Although real estate experts predict that the sector will recover from the impact of the Coronavirus pandemic, its short-term effects notwithstanding, they maintain that investors must imbibe suitable changes in planning and execution, to continue to generate profit from their realty investments.

If falling interest rates and discount offers on property investment, have provided you with enough confidence to invest in a property to earn rental income, conscious choices would have to be made to reap the benefits of this decision in the post-Coronavirus world. The COVID-19 lockdown is likely to have a lasting impact on human psychology, with ownership of property gaining importance, among a generation that has been labelled as ‘Generation Rent’, because of its tendency to prefer rental properties over ownership. If that were to happen, the rental market in India would become even more competitive and landlords would have to discover new ways to protect their interests.

See also: Will rentals drop due to the Coronavirus outbreak?

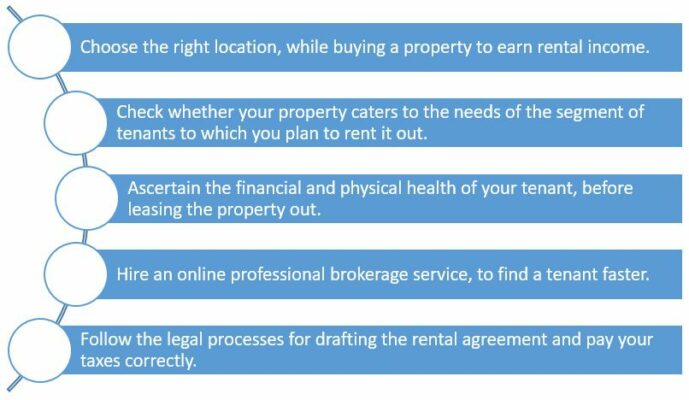

Choose the right location

Among the many things that will not change, as far as profitability of property investments are concerned, is its location. What remains to be seen is whether ‘good’ locations remain ‘good’ in the present context, as well. Property seekers should do a thorough and diligent research about the location, if one is yet to select a rental property. Properties within close vicinity of business districts and job markets, will invariably have high occupancy levels and hence, earn higher rentals.

Be clear about the target audience for your tenants

Right at the start, the owner must be clear about who his target audience would be. This is a crucial factor, while selecting the property configuration and amenities. Let us assume that you bought a rental property in a locality that has a high population of students, because there are various educational institutes nearby. A 3BHK home with common facilities, can quickly be turned into a PG, making it a perfect choice for the students. Similarly, 1BHK properties would make better sense, if you plan to let out your property to single working professionals or married couples without a big family. The requirement of each tenant section is different and your property must be able to supply the same. A working professional would need a parking space, in all likelihood. Students, on the other hand, would require house-keeping facilities.

Verify your tenant’s background

The entire success of your venture, depends on how diligently the tenant verification is carried. One has to ensure that they are letting their premises to law-abiding citizens, in order to maintain one’s own safety. With the Coronavirus pandemic bringing health aspects into focus, you should also be aware of your tenant’s medical history.

See also: Is police verification of tenants legally necessary?

As the whole point of renting out your property, is to generate income, the landlord must gauge the income-generating capacity of the prospective tenant. The nature, tenure and type of your tenants work, could help the landlord to ascertain how regular they are going to be with their payments. You should ask questions and seek proof, pertaining to your tenant’s professional history.

See also: Can tenants stop paying lease rent due to COVID-19?

Take the help of professional brokerage services

Traditionally, landlords saw no need to hire any professional services, to help them market their property. They would mostly depend on their friends, families, neighbours and luck, to find a suitable tenant. However, in a world where ordering food online, fixing our transport using mobile apps and finding our future life partners through the help of the internet have become the norm, these old-fashioned ways have limited scope, in terms of finding a tenant. Consequently, you can consider hiring an online professional brokerage service, to assist you in finding a tenant faster. Moreover, such services are not too expensive, because of the huge competition in this field. Since maintaining social distance is going to be high on people’s agenda, you need not visit their offices time and again, as most of the business can be conducted online.

Not only that, tools such as Housing.com’s PayRent provide tenants with the option to make timely rental payments with their credit cards, without having to visit the landlord. Similarly, Housing.com’s upcoming online rent agreement facility, will ensure that the landlord can get the contract worked out in a contactless and paperless manner.

See also: Everything you need to know about rent agreements

Ensure that all the paperwork is in place

The government has formulated the Draft Model Tenancy Act, 2019. However, states are yet to formulate their rules in this regard. Follow the basic rules as prescribed under the model law, in order to steer clear of any tenant-related issues in future. Also, you are supposed to make declarations about your rental income in your income tax returns and pay taxes accordingly.

In order to avoid any legal or financial trouble, keep your records straight. It would also be financially prudent to hire an experienced chartered accountant (CA), in case you own multiple properties and the tax work gets too complex. Even more importantly, a CA is better trained and equipped to help you save on taxes.

See also: Tax on rental income and applicable deductions

FAQs

Can tenants skip paying rent citing COVID-19?

Tenants cannot seek a waiver of rent, unless such a situation has been provided for, in the agreement signed between the landlord and the tenant.

Is rental income taxable?

The Income Tax Act of India has a specific head of income, titled ‘Income from house property’, to tax the rent received by an owner of a property.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]