Owners of residential properties in Pune, are liable to pay property tax every year to the Pune Municipal Corporation (PMC) or the Pimpri Chinchwad Municipal Corporation (PCMC), based on the location of their property. Property owners in Pune can also pay the property tax online, through the official portal of Pune Municipal Corporation. Here is how to proceed with it.

How to check property tax bill in Pune?

Follow these steps to check your pending property tax bill in Pune:

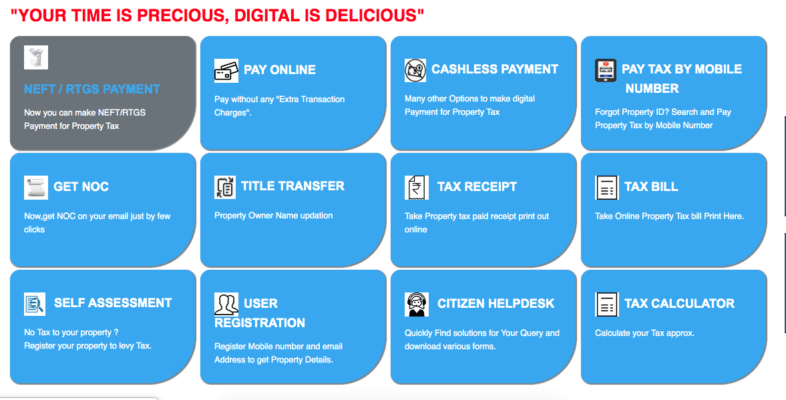

Step 1: Visit the PMC website (click here). You will see the following options on the home page:

Step 2: Select the’ Tax Bill’ option from the fourth column. You will be redirected to a new page.

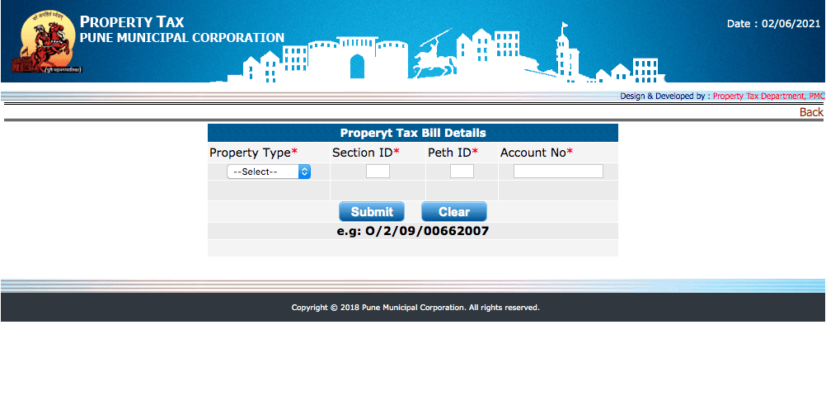

Step 3: Mention the details such as Section-ID, Peth ID and account number. The results will be displayed on the screen.

How to calculate property tax in Pune

The property tax is a percentage of the actual value of the property, which is based on the ready reckoner that is used to calculate stamp duty by the revenue department. The PMC offers an online property tax calculator, in which you can enter the following details and ascertain the amount of tax you need to pay on your property:

- Peth(location)

- Area

- Usage

- Type

- Total plinth area

- Construction year

Property tax = Tax rate * capital value

Capital Value = Base value * built up area * usage * building type * age factor * floor factor

Know about: Plot for sale in Pune

How to pay property tax in Pune online

The PMC invites property tax payments at its Citizen Facilitation Centre, bank partners (ICICI Bank, Bank of Maharashtra, Cosmos Bank and many more), self-pay tax payment kiosks, as well as online payments on its website. Online payments are your best option, as you can avail of the 2% rebate offered by the PMC and avoid extra charges.

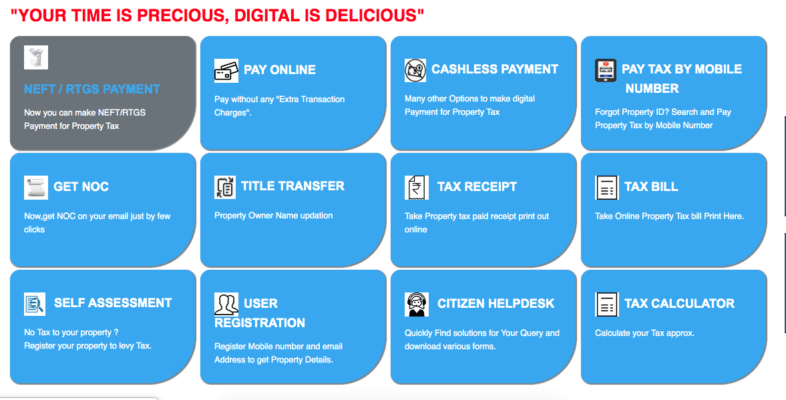

Step 1: Visit the PMC website (click here). You will see the following options on the home page:

Step 2: Click on ‘Pay online’ or ‘NEFT/RTGS payment’ as per your choice.

Step 3: Enter property details and click on ‘submit’.

Step 4: Verify the property owner details and also property tax dues that are displayed.

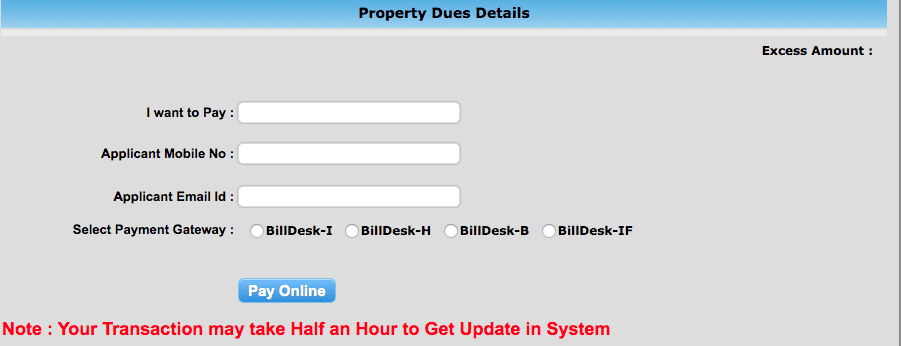

Step 5: Enter the amount you wish to pay, verify the mobile number and email id and select the gateway of payment, such as internet banking, debit/credit card, UPI, PhonePe, or digital wallet, as per your choice and make the payment.

Note: Payment by way of debit/credit card may incur additional charges.

Know about: Shivaji nagar Pune pin code

Other charges

If you choose to pay the property tax with your credit, debit or cash card, you will need to pay additional charges on the amount due. However, there are no additional charges, if you pay the tax through internet banking. The property tax should be paid to the PMC by June 30, every year, to avoid a 2% fine for every month of delayed payment. Also, ensure that the system updates your record and no outstanding amounts are shown against your account. If there are any errors, have them corrected immediately.

Check out: Flats for sale in Pune

Pune property tax: Latest updates

August 16,2021:

PCMC provides relief to its citizens by extending the deadline for paying the PCMC property tax of this financial year, to August 31,2021. This respite will aid citizens with tax benefits upon paying the entire tax amount in full before the deadline.

This is the second consecutive time the PCMC property tax deadline has been extended with the previous ones being June 30, 2021 and July 31, 2021 respectively.

August 2, 2021:

After the authority announced that 23 villages would be incorporated into the Pune Municipal Corporation (PMC) limits, on June 30, 2021, the municipal body might hike property taxes. Residents of these villages in Pune, with over 1,90,000 properties, will have to pay 35%-40% over and above the existing property taxes, according to the new proposal.

With the inclusion of these villages in the PMC limits, new taxes like water tax, land tax, municipal tax, general tax, tree conservation tax, fire tax, road tax and education, etc., will be included in the overall property tax liability. According to media reports, villages of Narhe, Manjri Budruk and Wagholi have the highest number of new tax payees.

June 2, 2021:

In a recent announcement, the PMC has extended the rebate for property tax payers till June 30, 2021. Under the rebate scheme, all property tax payers are eligible to get a 15% discount on their tax bill. Earlier, the scheme was valid till May 31, 2021. However, due to the ongoing COVID-19 pandemic, the civic body decided to extend the scheme for a month.

***

In a bid to automate the entire property tax assessment process, the PMC began geo-tagging properties all over the city. In July 2017, it was reported that of the eight lakh properties under its purview, 2.5 lakh had been mapped, using the Geographic Information System (GIS) technology. All properties were expected to be mapped, by January 2018. This exercise is expected to help the PMC to quickly identify unassessed and illegal properties and defaulters who have not paid their property tax and in turn, significantly increase the revenue for the municipal body.

In its annual budget proposal for 2017-2018, the PMC introduced a new initiative to encourage the timely payment of property taxes. According to the proposal, all regular payers of property tax, with no gap in payment years or outstanding payments, would be eligible to receive a Rs 5-lakh accident claim insurance from the PMC. This scheme is also expected to encourage slum residents to pay their ‘seva kar’ tax.

In April 2017, the civic body also announced a discount in property tax. Property owners who paid their tax by the end of May, could avail of a 10% discount on an amount below Rs 25,000 and 5% discount for amounts over Rs 25,000. It also offered an additional 2% discount, for making the payment online, on the PMC’s website.

check out: Wagholi pin code

FAQs

How can I check my property tax in Pune?

You can check property tax bill on PMC Website as mentioned above, in this article.

How can I reduce my property taxes in Pune?

You can pay your property tax before June 30, 2021 to get 15% rebate on your tax bill.

(With inputs from Surbhi Gupta)