One of the most sought after real estate destinations today is Navi Mumbai. What was once built as the satellite city to Mumbai has become an important city in itself.

The city ranks third cleanest city in the country as per the Swachh Survekshan 2024. A planned city with the right mix of residential and commercial property, Navi Mumbai is also known for its vast open spaces and state-of-art infrastructure including the transit oriented development in Seawoods Darawe, the Navi Mumbai Metro or the Mumbai Trans Harbour Link (Atal Setu). The city offers a mix of configurations across its various nodes ranging from 1 BHK to 3 BHK. 4 BHK, 5 BHK, duplexes, penthouse and villas are also available but more prevalent in periphery areas. The city has the presence of developers such as Adani, L&T Realty, Raheja Group, Wadhwa, Kalpataru, IndiaBulls, Arihant, Godrej, Hiranandani etc. who have projects here. Also, Cidco in the form of Cidco lottery’s Mass Housing Scheme, sells affordable housing to citizens here.

What is stamp duty?

While investing in a residential property, in addition to paying for the property, one also to be aware of the stamp duty and registration charges that are an add-on. Stamp duty is the tax that a property owner is supposed to pay to the state government for registering his property in the legal records.

While detailing about stamp duty, it is important to know about the ready reckoner rate is the minimum value in which a property in a location can be sold. The stamp duty and registration charges are calculated on the basis of the ready reckoner rate (RRR) that an area commands. Alternatively, it can be calculated based on the market value of the property (whichever is higher).Note that a property cannot be sold below the ready reckoner rate. Even if it sold, the stamp duty and registration charge will be necessarily done as per the existing ready reckoner rate. In this story, we focus on how to pay stamp duty and registration charges in Navi Mumbai.

What is stamp duty in Navi Mumbai?

Stamp duty in Navi Mumbai is the tax that one has to pay to legally get his property registered in Maharashtra’s legal book of records. It is mandatory to pay the stamp duty and registration charges in Navi Mumbai under Section 3 of the Indian Stamp Act, 1899. The Navi Mumbai stamp duty is governed under the Maharashtra Stamp Act and is imposed at the time of the registration of legal instruments such as sale deed, gift deed, exchange deed, partition deed, lease deed, relinquishment deed, etc.

Stamp duty and registration charges in Navi Mumbai 2024-25: Quick facts

| Stamp duty Navi Mumbai | Governed by Maharashtra Stamp Act |

| Registration charges in Navi Mumbai | 1% of property value if property value is greater than Rs 30 lakh. If not, Rs 30,000 |

| Online portal | https://igrmaharashtra.gov.in/ |

| Rebate for women | 1% |

What are registration charges in Navi Mumbai?

Along with the stamp duty, buyers have to pay a registration fee for the documentation work. This is less than the stamp duty. In Navi Mumbai, registration charge is around 1% of the property value if the property cost is less than Rs 30 lakh. If the value is more than Rs 30 lakh, then the registration charges in Navi Mumbai is Rs 30,000.

Metros cess on property purchase in Navi Mumbai

Started in April 1, 2022, the Maharashtra government levies a 1% metro cess along with stamp duty on property purchase in Navi Mumbai, Pune, Thane and Nagpur. Through this cess, the state government gathers funds for the development of transportation infrastructure projects.

Stamp duty and registration fee in Navi Mumbai in 2024

| Area | Stamp duty for men | Stamp duty for women | Registration fee |

| Navi Mumbai | 7%

(6% stamp duty + 1% metro cess) |

6%

(5% stamp duty + 1% metro cess) |

1% |

| Thane | 7%

(6% stamp duty + 1% metro cess) |

6%

(5% stamp duty + 1% metro cess) |

1% |

Stamp duty on different conveyance deeds in Mumbai in 2024

| Conveyance deed | Stamp duty rate |

| Gift deed stamp duty Mumbai and other parts of Maharashtra | 3% |

| Gift deed stamp duty for residential/agricultural property passed on to family members | Rs 200 |

| Lease deed | 0.25% of total rent |

| Power of attorney | 0.25% of the market value of the property |

Stamp duty on different types of property in Mumbai in 2024

| Redeveloped project | Allottee will pay Rs 100 as stamp duty

The stamp duty between developer and housing society will be charged as per conveyance deed. |

| Resale project | 7% of value of project for men

6% of value of project for women |

| Investors | Stamp duty waiver period extended upto 3 years |

| Stamp duty for consulates/ embassies | Rs 100 |

Registration charges in Navi Mumbai in 2024

| Buyer | Registration fee |

| Male | Property value below Rs 30 lakh: 1%

Property above Rs 30 lakh=Rs 30,000 |

| Female | |

| Joint |

Stamp duty and registration charges in Navi Mumbai for women

Similar to Mumbai, women homebuyers in Navi Mumbai also enjoy a rebate of 1% in stamp duty charges. This is allowed only for residential real estate. Note that this rebate is only for sole women ownership and not valid for joint registration.

Stamp duty of resale flat in Navi Mumbai 2024

| Gender | Stamp duty | Registration charges |

| Male | 7% of property’s market value | 1 % of the property value |

| Female | 6% of property’s market value | 1 % of the property value |

Stamp duty on key deed in Navi Mumbai in 2024

| Name of deed | Stamp duty rate |

| Gift deed stamp duty Mumbai and other parts of Maharashtra | 3% |

| Gift deed stamp duty for residential/agricultural property passed on to family members | Rs 200 |

| Lease deed | 5% |

| Power of attorney | 5% for property located in municipal areas, 3% for property located in gram panchayat areas. |

How is stamp duty calculated in Navi Mumbai?

- Buyers have to pay the stamp duty based on the transaction value as specified in the sale agreement.

- A property cannot be bought or sold below the government-prescribed ready reckoner (RR) rates in Navi Mumbai.

- In case the residential property is being registered at a value higher than the RR rate, the buyer will have to pay the stamp duty on the higher amount. If the property is being registered at a value less than the RR rates, the stamp duty will be calculated as per the ready reckoner rates.

Examples of stamp duty calculated in Navi Mumbai

Illustrated is an example of stamp duty calculated in Navi Mumbai.

Example 1: Male owner

Amit bought a property in Taloja, Navi Mumbai for Rs 85 lakh.

Since the property value is above Rs 30 lakh, the registration charges is Rs 30,000.

Stamp duty is 7% of 85 lakh that is equal to Rs 5,95,000.

Total stamp duty and registration charges is Rs 6,25,000.

Example 2: Male owner

Amit bought a property in Taloja, Navi Mumbai for Rs 25 lakh.

Since the property value is below Rs 30 lakh, the registration charges is 1% of the property value and is equal to Rs 25,000.

Stamp duty is 7% of 25 lakh that is equal to Rs 1,75,000

Total stamp duty and registration charges is Rs2,00,000

Example 3: Female owner

Ashwini bought a property in Taloja, Navi Mumbai for Rs 85 lakh.

Since the property value is above Rs 30 lakh, the registration charges is Rs 30,000.

Stamp duty is 6% (1% rebate for female homebuyers) of 85 lakh that is equal to Rs 5,10,000.

Total stamp duty and registration charges is Rs 5,40,000.

Example 4: Female owner

Ashwini bought a property in Taloja, Navi Mumbai for Rs 25 lakh.

Since the property value is below Rs 30 lakh, the registration charges is 1% of property value that is equal to Rs 25,000.

Stamp duty is 6% (1% rebate for female homebuyers) of 25 lakh that is equal to Rs 1,50,000.

Total stamp duty and registration charges is Rs 1,75,000.

Example 5: Joint ownership: Male owner and Female owner

Ashwini and Amit bought a property in Taloja, Navi Mumbai for Rs 85 lakh.

Since the property value is above Rs 30 lakh, the registration charges is Rs 30,000.

Stamp duty is 7% (No rebate for joint ownership) of 85 lakh that is equal to Rs 5,95,000.

Total stamp duty and registration charges is Rs 6,25,000.

Documents for property registration in Navi Mumbai

- Agreement to sale

- Sale deed

- Encumbrance certificate

- Property tax receipts

- No-objection certificate

- Power of Attorney, if applicable

- Stamp duty and registration fees payment proof

- Occupancy certificate for new buildings

- Completion certificate for under-construction buildings

- TDS deduction certificate (applicable on properties worth over Rs 50 lakh)

- PAN Card of buyer

- PAN Card of seller

- Aadhaar card of seller

- Aadhaar card of buyer

- Passport size photos of buyer and seller

- ID proof of buyer

- ID proof of seller

- ID proof of witnesses

- Address proof of buyer

- Address proof of seller

- Address proof of witnesses

Factors affecting stamp duty and registration in Navi Mumbai

Mentioned are factors that influence the stamp duty and registration charges for a property transaction in Navi Mumbai.

Property type: The stamp duty and registration charges depend on the property type. The stamp duty of residential properties attract lesser stamp duty rates as compared to commercial properties.

Property location: The location of the property plays a significant role in determining stamp duty and registration charges. Different regions within Navi Mumbai may have distinct stamp duty rates and regulations.

Property value: The charges for stamp duty and registration may be calculated based on the property’s value. This value is determined by the ready reckoner rate or the market valye whichever is more. Typically, the stamp duty on a property sale is a percentage of the property’s selling price.

Ownership type: The type of ownership can also impact the stamp duty and registration charges in Navi Mumbai. For example, properties owned by companies may incur higher stamp duty compared to those owned by individuals.

How to pay stamp duty online in Navi Mumbai?

Home buyers can pay e-stamp duty and registration charges for property registration online in Navi Mumbai. This can be done through the Maharashtra stamp and registration departments, Government Receipt Accounting System (GRAS).

Users can log on to the website, https://gras.mahakosh.gov.in, provide all the property and personal details and make the online payment using various channels.

Here is a step-by-step process to do that:

Step 1: Select the ‘Pay Without Registration’ option, if you are not a registered user. A registered user can key in the login details to proceed.

Step 2: If you choose the ‘Pay Without Registration’ option, a new page will appear where you have to select ‘Citizen’ and select the type of transaction.

Step 3: Select ‘Make Payment to Register your Document’. A buyer has the option to pay stamp duty and registration charges together or separately.

Step 4: Enter all the required fields such as district, the sub-registrar’s office, property details, transaction details, etc.

Step 5: After selecting the payment option, proceed with the payment. After this, an online receipt will be generated. This document must be presented at the sub-registrar’s office at the time of the property registration.

How to pay stamp duty offline in Navi Mumbai?

To pay Navi Mumbai stamp duty offline, you can follow these methods:

Get stamp papers from authorised vendors

A home buyer need to buy stamp papers of the necessary value from a licenced stamp vendor for your transaction. This is applicable when the value of the stamps is below Rs 50,000.

Franking

Authorised banks in India offer franking services where they affix a denomination or stamp on property purchase documents.

How to apply for stamp duty refund in Navi Mumbai online?

If an applicant wants to cancel the property in Navi Mumbai within six months, he can get a stamp duty refund after a 10% deduction.

Step 1: Log on to https://appl2igr.maharashtra.gov.in/refund/

Step 2: Agree to the terms and conditions. Next, click on New Entry.

Step 3: Key in mobile number, OTP, captcha and click on submit.

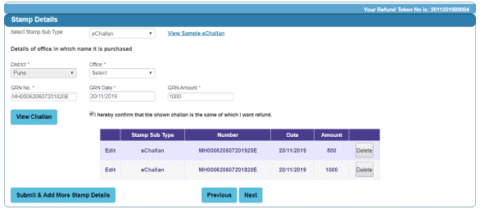

Step 4: You will get refund token number. Next, create password, confirm password, enter captcha and click on submit.

Step 5: Click on if you want to get old data or no.

Step 6: Enter refund token number, select on refund as stamp duty and fill details and proceed.

Step 7: Enter stamp purchaser’s details like bank account details where the stamp duty amount will be refunded.

Step 8: Enter the stamp details.

Step 9: Cite the reason for the stamp duty refund and select if the document is registered or not registered.

Step 10: Upload documents and proceed. You will get an acknowledgment receipt once all done.

How to view status of stamp duty refund in Navi Mumbai?

Step 1: Log on to https://appl2igr.maharashtra.gov.in/refund/

Step 2: Enter the refund token number, the password, the captcha and click on view status. If you want to modify something, click on the modify option.

Step 3: Click on View Status.

What are tax benefits on stamp duty and registration charges in Navi Mumbai?

On payment of stamp duty and registration charges in Navi Mumbai, home buyers under section 80C can claim a tax deduction of upto Rs 1.5 lakh on the stamp duty charges.

How can these tax benefits be claimed on stamp duty Navi Mumbai?

- One can claim the tax deduction on stamp duty charges only in the in which the payment was done.

- Tax deduction can be claimed only new residential property. No tax deduction can be claimed on resale or commercial property.

- Only on properties that are completed and OC has been received can an owner get tax benefits on.

- Only the home buyer who has the paid the stamp duty (the home owner) can claim tax deduction. No other person can claim tax deduction on Navi Mumbai stamp duty that has been paid.

- Joint owners can claim tax deduction of Rs 1.5 lakh individually under section 80C.

- Plots for residential purposes can also avail of tax deduction under 80C.

- Note that a home owner can also avail tax deduction under 80C for other taxes such as service tax. However, this cannot be done if the homebuyer has occupied it wholly or partially.

Housing.com POV

Navi Mumbai has always been one of the fastest growing cities among all peripheral locations to Mumbai. With the city not enjoying connectivity to not just Mumbai but to other neighbouring cities easily with infra such as the Mumbai Pune Expressway, the Virar Alibaug Multimodal Corridor, the Samruddhi Mahamarg etc. With Navi Mumbai opening more and more nodes and residential real estate growing, there are many options for people to choose property from depending on the location, budget, builder, configuration etc. Navi Mumbai stamp duty contributes a significant amount to the state exchequer and payment of this ensures that residential property is registered in legal records.

FAQs

What is the rate of stamp duty in Navi Mumbai?

The stamp duty rate in Mumbai is 7% for men and 6% for women.

How is stamp duty calculated on flats in Navi Mumbai?

Stamp duty is calculated, based on the property value as mentioned in the sale agreement. However, note that a property cannot be registered below the RR rates in the city.

How can I pay stamp duty and registration fees online in Navi Mumbai?

A home buyer can visit the Maharashtra government’s Government Receipt Accounting System (GRAS) website, to make the online payment of the Navi Mumbai stamp duty.

When paying Navi Mumbai stamp duty, whose name should property stamp papers bear, the buyer, the seller or the lawyer?

While paying the Navi Mumbai stamp duty, the stamp should be purchased in the name of any of the parties who are printing the document. The stamp should not be purchased in the name of the lawyer or the third party.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |