June 30, 2023, is now the last date to link your PAN with Aadhaar. The previously set March 31 deadline was extended on March 28, 2023, though a notification by the Central Board of Direct Taxes.

If the linking of the two cards is not done by that date, your PAN will become inoperative.

“As per Income-Tax Act 1961, it is mandatory for all PAN holders, who do not fall under the exempt category, to link their PAN with Aadhaar before March 31, 2023. From April 1, 2023, the unlinked PAN shall become inoperative. The last date is approaching soon. Don’t delay, link it today!” the department said in a tweet.

See also: Linking mobile number with Aadhar card online: A step-by-step guide

This leaves income taxpayers in India with a nearly 3-month window to complete Aadhaar-PAN linking.

According to a statement issued by the Central Board of Direct Taxes, taxpayers will not be able to furnish, intimate or quote their PAN if it becomes inoperative. This would make them liable to the consequences under the act for such failure.

“In order to mitigate the inconvenience to taxpayers, as per Notification No.17/2022 dated March 29, 2022, a window of opportunity has been provided to taxpayers up to March 31, 2023, to intimate their Aadhaar to the prescribed authority for Aadhaar-PAN linking without facing repercussions. As a result, taxpayers will be required to pay a fee of Rs. 500 up to three months from April 1, 2022, and a fee of Rs.1000 after that, while intimating their Aadhaar. However, till March 31, 2023, the PAN of the assesses who have not intimated their Aadhaar will continue to be functional for the procedures under the act, like furnishing of return of income, processing of refunds etc.,” it said.

Penalty on Aadhaar-PAN linking

- The last date for linking Aadhaar with PAN without any penalty was March 31, 2022.

- A penalty of Rs. 500 was charged from people who linked Aadhaar with PAN on or before July 1, 2022.

- A penalty of Rs. 1,000 is applicable to people linking Aadhaar with PAN after July 31, 2022. This means those linking the two identification cards will have to pay Rs. 1,000 at the time of linking.

Prerequisites for Aadhaar-PAN linking

- Valid PAN number

- Valid Aadhaar number

- Valid mobile number

How to link Aadhaar with PAN?

You can link your PAN with Aadhaar through the Income-Tax e-filing portal, SMS or by visiting NSDL/UTIIL offices. Here is how to do it online.

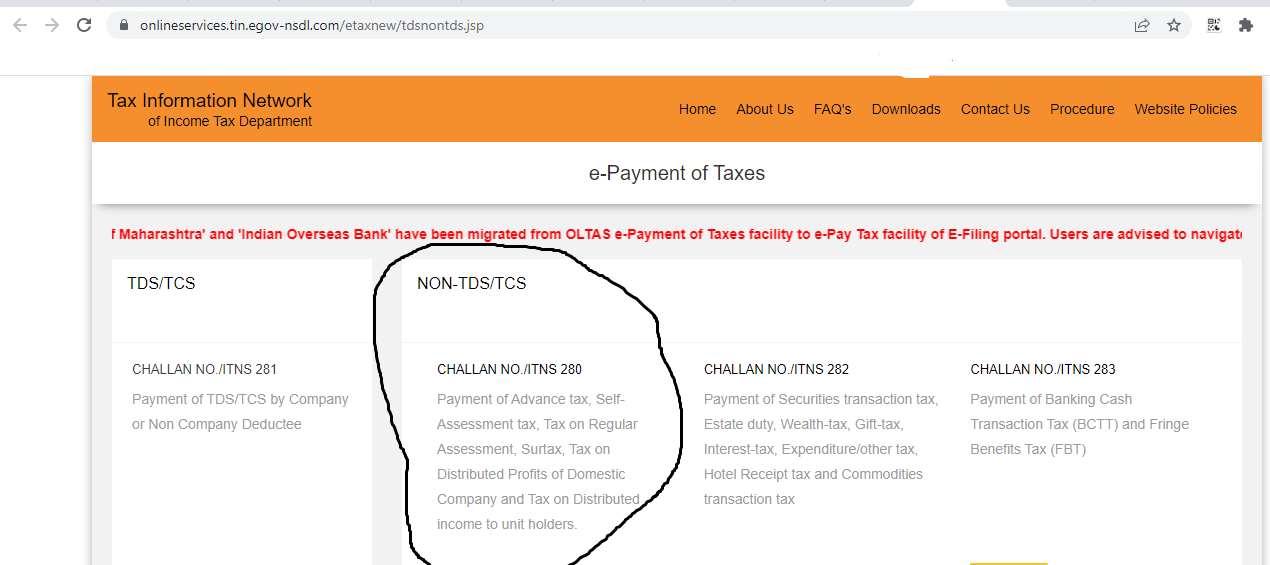

Step 1: Visit the TIN website (egov-nsdl.com) to pay late fee Rs. 1,000. Click on the ‘Proceed’ button in non-TDS/TCS category Challan no./ITNS 280.

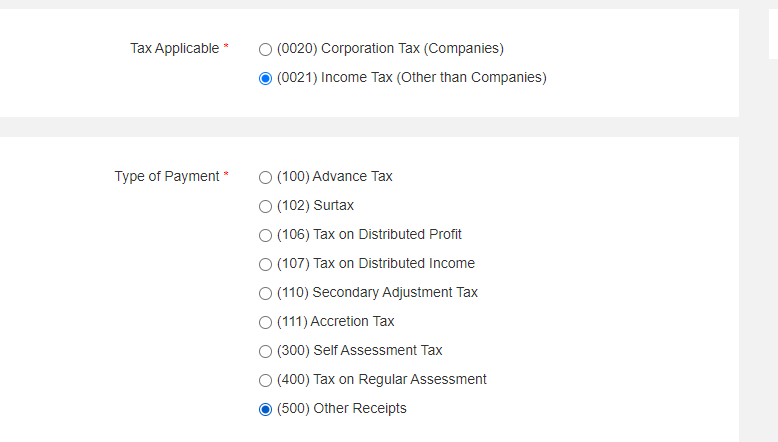

Step 2: From the Tax Applicable category, check the (0021) Income Tax (Other than Companies) option.

Step 3: For Type of Payment category, check the Other Payment option.

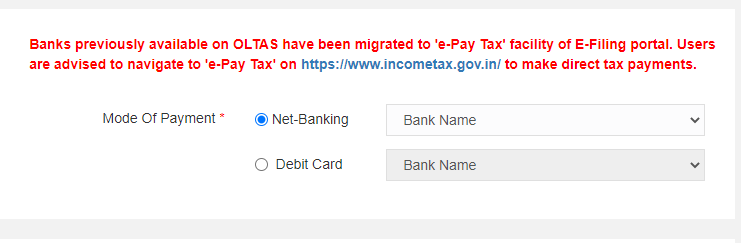

Step 4: Select mode of payment (net banking, or debit card). Select your bank.

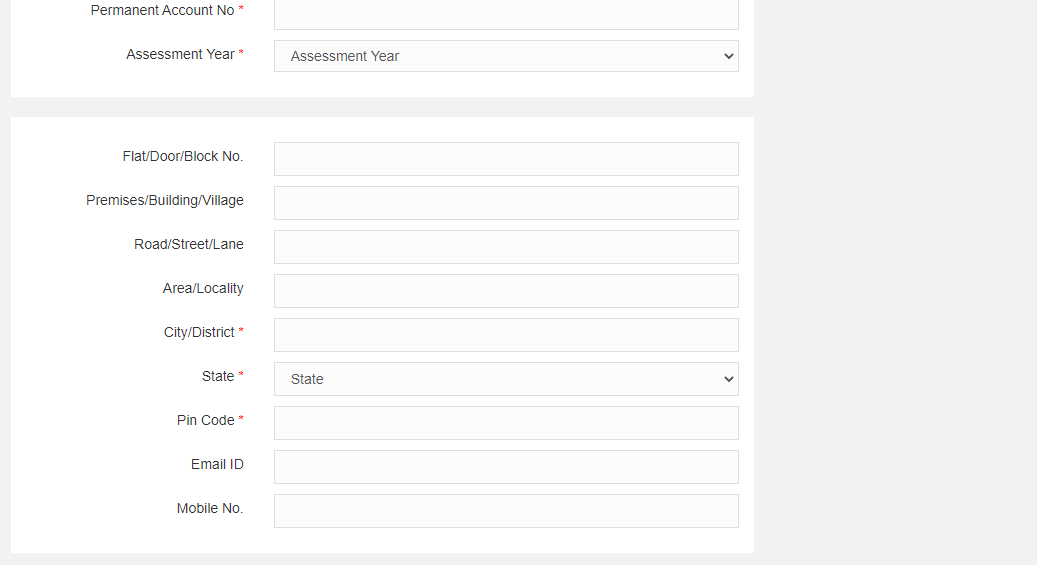

Step 5: Provide all other details.

Step 6: The penalty is now paid. Submit the PAN-Aadhaar link request on e-filing portal after 4-5 working days of making the fee payment.

Step 7: Go to e-filing portal and login. On the dashboard, under the ‘Link Aadhaar to PAN option’, click Link Aadhaar.

Step 8: Enter the PAN and Aadhaar number and click ‘Validate’ and provide penalty payment details. Following this, your Aadhaar-PAN will be linked successfully. In case Aadhaar and PAN are linked, the following message will appear on the screen: “PAN is already linked with the Aadhar or with some other Aadhar”.

Aadhaar-PAN linking news update

Inoperative PAN: I-T dept asks NRIs to submit residential status proof

July 20, 2023: Non-resident Indians (NRIs) and foreign citizens whose permanent account numbers have been made inoperative because those were not linked with Aadhaar should submit documentary proof of their residential status with their jurisdictional assessing officer (JAO) to make the PAN operational once more, the income tax department said in a tweet on July 18.

“The NRIs whose PANs are inoperative are requested to intimate their residential status to their respective JAO, along with supporting documents with a request to update their residential status in the PAN database. Details of JAO can be found at: https://eportal.incometax.gov.in/iec/foservices/#/pre-login/knowYourAO,” the tweet read.

Read full coverage here.

Over 135.2 crore Aadhaar cards generated: Economic Survey

FAQs

What is the last date to link Aadhaar with PAN?

The last date to link Aadhaar with PAN is March 31, 2023.

What if I don’t link Aadhaar with PAN?

Your PAN card will become ineffective if it is not linked with Aadhaar by March 31, 2023.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]