Kozhikode, also known as Calicut, is a well-developed city in Kerala. The Kozhikode Municipal Corporation is the municipal authority responsible for providing civic amenities and developing infrastructure in the city. The civic body also collects taxes, such as property tax in Kozhikode. It provides an online facility, the Sanchaya portal, for property tax payments and other related services.

Property tax in Kozhikode

Property tax in Kozhikode is the annual tax that owners of residential and non-residential properties must pay to the municipal corporation of the city. The tax collected forms a major part of its revenue, which is utilised for the development of civic amenities and various projects in the city.

There is a user-friendly portal available for Kozhikode Corporation building tax online payments. The portal’s ‘Quick Pay’ enables users to pay property tax without logging in.

How to pay property tax in Kozhikode online?

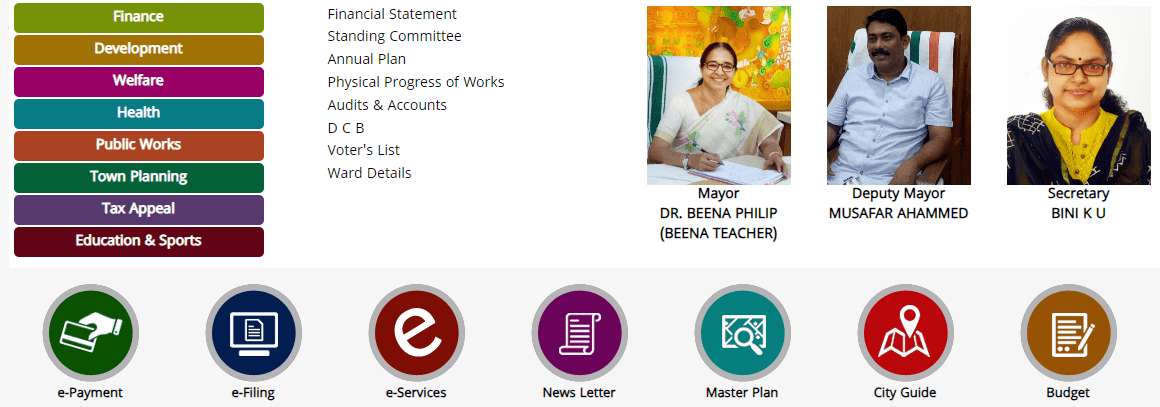

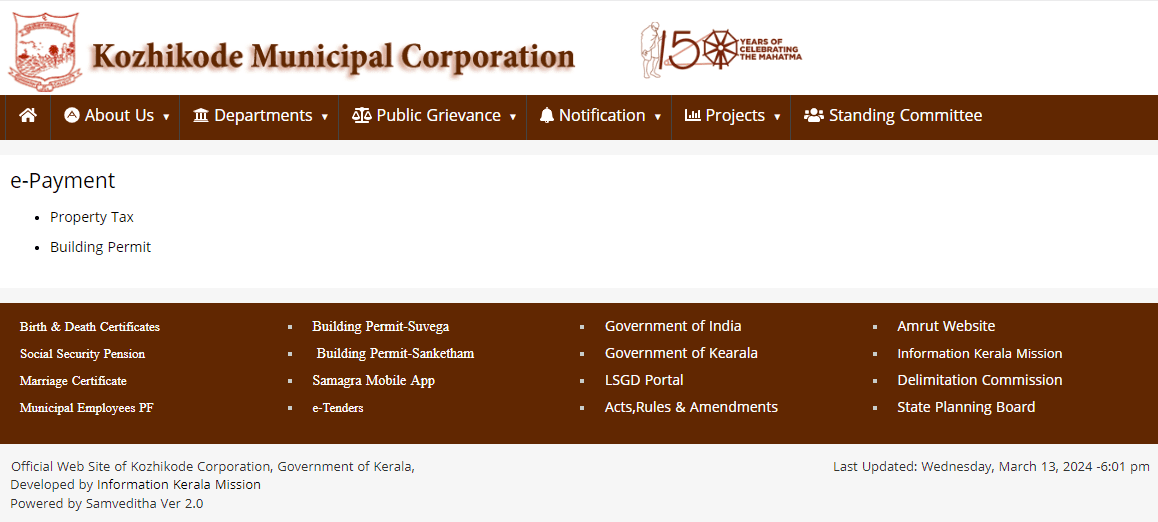

- Visit the official Kozhikode Municipal Corporation website at https://kozhikodecorporation.lsgkerala.gov.in/en.

- Scroll down and click on ‘e-Payment’ service.

- In the next page, click on ‘property tax’.

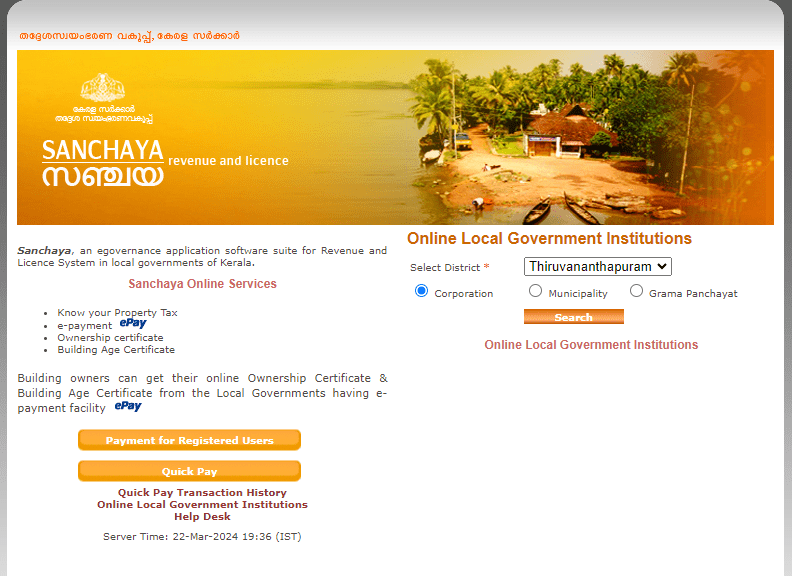

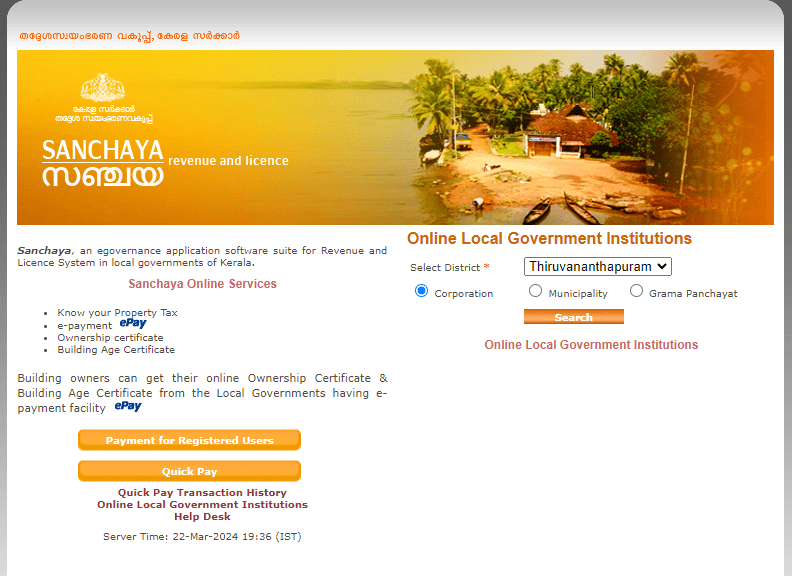

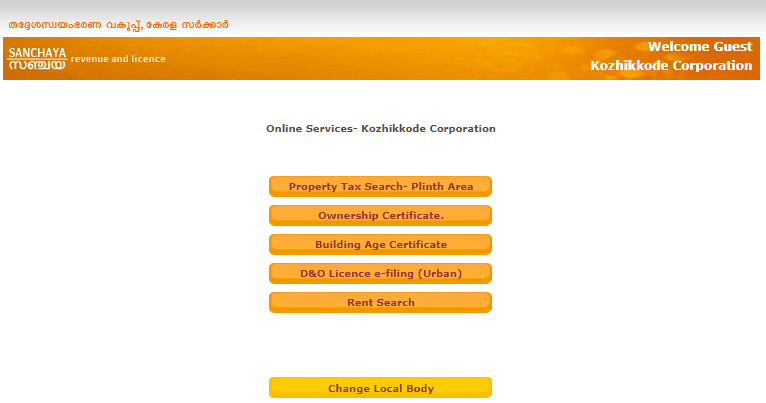

- Users will be directed to the Sanchaya portal https://tax.lsgkerala.gov.in/epayment/index.php.

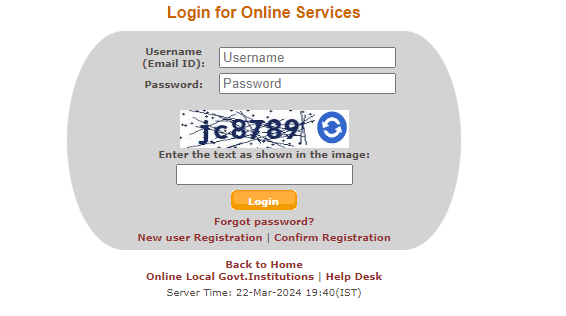

- Click on ‘Payment for Registered Users’ link.

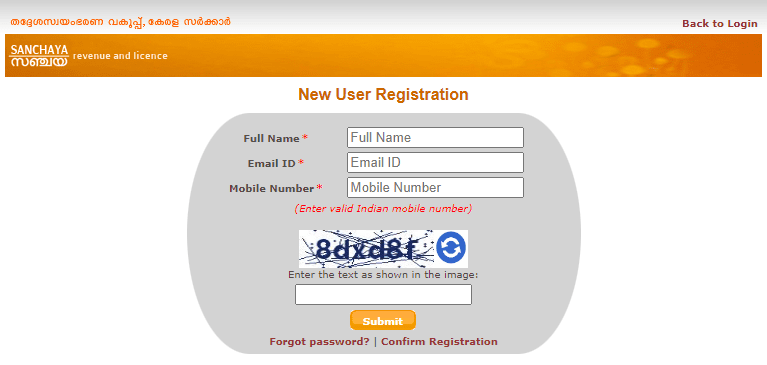

- New users must register by clicking on ‘New User Registration’ link.

- Provide the required details, such as full name, e-mail address, and mobile number.

- Submit the captcha code and click on ‘Submit’.

- Go back to the login page and enter the username and password to log into the portal.

- On the property tax payment page, enter the property details and proceed to pay tax.

How to pay property tax in Kozhikode online via Quick Pay?

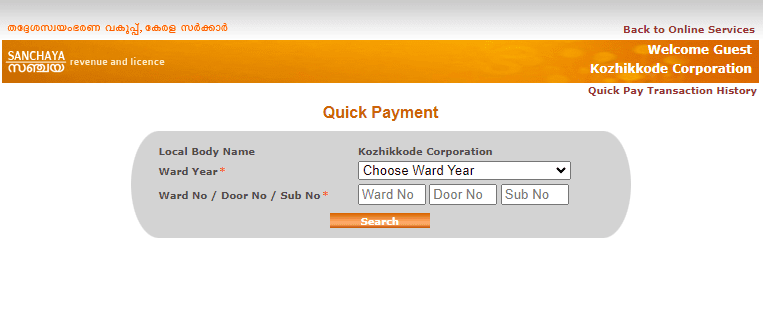

- The Sanchaya portal provides a Quick Pay option to pay property tax without logging in.

- Visit the official Kozhikode Municipal Corporation website, kozhikodecorporation.lsgkerala.gov.in

- Click on ‘E-Payment’ on the homepage.

- Choose the ‘property tax’ link.

- Users will be directed to the Sanchaya portal.

- Click on ‘Quick Pay’.

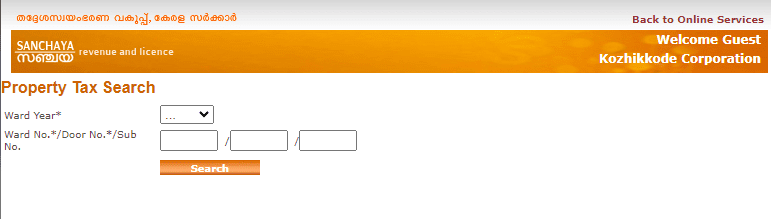

- Provide ward year, ward number, door number, or sub number.

- Click on ‘Search’ and proceed to pay the property tax.

How to search for property tax in Kozhikode?

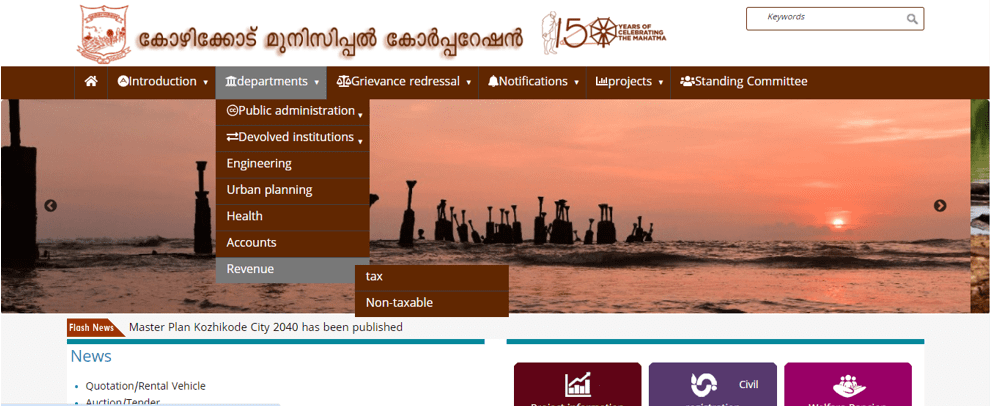

- Visit the Kozhikode Municipal Corporation website, lsgkerala.gov.in.

- Click on ‘Revenue’ under ‘Department’.

- Select ‘Property Tax’ from the given options.

- Click on ‘Property Tax Search-Plinth Area’ link.

- Select ward year, ward number, door number or sub-number.

- Click on ‘Search’.

How to download quick payment receipt in Kozhikode?

- Visit the Kozhikode Municipal Corporation website.

- Click on ‘E-Payment’.

- Select ‘Property Tax’.

- Users will be directed to the Sanchaya portal.

- Click the ‘Quick Pay’ link.

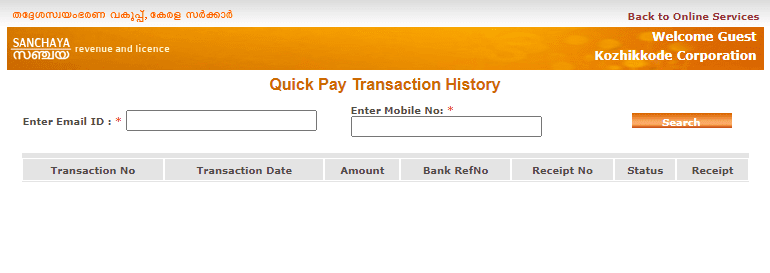

- Click the ‘Quick Pay Transaction History’ link.

- Submit the required details, such as registered e-mail ID, and mobile number.

- Click on ‘search’.

- The property tax payment status will be displayed. Users can download the quick payment receipt for Kozhikode property tax.

How to check reports on Sanchaya Portal?

- Log to the Sanchaya Portal account using your credentials. Click on the reports section.

- Select the type of report from the dropdown. Reports may include payment history, pending bills, and other property-tax details.

- Users can customise their report by choosing a date range or other parameters.

- Click on ‘Generate’ or ‘View Report’.

- The report will be generated.

Sanchaya Portal: Overview

Sanchaya is an e-governance portal provided by the Kerala government, which facilitates property tax management in an efficient manner. It is a comprehensive portal for Revenue and Licence System in local governments of Kerala, enabling efficient revenue collection, tracking of licenses and maintenance of records.

The online portal simplifies the process of property tax payment and provides a host of services for citizens. Users must first register themselves on the portal by creating an account. The registration requires basic details for authentication. After registration, users can access their personalised dashboard and procced to avail various services, including property tax payment.

Sanchaya Portal: Features

- Simplified registration: The registration process on Sanchaya Portal is easy. The portal provides confirmation after registration, ensuring enhanced security.

- Access to payment data: Citizens can access the Sanchaya portal to get details of their past property tax payments and maintain their financial records.

- Quick Pay link: The portal has a Quick Pay option to enable faster property tax payments without extensive navigation.

- Report creation: Users can retrieve reports related to property tax, payments, and other transactions through the official portal, thus ensuring better compliance with regulations.

- Property tax search using plinth area: The Sanchaya portal has the option for searching property tax information based on the plinth area, which minimises hassles for users.

- Rent payment integration: The Sanchaya portal provides an option for rent payments, which is beneficial for citizens when it comes to managing their rent payments along with Kozhikode Corporation building tax online payments.

- Regular updates: The Sanchaya portal shares regular updates with users regarding any changes or developments in the government’s policies and regulations.

How to pay property tax in Kozhikode offline?

Property owners in Kozhikode can visit the municipal authority’s office in their area and provide the property ID and supporting documents. After verification, they can pay their property tax by using the challan. A receipt will be provided, which is proof of the property tax payment.

Property tax in Kozhikode: Documents and details required

- Building ID

- Owner’s name

- Property address

- Aadhaar card

Housing.com News Viewpoint

The Sanchaya portal provides an online facility for property owners to view their property tax dues and make online property tax payments. This ensures convenience for property owners and encourages timely and hassle-free payment.

FAQs

How to check property tax online in Kozhikode?

Property taxpayers must visit the official Kozhikode Municipal Corporation website to pay their property tax online.

What is the property tax rate in Kozhikode?

As per the revised guidelines, the property tax rate for residential buildings is Rs 16 per square metre.

Who can pay property tax in Kozhikode?

All owners of any residential or non-residential property in Kozhikode must pay the property tax to the municipal corporation.

What details are required to pay the property tax in Kozhikode?

Details such as building ID, and property address are required to pay the property tax.

What is the last date for property tax payment in Kozhikode?

Property tax must be paid to the Kozhikode Municipal Corporation by March 31, 2024.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.