Under income tax laws in India, taxpayers have been made liable to deduct tax at source of payments made to Non-Resident Indians (NRIs). Form 27Q acts as the statement of this tax deduction of payments made to NRIs. In this guide, we will talk about this form in detail.

See also: Tax implication on NRIs property sale in India

What is Form 27Q?

Form 27Q is the TDS return statement for the non-salary payments made to an NRI and foreigners. Once the TDS return is filed, the TDS deductor must issue NRI Form 16A or a TDS certificate. The TDS certificate must be sent to the NRI within 15 days of the deadline for filing TDS returns for the relevant quarter.

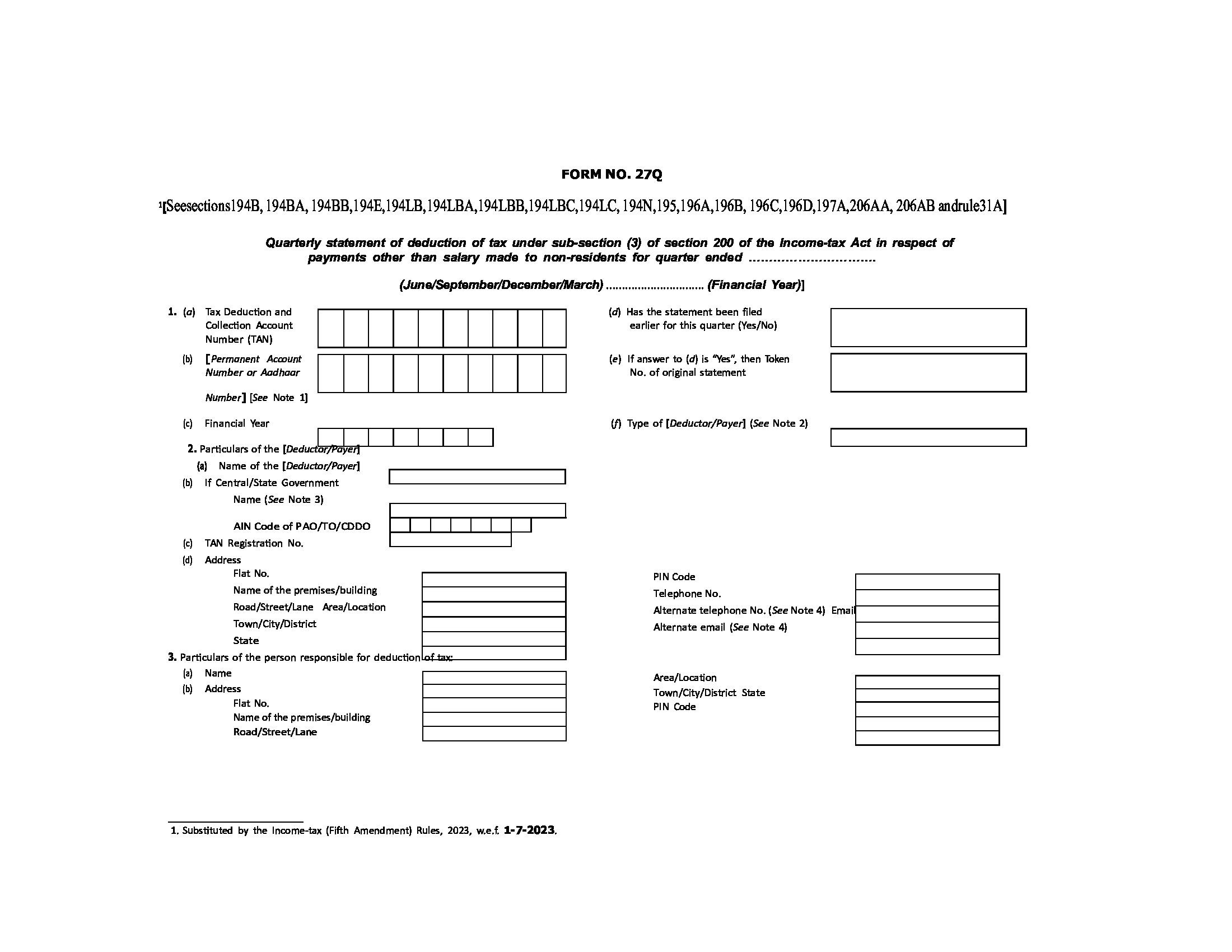

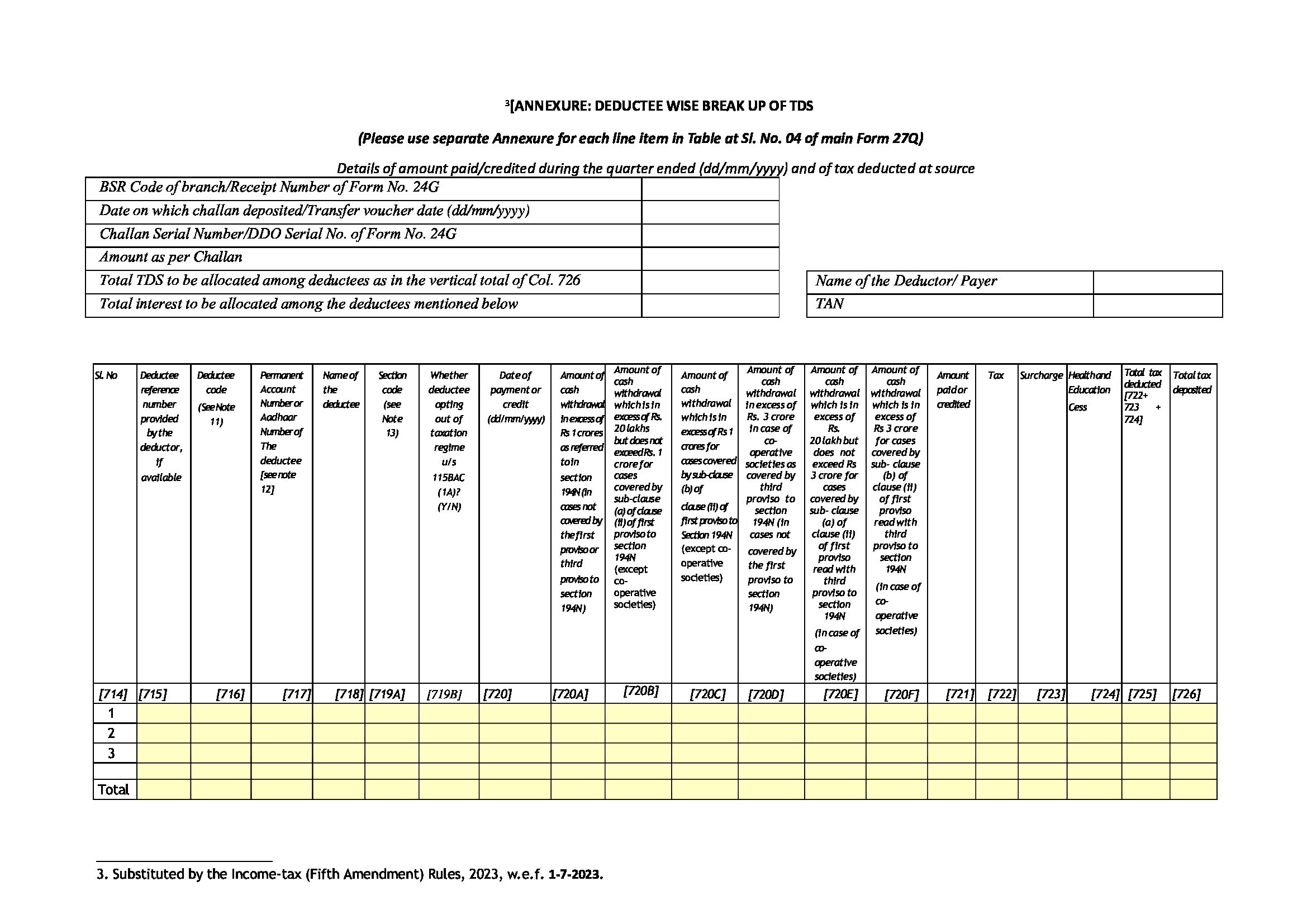

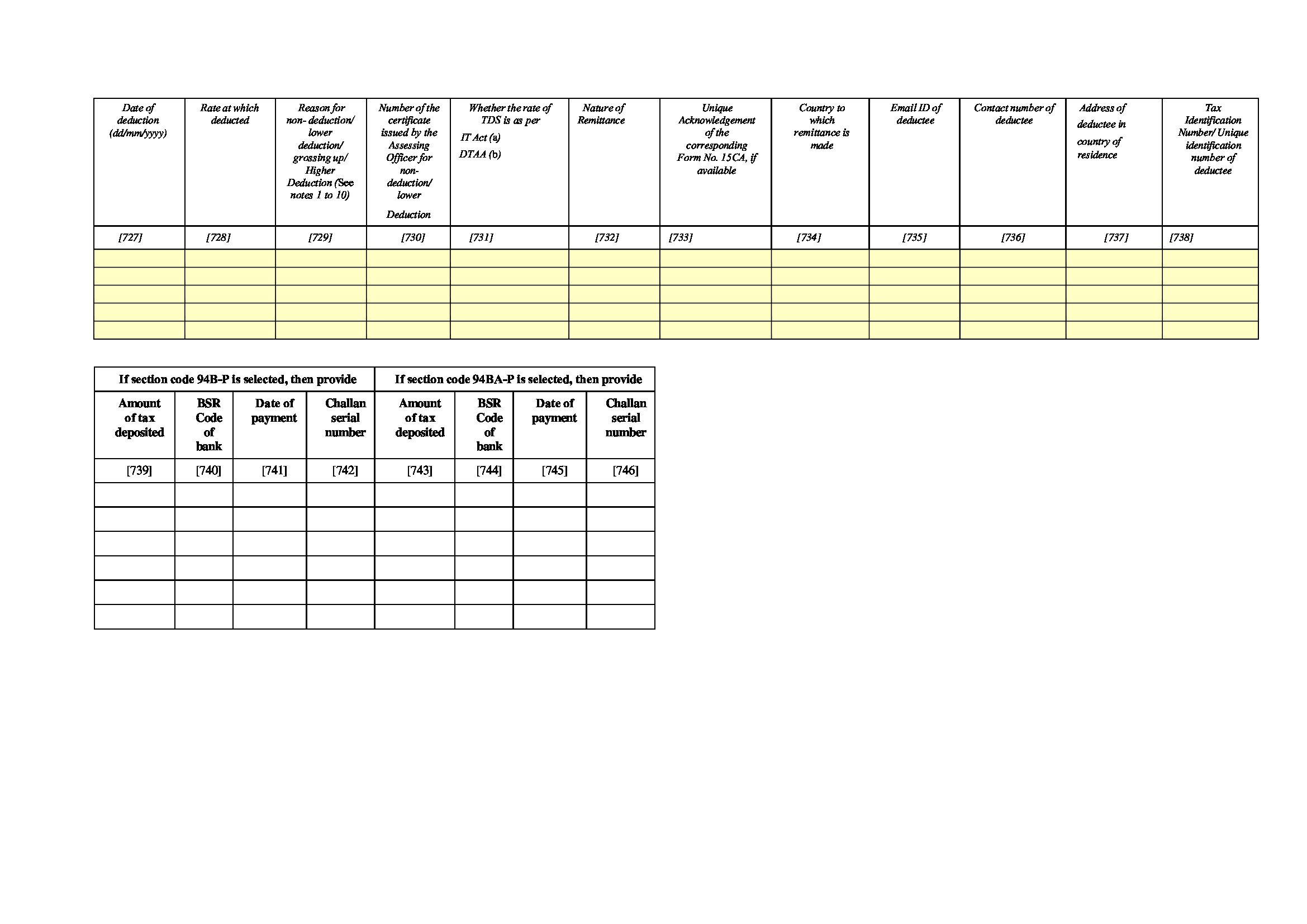

Form 27Q sample

Details in Form 27Q

The following details are included in Form 27Q:

Payer details

- PAN

- TAN

- Contact details

- Name

- Address

- Financial year

- Assessment year

- Original statement or the receipt number of the return already filed

Payee

- PAN

- Telephone number

- Email ID

- Address

- Contact number

- Name

- Branch of the division

Challan

- TDS amount

- BSR code

- Collection code

- Tax deposit date

- Method of TDS deposition

- Education Cess amount

- Amount of interest

- Total tax deposit

- Number of demand draft or cheque

Deduction

- PAN

- Amount of TDS

- Name of the tax collector

- Amount paid to payee

Due dates for filing TDS of a fiscal

- April-June or Quarter 1 July 31

- July-September or Quarter 2 October 31

- October-December or Quarter 3 January 31

- January to March or Quarter 4 May 31

FAQs

What is TDS?

TDS is tax deducted at source.

What is the meaning of TDS?

Income tax laws in India has provisions for tax deduction at source to check evasions. This type of tax deduction is known as tax deduction at source (TDS).

Who is liable to deduct TDS?

TDS is deducted by the company making the payment.

On what kind of payments TDS is deducted?

TDS is imposed on several kinds of payments, including salary, rent, commission, brokerage, commission, professional fees, interest, etc.

What is TDS return?

A TDS return is a statement of taxes paid during a quarter. The statement is submitted by the deductor to the Income Tax Department.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

sunita.mishra@proptiger.com