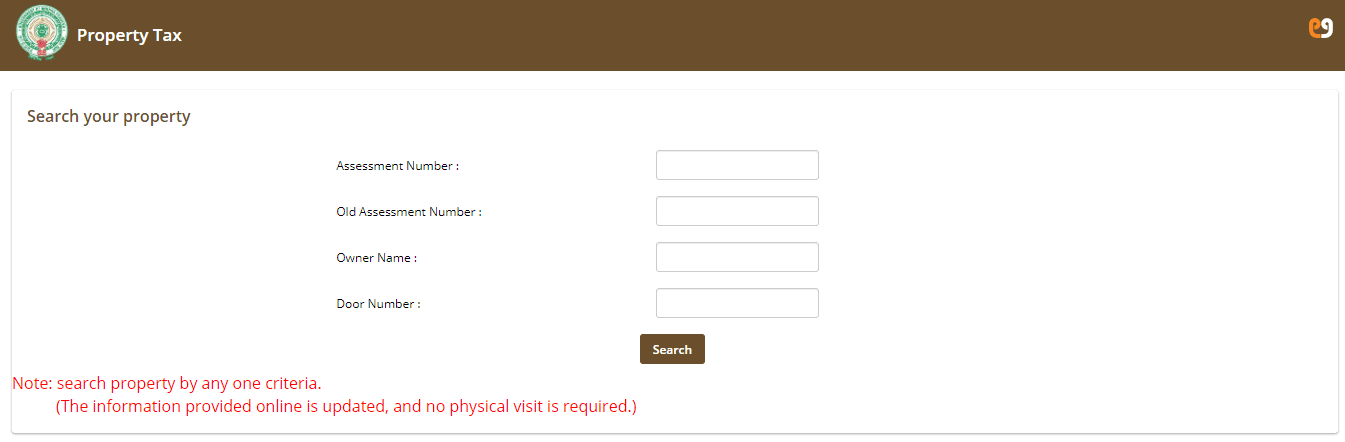

- On the next page, provide details such as assessment number, old assessment number, owner name and door type. Click on ‘Search’.

- The property tax dues will reflect on screen. Proceed to make the payment through any online payment method.

How to calculate property tax in Kakinada?

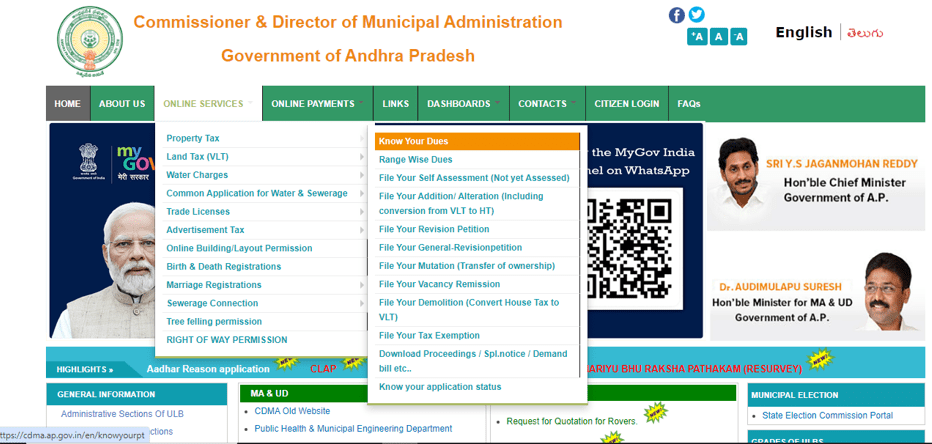

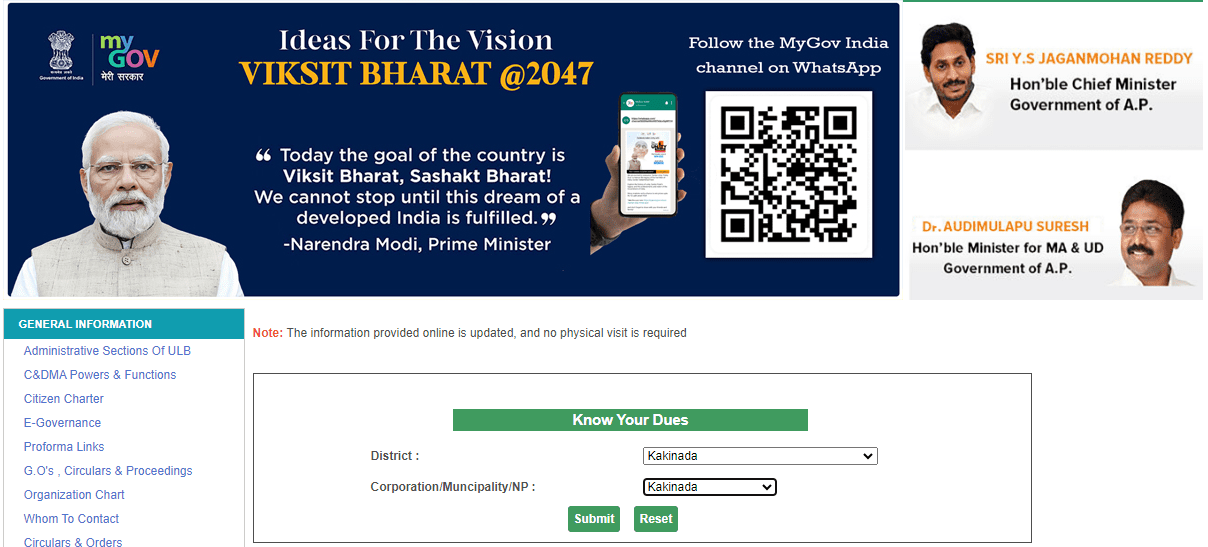

- Go to the official website of the Commissioner & Director of Municipal Administrations, Government of Andhra Pradesh (CDMA) https://cdma.ap.gov.in/ .

- Click on ‘Know your dues’ under ‘Online Services’.

- Choose district and corporation from the dropdown menu.

- Choose ownership category, total area in sq yd, land underneath sq yd, habitation, IGRS locality, IGRS ward, IGRS block, door number.

- Enter floor number, building classification, nature of usage, IGRS, classification, construction date, plinth area (sqft), building plan, and plinth area.

- Click on calculate.

How to change name in property tax in Kakinada?

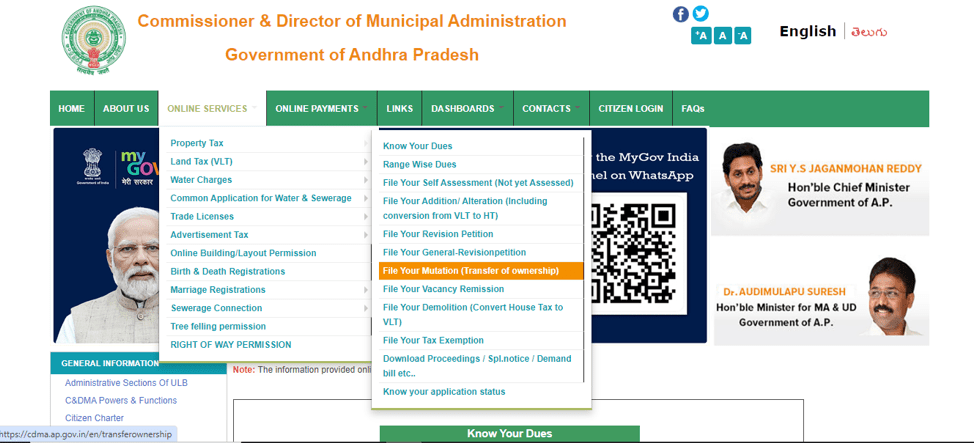

- Go to the official website of the Commissioner & Director of Municipal Administrations, Government of Andhra Pradesh (CDMA) https://cdma.ap.gov.in/.

- Under ‘Online Services’, click on ‘File your Mutation (transfer of ownership)’ option.

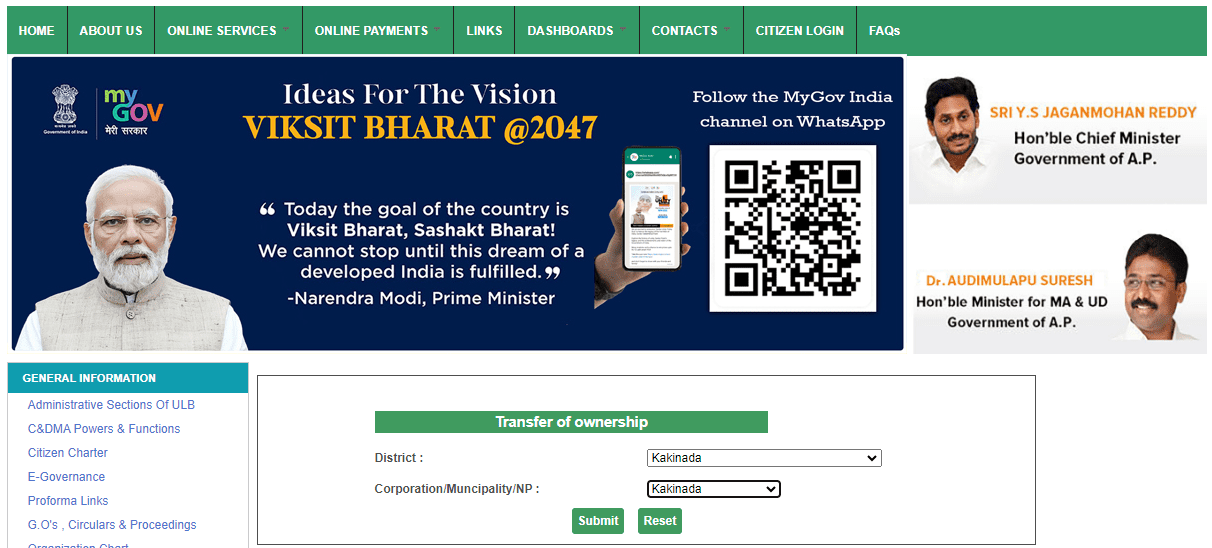

- Select the district and corporation from the dropdown. Click on ‘Submit’.

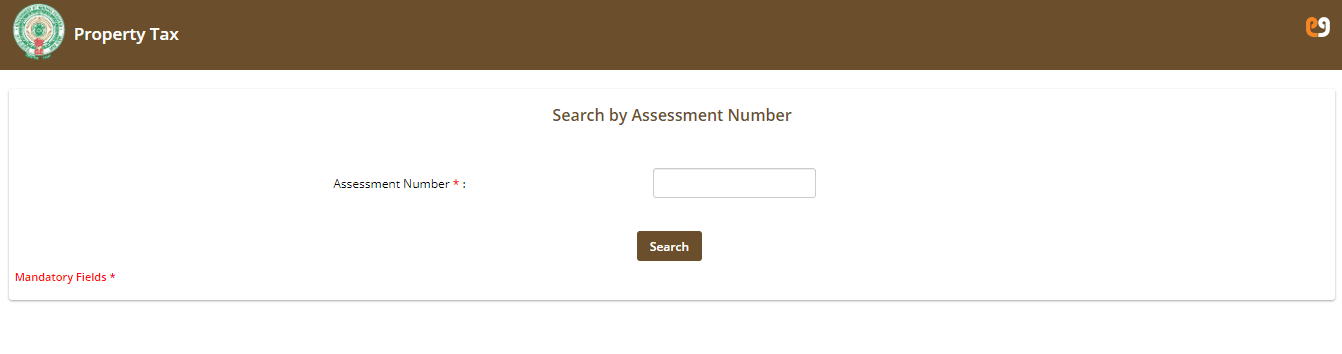

- On the next page, provide your assessment number and click on ‘Search’.

- In the next step, submit details such as ownership form and ‘Submit’.

FAQs

What is the last date for property tax payment in Kakinada?

The last date for the payment of property tax in Kakinada is April 30th of the current year.

What is the property tax rebate in Kakinada?

Property owners in Kakinada can pay their property tax for the first and second half of the current year by April 30. Those who make the payment on or before the due date can avail of a 5% rebate on the total tax value.

How to check property tax dues in Kakinada?

One can check his property taxes online in Kakinada on the official website of the Commissioner & Director of Municipal Administration, Government of Andhra Pradesh.

How is property tax calculated in Kakinada?

Property tax is calculated by the local authority after considering several factors, such as type of property, location, etc.

How to download property tax receipt in Kakinada?

One can download property tax receipt through the online payment page of CDMA.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.