The Maharashtra State Legislative Assembly on August 3, 2023, passed a Bill to allow the Pune Municipal Corporation (PMC) to continue with providing 40% discount on PMC property tax for self-occupied residential properties.

While the rebate was introduced around 50 years ago, it was stalled in 2019. Even as it was waiting for the Maharashtra government to give clarity on the dues to be recovered, the PMC continued collecting complete property tax from property owners from April 1, 2019.

Note that if a property owner eligible for discount has paid the complete property tax amount in advance, the PMC will refund the excess amount in four phases over four years.

Last date to submit PT-3 application form for PMC property tax rebate

The last date to submit PT-3 application form for PMC property tax rebate was November 30, 2023. However, according to a HT report, the Pune Municipal Corporation (PMC) has once again decided to give an extension as less than one lakh citizens have submitted the PT-3 forms.

PMC property tax department head, Ajit Deshmukh, told HT, “The last date to fill up the PT 3 forms was November 30. However, only 96,257 citizens have submitted the form. Now, the PMC will allow the citizens to submit this form beyond the deadline so that they are able to get the benefit of the 40% concession in property tax.” This is the second extension given by the PMC. Previously, the last date to submit the PT-form was November 15, 2023.

PMC property tax 40% rebate: Eligibility

- All properties surveyed under the geographic information system (GIS) will get property tax bills that reflect the 40% discount.

- All properties registered between April 1, 2018 and March 31, 2023 that have not yet received the 40% PMC property tax discount must fill up the PT-3 application form.

- Properties that are registered before April 1, 2019, need not fill the PT-3 application form.

PMC property tax: Steps to get discount

To avail the 40% rebate in property tax in Pune re-implemented by the PMC, property owners registered with the corporation from April 1, 2019, onwards have to submit proof of self-occupancy of the property.

- Property owners have to get a No Objection Certificate (NOC) from the society that states that the property is used for personal purposes and is not rented.

- Property owners also have to submit form PT-3 and Rs 25 fee to the nearest ward office or tax inspector.

- Property owner has to give proof of all other properties owned by him in Pune city.

- All documents have to be submitted to the PMC by November 30, 2023.

- Residents who fail to submit the proof will have to pay the property tax amount in full (without any rebate).

PMC property tax: Self-occupancy proof documents

- No objection certificate (NOC) of housing society

- Voting card

- Passport

- Driving license

- Ration card

- Gas connection card

PMC property tax: How to download PT-3 form?

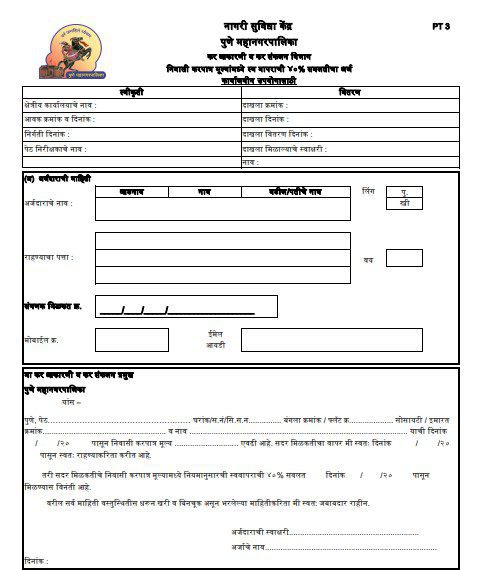

To download the PT-3 form, logon to https://propertytax.punecorporation.org/. At the bottom of the page, click on PT-3 form listed below Forms New. Alternatively, you can also click on Forms button at the right side panel.

You will access the PT-3 form in Marathi. Fill the form and follow the process mentioned above. Note that the below shown forms are samples and for your use, download from the PMC official website.

You can also get the PT 3 forms from the PMC ward offices and chief citizen facilitation centres.

PMC property tax: Where to submit the documents?

The application form, supporting documents and fee can be submitted at the PMC citizen facilitation centres, regional ward offices and Peth Inspectors’ offices.

PMC Property tax: Who are not eligible for rebate?

- Properties that have been rented out are not eligible for the 40% rebate in property tax.

- There will be no discount for newly registered properties.

- If all required documents are not submitted on time, the property will be considered as not self-occupied and the rebate will not be given.

FAQs

How can I avail 40% property tax discount in Pune?

You can avail the 40% property tax discount in Pune by submitting the PT-3 form.

What is the last date for property tax in Pune 2023?

June 30, 2023 was the last date for paying the PMC property tax for the Financial Year 2022-23.

Who is liable to pay property tax in Pune?

Any person who owns a property in the PMC jurisdiction is liable to pay property tax in Pune.

What is rebate under 80C 2023-24?

Rs 1.5 lakh every year from the taxpayer's total income.

How much is the fee for submitting documents for availing 40% PMC rebate?

Property owners have to pay a fee of Rs 25.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]