The proposal of the GST Council, to reduce the Goods and Services Tax (GST) rate on under-construction properties, will likely have mixed implications for the sector, with consumers for high-price inventory (such as Mumbai and NCR) standing to benefit, although the absence of input tax credit may impact the overall costing in cities such as Bengaluru, with lower realisations, says a report by Kotak Institutional Equities. However, the lower tax reduces the differential pricing for under-construction and completed properties and may prompt changes in consumer behaviour, in terms of timing their purchases. This augurs well for retail housing finance volumes and asset quality performance of developer loans in metros, the report added.

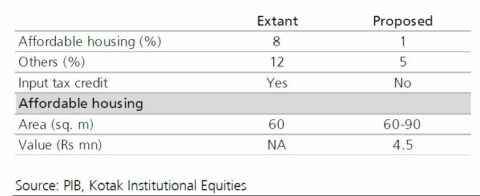

Details of GST rates proposed from April 1, 2019

See also: GST on under-construction flats slashed to 5%, affordable housing to 1%

Reduction in GST may not benefit properties having lower price points

The revised rates of GST may not necessarily work favourably in case of:

(1) Lower price-point apartments (such as Bengaluru) and

(2) Where the builder has given the consumer the full benefit of input tax credit.

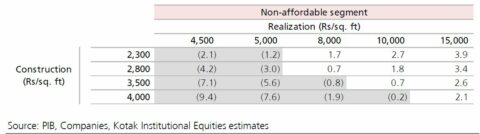

A headline GST of 5 per cent, compared to 12 per cent previously, is optically much lower. However, this needs to be seen in the context of removal of input tax credit. Buyers in cities such as Mumbai and Gurugram, will enjoy savings of three to four per cent. In general, consumers will be better with price points higher than Rs 6,000 per sq ft (assuming a construction cost of Rs 2,300 per sq ft).

Developers in select cities will have to take marginal price increases or bear the brunt of lower margins at unchanged prices. The exemption of GST on payments for JDA/FSI works favourably, as it limits the impact of lack of input tax credit.

Developers who retained part of the input tax credit will be worse-off under the new regime. Incremental clarity is required on usage of extant input tax credit, for services and material cost already paid. Further, the new tax rate will only be applicable from April 1, 2019 and accordingly, March 2019 will be a transition month that will likely see lower sales and will even have extant buyers requesting for a delay in the raising of new bills.

Computation of impact of GST revision on net property prices

New definition of affordable housing could keep a lot of metro cities outside its ambit

The new GST rules have reduced the headline rate to 1 per cent from 8 per cent (with input tax credit) for affordable housing. However, the definition of affordable housing now allows apartments of 60 sq m for metro cities and 90 sq m for non-metro cities, with a cap on the value of the asset at Rs 45 lakhs. A lot of small-sized apartments in metro cities may not be within the Rs 45-lakh limit and therefore, may not enjoy the lower GST under affordable housing. Apartments in other cities and those in the outskirts of metros, with ticket size up to Rs 45 lakhs will be the key beneficiaries, depending on the price point and construction cost.

Sensitivity of savings from proposed GST rates to property prices (%)

HFCs may benefit from higher volumes and improved liquidity for developers in metros

Lower prices for customers in metros such as Mumbai and NCR (wherein, land prices are high and hence, input tax credit in the previous regime was low) will help boost retail housing volumes in these locations. Private banks and large players like HDFC, are present in this space (even as HDFC has higher focus in the lower end).

Property prices across key metro cities

Market sources suggest that customers have been waiting for projects to be completed, to avoid the burden of GST, which is applicable only on under-construction projects. This had further stretched the financials of under-construction projects that were constrained due to weak demand and stable real estate prices. Higher under-construction sales in metros, post a price reduction following lower GST rates, will improve the financial health of large developers operating in these locations. This, in turn, will reduce the asset quality risk for HFCs lending to this segment.

Most HFCs have focused on the lower-end of the market with average ticket size of Rs 20-30 lakhs (Rs 2-3 million). The average ticket size of HDFC is Rs 2.6 million and LICHF is Rs 2.4 million. Assuming an average LTV of 45 per cent for LICHF and 60 per cent for HDFC, the average price of apartment works out to Rs 4.5-5.2 million – broadly around the cap of Rs 4.5 million for apartments attracting 1 per cent GST.

Housing News Desk is the news desk of leading online real estate portal, Housing.com. Housing News Desk focuses on a variety of topics such as real estate laws, taxes, current news, property trends, home loans, rentals, décor, green homes, home improvement, etc. The main objective of the news desk, is to cover the real estate sector from the perspective of providing information that is useful to the end-user.

Facebook: https://www.facebook.com/housing.com/

Twitter: https://twitter.com/Housing

Email: [email protected]