There has been a whopping 50 per cent jump in overall new housing launches in Q2 2018, over the preceding quarter, with the maximum supply in the affordable segment (less than Rs 40 lakhs). Interestingly, the affordable housing supply increased by 100 per cent in Q2 2018 over Q1 2018 and this supply has led the overall growth.

On the sales front too, housing sales across the top seven cities of India (NCR, MMR, Chennai, Bengaluru, Pune, Kolkata and Hyderabad) also rose by 24 per cent, compared to Q1 2018, indicating that hitherto abstaining home buyers are back on the market. Developers are working hard to clear unsold inventory, with attractive schemes, freebies and discounts. Moreover, the positive impact of the policy reforms, including RERA and GST, have begun to bear fruit.

Affordable housing: 100 per cent jump and key growth contributor to Q2 supply

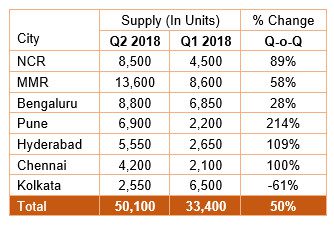

Q2 2018: New launches

The top seven cities witnessed new unit launches of around 50,100 units in Q2 2018, as opposed to 33,400 units in Q1 2018. The major cities contributing to Q2 2018 new unit additions, include the Mumbai Metropolitan Region (MMR), National Capital Region (NCR), Bengaluru and Pune, altogether accounting for 75 per cent of the new supply.

- Approximately 6,900 units were launched in Pune – a significant increase of 214 per cent from Q1 2018. Two large affordable housing projects, comprising 1,900 units, were the key contributors to the increase in new units hitting the Pune market in Q2.

- Hyderabad added 5,550 units in Q2 2018, a massive quarterly increase of 109 per cent. The city has garnered prominent visibility on the Indian real estate map, with its high liveability index vis-à-vis many other cities.

- Chennai’s new supply doubled to 4,200 units in Q2 2018, compared to only 2,100 units in Q1 2018. Over 64 per cent of the new supply was added in the affordable segment.

- NCR contributed 17 per cent new supply with 8,500 units, an increase of 89 per cent over the previous quarter. Of this, 54 per cent comprised of units in the affordable segment.

- MMR saw maximum supply with nearly 13,600 units in Q2 2018, a significant increase of 58 per cent over the previous quarter.

- Bengaluru added 8,800 units in Q2 2018, a quarterly increase of 28 per cent. This city is maintaining its intelligent approach to changing market dynamics.

- Kolkata’s new launches recorded a drop of 61 per cent from the previous quarter, with approximately 2,550 units. During the previous quarter, a large affordable housing project of around 3,500 units, was a key contributor to the new launch supply. The drop noted in Q2 2018 reflects developers’ focus on completing under-construction projects, rather than launching new ones.

See also: Residential realty sees turnaround, as sales jump 33% in Q1 2018: PropTiger’s Realty Decoded report

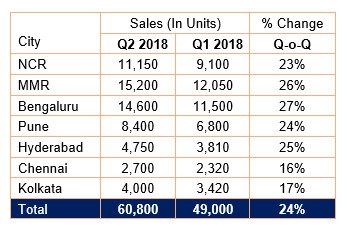

Improving sales

In terms of housing sales during Q2 2018, the top even cities together witnessed an increase of 24 per cent over the previous quarter. Around 60,800 units were sold in Q2 2018 with the NCR, MMR, Bengaluru and Pune together accounting for 81 per cent of the overall sales. End-user-driven Bengaluru led the pack, on the back of re-ignited interest from IT/ITeS professionals reacting to the mitigated job risks and overall favourable economic environment.

- Bengaluru saw the highest jump in sales in Q2 2018, with sales increasing by 27 per cent, from 11,500 units in Q1 2018 to 14,600 units in Q2 2018.

- MMR sales rose by 26 per cent, from 12,050 units in Q1 2018 to 15,200 units in Q2 2018.

- Sales in Hyderabad increased by 25 per cent over Q1 2018, with 4,750 units.

- Pune’s sales increased by 24 per cent over the previous quarter, with 8,400 units.

- NCR’s sales increased by 23 per cent, from 9,100 units in Q1 2018 to 11,150 units in Q2 2018, denoting a significant improvement in market conditions.

- Kolkata’s sales increased by 17 per cent, from 3,420 units in Q1 2018 to 4,000 units in Q2 2018.

- Chennai’s sales rose by 16 per cent, from 2,320 units in Q1 2018 to 2,700 units in Q2 2018.

Unsold inventory: The overall unsold inventory declined by two per cent, from 7.11 lakh units in Q1 2018 to 7.0 lakh units in Q2 2018 (by 10 per cent from 7.7 lakh units in Q4 2017).

Marginal price increase: Residential property prices across the top cities increased by one per cent in Q2 2018, compared to the previous quarter, barring Chennai and Kolkata (where prices remained stagnant). The ample unsold stock, is keeping price growth in check.

Dominant segments: The market continued to be dominated by the affordable and mid-range segments. 77 per cent (38,600 units) of unit launches were in the price category of less than Rs 80 lakhs. The affordable segment accounted for a whopping 46 per cent share of the total new launches.

Conclusion

Considering the growth in supply and sales in H1 2018, the upcoming festive season may finally be a vibrant one again, more so as more new launches across the major cities will offer buyers a wider spread of options and help control prices. However, whether infrastructure status to affordable housing and sops for MIG-I and MIG-II home buyers under the PMAY will help fulfil the government’s vision of ‘Housing for All by 2022’, remains hard to say. Nevertheless, what is certain is that affordable housing has kept the market’s momentum going for some time now. If developers remain focused, add only relevant supply and ensure 100 per cent RERA compliance, we may yet see this dream project become a reality.

(The writer is chairman, ANAROCK Property Consultants)