All members of the Employees Provident Fund Organisation (EPFO) are assigned a unique 12-digit Universal Account Number (UAN) by the labour and employment ministry. With UAN, EPF members can access a whole gamut of services online on the EPFO member portal.

Services on EPFO member portal

- Download EPF Passbook

- Know your PF balance

- Download UAN card

- List previous PF member IDs

- Enter KYC details

- Complete EPFO e-nomination

- Check eligibility for online transfer claim

- Edit personal details

- Transfer money from one PF account to another

- To opt for higher EPFO pension

How to find UAN?

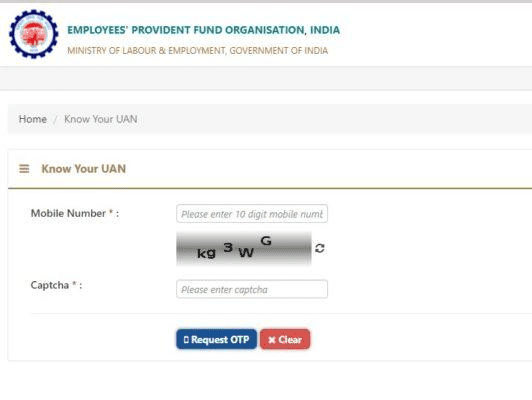

Step 1: Visit the official UAN portal.

Step 2: Under ‘Important Links’, click on the ‘Know your UAN’ option.

Step 3: Enter mobile number and Captcha code for verification. After this, click on the ‘Request OTP’ button.

Step 4: Enter the 6-digit OTP you receive on your mobile. Click on the ‘Validate OTP’ option.

Step 5: Once the OTP validation is successful, click on ‘OK’.

Step 6: You will now be asked to give your name, date of birth, Aadhaar number and captcha. Enter the details and click the ‘Show UAN’ button. In place of Aadhaar, you can also use your PAN or member ID to know your UAN.

Step 7: Your UAN will now be visible on the screen.

How to find your UAN offline?

Check your salary slip

You can check your salary slip to find out your UAN. Among many other details about your and your employer, your salary slip will have your UAN number, mentioned as PF UAN.

Find out UAN from employer

You can go to the HR department in your company and ask them about

your UAN. They will be in a position to share with you as soon as it is generated by the EPFO.

How to activate UAN?

Step 1: On the EPFO homepage, click on the ‘For Employees’ option under ‘Services’.

Step 2: Under the ‘Services’ section, click on ‘Member UAN/Online Services’.

Step 3: On the next page, click on the ‘Activate UAN’ option under ‘Important Links’.

Step 4: On the next page, fill in your UAN number or your member ID, Aadhaar number, name, date of birth, mobile number, and enter the captcha. Also, check the box to give consent to provide your Aadhaar Number, before hitting on ‘Get authorization PIN’.

Step 5: An OTP will be sent to your mobile number. Use this OTP and hit the ‘Validate OTP and Activate UAN’ option. On UAN activation, EPFO will send you an SMS on your mobile to access your PF account.

How to generate UAN login password?

Step 1: Visit the UAN portal.

Step 2: On the home page, click on the ‘Forgot Password‘ option.

Step 3: The next page will ask you to enter your UAN and the Captcha shown on the page. After filling these, click on Submit.

Step 4: On the next page, you will be asked to give your name, date of birth and gender. Once you fill this information, click on Verify.

Step 5: You will now have to verify yourself. To do that, provide your Aadhaar number and enter the Captcha. Also, click on the undertaking to allow verification.

Step 6: Your the Aadhaar number is verified. You will be asked to enter your mobile number to receive OTP.

Also tick on the following consent: “I hereby consent to provide my Aadhaar Number, Biometric and/or One Time Pin (OTP) data for Aadhaar based authentication for the purpose of establishing my identity”

Step 7: You will receive an OPT on your mobile number. Enter this OTP and the Captcha in the required field. Now, click on Verify.

Step 8: You will now be asked to set a new password. Make sure your password has at least 8 characters, with at least one upper case letter, one special character and one number. Confirm it, too.

Step 9: You UAN login password has been changed successfully.

How to log into your EPF account with UAN?

Step 1: Visit the official EPFO website.

Step 2: Enter the UAN number, password and captcha. Click on the Sign In button on the UAN member portal.

Step 3: On the home page, you can see your UAN number, date of birth, Aadhaar number, bank account number(s) linked with your UAN, your PAN number, your email ID and other details.

Services with UAN online

After UAN, you can use the following facilities under various taps:

View

1. Under the ‘View’ option on UAN member portal, you can see:

- Your profile

- Service history

- UAN Card

- Passbook

Profile

By clicking on ‘Profile’, you will be able to see details such as:

- UAN

- Name

- Date of birth

- Gender

- Father’s/Husband’s Name

- Mobile number

- Email ID

- If you are an international worker

- Qualification

- Marital status

- Whether differently able

The Employees’ Provident Fund Organisation (EPFO) has issued a new circular to standardise the process of EPF member profile update. In an internal circular issued to its zonal offices on August 23, 2023, the pension fund body has elaborated on the standard operating procedure (SOP) that must be followed in joint declaration for correction in UAN profiles.

Service history

By clicking on the ‘Service Details’ section, you can view the following details:

- Member ID

- Name

- Name of the establishment

- Date of joining EPF

- Date of ending EPF

- Date of joining EPS (Employee Pension Scheme)

- Date of ending EPS (Employee Pension Scheme)

- Date of joining FPS (Family Pension Scheme)

- Date of ending FPS (Family Pension Scheme)

UAN Card

You can view and downloaded your UAN card UAN under this section.

EPF Passbook

In this section, the option to view your EPF passbook option is made available. However, to view your EPF passbook is available at www.epfindia.gov.in.Here is how to view your EPF passbook.

Manage

2. Under the ‘Manage’ option on UAN member portal, you can see:

Basic details: Using this section, you can modify your name, date of birth, gender and employer using Aadhaar-based authentication.

(Note: The EPFO has removed Aadhaar from that list of documents that act as date of birth proof. Announced through a circular on January 16, the move by the Employee Provident Fund Organisation (EPFO) comes after the Aadhaar-issuing authority UIDAI issued a letter over the matter.

“In this connection, a letter has been received from UIDAI (copy attached), wherein it has been stated that the use of an Aadhaar, as proof of DoB needs to be deleted from the list of acceptable documents. Accordingly, the Aadhaar is being removed from the list of acceptable documents for correction in date of birth as mentioned in Table-B of Annexure -1 of the JD SOP under reference,” the EPFO said.)

Contact details: You can change and update your new email ID or phone number on the UAN member login portal.

e-KYC: Using this section, you can mofify details related to your bank account, PAN, Aadhaar and passport.

e-Nomination: Using this option, you can add or delete or mofidy the details of your PF nominees.

Mark exit: To apply for PF transfer from a previous employer, the former employer must mark exit on the EPFO portal. You can update this information yourself under this section.

Account

Using this option, change or resent your EPF account password using Aadhaar-based OTP authentication.

Account settings

Online Services

Under the ‘Online Services’ option on UAN member portal, you can see:

Claim (Form 31, 19,10C & 10D): Access full or partial withdrawal documents, Form 31, 19 and 10C using this option.

Transfer Request: Request the transfer of your PF amount from the previous account into the current one.

Track EPF Claim status: Tack the EPF claim status in the ‘Track Claim Status’ section without using any acknowledgement number or PF account number.

See also: All about EPF housing scheme

How to link UAN with PAN?

Step 1: Go to the EPFO member portal home page. Use your UAN and password to log in.

Step 2: From the main menu, click on the ‘Manage’ option.

Step 3: Under the Manage option you will find the by ‘KYC’ option. Click on it.

Step 4: You will find a list of documents to be updated under the ‘Document type’ option.

Step 5: Click on PAN, and enter you PAN number and name.

Step 6: Click on ‘Save’.

Step 7: Once the income tax department verifies the details, your UAN will be linked with PAN.

How to link UAN with Aadhaar?

Under Section 142 of the Code on Security, 2020, the electronic challan-cum return facility is allowed to be filed only by those EPF subscribers whose Aadhaar number is seeded with their UAN. This rule has been in effect since June 1, 2021.

Step 1: To link your Aadhaar number with UAN, visit https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Use your UAN and password to log in.

Step 3: On the Member Homepage, select ‘KYC’ option under the ‘Manage’ tab.

Step 4: Select the ‘Aadhaar’ option to add a KYC document.

Step 5: Input your Aadhaar number in the requested field and click on the Save option.

Step 6: The status of Aadhaar will change from not approved to Pending, after you save these changes.

Your UAN will be linked with your Aadhaar only after your employer and the EPFO approve these changes.

How to check if Aadhaar-UAN linking status?

Step 1: To know if your Aadhaar number is linked to your PF account, visit https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Use your UAN and password to log in.

Step 3: On the homepage, select ‘KYC’ option under the ‘Manage’ tab.

Step 4: If your Aadhaar number is displayed on the screen under the verified documents page, your UAN is linked with Aadhaar. If not, you will have to link your UAN with Aadhaar.

How to transfer money from one PF account to another with UAN login?

Step 1: Visit the EPFO unified portal. Log in using your UAN, password and captcha code.

Step 2: After you log in, under the Online Services tab, click on One Member-One EPF Account (Transfer Request) option.

Step 3: A new page will open, showing all your personal details. The page will also show you the details of the account where your PF money will be transferred.

Step 4: Select between your previous and current employer for DSC authorised signatory.

Step 5: An OTP will be sent to your mobile for verification. Enter that OPT in the requested field and click on Submit.

Step 6: Fill up Form 13 online now to proceed with PF transfer request.

Step 7: After filling the form online, take a printout, sign it and submit it with your employer within 10 days. After verification, your PF money will be transferred in your new account.

How to view and download UAN card?

Step 1: Copy and paste the below link into your web browser.

https://unifiedportal-mem.epfindia.gov.in/memberinterface/

The following page will appear on your screen.

Step 2: Enter your UAN, password and captcha code on the EPFO homepage, to log in.

Step 3: Click on the UAN card option.

Step 4: Your UAN card will appear on the screen along with your details and image. Click on the download icon to download the PDF file.

Step 5: Your UAN card will download to your computer. Save it in a proper location and also take a printout.

Queries related to UAN login portal

UAN Helpdesk Number : 18001-18005

UAN Helpdesk Email Id : uanepf@epfindia.gov.in

FAQs

Can I view my UAN card on the UAN login portal?

You can view and download your UAN card in the View section at the UAN login portal.

Can I view my EPF passbook on the UAN member portal?

Members have to visit- www.epfindia.gov.in for checking their passbook.

Why are my previous member IDs listed on the UAN portal?

All member IDs assigned to an EPF member are shown under the Service Details section on the UAN member portal. This is to enable transfer and withdrawal claims.

Which documents should I submit for updating KYC details for UAN?

PAN card, Aadhaar card, bank account number and passport details are accepted for KYC update on the UAN member portal.

How to update your gender at the UAN portal?

On the EPFO website, log in using UAN number. Under the tab Manage, click on the option Modify Basic Details. Enter the Aadhaar number to proceed with the entry of the details like name, gender and date of birth.

How do I get my UAN number?

Your employer can help you know your UAN. For new employee, the employer generates and activates the UAN. The employee can acccess his UAN login using his credentials on the official webpage or the UMANG app.

What is the UAN login password?

UAN password is created during the registration process. A user has the option to reset/change the UAN login password by clicking on the 'Forgot Password; link on the UAN login page.

Can I change my UAN login password?

Yes, you can change your UAN login password.

Can I link multiple EPF accounts to my UAN?

Yes, you can link multiple EPF accounts to your UAN. Use the 'Link Multiple EPF Accounts' option on the EPFO portal.

What if I am unable to log in to my UAN account?

If you are unable to log in to your UAN account, reset your password or contact the EPFO helpdesk.

Why is it UAN activation necessary for completing the process of auto transfer?

The idea behind UAN activation is to ensure that the members get updated status of any transactions taking place in their PF accounts on the mobile no. registered through activation.

Can I have two UANs?

An employee can have only one UAN. He/she can, however, have multiple PF member IDs.

Who allocates the UAN number?

All UAN numbers are generated and allotted by the Employees’ Provident Fund Organisation (EPFO). They also have authentication by the Labour and Employment Ministry.

Is UAN mandatory for online claims?

Yes, UAN, is mandatory for online claims.

What is the difference between PF member ID and UAN?

A member ID or PF number is given to an employee of a company. This member ID is an alphanumeric code. The UAN, on the other hand, is a unique number assigned to each employee. One member can have multiple member IDs but they can have only one UAN.

Is UAN linked with the PAN of the employee?

Yes, UAN is linked with the PAN of the employee.

How can I find my UAN number?

To find out your UAN number, visit epfindia.gov.in/memberinterface. Go to the option 'Know your UAN Status' and select your state and EPFO office from the drop-down menu. Enter your PF number/member ID, your name, date of birth, phone number and captcha code to proceed.

Is UAN number and PF Number same?

No, a UAN is a universal ID allocated to a EPFO member while he can have many PF IDs. A UAN is a 12-digit unique number while the PF account number is 22-digit unique number.

What is UAN number example?

Following are some of the examples of UAN number: 100904319456; 100985112956; 100920263757; 100896312605; 100296386154; 100419534363

Is UAN number and Aadhaar same?

No, your UAN is your universal ID for EPFO-related works. Your Aadhaar on the other hand is your bio-metric ID.

What happens to PF money in case of a job change?

Either a new PF accounts is created or the employee can request his new employer to use the existing PF account.

Is UAN login needed for PF withdrawal process?

Using your UAN login, you can unlock all your PF information online, including PF transfer and claims. Doing so without it is not possible.

What to do if 2 UANs have been allotted to me?

Two UANs may have been allotted to you because of not filling of ‘Date of Exit’ by your previous employer in the ECR filing and/or you have applied for transfer of service in your current establishment. In such a case, immediately report the matter to your employer and through email to the EPFO (uanepf@epfindia.gov.in) by mentioning both -your UANs). After due verification, the previous UAN allotted to you will be blocked and the current UAN will be kept active.

Can I have multiple PF numbers?

You can have multiple PF numbers if you have worked in many companies and did not opt for your PF money to be credited in your existing PF account at the time of joining a new organsation.

Is it legal to have multiple PF IDs?

Yes, it is legal to have multiple PF IDs. But, this is not true in case of UAN. You can have only one UAN.

How can I seek the help for queries related to UAN portal?

For queries related to the UAN Member Portal, you may contact: UAN Helpdesk Number : 18001-18005 UAN Helpdesk Email Id : uanepf@epfindia.gov.in

If I have two or more UANs, how can I withdraw balance from my previous UANs?

Transfer the balance and service to current UAN by submitting online Form-13. For this, you have to get the data (name, date of birth and gender) corrected in pervious UAN, if not correct and not matching with aadhar data, through the previous employer and link the UAN with Aadhar. In case data is correct, you can yourself link it through member portal.

Can one mobile number be linked with multiple UANs?

One mobile number can be used for registration with one UAN only.

How to activate UAN via offline mode?

UAN registration and activation can be done only online.

Why are my previous member IDs listed on the portal?

All member IDs assigned to a member can be seen under the ‘Service Details’ section on the UAN Member portal. This simplifies transfer and withdrawal claims.

Will a new UAN get generated when I change my job?

No, irrespective of the PF member IDs that get created, UAN remains the same for an EPF member.

How to view my UAN card at the UAN portal?

The facility to view your UAN card is available under the ‘View’ option on your member home page.

How to change date of birth at the UAN portal?

The facility to change the date of birth is available under the ‘Manage’ option on your member home page.

What is captcha?

Captcha is short for Completely Automated Public Turing test to tell Computers and Humans Apart. It is a security measure used on websites and online platforms to ascertain whether a user is a human or a computer programme (bot). It is designed to protect against automated spam, abuse and unauthorised access.

What types of captcha are there?

The most common form of Captcha is distorted or scrambled letters, numbers or images and asking the user to correctly identify and input the characters into a text box. Other variations of Captcha include solving mathematical equations, selecting specific images from a grid or completing simple tasks that require human-like reasoning.

I am not able to activate my UAN due to mismatch in name in PPO and Aadhaar and so not able to apply online for higher pension.

Activation of UAN is not required to apply for higher EPF pension. Provide details given on the application for validation of joint options name/DOB as per PPO. For joint options, the name and date of birth should be the same as on your UAN.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |