Property owners in Andhra Pradesh’s Kurnool should pay property tax levied by the Kurnool Municipal Corporation every year. One of the largest sources of revenue for the municipal body, this tax is used for the area’s overall development that includes introducing new facilities and improving the existing ones. Are you looking for help on how to pay Kurnool property tax? This guide is a must-read for you if you are searching for how to pay property tax Kurnool.

Check how to pay property tax in Kakinada online

What is the property tax rate in Kurnool?

| Name of district | Name of urban local body (ULB) | ULB code | Total residential tax (half-yearly) | Total non-residential tax (half-yearly) |

| Kurnool | Adoni | 1015 | 0.075 | 0.15 |

| Kurnool | Gudurknl | 1163 | 0.075 | 0.15 |

| Kurnool | Kurnool | 1016 | 0.075 | 0.15 |

| Kurnool | Yemmiganur | 1018 | 0.075 | 0.15 |

Source: CDMA portal

How to register with CDMA online?

To pay Kurnool property tax online, you should first register on the Commissioner and Director of Municipal Administration (CDMA) portal.

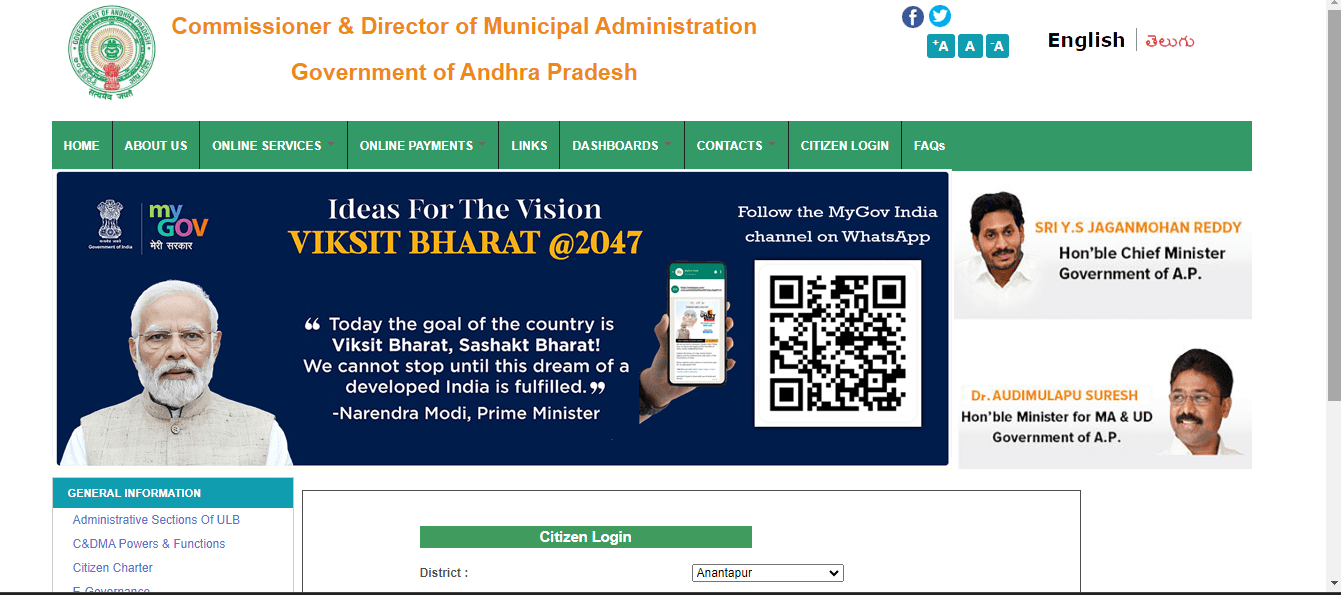

- Go to the CDMA portal at https://cdma.ap.gov.in/

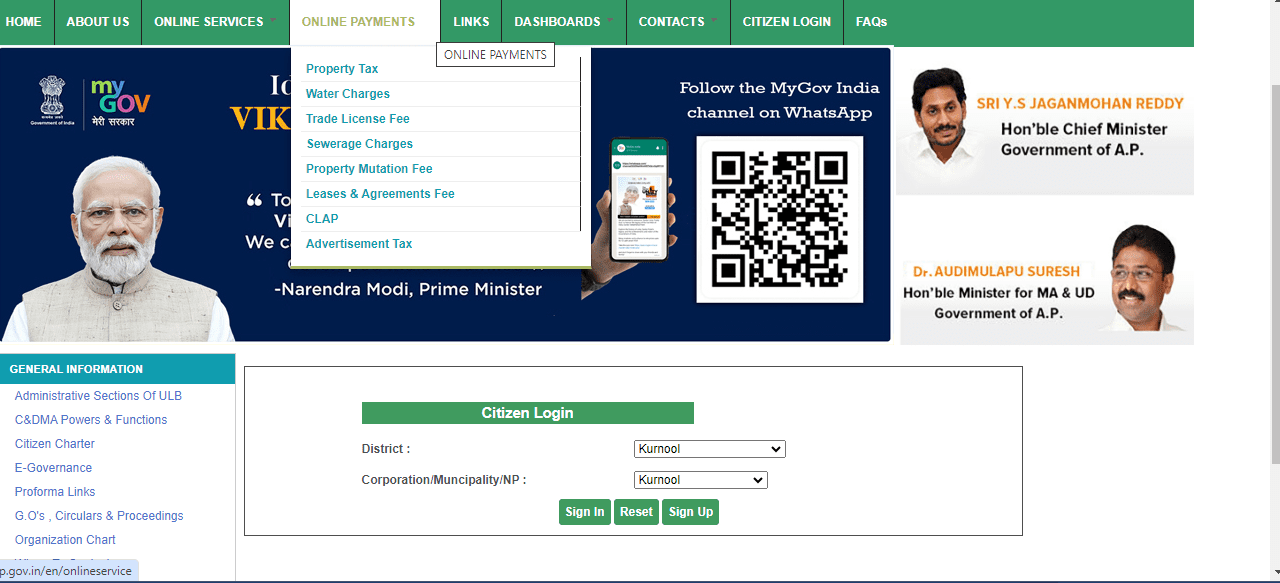

- On the homepage, click on ‘Citizen Login’. You will reach here:

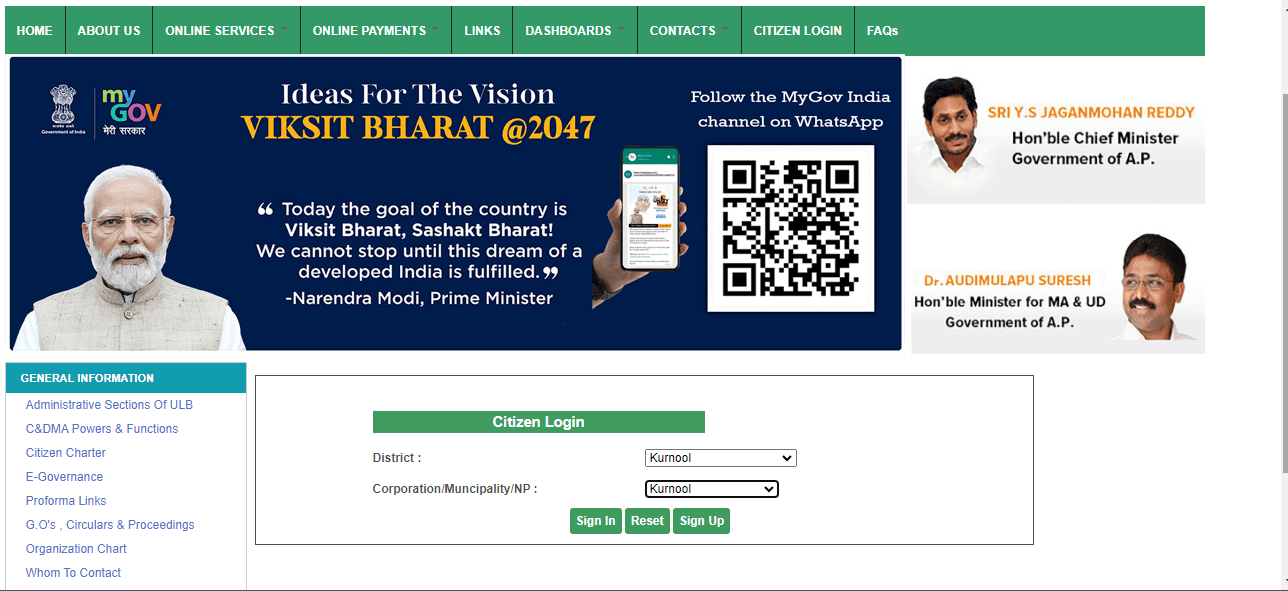

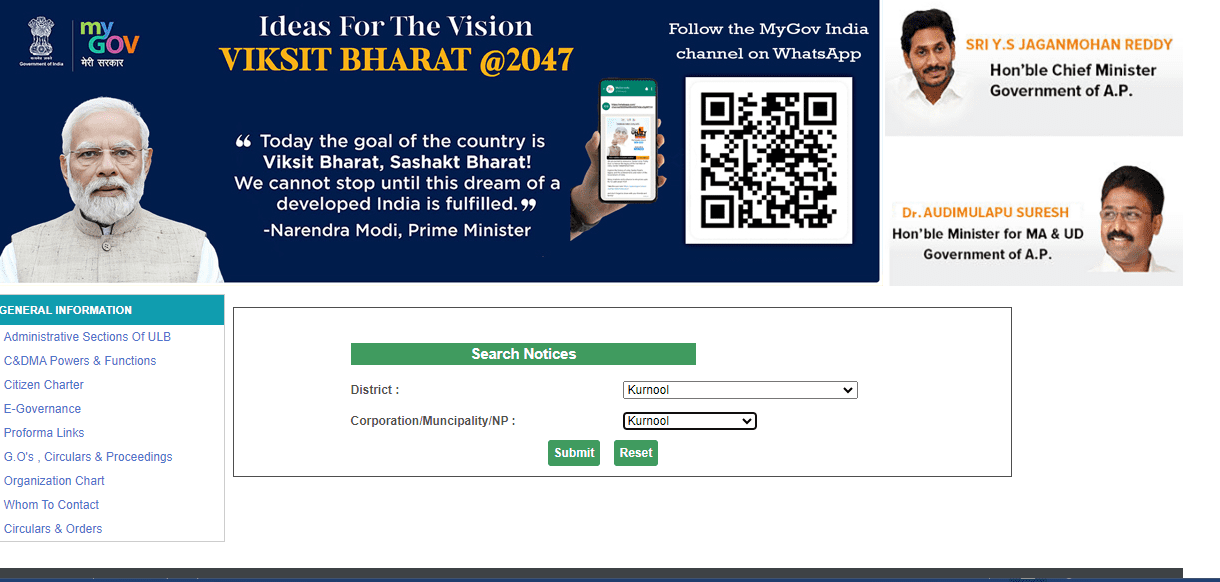

- Select district as ‘Kurnool’ and corporation municipality/NP as ‘Kurnool’ and click on ‘Sign Up’.

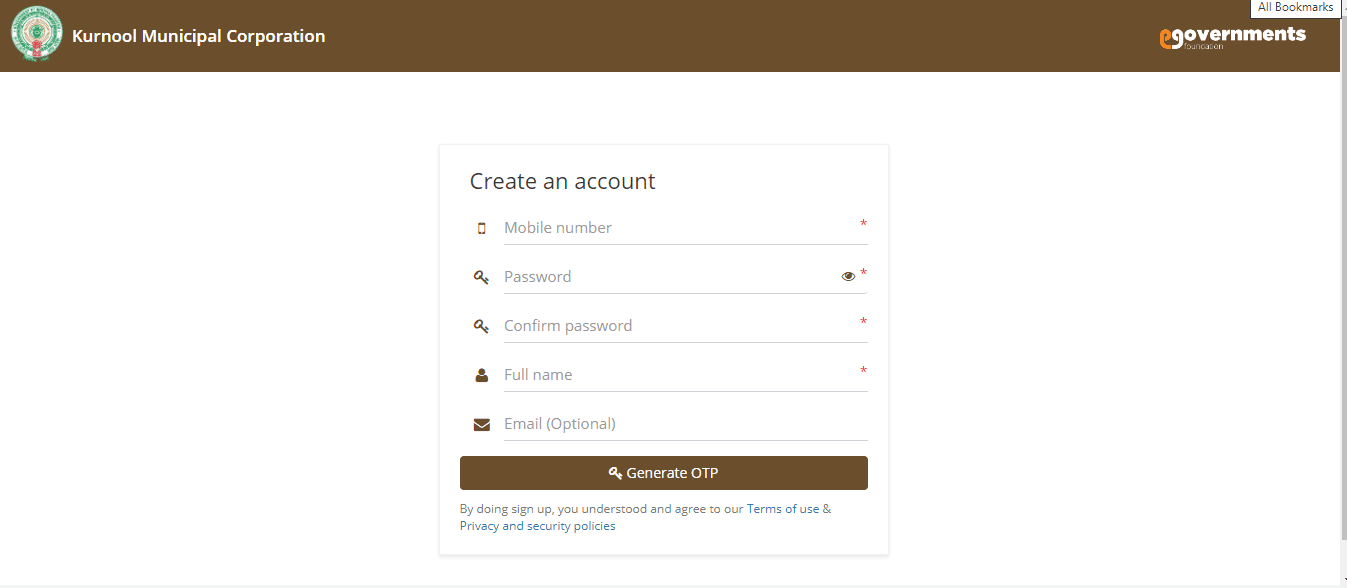

- You will reach the following page, where you should fill in all details and click on ‘Generate OTP’.

- Enter OTP and click on register as user. Once, you are registered, you will see a green window that confirms your registration.

How to calculate property tax Kurnool?

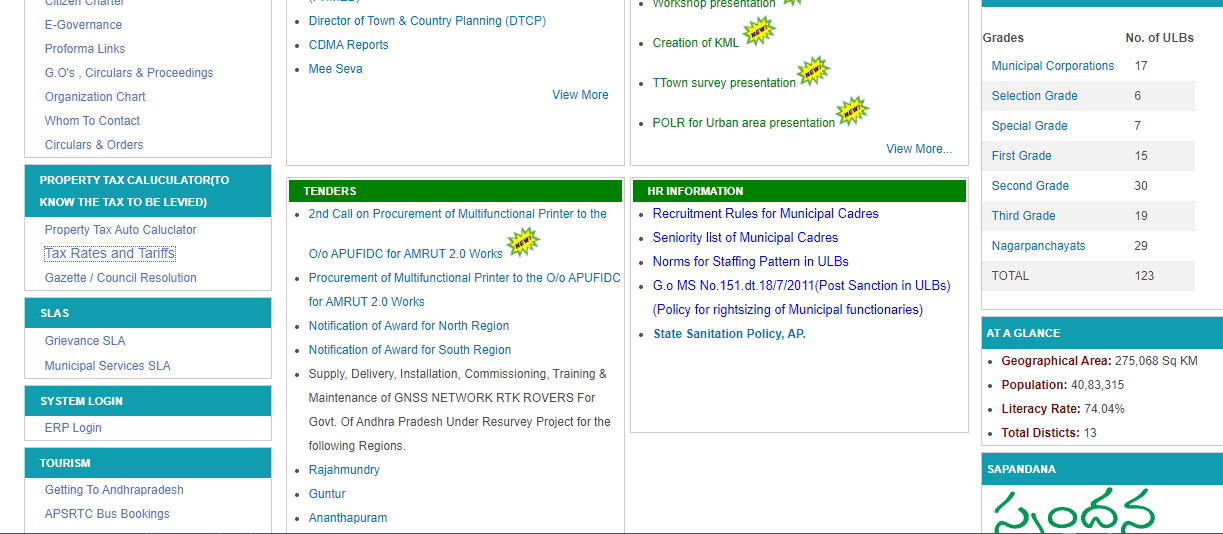

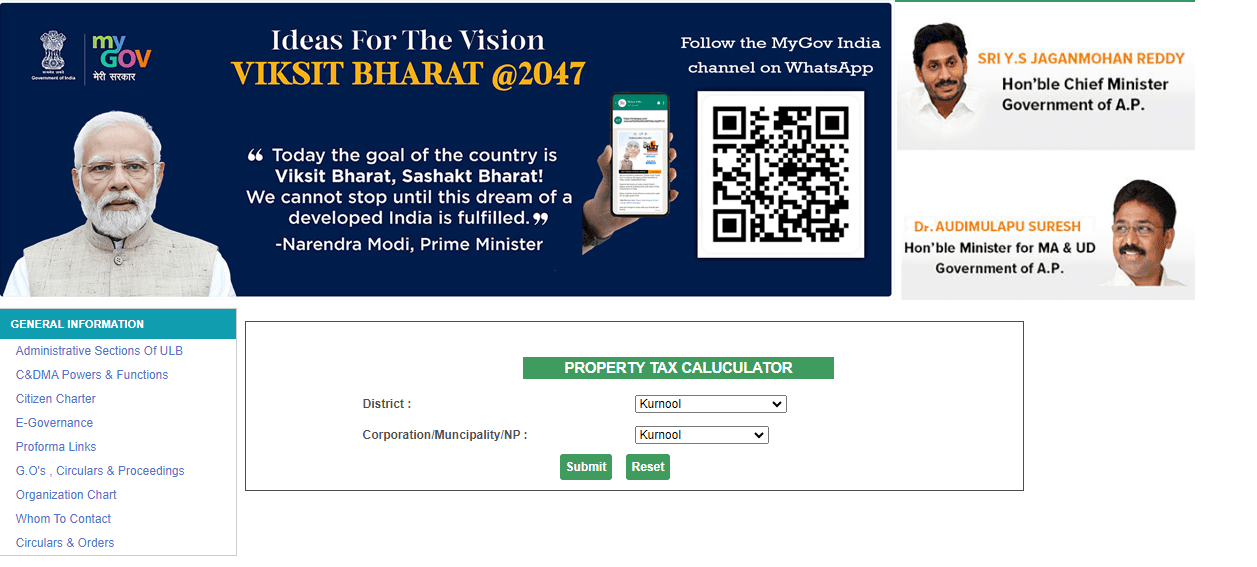

- On the CDMA portal at https://cdma.ap.gov.in/ click on ‘Property Tax Auto Calculator’.

- You will reach the following page. Select district and corporation municipality/ NP as ‘Kurnool’ and click on ‘Submit’.

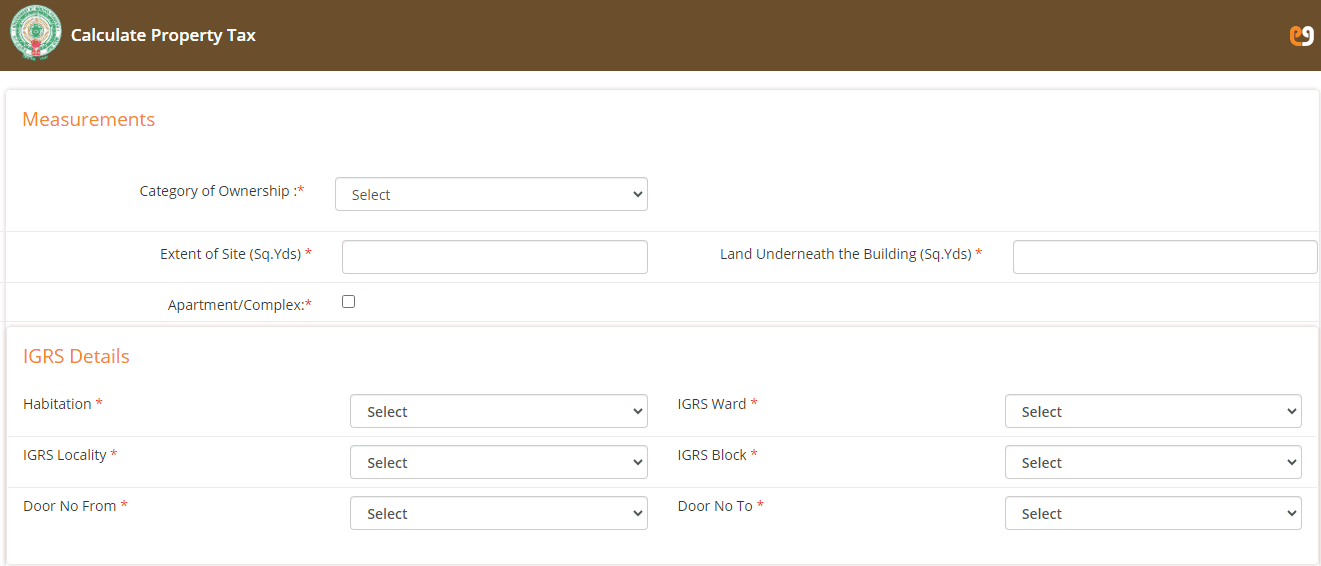

You will reach the following page. Enter all property- related details and click on calculate to know the approximate property tax amount to be paid.

How to pay property tax Kurnool online?

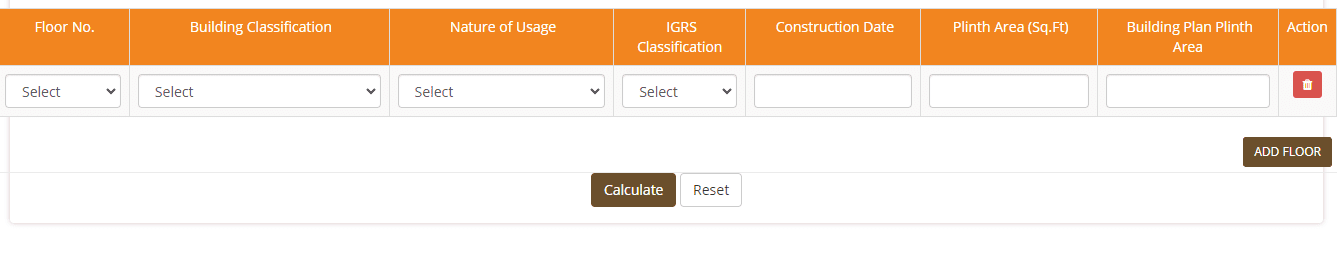

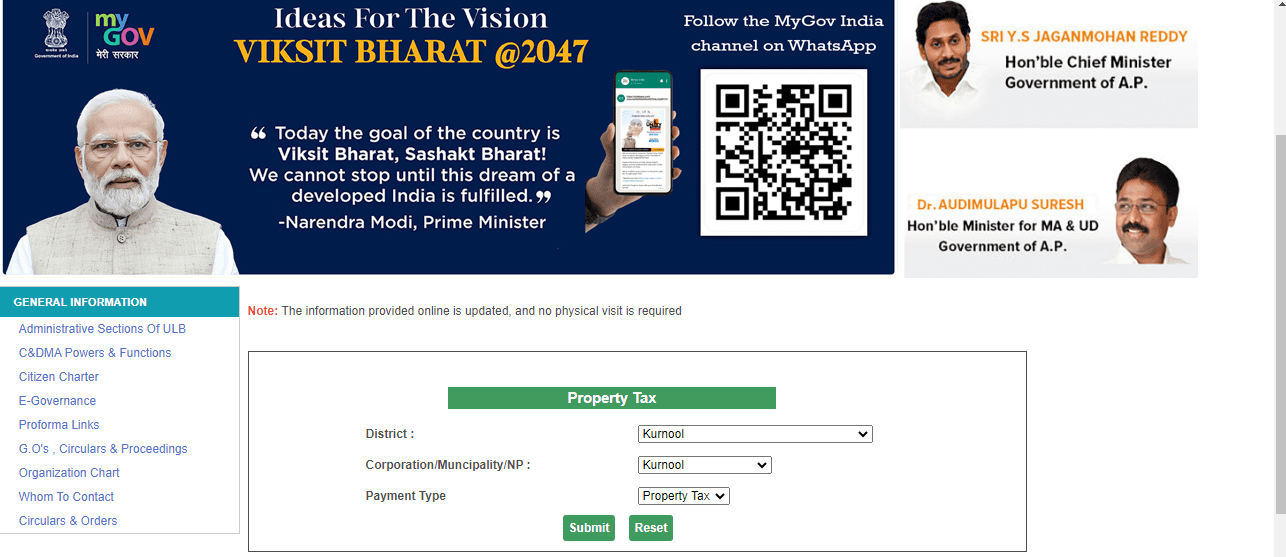

- Log on to the CDMA portal at https://cdma.ap.gov.in/

- Click on ‘Online Payments’ on the homepage and select property tax.

- You will reach the following page. Select district as ‘Kurnool’ and municipality/NP as ‘Kurnool’. Select ‘Property Tax’ for payment type.

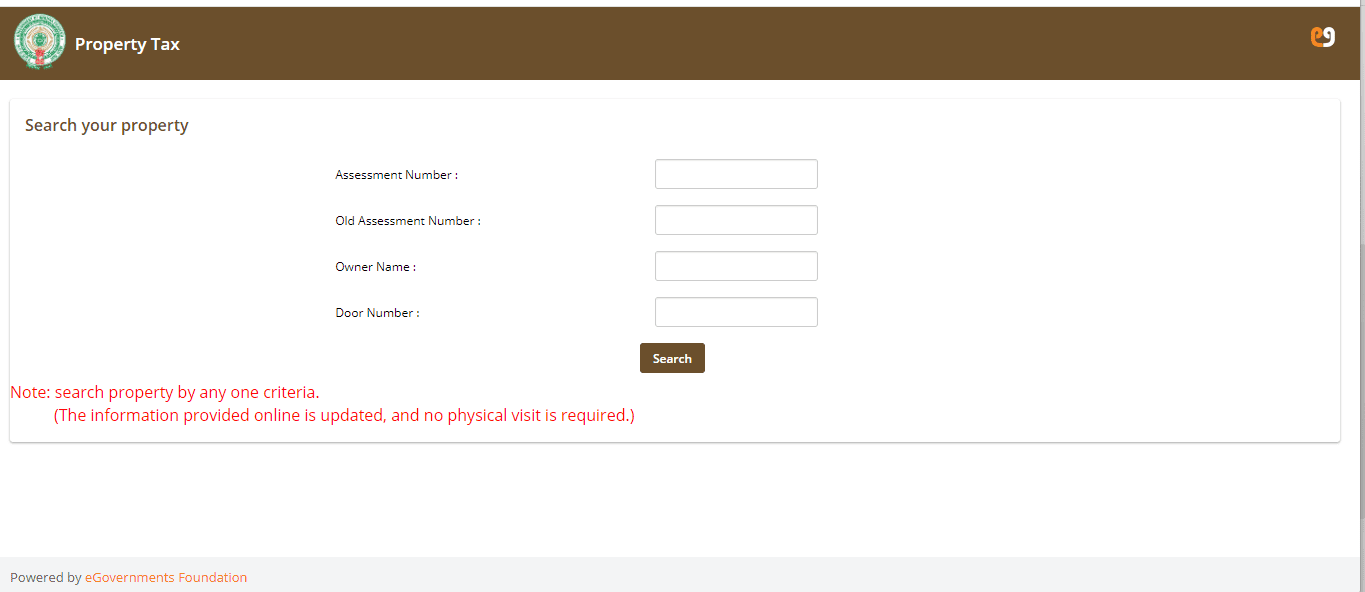

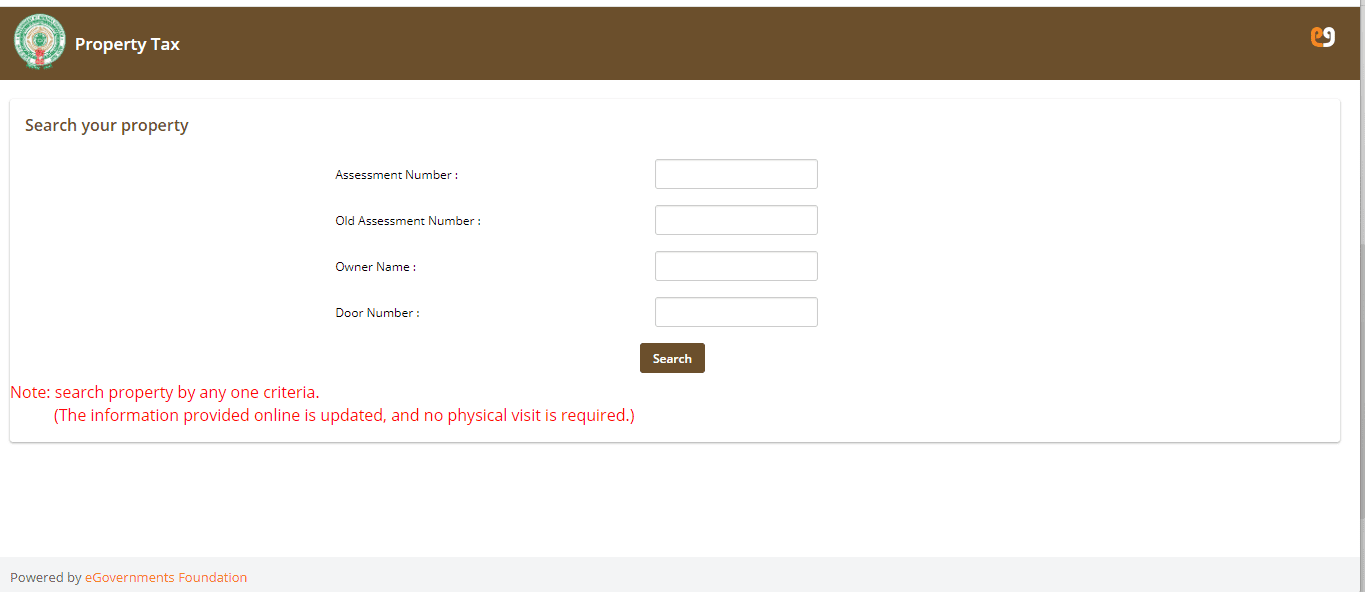

- You will reach here:

Enter assessment number, old assessment number, owner’s name, door number, and click on ‘search’.

- You will see all the details about the property tax payment and the net payable amount.

- Click on ‘Pay Tax’ and enter the amount to be paid and click on ‘Pay Online’.

- You can make the Kurnool Municipal Corporation house tax online payment through net banking, debit card, or credit card.

- Once the payment is done, you will get the Kurnool Municipal Corporation property tax payment receipt as an acknowledgement.

How to pay property tax Kurnool offline?

- You can pay Kurnool Property Tax offline by visiting the nearest citizen service centre also known as the PuraSeva centre in the municipal office.

- You can also pay the property tax at the urban local body (ULB) counter in your area.

Ensure that while paying the Kurnool Municipal Corporation house tax offline, you have all the supporting documents. You can proceed with the payment through cash or cheque.

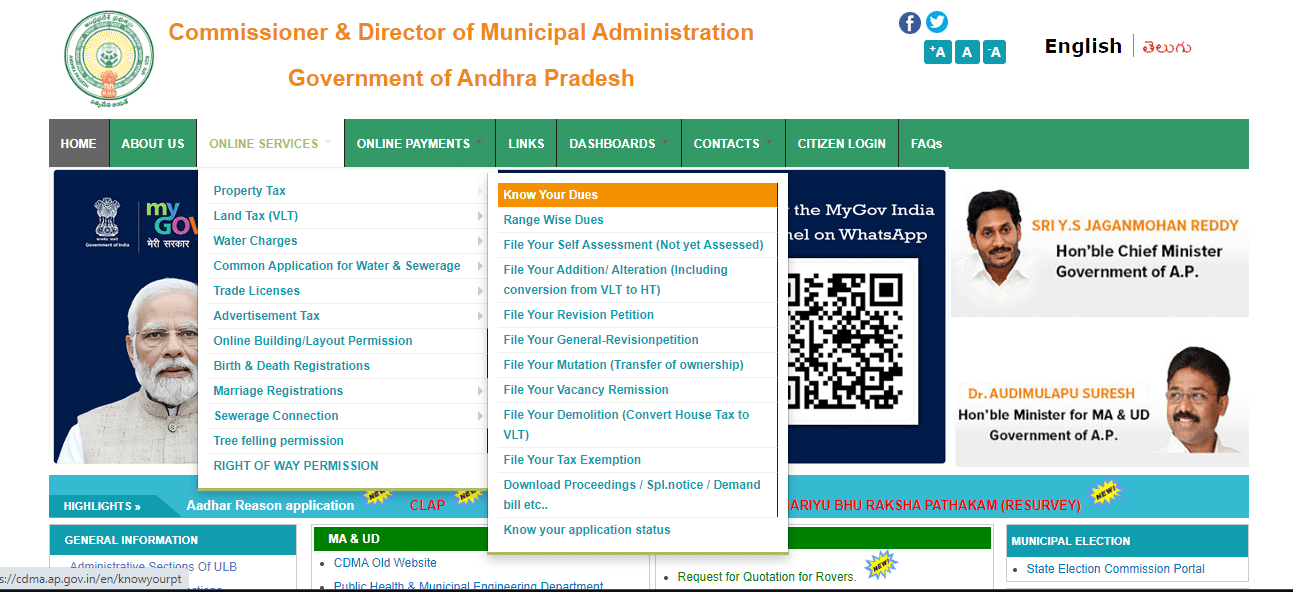

Kurnool Property Tax: Other online services

In addition to paying Kurnool Property Tax online, you can also avail of other services.

- Click on ‘Online Services’ on the homepage.

- Select ‘Property Tax’ and you will see an array of online services with respect to property tax.

These are:

- Addition/Alternation (including conversion from Vacant Land Tax (VLT) to House Tax (HT))

- Revision petition

- General revision petition

- Mutation (transfer of ownership)

- Vacancy remission

- File your demolition (convert HT to VLT)

- File your tax exemption

- Click on the required service, select the district and corporation municipality/NP as ‘Kurnool’ and click on ‘submit’.

- Enter assessment number and proceed with accessing the service.

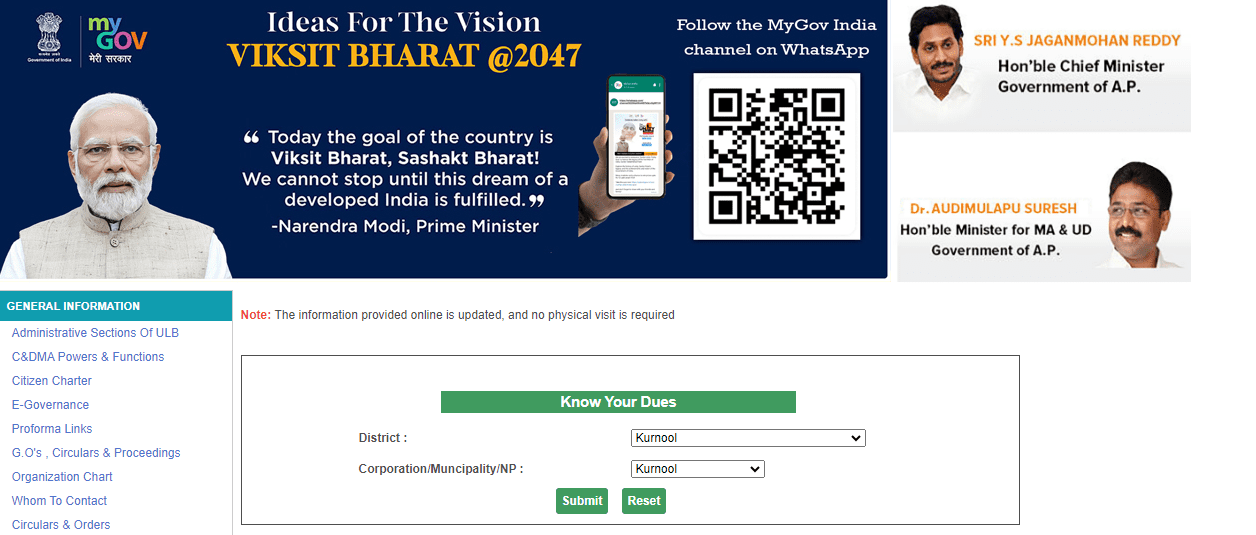

How to know your dues related to Kurnool Property Tax?

- Click on ‘Know Your Dues’ to inquire about the property tax amount pending.

- Select district and corporation municipality/NP as ‘Kurnool’ and click on ‘Submit’.

- Enter property details, such as assessment number, old assessment number, owner’s name, door number, and click on ‘Search’ to know the outstanding payment to be done.

Kurnool Property Tax: Self-assessment

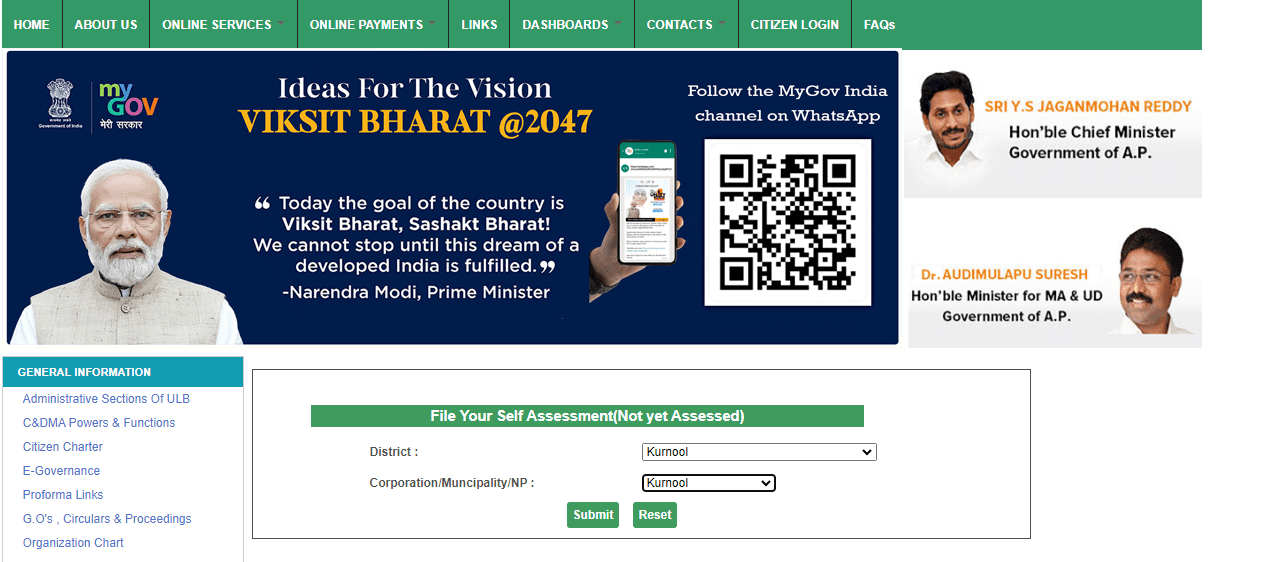

If your property is yet not registered with the Kurnool Municipal Corporation, then you can file for your self-assessment and make payment.

- Click on ‘File Your Self Assessment’.

- Select district and corporation municipality/NP as ‘Kurnool’ and click on ‘submit’.

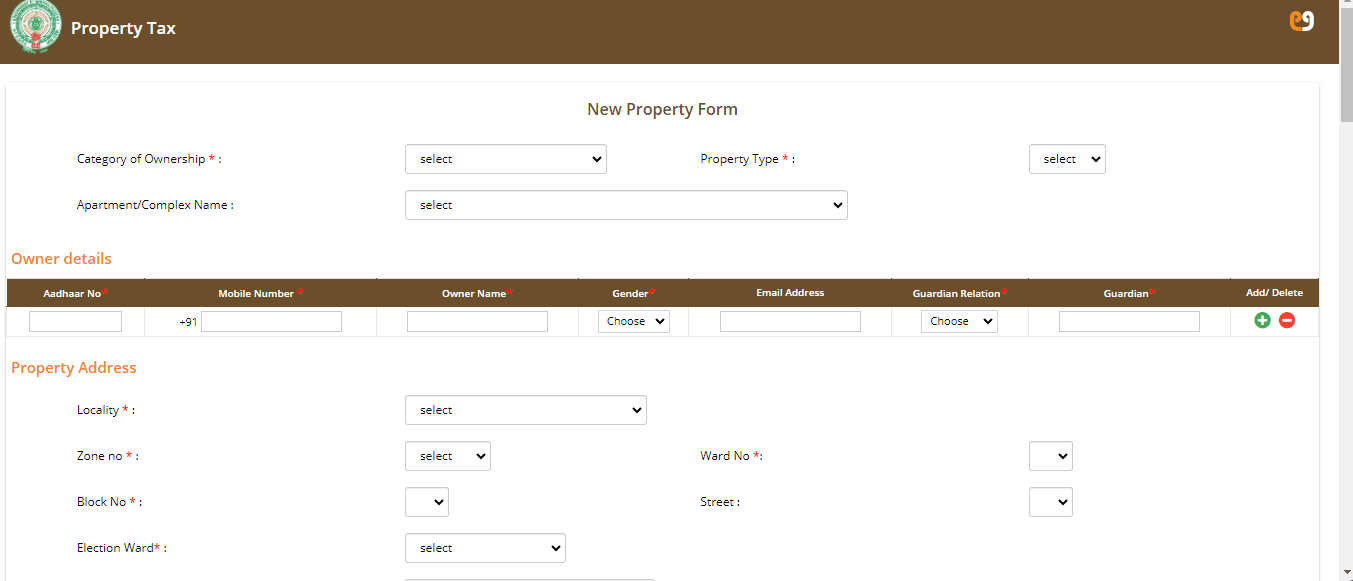

- Fill in the new property form with all details and attach all property documents. Once done, click on ‘forward’.

(Part of the new property form)

You can find the form on: KurnoolEmunicipalityPropertyNewForm

- Once the self-assessed property tax is paid, a 10-digit assessment number is generated.

- Also, a Self-Assessment Certificate and an SMS will be sent.

- The assessment number can be used to make further tax payments.

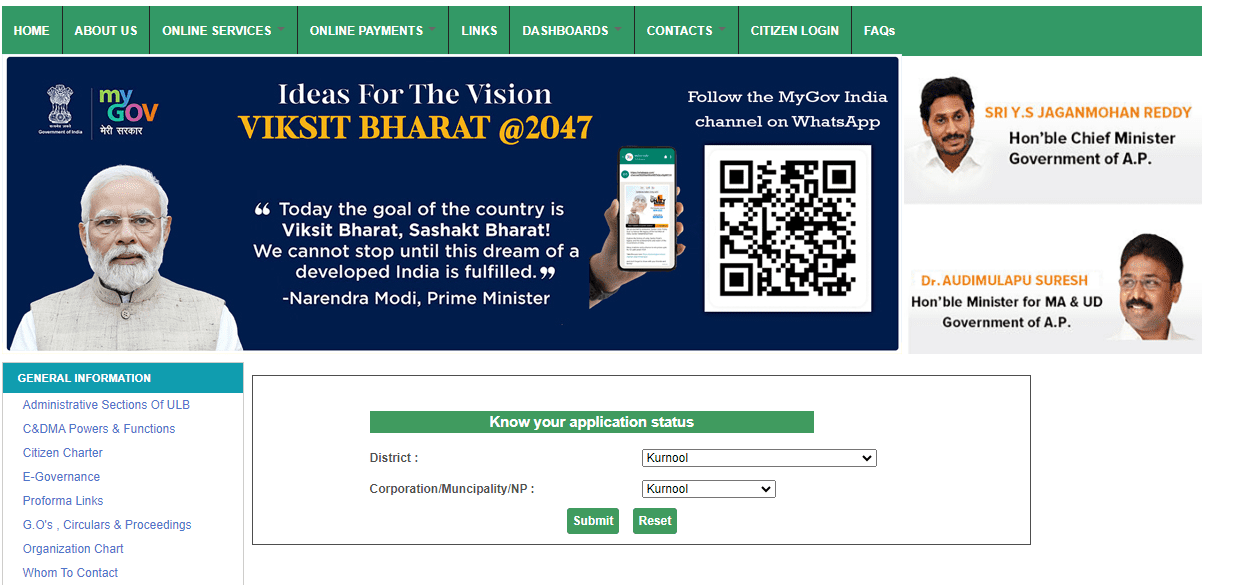

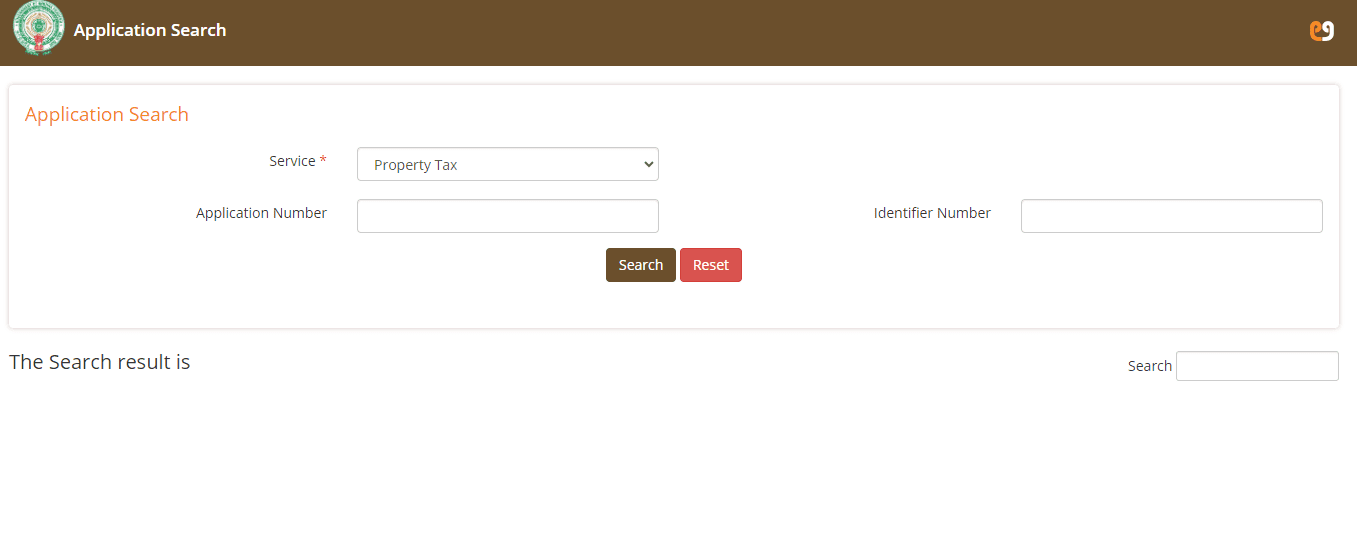

Kurnool Property Tax: Know your application status

- Click on ‘Know Your Application Status’.

- Select district and corporation municipality/NP as ‘Kurnool’ and click on ‘submit’.

- Select ‘property tax’ as service.

- Enter application number.

- Enter identifier number and click on ‘search’.

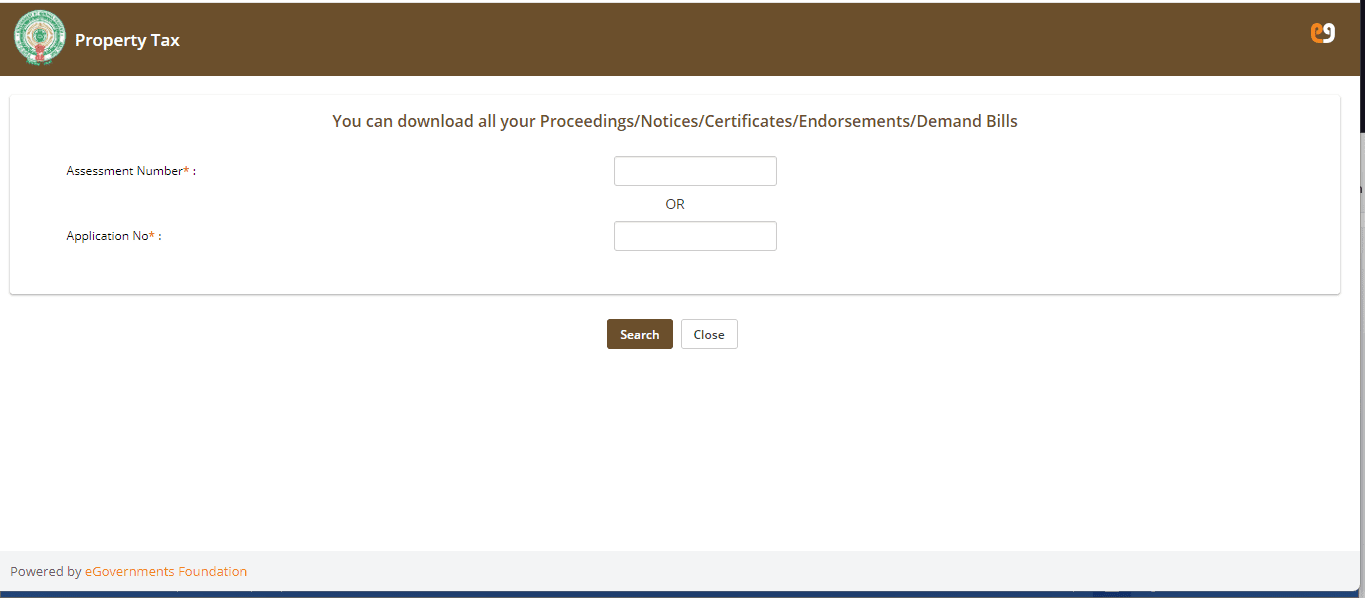

How to download proceedings, special notice and demand bill on CDMA website?

- Under the online services tab, click on property tax and click on the download proceedings, special notice, demand bill.

- Select district and corporation municipality/NP as ‘Kurnool’ and click on ‘submit’.

- Enter assessment number or application number and click on ‘search’.

Kurnool Property Tax: Penalty and rebates

Failure to pay Kurnool Property Tax on time will attract penalties. If you don’t pay the property tax for the first-half by June and for the second-half by December, you will be levied a penalty of 2% for every month.

If you don’t pay these penalties on time, you may run into the risk of your property getting attached and auctioned. We would recommend avoiding such situations by taking advantage of the rebates offered by the Andhra Pradesh government on the property tax payment. On paying the property tax in advance for FY2024-25 by April 30, you can avail of a 5% rebate on the property tax.

FAQs

How do I check my Andhra Pradesh house tax online?

Log on to the CDMA website and select ‘property tax service’ and check your Andhra Pradesh house tax details.

Which app is used to pay property tax online in Andhra Pradesh?

You can use the Puraseva mobile app to pay property tax in Andhra Pradesh.

How is house tax calculated in Andhra Pradesh?

The residential property tax in Andhra Pradesh is calculated based on the Annual Rental Value (ARV), and the fixed tax rate set by the municipal corporation for each property within the ULB limits.

What is property tax assessment number?

It is a 10-digit number by which you can find all details related to your property online and pay your property tax.

What is the penalty for late payment of property tax?

A 2% penalty on the property tax per month is charged and will be levied for all months for which late payment is done.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: anuradha.ramamirtham@housing.com