The Food Safety and Standards Authority of India (FSSAI) is a governmental organisation. It seeks to maintain food safety and regulation throughout India. The fundamental way through which FSSAI guarantees food safety and control is through registration or licensing. Every food business operator in India is required to hold an FSSAI Registration or licence in compliance with Sections 31(1) and 31(2) of the Food Safety and Standards Authority of India Act, 2006.

The licensing and registration procedure is governed by the 2011 Food Safety & Standards (Licensing and Registration of Food Businesses) Regulations. FBOs may, however, also require Form E in order to run their company in addition to FSSAI Registration. You will learn all there is to know about Form E Food Quality Warranty – FSSAI Certificate in this post.

FSSAI certificate: Meaning of the FSSAI licence number

No matter how much money they make or how big their operation is, all FBOs receive a 14-digit food licence number. The 14-digit number is divided into 5 portions, each of which stands for one of the following:

- First digit: The food business’s registration status

- Code of the state in which the food activities are carried out, second and third digits

- Fifth and fourth digits: the year when the food item was produced

- Sixth through eighth digits: number of enrollees

- Permit number assigned to the maker or manufacturer’s, ninth and tenth digits

FSSAI certificate: FSSAI licence types

According to the company’s annual revenue, there are three sorts of FSSAI certificates.

1. Basic FSSAI FoSCos licence

A company that generates less than 12 lakhs in revenue must obtain an FSSAI basic licence.

Furthermore, the basic registration must be upgraded to the state licence as soon as the company’s annual revenue exceeds 12 lakhs. As the name suggests, it is a middle-level licence that small enterprises or startups typically choose.

2. State licence from FSSAI FoSCos

A state licence must be obtained by any firm with a revenue of between 12 lakhs and 20 crores. Small and medium-sized firms, merchants, restaurant marketers, storage facilities, wholesalers, etc., also obtain the FSSAI State licence.

3. FSSAI’s central licence for FoSCos

The company must get an FSSAI Central licence if its annual revenue exceeds 20 crores. Additionally, the same licence must be obtained by importers, manufacturers, Central Government operators, airports, seaports, railroads, etc.

The cost of getting the aforementioned licences might vary based on a number of criteria, but their durations range from one to five years.

FSSAI certificate paperwork

As was already noted, there are three distinct sorts of FSSAI licence, and each one has a unique set of documentation requirements.

Documents needed to apply for a basic FSSAI licence

- Passport-size photo of a designated individual (latest).

- Evidence of the authorised person’s address.

- Both the business’s address and name.

- Specifics about the business’s nature.

- The FSSAI’s declaration form.

State FSSAI licence documents

- As identity evidence, you can use your Aadhar card, passport, voter ID card, driving licence, etc.

- Specifics about the type of business.

- If the business premises are rented, you must provide the leasing agreement.

- If applicable, you must provide proof of government registration, such documents attesting to your company’s incorporation, a trade licence, a partnership agreement, firm registration, a GST registration number, etc.

- You must provide the MoA (Memorandum of Association) and AOA (Article of Association) or Partnership Deed if the business location is a partnership firm or private limited corporation.

- It is necessary to submit the trade licence, corporation licence, municipality licence, shop, and establishment registration (any one).

- Form for FSSAI declaration.

Documentation necessary for manufacturing or rebuilder categories

- The design of the facility.

- Images of production facilities.

- The information about the items is submitted on the firm letterhead.

- On the firm letterhead, information about the production-related machinery is included.

Central FSSAI licence documents

- You must present an Aadhar card, voter ID card, passport, driver’s licence, or any other identity document as confirmation of your identity.

- If the business location is rented, you must produce the leasing agreement.

- A company incorporation certificate, a partnership deed, a firm registration, a trade licence, a GST registration number, or shop and establishment registration are just a few examples of government registration documents you must submit.

- A letter of authorisation from the business confirming that the relevant individual is authorised to submit the FSSAI application is necessary if you run a partnership firm or private limited company.

- The list of food categories the manufacturer plans to create must be submitted in the case of the manufacturer.

- It is required to submit an IE code (Import Export Code) for the category of import and export.

Necessary documents for the manufacturing category

- Images of the production facility.

- Product information and a plant’s layout.

- On the corporate letterhead are details on the production-related machinery.

- If your company works with a mineral water facility, you must provide the water test result.

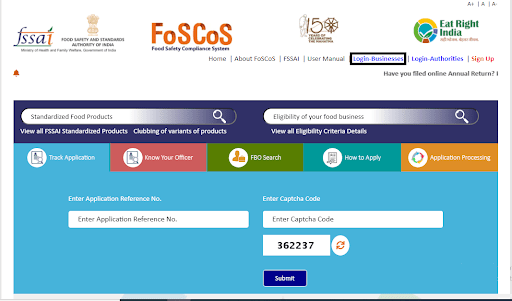

Obtaining an FSSAI certificate

- The application will be sent in accordance with Form A.

- A unique application reference number is generated once the application form is submitted.

- The Registration Authority (RA) will decide whether to accept or reject the application for the FSSAI certificate within seven days after registration.

- Either an inspection will be conducted by the registration authority or it won’t.

- If an inspection is not necessary, the food company operator may start operations.

- The Registration Authority will, however, send out a notification for the inspection if necessary.

- Inspection will be required within 7 days of the notification being issued for it.

- You are qualified to obtain the FSSAI certificate and start your business if you passed the inspection.

- The inspection will be done later on, within 30 days.

FSSAI certificate: Advantages

Before beginning any food company activity, the business operator must get an FSSAI licence. Every food processing facility, regardless of whether it deals in food manufacture, sales, or distribution, is required to comply with this regulatory requirement.

The following are some advantages of FSSAI registration:

Customer expertise

With incidents like Maggie and allergy attacks, food cleanliness has recently come under scrutiny; as was seen in the Burger King case, the rules for food safety are now being taken seriously. All food businesses must abide by the rules or face severe penalties.

Growth of the business

Your FSSAI licence may be useful in the future if you decide to extend your business to other states. Through a Fssai licence, you may also readily receive financing for your operation or business. Consumers will feel more confident if you have a valid food licence, which will make it easier for you to develop your premises.

Sound legal decision

The user gains trust from seeing the FSSAI logo on your menu and packaging bags since it guarantees the food is healthy and of high quality. Furthermore, the real cost of registering is far smaller than the penalty that will be assessed. Therefore, it is generally recommended that food business owners obtain an FSSAI licence before launching their enterprise.

FSSAI certificate: Returns of FSSAI

All food producers, whether packers, re-labellers, or importers, must maintain an account of their stock and transactions. Before May 31st of each year, Form D-1 can be used to physically file the annual return for FSSAI as well as to complete an online filing method. It is necessary to file the following information.

- Description of the made or produced good

- Product size and quantity, as well as the price per unit or kilogramme.

- The country’s specifics coupled with the volume of goods imported or exported.

FSSAI certificate: Exemptions

Every food company operator is required by law to submit an annual return, although a select few enterprises are exempt from the need. This list was created based on the notification that was sent out on June 10th, 2014, and includes canteens, grocery shops, fast food restaurants, and small eateries.

FAQs

How can an online food seller obtain an FSSAI licence?

The FSSAI has broadened its purview to cover e-commerce food service apps. This group comprises online grocery retailers like Amazon, Big Basket, and Zomato, as well as delivery services like Uber Eats and Swiggy.

What is the FSSAI's guidance about the food preparation area?

Cooking and frying should be done in front of a chimney with enough suction power.

Housing News Desk is the news desk of leading online real estate portal, Housing.com. Housing News Desk focuses on a variety of topics such as real estate laws, taxes, current news, property trends, home loans, rentals, décor, green homes, home improvement, etc. The main objective of the news desk, is to cover the real estate sector from the perspective of providing information that is useful to the end-user.

Facebook: https://www.facebook.com/housing.com/

Twitter: https://twitter.com/Housing

Email: [email protected]