The last date for PAN-Aadhaar linking is June 30, 2023. In case PAN-Aadhaar linking is not done by the date, your PAN will become inoperative from July 1, 2023. The income tax (I-T) department has said so in a notification issued on March 28, 2023.

See also: What is the last date to link Aadhaar with PAN?

Who are exempted from linking PAN-Aadhaar?

Unless you belong to the exempt category, linking of PAN and Aadhaar is mandatory. According to a notification issued by the finance ministry in May 2017, some people have been exempted from mandatory PAN-Aadhaar linking. These people include:

- People living in Assam, Jammu & Kashmir, and Meghalaya.

- People aged 80 years or above

- Non-resident Indians

- Person not a citizen of India

What if PAN becomes inoperative?

According to a circular issued by the Central Board of Direct Taxes on March 30, 2022, once your PAN becomes inoperative:

- You will not be able to file I-T returns.

- Pending returns will not be processed.

- Pending refunds will not be issued.

- Pending proceedings as in case of defective returns cannot be completed.

“The taxpayer might face difficulty at various other fora like banks and other financial portals as PAN is one of the important KYC (know your customer) criterion for all kinds of financial transaction,” the circular said.

For instance, quoting either PAN or Aadhaar for depositing or withdrawing over Rs 20 lakh in a financial year, or opening a current account is mandatory. In case of an inoperative PAN, this may become difficult.

Pre-requisite for PAN-Aadhaar linking

- Valid PAN

- Aadhaar number

- Valid mobile number

How to link PAN with Aadhaar?

Late fee payment

Step 1: Before starting the linking process, you will have to pay the late fee of Rs 1,000. To pay the fee, copy and paste the following address in your browser.

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

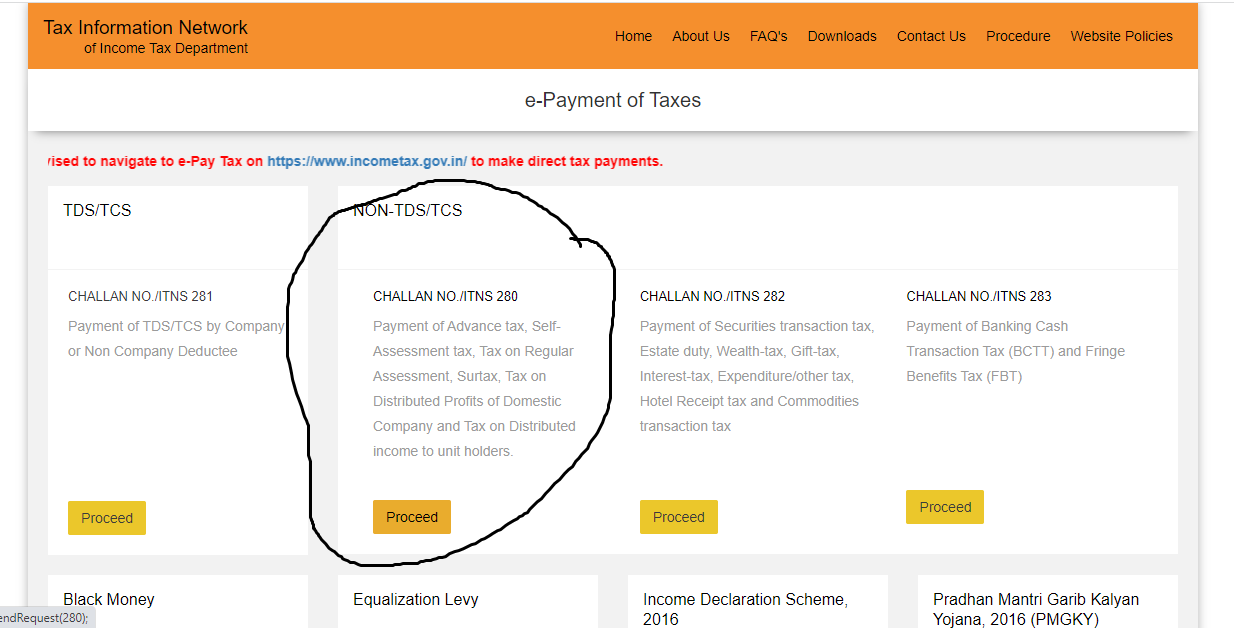

Step 2: On the homepage, you will find the NON-TDS/TCS option. Click on Proceed.

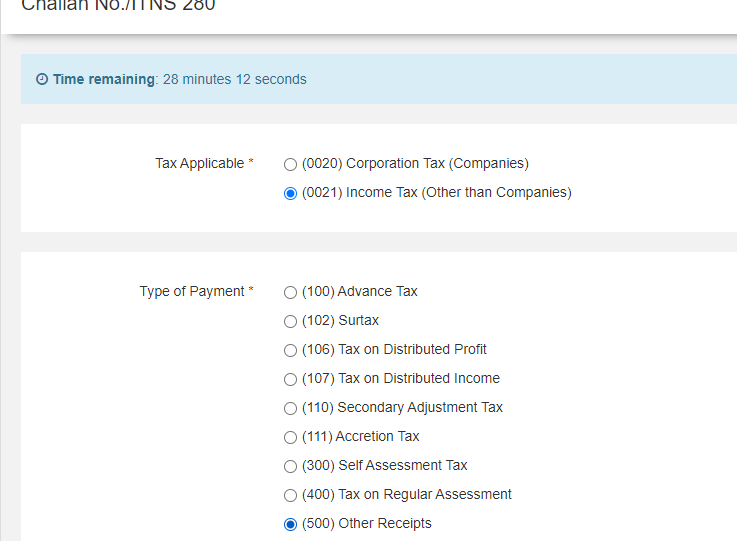

Step 3: On the next page, in Tax Applicable option, check 0021 option meant for individual taxpayers. Companies have to select other option. In Type of Payment, select 500 Other Receipts.

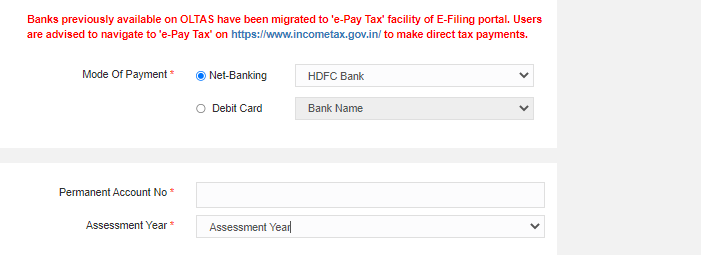

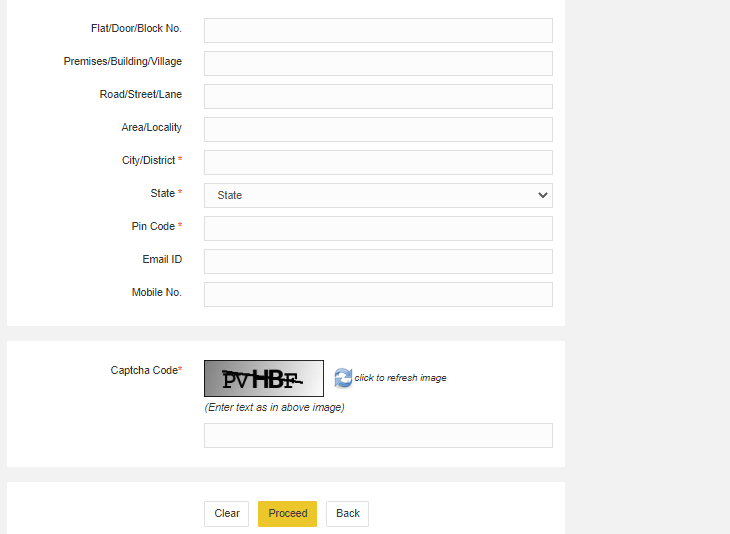

Step 4: Select the mode of payment, fill PAN number and assessment year. Also provide address details, enter captcha, and click on Proceed.

The late fee payment will be successful in case all details are correct.

Income tax PAN-Aadhaar linking

Step 1: Five days after you have made the payment, you can start PAN-Aadhaar linking. For this, copy and paste the following address in your browser.

https://eportal.incometax.gov.in/iec/foservices/

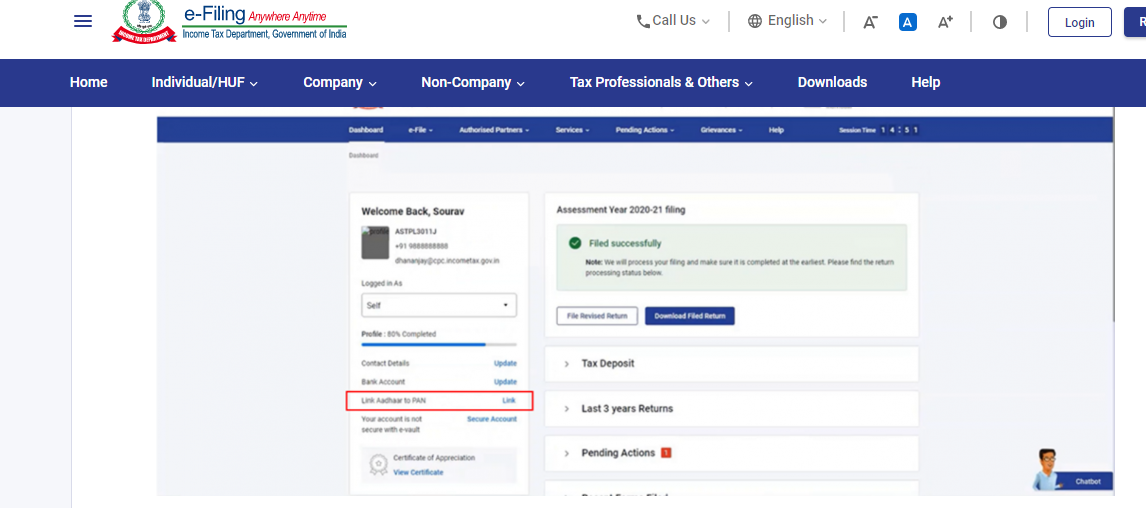

Step 2: Once you log in, click on ‘Link Aadhaar’ under the ‘Link Aadhaar to PAN’ option.

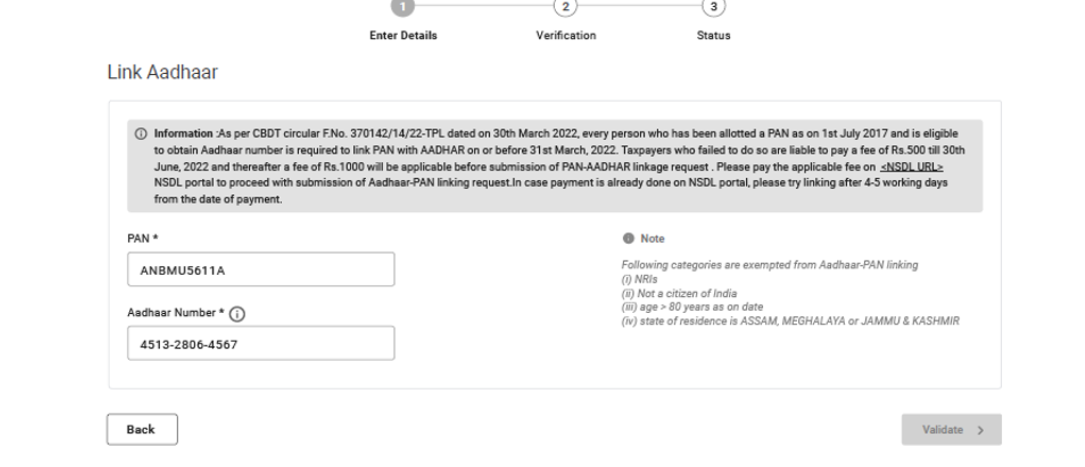

Step 3: Enter the PAN and Aadhaar numbers and click on Validate.

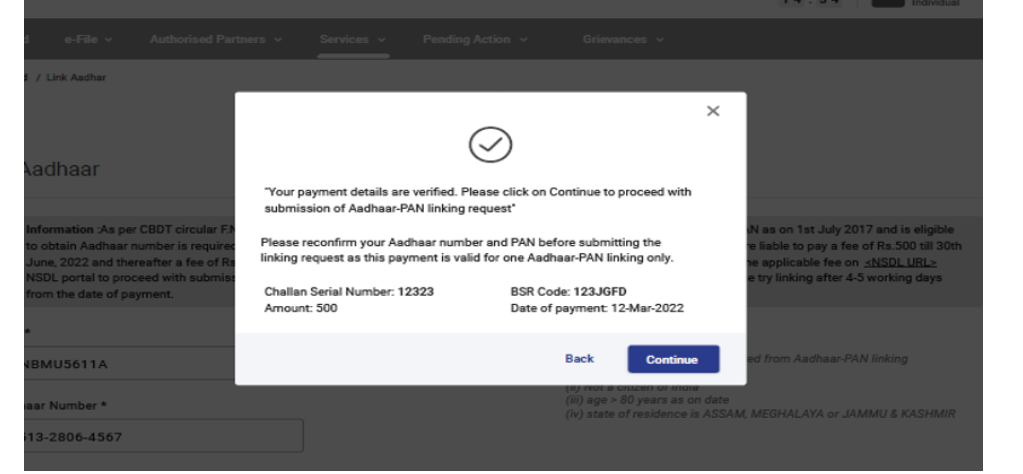

Step 4: After validating PAN and Aadhar, you will see a pop-up message saying Your payments details are verified. Click on Continue on the pop-up message to submit Aadhaar link request.

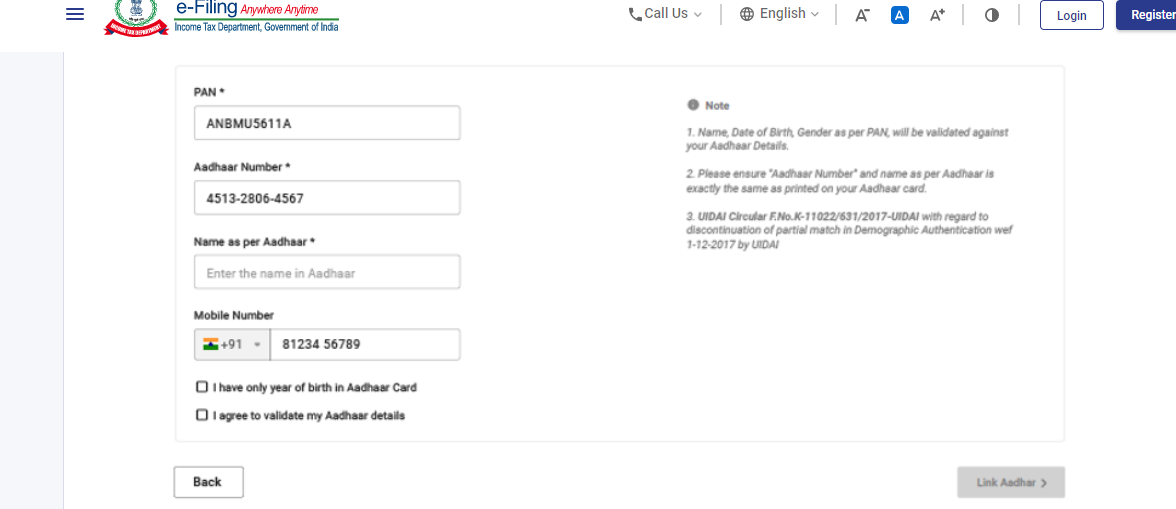

Step 5: Fill all details as asked and click on Link Aadhaar button.

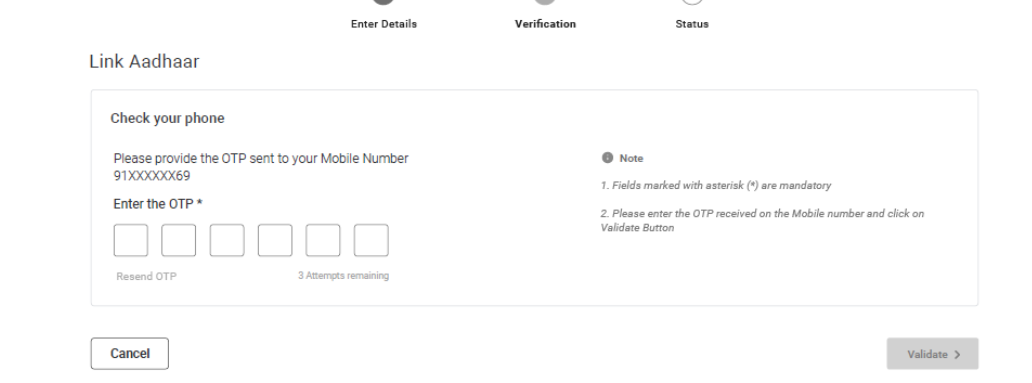

Step 6: Enter the 6-digit OTP received on mobile and click on Validate.

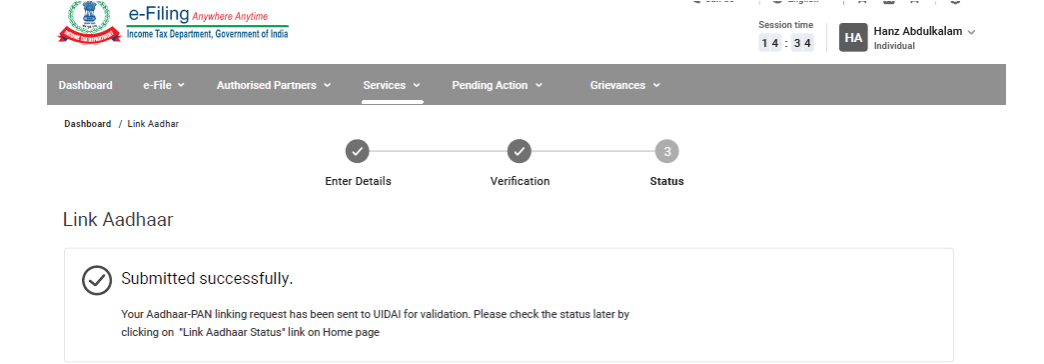

Step 7: Your request is successfully made. Now you can check the Aadhaar-PAN link status.

PAN-Aadhaar linking through SMS

You can link your Aadhaar with PAN through an SMS-based facility. For this, send an SMS to either 567678 or 56161 from your registered mobile number in the following format.

UIDPAN<SPACE><12 digit Aadhaar><Space><10 digit PAN>

Read also: Linking mobile number with Aadhar card online

How to visit PAN-Aadhaar link status?

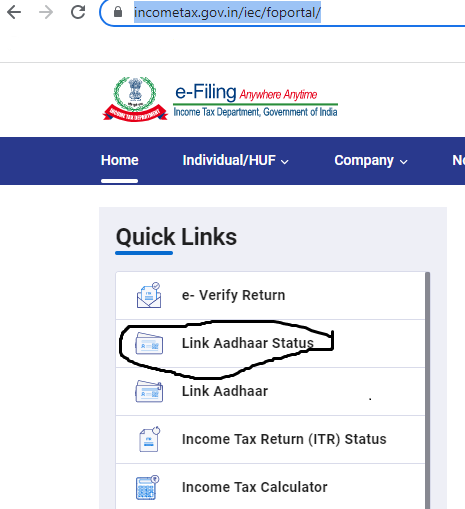

Step 1: Copy and paste the following address in your web browser.

https://www.incometax.gov.in/iec/foportal/

Step 2: On the homepage, click on Link Aadhaar Status.

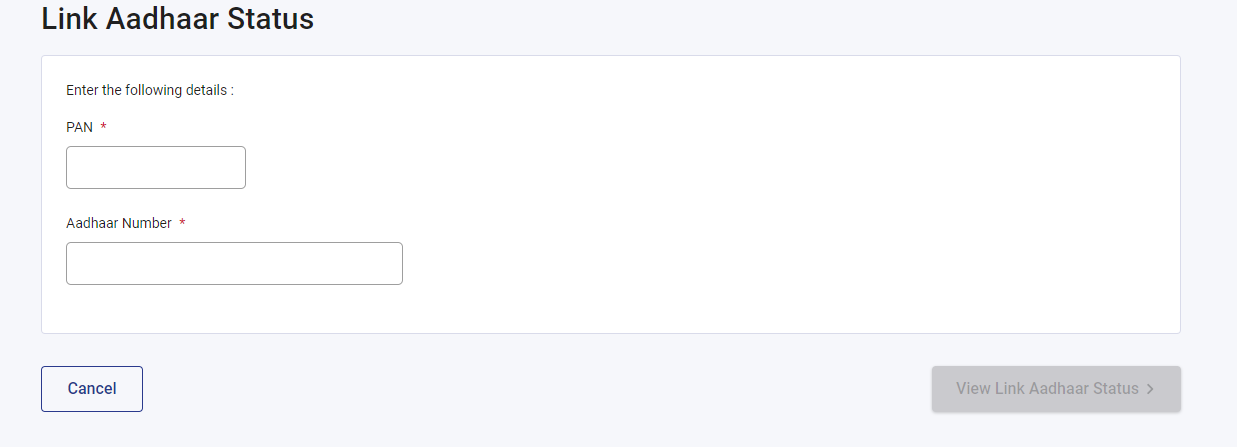

Step 3: Provide your PAN and Aadhaar numbers and click on View Link Aadhaar Status.

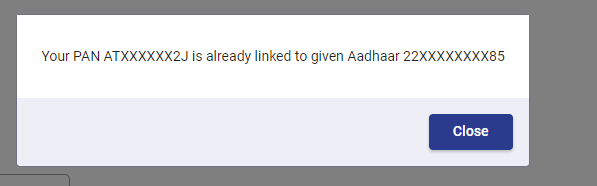

Step 4: The following message will pop up on your screen if your PAN has been linked with Aadhaar successfully.

Will PAN-Aadhaar linking last be extended beyond March 31, 2023?

Yes, the Central Board of Direct Taxes has extended the deadline to link your PAN with Aadhaar by 3 months to June 30, 2023.

“In order to mitigate the inconvenience to the taxpayers, a window of opportunity has been provided to the taxpayers up to June 30, 2023, to intimate their Aadhaar to the prescribed authority for Aadhaar-PAN linking without facing repercussions,” the CBDT said in a notification earlier.

Aadhaar-PAN linking news update

Inoperative PAN: I-T dept asks NRIs to submit residential status proof

July 20, 2023: Non-resident Indians (NRIs) and foreign citizens whose permanent account numbers have been made inoperative because those were not linked with Aadhaar should submit documentary proof of their residential status with their jurisdictional assessing officer (JAO) to make the PAN operational once more, the income tax department said in a tweet on July 18.

“The NRIs whose PANs are inoperative are requested to intimate their residential status to their respective JAO, along with supporting documents with a request to update their residential status in the PAN database. Details of JAO can be found at: https://eportal.incometax.gov.in/iec/foservices/#/pre-login/knowYourAO,” the tweet read.

Read full coverage here.

Over 135.2 crore Aadhaar cards generated: Economic Survey

Aadhaar is an essential tool for social delivery by the state. “A total of 318 Central schemes and over 720 state direct benefits transfer schemes are notified under Section 7 of the Aadhaar Act, 2016, and all these schemes use Aadhaar for targeted delivery of financial services, subsidies, and benefits,” said the Economic Survey 2022-23, tabled by finance minister Nirmala Sitharaman on January 31, 2023.

FAQs

What is the last date to link PAN with Aadhaar?

June 30, 2023, is the last date to link PAN with Aadhaar.

Which authority issues Aadhaar?

Aadhaar is issued by the Unique Identification Authority of India to a resident of the country.

Which authority issues PAN cards?

PAN is a 10-digit alphanumeric number allotted by the income tax department to a person, firm or entity.

What is the fee to get a PAN card?

PAN is issued for a fee of Rs 110. It is issued in the form of a laminated card known as ‘PAN’ card.

What is the official website to link PAN with Aadhaar?

https://eportal.incometax.gov.in/iec/foservices/ is the official website to link PAN with Aadhaar.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]