There are several cities in Uttarakhand, such as Dehradun, Mussoorie and Roorkee, that are emerging as a preferred destination for homebuyers looking for second homes. Besides the specific rules and regulations for purchasing a property in the state, a buyer should also be aware of the circle rates, the property rate fixed by the state government for the purpose of stamp duty payment. The circle rates are periodically revised by the state government. Usually, circle rates are higher for high-end localities and relatively lower for other areas.

See also: Rules and regulations to buy properties in Uttarakhand

What is the circle rate in Uttarakhand?

The circle rate in Uttarakhand refers to the minimum value at which a property must be registered in case of its transfer. According to the regulations, the property must be registered based on the circle rate, or the transaction value, whichever is higher. Circle rates are also referred to as ready reckoner rates. Typically, the market rate is higher than the circle rate. When buying a property, a person must pay the stamp duty and registration charges, calculated based on the circle rate.

How do you find the circle rate in Uttarakhand?

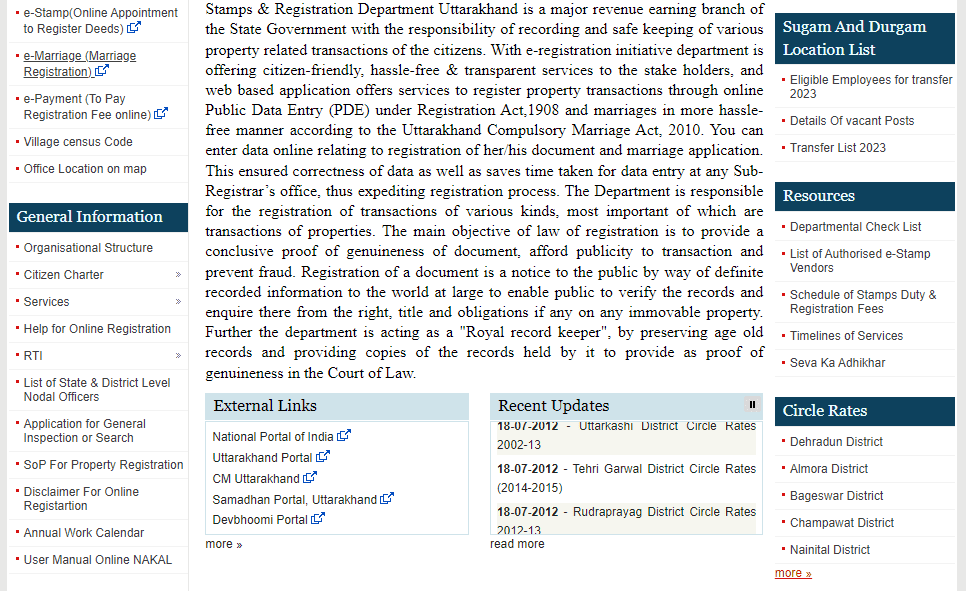

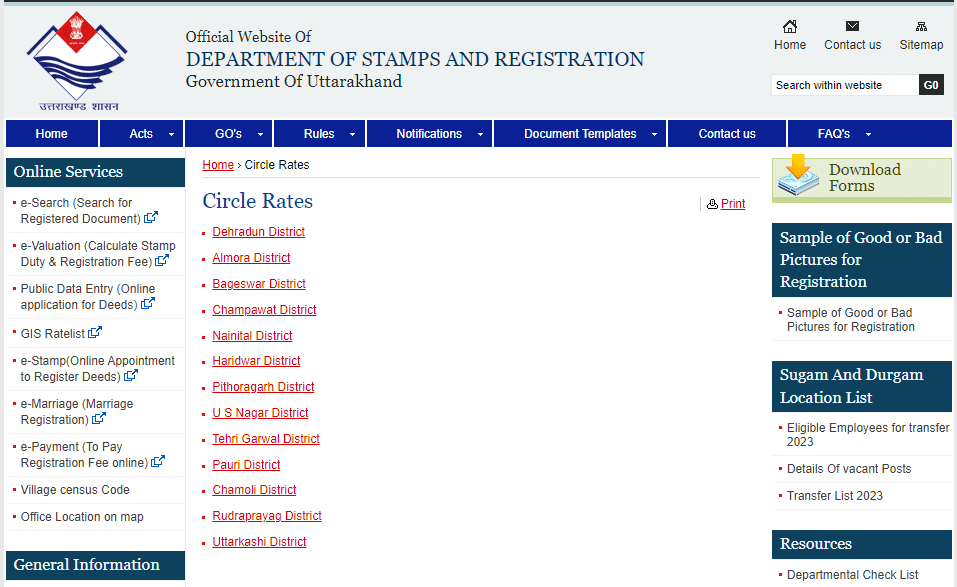

- Visit the official portal of Uttarakhand Stamps and Registration Department at https://registration.uk.gov.in/.

- Under the circle rates section in the right hand side, choose the district to proceed.

Circle Rate in Dehradun District, Uttarakhand

| Zone | Village (area) | Agricultural land circle rate (Rs per square metre) | Non-agricultural land circle rate (Rs per sqm) | Apartment/flat (Rs per sqm) |

| A | Akhandawali Bhiling, Bagda Dhoran, Badasi Grant, Caravan Karanpur, Kali Mati, Pavla Sauda, Sila | 1,000 | 4,000 | 18,000 |

| B | Bullawala, Chandimari, Chadamiwala, Dharamchuk, Dudhali, Phanduwala, Jhabrawala, Khata, Khairi, Kishanpur, Kudkawala, Madhowala, Mohammadpur, Morkhan Grant-II, Nagal Jwalapur, Prem Nagar, Teliwal | 1,400 | 4,500 | 18,500 |

| C | Asthal | 2,000 | 7,000 | 21,000 |

| D | Gallajwadi, Jharipani, Kyarkuli Bhatta | 3,000 | 6,000 | 20,000 |

| E | Vilaspur Kandali | 1,500 | 6,000 | 20,000 |

| F | Ambiwala, Bharuwala, Chak Banjarawala, Gorakhpur Mafi, Kheda Mansingh Wala, Telpura Grant | 3,500 | 7,000 | 21,000 |

| G | Bhangwantpur, Bhist village, Chandotri, Purukul, Salan village, Saloniwala | 4,000 | 8,000 | 22,000 |

Circle Rate in Uttarakhand: List of districts

- Dehradun

- Almora

- Bageswar

- Champawat

- Nainital

- Haridwar

- Pithoragarh

- US Nagar

- Tehri Garwal

- Pauri

- Chamoli

- Rudraprayag

- Uttarkashi

Factors that impact minimum circle rate in Uttarakhand

Several factors influence the circle rates in Uttarakhand, which include:

- Type of property, such as a flat, plot or farmland

- Usage such as commercial or residential purpose

- Local demand

- Zone-wise location of the property

- Age of the property

- Facilities near the property

Impact of property age on circle rate in Uttarakhand

Properties are assessed on a multiplication factor, depending on the property’s age.

| Property age (year) | Multiplication factor (in percentage) |

| 1 | 0.99 |

| 5 | 0.95 |

| 10 | 0.904 |

| 15 | 0.86 |

| 20 | 0.817 |

| 25 | 0.777 |

| 30 | 0.739 |

| 35 | 0.703 |

| 40 | 0.668 |

| 45 | 0.636 |

| 50 | 0.605 |

| 55 | 0.575 |

| 60 | 0.547 |

| 65 | 0.518 |

| 70 | 0.494 |

| 75 | 0.47 |

| 80 | 0.447 |

| 85 | 0.425 |

| 90 | 0.404 |

| 95 | 0.384 |

| 100 | 0.366 |

FAQs

What is the circle rate in Uttarakhand?

Circle rate refers to the minimum value, as decided by the state government, below which a property cannot be registered when it is transferred.

How do you know the circle rate of property in Uttarakhand?

If you are buying a property in Uttarakhand, visit the official portal of Uttarakhand Stamps and Registration Department to check the circle rates online.

How do you find the rate of a property?

Property rates are set based on several factors, such as property type, usage, local demand, age, zone-wise location of the property, facilities, etc.

How do you calculate property value based on circle rates?

Property value is calculated based on circle rates through the formula build-up area in square metres* circle rate for the locality in Rs per sqm.

What is the stamp duty charged in Uttarakhand?

Stamp duty charges in Uttarakhand vary between 3% and 5%.

What is the government rate of land in Uttarakhand?

Non-agricultural land circle rate in Uttarakhand ranges between Rs 4,000 and Rs 8,000 per sqm while agricultural land ranges between 1,000 and 4,000 per sqm.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.