India’s largest public lender State Bank of India (SBI) has hiked interest rates across lending benchmarks in the range of 25 to 35 basis points. To be effective from December 15, 2022, the rate hike in marginal cost of funds-based lending rates (MCLR), external benchmark lending rate (EBLR) and repo linked lending rate (RLLR) will increase the cost of borrowing for new and well as existing SBI customers. The announcement by the public lender comes after the RBI recently hiked the repo rate by 35 basis points to bring it to 6.25%.

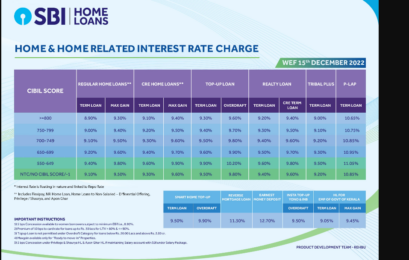

SBI home loan interest rates after December 15, 2022

After the hike, SBI customers will pay the following interest on their home loans linked to different benchmarks:

SBI MCLR from December 15, 2022

SBI has hiked its MCLR across tenors by 25 basis points. Home loans are linked with 1-year MCLR.

| Tenor | Earlier rate | Revised rate |

| Over night | 7.60% | 7.85% |

| 1 month | 7.75% | 8% |

| 3 month | 7.75% | 8% |

| 6 month | 8.05% | 8.30% |

| 1 year | 8.05% | 8.30% |

| 2 years | 8.25% | 8.50% |

| 3 years | 8.35% | 8.60% |

See also: All about SBI home loan interest

SBI EBLR/RLLR from December 15, 2022

SBI’s repo rate linked home loan interest and extremal lending benchmark rate have been hiked to 8.90% from the previous 8.55%. However, the best rate is available to only those customers who have a credit score of over 800. Depending on their credit score customers may be asked to pay an interest of up to 9.40%.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]