Paying rent with a credit card can be tempting, especially if you’re trying to build up rewards points or want to make your ends meet. However, before you decide to take this route, it’s important to understand the pros and cons of paying rent with a credit card. Let’s explore the advantages and disadvantages of paying rent through a credit card, so that you can make the right choice.

Paying rent with credit card: Pros

These are some of the major advantages of using a credit card to pay your rent.

Earn rewards points

One of the main advantages of paying rent through a credit card is that you can earn rewards points. Many credit cards offer points, or cashback for every penny you spend, which can add up quickly if you’re paying a large monthly rent. Some credit cards also offer sign-up bonuses or other rewards for using their cards to pay rent.

Convenience

Paying rent through a credit card can be a convenient option, especially if you don’t have a checking account or do not prefer cheques. You can set up automatic payments and should never worry about late fees or missed payments.

Build credit score

Using your credit card to pay rent can also help you build credit. If you make payments on time and keep your credit utilisation low, it can positively impact your credit score in the long run.

Emergency funds

Paying rent through a credit card can also provide a source of emergency funds if you need them. If unexpected expenses arise and you don’t have cash in hand, you can use your credit card to cover your rent payments and avoid late fees.

Paying rent with credit card: Cons

Following are some drawbacks associated with using a credit card to pay rent.

High fees

One of the biggest disadvantages of paying rent through a credit card is the high fees. Many platforms charge a convenience fee for facilitating rent payment through credit card, which can range from 2-3% of the rent amount. If you’re paying a high monthly rent, these fees can add up quickly and negate any rewards you earn.

Interest charges

If you don’t pay your credit card balance fully every month, you’ll be subjected to interest charges. Credit card interest rates can be as high as 25% or more, which can quickly add up if you’re carrying a balance from month-to-month.

Risk of debt

Paying the rent with a credit card can also put you at risk of accumulating debt. If you don’t have funds to repay your credit card balance in full every month, you may end up carrying a balance and paying interest charges for months or even years.

Things to consider before paying rent with credit card

Before you decide to pay rent using a credit card, it’s important to consider several factors that could affect your finances. These include:

Credit utilisation ratio

Paying rent with a credit card could increase your credit utilisation ratio, which could negatively impact your credit score. Your credit utilisation ratio is the amount of credit you use compared to the amount of credit available to you. It’s recommended to keep your credit utilisation ratio below 30% to maintain a good credit score.

Interest charges

If you carry a balance on your credit card, interest charges will apply. The interest charges can accumulate over time, making it more expensive to pay rent with a credit card than other payment methods.

Processing fees

Credit card companies may charge a processing fee for using a card to pay rent. This fee can vary between 2% and 4% of the total rent amount. Moreover, platforms that facilitate rent payment via credit card also charge an additional convenience fee. This way, the cost of paying rent with a credit card could quickly add up.

It’s important to weigh the benefits of earning rewards points or building credit against the potential fees and interest charges associated with paying the rent through a credit card. Always read the fine print and understand the terms and conditions before using your credit card to pay the rent. With careful consideration and planning, paying rent with a credit card can be a smart financial move.

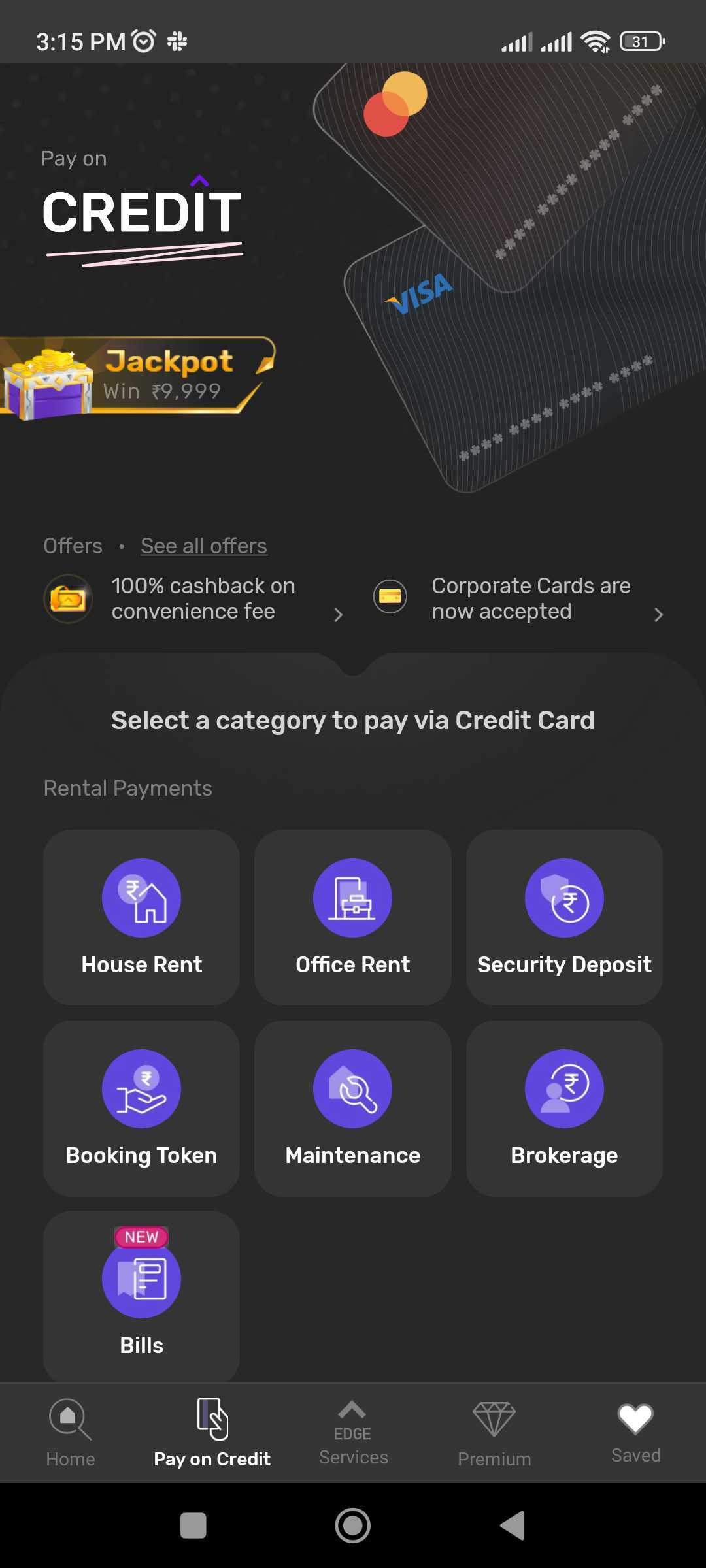

How to pay rent with a credit card?

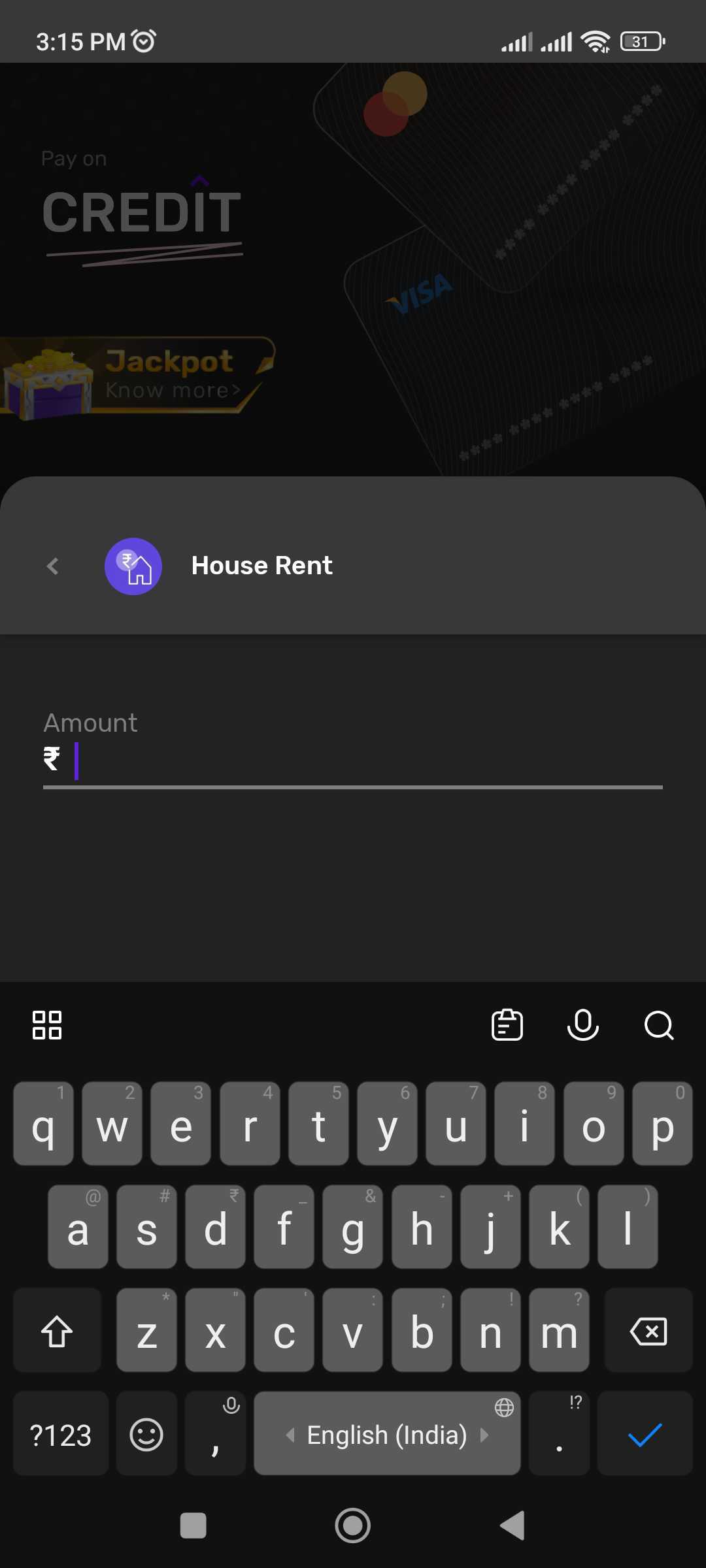

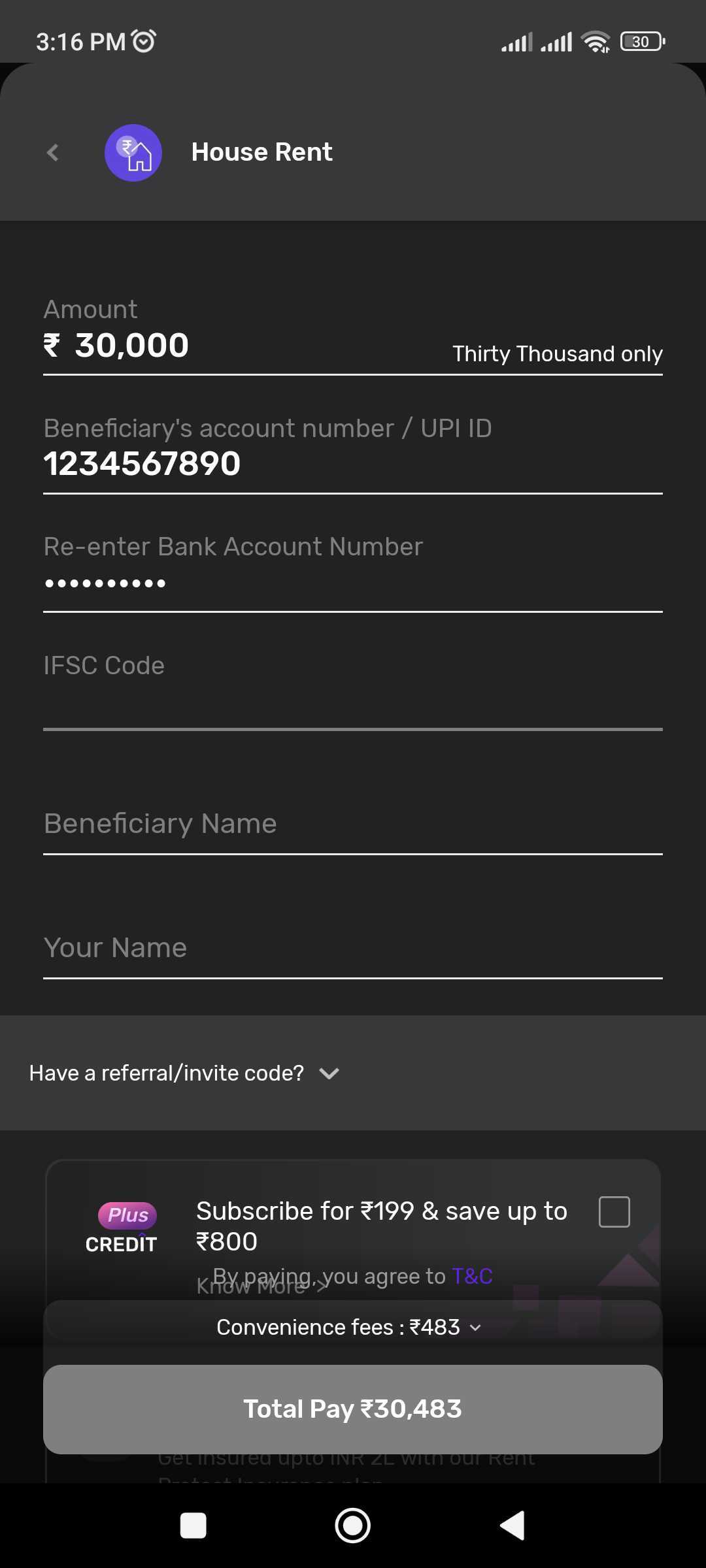

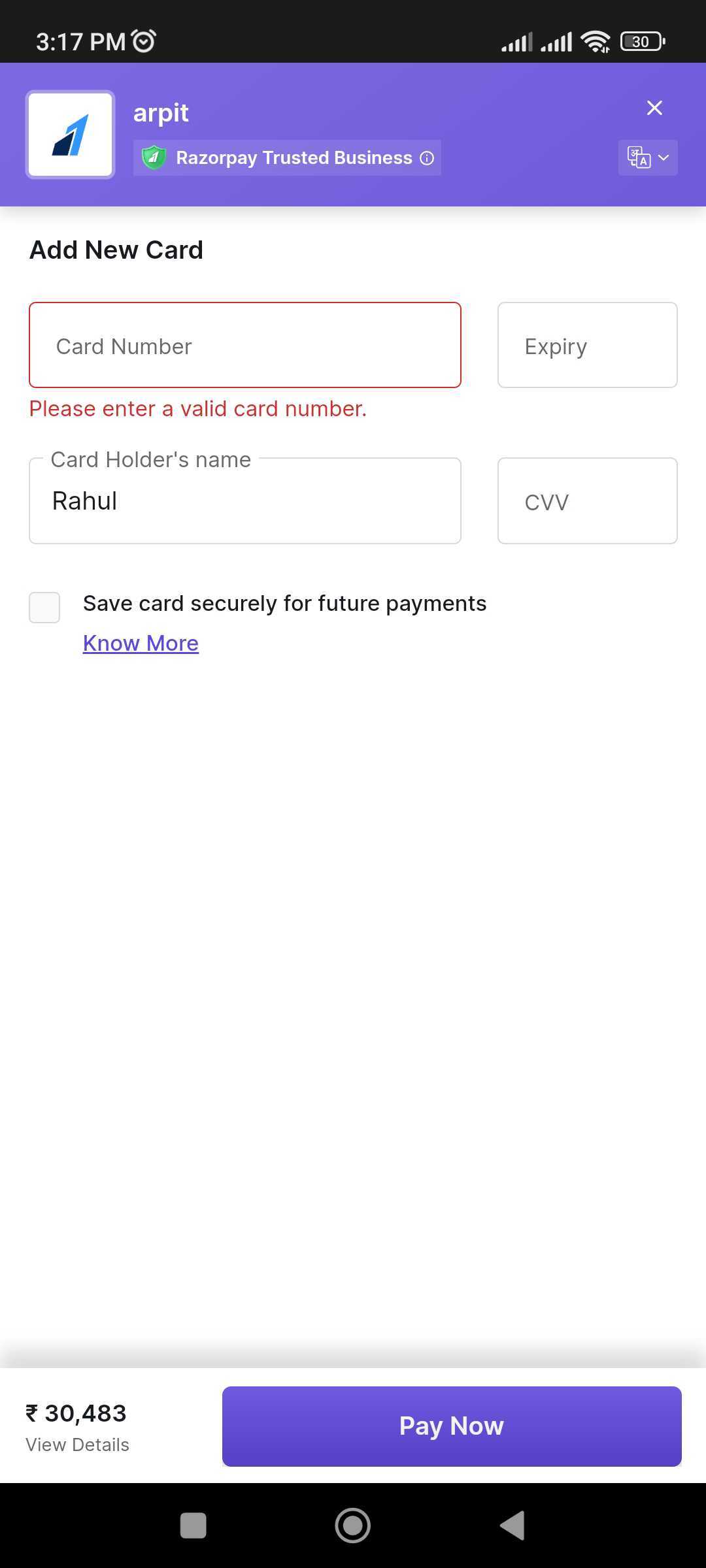

Paying rent through a credit card is quite simple and convenient, especially if you make the payment via the Pay Rent platform. Follow the steps to make the payment:

Step 1: Download the housing app and login using your mobile number.

Step 2: For rent payment, click on the ‘House Rent’ option.

Step 3: Enter the amount to be paid.

Step 4: Provide the landlord’s name, account details, phone number and PAN (optional). These details can be saved, preventing the need for entering these again for future payments.

Step 5: Enter your credit card details and provide the OTP for verification.

Once done, you will be redirected to the final payment page, which will reflect the amount transferred as well as nominal convenience charges applicable. You can choose to generate an instant receipt. The rent amount will transferred to your landlord’s account within 24 hours.

FAQs

Can I pay my rent through a credit card?

Yes, you can pay your rent through a credit card. However, be aware of the fees and interest charges associated with paying the rent through a credit card.

What are the fees for paying the rent with a credit card?

The fees for paying the rent with a credit card vary depending on your credit card company and the platform your use to make the payment.

Is it worth paying the rent through a credit card?

It depends on your individual circumstances. If you're able to repay your credit card balance in full every month, it may be worth paying rent with a credit card to earn rewards points. However, if you're carrying a balance or the convenience fee is too high, it may not be worth it.

How can I pay my rent with a credit card?

To pay your rent through a credit card, you can use our the Pay Rent platform, which makes it very quick and easy for you to make the payment within a few clicks

How does paying the rent with a credit card affect my credit score?

Paying rent with a credit card can positively impact your credit score if you make your payments on time and keep your credit utilization low. However, if you carry a balance or miss payments, it can negatively impact your score.

Can I pay rent with a debit card instead of a credit card?

Yes, many landlords accept debit card payments. However, be sure that you won't earn rewards points or cashback for using a debit card to make rent payments.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

Dhwani is a content management expert with over five years of professional experience. She has authored articles spanning diverse domains, including real estate, finance, business, health, taxation, education and more. Holding a Bachelor’s degree in Journalism and Mass Communication, Dhwani’s interests encompass reading and travelling. She is dedicated to staying updated on the latest real estate advancements in India.

Email: dhwani.meharchandani@housing.com