To subsume almost all indirect taxes in India, except for a few state taxes, the government in 2017 launched the Goods and Services Tax (GST) regime that is in line with globally-accepted tax regimens.

The Goods and Services Tax (GST) covers real estate in India through works contracts and building and constitution works as all components used in the development work attract GST. To put it simply, covered under the new regime is the Indian construction industry, which continues to attract high rates of taxes through a blend of levies imposed on the purchase of various building construction materials.

Check out our guide on GST search and GST verification

GST on construction, building materials

GST is a four-tier tax builders in India have to pay on purchase of construction and building material. The GST rate on construction materials and building materials ranges between 5% and 28%.

See also: E way bill login: All you need to know

GST Rates on Construction Materials (Old vs New)

| Construction Material | Old GST Rate | New GST Rate (2025) |

| Natural Sand | 5% | 5% |

| Building bricks, Fossil bricks | 5–28% | 5% |

| Fly-ash bricks | 5% | 5% |

| Coal | 5% | 5% |

| Glass-based paving blocks | 18% | 18% |

| Pebble, gravel and crushed stone | 5% | 5% |

| Marble and granite blocks | 12–28% | 5% |

| Building stones | 5% | 5% |

| Cement (all types) | 28% | 18% |

| Iron and steel products | 18% | 18% |

| Tiles (earthen, roofing) | 5% | 5–18% (type-based) |

| Wall tiles | 28% | 18% |

| Bamboo floor tiles | 18% | 5% |

| Artificial stone, cement, concrete tiles | 5–28% | 5–18% (type-based) |

| Wiring and electrical fittings (incl. cables) | 18–28% | 18% |

| Paint and varnish | 18% | 18% |

| Pipe fittings | 18% | 18% |

| Ceramic goods and refractory bricks | 18% | 18% |

| Wallpapers | 28% | 18% |

| Locks | 18% | 18% |

| Sanitary wares | 18–28% | 18% |

Also read: GST portal login

Sand GST rate

5%: Natural sand of all kinds other than metal-bearing sand.

18%: Bituminous or oil shale and tar sands, bitumen and asphalt, natural asphaltites and asphaltic rocks.

Cement GST rate (revised)

| Cement Type / Material | Old Rate | New Rate (2025) |

| Super sulphate cement | 28% | 18% |

| Slag cement | 28% | 18% |

| Aluminous cement | 28% | 18% |

| Portland cement | 28% | 18% |

| Refractory cement | 12% | 18% |

| Mortars | 12% | 18% |

| Concrete | 12% | 18% |

GST on bricks

5%: Building bricks, fossil bricks, and fly-ash bricks (previously taxed 5–12%).

Supply of bricks is now standardized under 5%, replacing the earlier dual structure (12% with ITC or 6% under composition).

Under the earlier GST framework, bricks attracted 12% with ITC or 6% under a special composition scheme for small kilns. However, following the 2025 GST 2.0 reform, bricks (including fly-ash and fossil bricks) are now uniformly taxed at 5%, simplifying compliance and lowering costs for the sector. Similarly, wall tiles, refractory bricks, and ceramic goods are taxed at 18%, while materials such as artificial stone, concrete tiles, cement-based blocks, and glass paving blocks now fall within the 5%–18% range, replacing the earlier 28% slab.

See also: How to get a home construction loan, to construct your own house

GST on gravel and crushed stone

Building stones such as basalt, sandstone, porphyry, and other similar materials continue to be taxed at 5%. Likewise, pebbles, gravel, and crushed stones used in concrete also attract a 5% GST rate. This slab remains unchanged under the 2025 revisions.

GST on marble and granite

Earlier, marble and granite had dual slabs (12% for blocks and 28% for finished products). Under the 2025 revision, rates have been brought down and simplified:

- 5%: Marble and granite blocks.

- 18%: Finished marble and granite products.

This change significantly reduces costs for flooring and finishing works compared to the earlier 28% bracket.

GST rate on building stone

5%: Porphyry, basalt, sandstone and other monumental or building stone, both, in blocks and slabs.

GST rate on muram soil

Murum soil, also known as Muram, is widely used in plinth filling, road pavements, and footing pits. Earlier taxed at 18%, it now falls under the 5% GST slab in line with other natural construction inputs like sand and gravel.

GST on steel

All iron and steel products, including rods, wires, blocks, and rolls, are subject to a uniform GST rate of 18%.

GST rate for tiles (Old vs New)

| Construction material | Old GST Rate | New GST Rate (2025) |

| Earthen or roofing tiles | 5% | 5% |

| Bamboo flooring tiles | 18% | 5% |

| Cement tiles | 28% | 18% |

| Concrete tiles | 28% | 18% |

| Artificial stone tiles | 28% | 18% |

| Plastic floor coverings (in rolls or tiles) | 28% | 18% |

| Plastic wall or ceiling coverings | 28% | 18% |

| Panels, boards, tiles, blocks (vegetable fibre, straw, wood particles with binders) | 28% | 18% |

| Ceramic flooring blocks | 28% | 18% |

| Support or filler tiles | 28% | 18% |

| Articles of plaster (boards, sheets, panels, tiles) | 28% | 18% |

| Hearth or wall tiles | 28% | 18% |

| Ceramic mosaic cubes | 28% | 18% |

| Glazed ceramic flags and paving | 28% | 18% |

| Glazed hearth or wall tiles | 28% | 18% |

| Glazed ceramic mosaic cubes | 28% | 18% |

GST on coal

The Indian government has eased the tax burden on coal producers by placing coal in the 5% GST tax bracket.

See also: All about the National Building Code

GST rates on interior furnishing materials in 2025 (updated)

When budgeting for construction, it is important to factor in the GST on interior materials. Under GST 2.0, most slabs were rationalised to 5% or 18%, with higher 28% rates removed for essential fittings.

Tiles

- Earthen or roofing tiles: 5%

- Bamboo tiles: 5% (reduced from 18%)

- Other tiles (glazed ceramic, plastic, concrete, artificial stone, ceramic flooring blocks, wall tiles): 18% (reduced from 28%)

Wood

- Natural wood & plywood for furniture: 18% (earlier 28%)

- Finished wooden furniture: 18% (standardised, earlier 12% with ITC benefit)

Wires and electrical fittings

- Insulated concealed wires & cables: 18% (earlier 28%)

- Electrical machinery & equipment (lighting, fittings, sound systems, appliances): 18% (earlier 28%)

Wallpapers, paints, and varnishes

- Wallpapers & wall coverings: 18% (earlier 18–28%)

- Paints & varnishes (enamels, lacquers, polymers): 18%

- Resin cement, glazier’s putty, painter’s filling materials: 18%

Bathroom fittings

- Ceramic sinks, washbasins, closet pans, urinals: 18% (earlier 28%)

- Pipe fittings (copper, plastic, nickel, aluminium, iron, steel): 18%

- Plastic pipes & hoses: 5%

- Sanitary ware parts (iron & steel): 18% (earlier 28%)

Interior accessories

- Locks (combination, key, electrical, padlocks): 18%

- Furniture, door, window, blind fittings (base metal): 18% (earlier 28%)

The key impact is that most interior materials earlier taxed at 28% have now been rationalised to 18%, with a few eco-friendly or natural categories (like bamboo and plastic pipes) placed in the 5% slab.

GST on post-possession repairs and interior work

While GST on construction materials and services is commonly discussed for new projects, it is equally important to understand the tax implications for renovation and repair works after possession.

GST applicability on post-possession works:

- Interior design and execution contracts (e.g., false ceiling, modular kitchen, carpentry): Attract 18% GST, even if materials are supplied by the contractor.

- Pure labor contracts for repair or painting services: Typically attract 18% GST.

- Material-only purchases eg. tiles, lights, sanitary ware): GST is applicable as per the revised slabs, mostly 5% or 18% (earlier 18–28%).

GST rates on construction services in 2025

Construction services include different types of contracts and labour arrangements. After GST 2.0, rates have been standardised.

Works contract

A works contract covers building, installation, repair, and maintenance. Earlier, slabs varied between 12% and 18%. Now:

- All works contracts (irrespective of material-labour split): 18% GST.

Labour contract

- Labour and contractor services: 18% (earlier 12%).

- Architectural and design services: 18% (unchanged).

Reverse charge mechanism in construction industry

The Reverse Charge Mechanism (RCM) continues to apply when builders purchase goods or services from unregistered vendors (such as small labour contractors). Builders must pay GST directly to the government, but can claim input tax credit (ITC) where allowed. This ensures compliance but may temporarily affect cash flow.

GST rate on goods transportation for real estate

Transport of construction materials remains taxed at:

- 5% without ITC, or

- 12% with ITC.

The option must be selected at the start of each financial year.

GST rates on real estate projects

GST applies only to under-construction properties. Property owners who move into ready-to-move-in properties are exempt from GST, though they may still be subject to other taxes such as stamp duty and registration charges.

GST rates by project type

- Affordable housing: 1% without ITC

- Non-affordable housing: 5% without ITC

- Commercial properties: 12% with ITC

Note: The definition of affordable housing has been updated. It now includes properties with a carpet area not exceeding 60 sq m in metropolitan cities and 90 sq m in non-metropolitan cities across India.

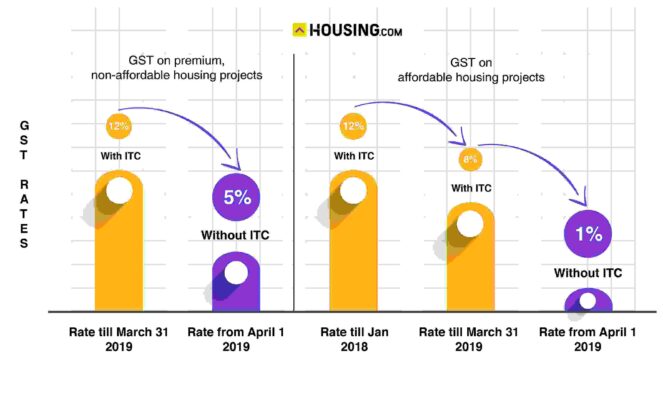

GST has been a significant shift in India’s tax system, seen as both beneficial and challenging. While it has evolved since its introduction, there is still room for improvement. In April 2019, GST rates for residential construction costs were revised.

Currently, the GST rate for under-construction properties is 5% without itc. This rate varies depending on the type of project and state regulations. For affordable housing—properties priced within ₹45 lakh—the GST rate is 1% without itc. For commercial properties, the GST rate is 12% with itc benefits.

How does GST affect the overall cost of construction?

Implementing the goods and services tax (GST) in India has significantly influenced the construction sector by altering the tax landscape for various building materials and services. Here’s how GST affects the overall cost of construction:

Unified tax structure: Before GST, the construction industry was subject to multiple indirect taxes, including VAT, service tax, and excise duty, leading to a cascading effect of taxes. GST has streamlined these into a single tax system, reducing the complexity and potential for double taxation.

Input tax credit (ITC): GST allows the seamless flow of input tax credits across the supply chain. Builders and contractors can now claim credits for the GST paid on inputs like cement, steel, and other materials, which can offset their output tax liability. This mechanism helps reduce the overall tax burden and can lead to cost savings.

Impact on material costs: The GST rates for construction materials vary, with essential items like cement taxed at 28% and steel at 18%. While some materials have seen a tax rate increase under GST, the availability of ITC can mitigate these costs. However, the net effect on construction costs depends on the proportion of materials used and the efficiency in utilizing ITC.

Cost implications for different projects: For affordable housing projects, GST is levied at a reduced rate of 1% without ITC, making such projects more financially viable. In contrast, other residential projects attract a 5% GST without ITC, which can increase the cost for buyers. Commercial properties are taxed at 12% with ITC, allowing developers to offset some of the tax liabilities through input credits.

Compliance and cash flow management: The GST regime necessitates strict compliance with tax filings and documentation. While ITC offers tax relief, it requires timely and accurate record-keeping. Delays in claiming ITC can impact cash flows, especially for large-scale construction projects.

How GST affects homebuyer and developer costs?

While GST aims to simplify taxation, its impact on the real estate value chain varies significantly for developers and end-buyers—particularly in under-construction properties.

Cost breakup before and after GST

Before GST, multiple taxes were applied, such as VAT (Value Added Tax), service tax, and excise duties on inputs. These taxes led to cascading effects and increased compliance. With GST, these have been subsumed into one uniform tax, but the removal of Input Tax Credit (ITC) for residential buyers (except in commercial and select affordable housing) has raised the net cost to consumers.

| Particulars | Pre-GST | Post-GST (with ITC) | Post-GST (without ITC) |

| Base property price | ₹45,00,000 | ₹45,00,000 | ₹45,00,000 |

| Indirect taxes on materials/labour | ~₹3,00,000 | Input tax credit adjusted | Burden on buyer |

| GST applicable | – | 12% (with ITC) | 5% (residential, no ITC) |

| Net buyer cost | ₹48,00,000 approx | ₹46,50,000 approx | ₹47,25,000 approx |

Illustrative example: ₹50 lakh under-construction flat

For a ₹50 lakh property in the non-affordable category:

- GST at 5% (without ITC) = ₹2.5 lakh additional cost to the buyer.

- Developers cannot claim credits for the tax paid on cement, steel, or services, which increases their overall construction cost. To recover this, the base price may be marked up before tax is applied.

Who bears the GST in affordable vs non-affordable segments

- Affordable housing (within ₹45 lakh): GST at 1% without ITC. The low rate keeps projects viable, but developers factor in input costs due to ITC ineligibility.

- Non-affordable housing: GST at 5% without ITC. Developers adjust pricing upwards to absorb tax inefficiencies.

- Commercial property: GST at 12% with ITC. Here, developers benefit from input credit and are less likely to increase base price.

Ultimately, in residential housing, buyers end up absorbing most of the GST burden due to the no-ITC structure.

How GST affects homebuyer and developer costs?

While GST aims to simplify taxation, its impact on the real estate value chain varies significantly for developers and end-buyers—particularly in under-construction properties.

Cost breakup before and after GST

Before GST, multiple taxes were applied, such as VAT (Value Added Tax), service tax, and excise duties on inputs. These taxes led to cascading effects and increased compliance. With GST, these have been subsumed into one uniform tax, but the removal of Input Tax Credit (ITC) for residential buyers (except in commercial and select affordable housing) has raised the net cost to consumers.

| Particulars | Pre-GST | Post-GST (with ITC) | Post-GST (without ITC) |

| Base property price | ₹45,00,000 | ₹45,00,000 | ₹45,00,000 |

| Indirect taxes on materials/labour | ~₹3,00,000 | Input tax credit adjusted | Burden on buyer |

| GST applicable | – | 12% (with ITC) | 5% (residential, no ITC) |

| Net buyer cost | ₹48,00,000 approx | ₹46,50,000 approx | ₹47,25,000 approx |

Illustrative example: ₹50 lakh under-construction flat

For a ₹50 lakh property in the non-affordable category:

- GST at 5% (without ITC) = ₹2.5 lakh additional cost to the buyer.

- Developers cannot claim credits for the tax paid on cement, steel, or services, which increases their overall construction cost. To recover this, the base price may be marked up before tax is applied.

Who bears the GST in affordable vs non-affordable segments

- Affordable housing (within ₹45 lakh): GST at 1% without ITC. The low rate keeps projects viable, but developers factor in input costs due to ITC ineligibility.

- Non-affordable housing: GST at 5% without ITC. Developers adjust pricing upwards to absorb tax inefficiencies.

- Commercial property: GST at 12% with ITC. Here, developers benefit from input credit and are less likely to increase base price.

Ultimately, in residential housing, buyers end up absorbing most of the GST burden due to the no-ITC structure.

Are there any GST rebates or exemptions for eco-friendly construction materials?

Yes, the Indian government continues to provide concessions on eco-friendly materials to promote sustainable construction:

- Solar panels and systems: Taxed at 12% GST, encouraging wider adoption of renewable energy while balancing revenue considerations.

- Fly-ash bricks: Now taxed at a reduced 5% GST (earlier 12%), making them more affordable and promoting their use as an environmentally friendly alternative to clay bricks.

Apart from this, the state-level incentives (property tax rebates, extra FAR, fast-track approvals for IGBC/GRIHA certified projects) remain valid and unchanged.

State-wise GST or tax benefits for eco-friendly construction

While GST rates are set at the central level, many state governments encourage sustainable and eco-friendly construction through supplementary tax benefits and regulatory relaxations. These incentives are usually linked to certifications such as IGBC, GRIHA, LEED, or BEE ratings and can significantly reduce overall project costs, even if they don’t directly lower GST liability.

Examples of state-level incentives (2025):

- Maharashtra: Offers 10%–15% rebate on property tax for IGBC or GRIHA-certified residential and commercial buildings in urban centres such as Pune, Thane, and Navi Mumbai.

- Andhra Pradesh & Telangana: Provide extra FAR (Floor Area Ratio) and fast-track building approvals for projects achieving IGBC or GRIHA certification. Telangana’s TS-bPASS system integrates these benefits into online clearance.

- Karnataka & West Bengal: Allow relaxations in building permit fees and rebates on development charges for certified green buildings, particularly in Bengaluru and Kolkata.

- Haryana: Permits higher ground coverage and building heights for projects with valid IGBC or GRIHA ratings, effectively increasing saleable area for developers.

- Delhi NCR (NDMC, Gurugram, Noida): Local bodies have introduced property tax rebates (up to 20%) for buildings that install rooftop solar panels and adopt energy-efficient systems.

- Kerala: Offers fast-track clearances and partial exemption from additional building permit fees for GRIHA/LEED-certified projects.

Most of these benefits are administered at the Urban Local Body (ULB) level, and availing them requires submission of valid certificates from recognised agencies (IGBC, GRIHA, LEED, or BEE).

Key takeaway: While GST itself does not directly differentiate between eco-friendly and conventional construction (beyond concessional rates for fly-ash bricks at 5% and solar panels at 12%), state-level property tax rebates, FAR relaxations, and clearance fast-tracks serve as powerful incentives that indirectly reduce overall costs for developers and buyers.

FAQs

What is the rate of the GST on steel?

From July 1, 2017 the rate of GST for steel is 18%. The GST rate for some of the input used by the steel industry like iron, coal and transportation services is 5%.

Types of cement are classified under which code of the GST?

Types of cement are classified under chapter 25 of the HSN Code.

What GST rate applies to bricks?

Bricks are taxed at 5% GST. However, the GST on supply of bricks was increased to 12% with input tax credit (ITC) from April 1, 2022.

How are construction materials taxed under GST?

Construction materials are taxed at varying rates under GST, ranging from 5% to 28%, depending on the type of material. For example, cement is taxed at 28%, while natural sand is taxed at 5%.

What is the GST rate for affordable housing projects?

The GST rate for affordable housing projects is 1% without ITC. This applies to properties priced within ₹45 lakh.

How does GST apply to transportation of construction materials?

Transportation of construction materials is taxed at 5% GST. Operators can choose between 5% GST without ITC or 12% GST with ITC at the start of the financial year.