Residential real estate sales saw some moderation in January 2019 (-4.6% yoy) and this is likely to accelerate in the two months up to March 2019, owing to the change in the rate of GST on real estate, applicable from April 2019, according to the ‘Real estate – state of the market’ report by Kotak Institutional Equities. Launch activity has compressed more aggressively (-60% yoy) and this trend is likely to continue, as marginal players face incremental pressures under a constrained liquidity environment, it added.

Steady sales and declining launches have led to a reduction in inventory and flat realisations

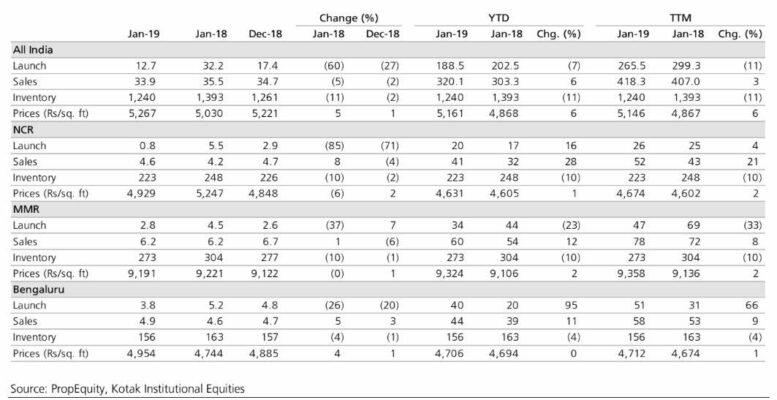

All-India real estate sales across major cities stood at 34 million sq ft in January 2019 (-4.6% yoy) against launches of only 12.7 million sq ft (-60% yoy). Sales momentum remained steady in January, in line with sales seen in previous months, at an average of 35 million sq ft in CY2018), even as launches took a hit across India, more strongly in the NCR and tier-2 cities. Launches in tier-2 cities dropped to 1.9 million sq ft against the average monthly launches of 5.4 million sq ft in CY2018. Declining launches and improving sales momentum have continued to decrease the inventory overhang, with all-India inventory declining 11% yoy to approximately 1.24 billion sq ft from 1.4 billion sq ft in January 2019. Prices across India remained largely flat at Rs 5,270 per sq ft in January 2019, although it was higher by 4.7% yoy.

Transitional GST provisions could lead to weak sales till March 2019

We would see headline sales numbers for the real estate sector in India moderate in February and March 2019, as consumers postpone sales to see the outcome of the revision in the Goods ans Services Tax (GST) rates, which have been reduced with effect from April 2019. Further, the transition provision (released in March 2019) allows for developers to choose extant higher rates (with ITC) or lower rates (without ITC) for under-construction properties. Lack of clarity on applicable rates for under-construction properties, as well as the transition to new rates from April 2019, could hinder sales and collection numbers for companies towards the end of the current fiscal.

Sales, launches and inventory across India, March fiscal year-ends, Jan 2018-Jan 2019 (million sq ft)

Region-wise highlights

National Capital Region

Sales activity in the NCR remained steady in January 2019, with sales of 4.6 million sq ft (+7.6% yoy) with major contribution coming from Gurugram (1.8 million sq ft) and Greater Noida (1.5 million sq ft). On an annual basis, sales averaged 4.3 million sq ft in CY2018. Launches in the NCR took a hit in January 2019, with only 0.8 million sq ft of new inventory coming in to the market (only in Ghaziabad), a sharp decline of 85% yoy. Net unsold residential inventory in the NCR stood at 223 million sq ft as of January 2019 and is equivalent to 51 months of sales (based on average of trailing 12 months). Realisations declined by 6% yoy in the NCR in January 2019 at Rs 4,930 per sq ft, likely on account of higher proportion of affordable housing projects.

See also: Lower GST rates may benefit the industry more than buyers

Mumbai Metropolitan Region

Launches in the MMR remained weak at 2.8 million sq ft (-37% yoy) in January 2019 in continuance with weak trends seen in November and December 2018. Sales remained flat at 6.2 million sq ft (+1% yoy) in January 2019, in keeping with the average of 6.5 million sq ft seen in CY2018. MMR witnessed the sharpest decline in inventory among all regions, even as outstanding inventory still remains the highest at 273 million sq ft in January 2019 (from 304 million sq ft in Jan 2018), which is expected to be absorbed in 42 months, on the basis of the prevailing past 12-month sales.

Bengaluru

Sales in Bengaluru in January 2019 stood at 4.9 million sq ft (+5% yoy) against launches of 3.8 million sq ft in January 2019. Launch activity at 3.98 million sq ft in January was low, in comparison to the average of 4.4 million sq ft per month in CY2018. Unsold inventory at 156 million sq ft, continues to be the lowest across regions in India. Realisations in January 2019 increased 4% yoy to Rs 4,950 per sq ft.

Home loan rates increase 65 bps over the past year

HDFC’s home loan rate currently stands at 9% as of March 2019, 65 bps higher than March 2017. More importantly, the spread between home loan rates and 10-year AAA yields stands at 159 bps. Outstanding loans to commercial real estate players grew 7.6% yoy to Rs 1.98 trillion in January 2019 (Rs 1.84 trillion in January 2018). Exposure to the housing sector (including priority sector) increased by Rs 1.7 trillion yoy to Rs 11.2 trillion in January 2019. On input cost, all-India cement prices remained flat in March 2019 at Rs 334 per bag of 50 kgs while rebar prices increased by 4% month-on-month to Rs 41,833 per ton in March 2019, down 6% yoy.

Housing News Desk is the news desk of leading online real estate portal, Housing.com. Housing News Desk focuses on a variety of topics such as real estate laws, taxes, current news, property trends, home loans, rentals, décor, green homes, home improvement, etc. The main objective of the news desk, is to cover the real estate sector from the perspective of providing information that is useful to the end-user.

Facebook: https://www.facebook.com/housing.com/

Twitter: https://twitter.com/Housing

Email: [email protected]