Kadapa is a city in southern part of Andhra Pradesh. The city has several localities that have emerged as preferred destinations for property seekers. If you own a property in Kadapa or planning to buy a property in the city, it is important to know the process for property tax payment. All property owners are required to pay their property taxes every year and the commissioner and director of the municipal administration of Andhra Pradesh (CDMA) is responsible for collecting property tax in Kadapa. Moreover, citizens can access the official portal of the authority to pay their property tax online.

In this guide, we will explain the process of property tax payments in Kadapa.

Check how to pay property tax in Kakinada

Property tax in Kadapa

Property tax in Kadapa is an annual tax that all property owners in the city, whether residential or non-residential, should pay to the local authority. The local government or municipal authority determines the property tax rates based on various factors, including the type of property.

Property tax rate in Kadapa in 2024

| District | YSR Kadapa | |

| ULB | Kadapa | |

| ULB Code | 1,013 | |

| ULB Grade | Corporation | |

| Criteria | Residential tax | Residential tax |

| General tax | 0.0375 | 0.0375 |

| Water tax | 0.012 | 0.024 |

| Drainage tax | 0.012 | 0.024 |

| Lighting tax | 0.00675 | 0.0135 |

| Conservancy tax | 0.00675 | 0.0135 |

| Total tax | 0.075 | 0.15 |

Source: CDMA, Andhra Pradesh

The property tax rates in Kadapa are determined by the local government and will vary based on the type of property.

How to pay property tax in Kadapa online?

Property tax in Kadapa can be paid through the official portal of CDMA using a valid assessment number, owner name, and door number.

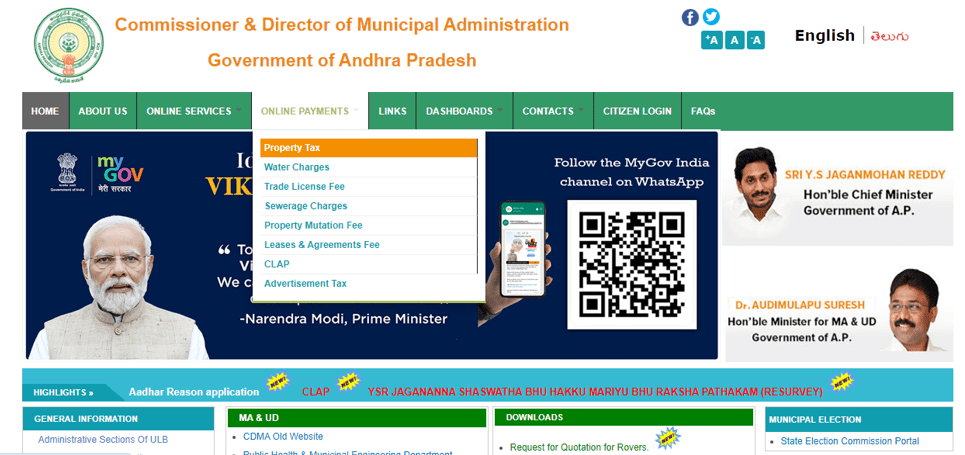

- Visit the official CDMA, Andhra Pradesh website at https://cdma.ap.gov.in/.

- Go to ‘Online Payments’ and click on ‘Property Tax’ from the dropdown menu.

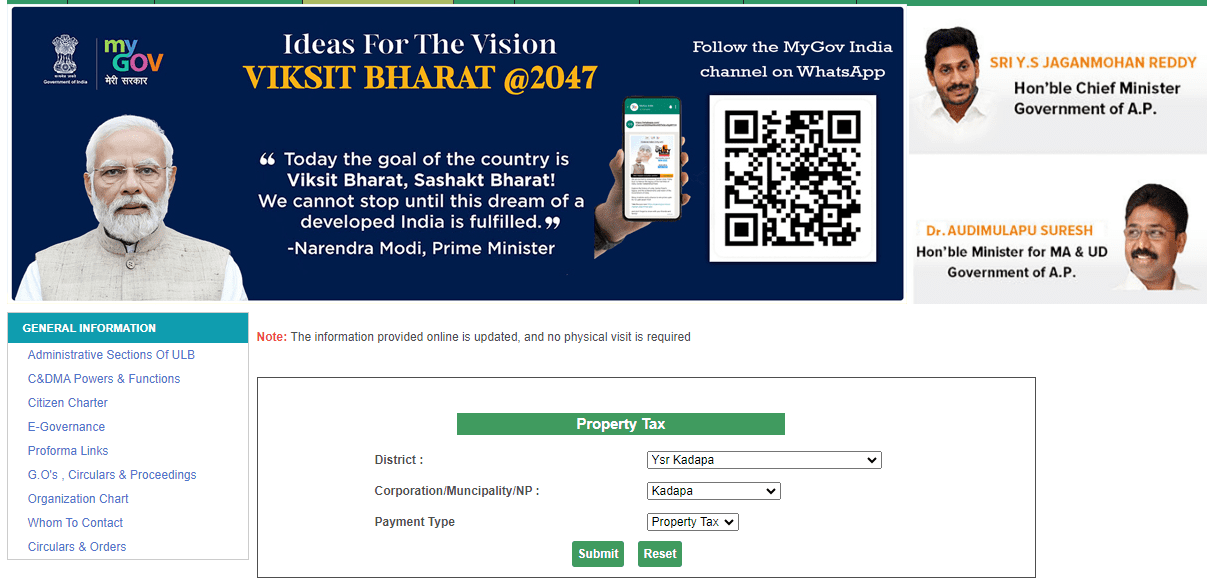

- On the next page, choose district, corporation, municipality, or NP, and payment type. Click on ‘Submit’.

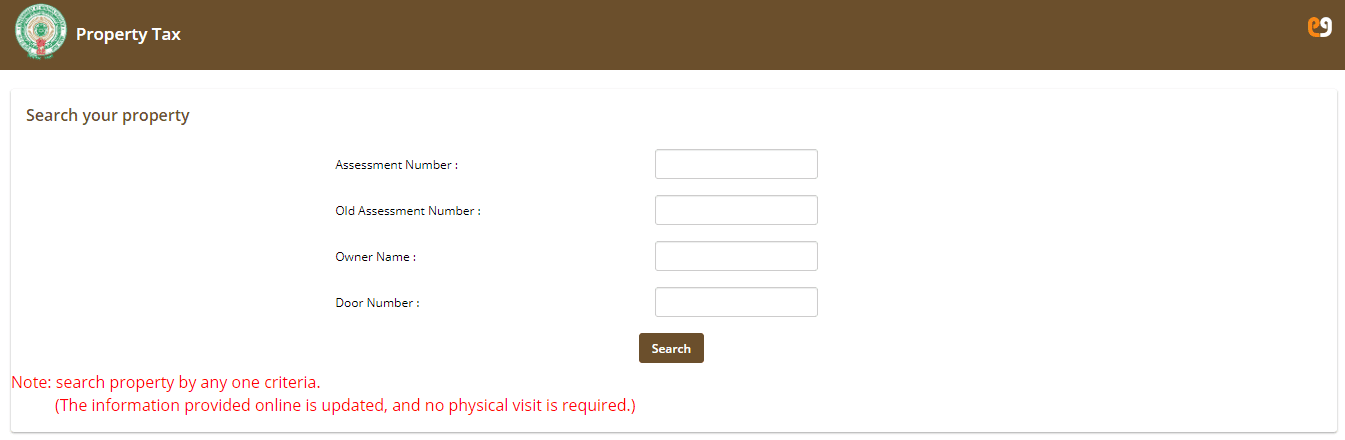

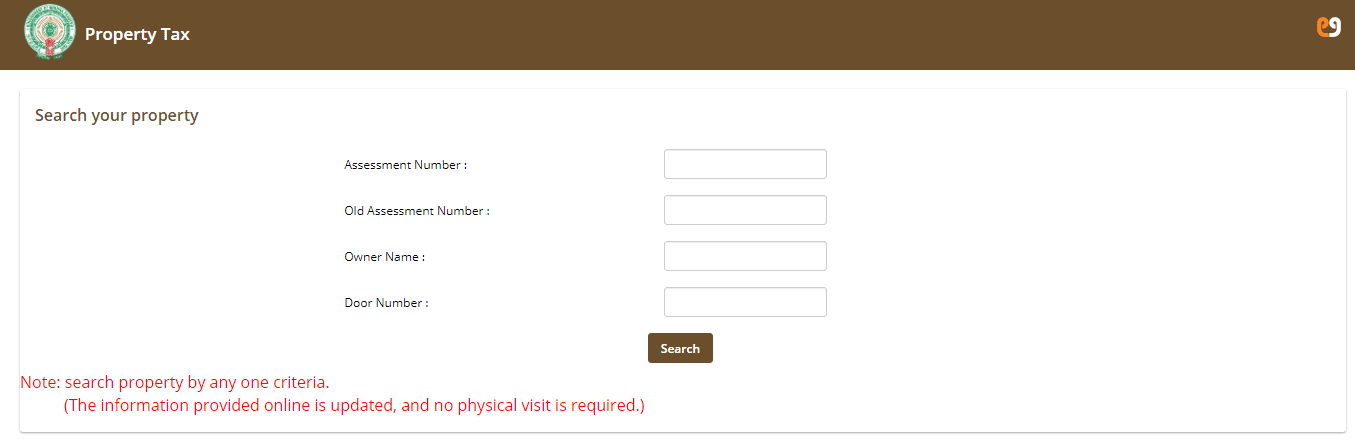

- Submit the assessment number, old assessment number, owner name, and door type in the given fields.

- Click on ‘Search’ after entering details and proceed to pay property tax in Kadapa.

What is the last date to pay property tax in Kadapa?

The last date to pay property tax in Kadapa is on or before April 30th for the first and second half of the current year. The last date is determined by the local government. Property owners are required to pay property taxes within the specified date.

What is the property tax rebate in Kadapa?

The property tax rebate is available for property owners in Kadapa. They can avail of a discount given by paying their property tax in advance. The municipal authorities recently announced that property taxpayers who pay their property tax in Kadapa by April 30 of the financial year can avail of a rebate equivalent to 5% on the amount payable.

Property tax calculator in Kadapa

Property owners can calculate their estimated taxes by accessing the property tax calculator provided on the CDMA official portal. Here’s a step-by-step guide.

- Visit the official CDMA website at https://cdma.ap.gov.in/.

- Under ‘Online Services’ on the homepage, click on ‘Property tax’ from the dropdown menu.

- Then, click on ‘Property Tax Auto Calculator’ link.

- Choose the district, corporation, municipality, or NP. Click on ‘Submit’.

- Provide the category of ownership, the land underneath the building (Sq Yd), the extent of the site (Sq Yd), apartment/complex and IGRS details.

- Click on ‘Calculate’ to calculate property tax in Kadapa.

Advance property tax payment in Kadapa

Property taxpayers in Kadapa are allowed to pay advance property taxes, which means paying their taxes within a specified deadline. This makes them eligible for a 5% rebate on the property tax if paid on or before April 30th for the first and second half of the current year.

How to change name in property tax documents in Kadapa?

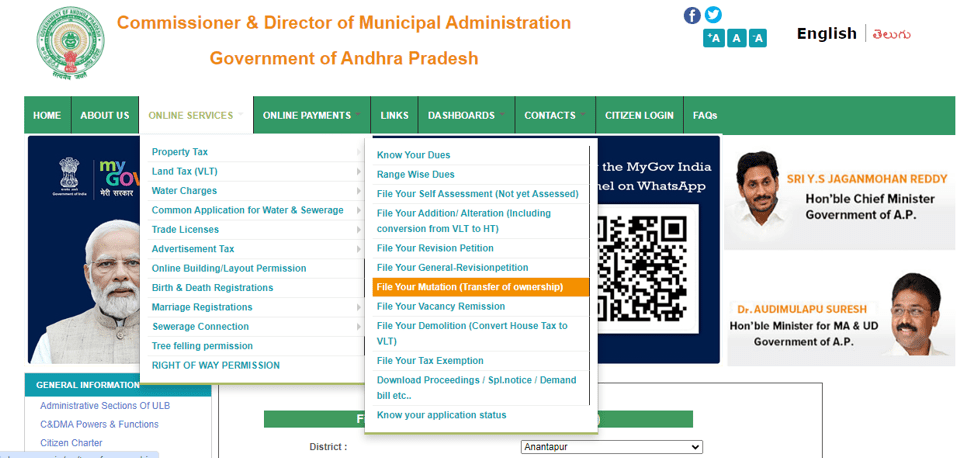

- Visit the official website of CDMA at https://cdma.ap.gov.in/.

- Click on ‘Property Tax’ under ‘Online Services’.

- Click on ‘File Your Mutation (transfer of ownership)’ link.

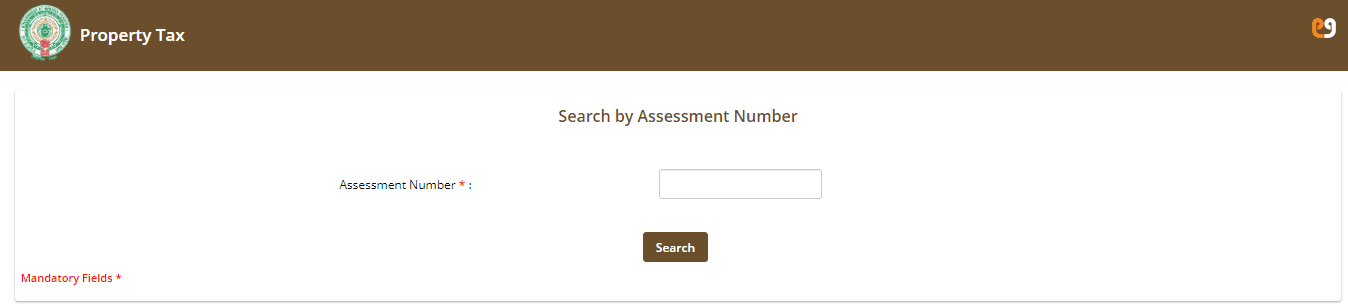

- Choose the district, corporation, municipality, or NP. Click on ‘Submit’.

- Provide the assessment number. Click on ‘Search’.

- Provide the required details to complete the submission of the ownership form.

How to check property tax dues in Kadapa?

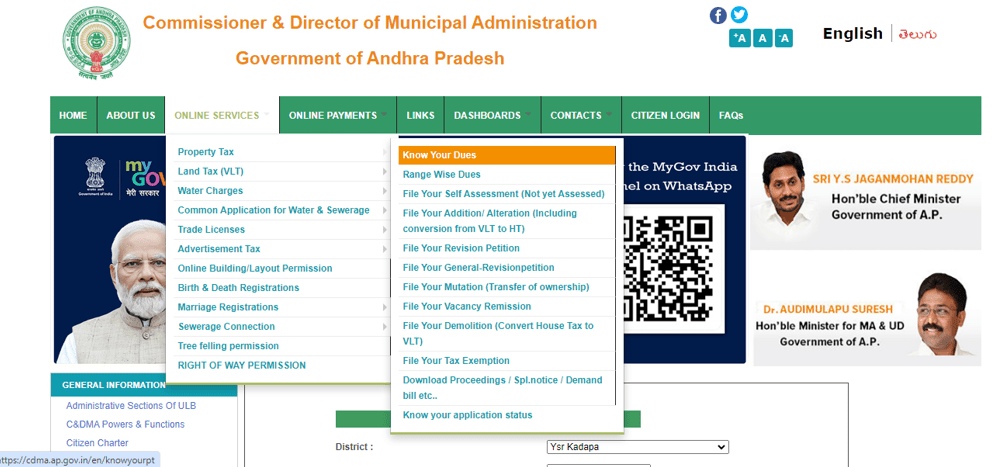

- Visit the official website of CDMA at https://cdma.ap.gov.in/.

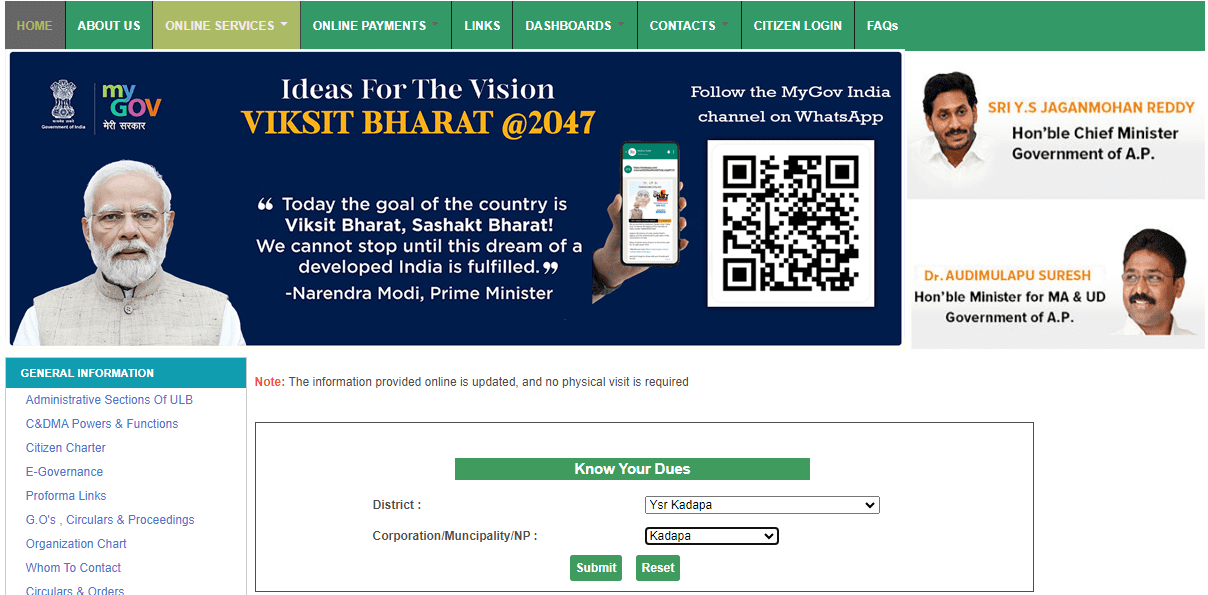

- Go to ‘Online Services’. Click on ‘Know Your Dues’ under ‘Property Tax’.

- Choose the district, corporation, municipality, or NP. Click on ‘Submit’.

- Submit the assessment number, old assessment number, owner name, and door type in the given fields.

- Click on ‘Search’ to view the tax dues.

How to pay property tax in Kadapa offline?

Property tax owners in Kadapa can visit the nearest Citizen Service Centres (Puraseva Centers) along with the property tax bill and required documents. Taxpayers can pay the amount through cash, cheque, debit card, or credit card.

Property tax payment in Kadapa: Documents and details required

- Assessment Number

- Old Assessment Number

- Owner’s name (proof)

- Address of the property

- Aadhaar card

Housing.com News Viewpoint

Property owners in Kadapa can pay their property taxes online through the CDMA official website, which ensures convenience and eliminates the need for visiting any local authority’s office. Moreover, property owners must ensure they pay their property tax to avoid any penalties and get the maximum benefits of available rebates.

FAQs

How to check property tax online in Kadapa?

Property owners in Kadapa can check their property tax on the official portal of CDMA at cdma.ap.gov.in.

What is the last date to pay property tax in Kadapa?

Property owners in Kadapa must pay their property tax on or before April 30th for the first and second half of the current year.

What is the property tax rebate in Kadapa?

Property tax in Kadapa must be paid before, or on deadline, which allows property owners to avail of a 5% rebate on the overall tax amount.

How is property tax calculated in Andhra Pradesh?

Property tax in Andhra Pradesh is calculated based on Annual Rental Value (ARV) and the tax rate, which is determined by the corporation for all properties located within limits of the Urban Local Bodies (ULBs).

Who should pay property tax in Kadapa?

Owners of all residential and non-residential properties in Kadapa must pay property tax to the local authority.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |