In India, Kurki (कुर्की) is an often-used medium to recover losses by private money lenders and institutional banks. This procedure, which causes a great deal of distress to the person at the receiving end, especially farmers, is a legal remedy available to lenders in the country.

What is Kurki?

Kurki means attachment of a person’s property pledged for a lending in case of a loan default. Kurki opens the process of auctioning an asset held by a borrower by a lender to recover loans. When a borrower fails to repay the loan, a lender is free to sell a pledged asset, or any other asset held by the borrower to recover his losses. This is the legal way of recovering losses suggested under Section-60 of the Code of Civil Procedure.

In India, Section-83 of the Code of Criminal Procedure (CrPC) also provides for attachment of property of an absconding person.

“The court issuing a proclamation under Section-82 may, for reasons to be recorded in writing, at any time after the issue of the proclamation, order the attachment of any property, movable or immovable, or both, belonging to the proclaimed person, provided that where at the time of the issue of the proclamation the court is satisfied, by affidavit or otherwise, that the person in relation to whom the proclamation is to be issued,” reads this section.

How does it work?

Under the legal provisions, a bank or any other lender should follow a well-explained procedure before they can auction and sell the assets of a borrower in an open market to recover their losses. To initiate Kurki, the lender will have to first approach a court of administrative authority. Once an approval to start the auction is given by the said court or authority (known as decree), the lender would have to give a notice to the borrower informing him about the process if the latter failed to repay his debt within a specified period.

If the borrower can repay his loans, the lender will have no reason to go ahead with Kurki. However, over the failure to pay the debt within the specified period, the lender will auction the asset and use the money to offset against the loss. Any amount generated in the excess of the loss should be returned to the borrower.

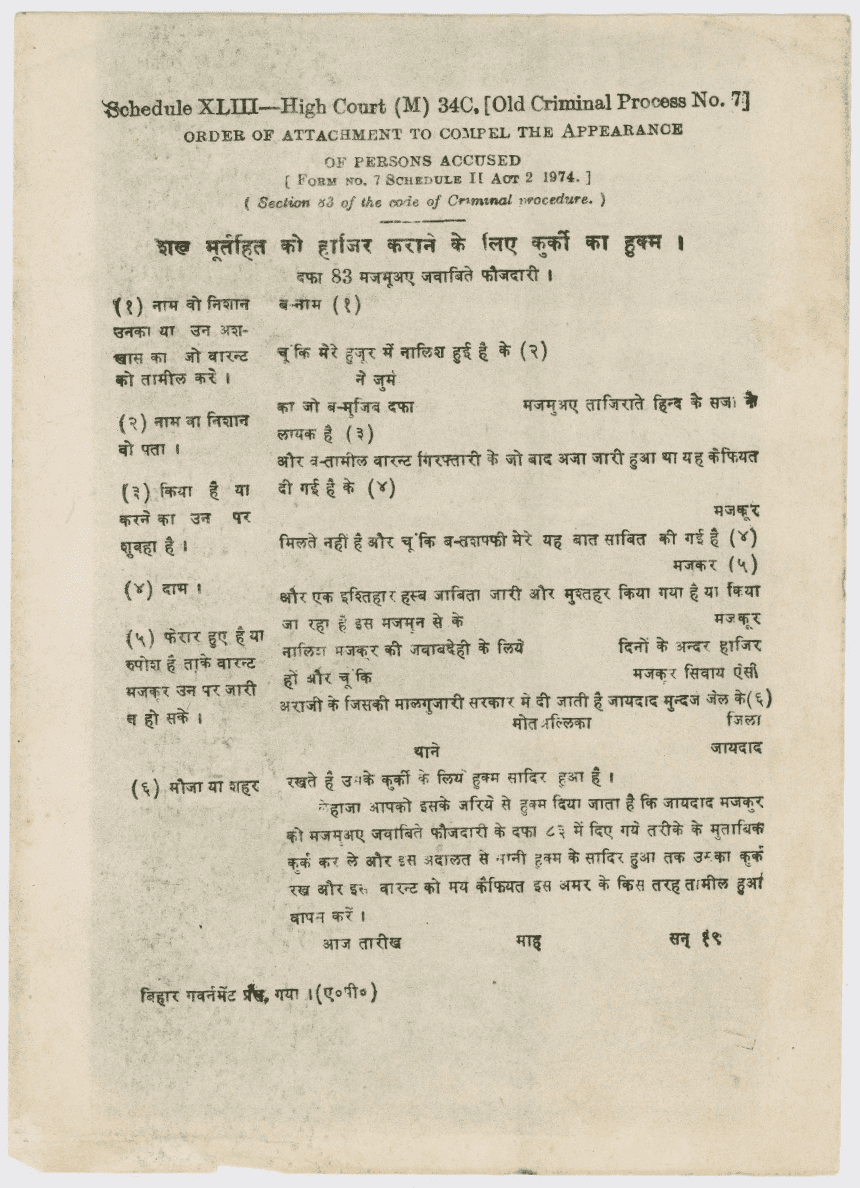

What is Kurki warrant?

Kurki warrant is issued by a competent authority to attach the property of a defaulter. A Kurki warrant will have the information about the lender, the defaulter, the nature of default, pending dues, details of the property to be attached and the time within which the property must be auctioned. It also explains the process to be followed.

Kurki warrant sample

Kurki warrant in English

Kurki warrant in Hindi

Kurki warrant PDF

Click here to download Kurki format in English.

Click here to download Kurki format in Hindi.

What assets can be sold as part of Kurki?

Section-60(1) of the CPC provides a list of properties which can be attached and sold for the purposes of execution of a decree passed by a civil court. These include:

- Land

- Houses or other buildings

- Goods

- Money

- Bank notes

- Cheques

- Bills of exchange

- Hundis

- Promissory notes

- Government securities

- Bonds or other securities for money, debts, shares in a corporation

- All other saleable properties, movable or immovable, belong to the judgment-debtor, or over which, or the profits of which, he has disposing power.

How is Kurki done?

If a property ordered to be attached is a debt or other movable property, the attachment under Section-83 CrPC is made:

- By seizure or

- By the appointment of a receiver or

- By an order in writing prohibiting the delivery of such property to the proclaimed person or to any one on his behalf or

- By all or any two of such methods, as the court deems fit.

If the property ordered to be attached is immovable, the attachment under this section will be made through the collector of the district in which the land is situated, and in all other cases:

- By taking possession or

- By the appointment of a receiver or

- By an order in writing prohibiting the payment of rent on delivery of property to the proclaimed person or to any one on his behalf or

- By all or any two of such methods, as the court deems fit.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |