Under the income tax act rules, a taxpayer is a person or a corporation that pays taxes on its income each year. Your income only becomes lawful after you file income tax filings and declare your revenues. Challan Identification Number (CIN) or Tax Deduction Account Number (TAN) are the two ways taxpayers can verify their challan’s progress. Banks can also examine the availability of challans received in their institutions online by choosing either the receiving local bank or the nodal bank location.

See also: How to use income tax Challan 281?

What is TDS challan?

TDS Challan is a designated form used for depositing Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) to the government. Introduced in 2004, TDS Challan aims to minimise human errors and simplify online tax deposit, collection, and TDS refund transactions. Individuals or payers responsible for making specific payments such as salary, interest, rent, commission, and others are required to deduct a predetermined percentage from the payment amount before disbursing it to the payee or employee, as per the TDS Challan regulations. Furthermore, every person who verifies the status of their TDS Challan is also responsible for submitting the TDS challan amount to the relevant tax authority.

Types of TDS challans

Taxpayers have the option to track the status of their e-challan, which needs to be deposited in the banks. There are three different types of TDS challans that a taxpayer may receive:

- TDS Challan 280: This form is used for depositing income tax.

- TDS Challan 281: This form is used for deductions related to Tax Deducted at Source (TDS) and Tax Collected at Source (TCS).

TDS Challan 282: This form is typically used for depositing wealth tax, gift tax, security or transaction tax, and various other indirect taxes.

TDS challan status enquiry

After taxpayers have paid their taxes, the issuing bank will digitally transfer the challan’s data to the income-tax division. Banks compare the information and data that the Tax Information Network (TIN) receives from the banks with the daily tax collections. The TIN allows taxpayers to track the functionality of their challans online.

They can confirm that your payment amount has been correctly accounted for in your identity using this tool. According to the collecting banks, the uploading banks’ challans may also be checked using this service.

Income tax challan status: How to determine and pay advance tax?

Add the total amount of revenue. Similar to how you would when completing your income tax return, include salary earnings, investment gains, stock dividends, etc. If you work as a freelancer, estimate your yearly income from all users and subtract your expenses. The costs are rent for your office, internet and phone service, computer depreciation, travel, etc.

What is Challan 280 and how to pay income tax?

On the income tax portal, you can now deposit your taxes through Challan 280. Since most people who earn a living through salaries may not have to pay any additional taxes, many businesses pay the taxable income on behalf of their members. You’ll need to complete the form’s fields with your information. You can use the completed form to settle your income tax online or offline at a bank.

Income tax challan status: Things to consider while paying a challan

When filling up the challan, the following guidelines should be prioritised:

- When choosing the proper tax head to pay, exercise caution when deciding your payment method.

- Pay attention when entering the amount.

- Double check the type of payment you select.

- The practical evaluation year needs to be chosen.

- Enter the Deductor’s PAN and TAN information accurately.

How to use Challan 280 for online income tax payment?

Step 1: Go to NSDL’s official website.

Step 2: Click the “Services” tab on the home page to access the drop-down menu.

Step 3: From the menu bar, tap the “e-payment: Pay Taxes Online” option.

Step 4: The page will take you to the page for “e-Payment of Taxation.” You could also hit “Click to pay income tax online” to go instantly to the “e-Payment of Taxes” page by selecting the checkbox located on the top right of the website.

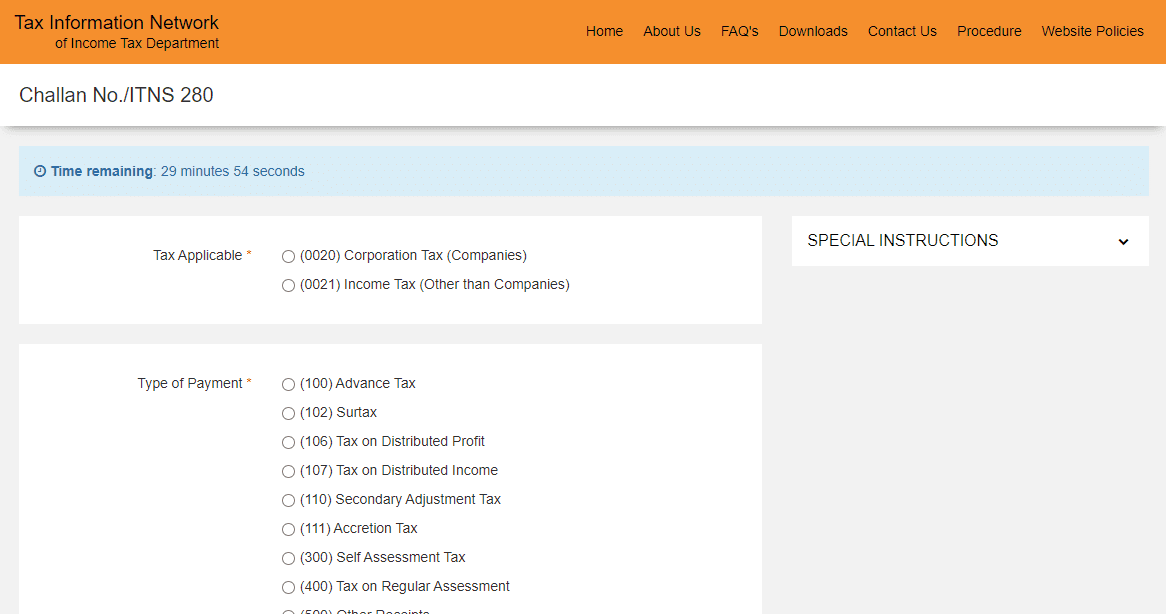

Step 5: Select challan No./ITNS 280 press ‘Proceed’.

Step 6: On the following page, you can see the challan, which you must fill out with information such as the relevant tax, the Permanent Account Number (PAN), the evaluation year, and other specifics.

Step 7: To file taxes, choose the “(0021) Taxable Income (Other than Corporations)” selection. For collecting corporation tax, businesses will choose the other option, “(0020) Corporation Tax (Companies).”

Step 8: After that, choose the appropriate “Type of Payment” from the list of possibilities, which includes (100) Advance Taxation, (102) Surtax, (106) Tax on Distributed Revenue, (107) Tax on Decentralised Income, (300) Self-Assessment Tax, and (400) Tax on Periodic Assessment.

Step 9: Next, select your preferred payment method. You can use a debit card or net banking to make the payment. After choosing the practical option, establish the bank’s identity from the drop-down menu beside your choice.

Step 10: Select the appropriate Assessment Year from the drop-down box and enter your PAN information. Remember that the 2022–23 evaluation year applies from 1 April 2022 to 31 March 2023.

Step 11: You must fill out your address, district, county, PIN code, email account, and contact number in the following stage.

Step 12: Next, type the “captcha code” on the screen into the appropriate field.

Step 13: Selecting the “Proceed” tab will take you to the “e-Payment site,” where you can settle the income tax for which you are responsible.

Income tax challan status enquiry options

Taxpayers can check the progress of their bank-deposited challan online. It provides two search functionalities.

CIN-based view

The Challan Identification Number (CIN) is a crucial tool for status inquiries and serves as evidence of tax payment. The taxpayer is responsible for ensuring the bank stamps the challan with the CIN. If not, the taxpayer may go to the bank and ask for the authorisation to be applied.

The taxpayer can examine the following information by inputting the challan identification number, which contains information such as the BSR code of the collecting unit, the challan acceptance date, the challan VIN, and the amount required.

- BSR Code

- Amount deposition date

- CIN number in challan

- Primary heading code and summary

- TAN/PAN details

- Taxpayer identity

- Date of receipt by TIN

- Verification that the provided amount is accurate

Checking challans: CIN-based process

Step1: Go to the challan request site of CINx

Step 2: Input the challan’s information, such as its serial number, date of payment, and branch’s BSR ID. Only following a week will the challan condition be notified.

Step 3: The system will show the challan status. Contact the bank where the challan was placed if the notice “no records found” is presented and it’s been over a week.

TAN-based view

A 10-digit number called a TAN is given to each person to deduct or collect tax from payments they have made. Every taxpayer required to withhold tax at source is required by section 203 of the income tax act to include their TAN number in any correspondence with the income tax department. The assessee can obtain the following information by entering the TAN and the challan tender period range for a specific financial period:

- CIN number

- Primary heading code with description

- Minor heading code with description

- Payment mode

The system will check to see if the amount entered by the taxpayer against a CIN equals the information submitted by the bank.

Checking income tax challan status: TAN-based process

Step 1: Access the TAN-Based Challan Request Site.

Step 2: Input the date and specify a range for the payment date.

Step 3: The program will display the status of each challan for payments made at this time. If “no records found” is the message that appears and more than a week has passed, get in touch with the bank where you deposited the challan.

How to determine a bank’s status on income tax challan?

Recognising bank branch

The tax-receiving branch can obtain the actual sum and the overall number of challans for each key head code by giving the branch scroll period and the primary head code’s summary. The collecting branch may also access the information below:

- Challan serial number

- Challan tender date

- PAN/TAN details

- Taxpayer identity

- Amount to be paid

- Date of receipt by TIN

Nodal bank branch

The nodal section can display the accompanying information by entering the nodal scroll time and the primary head code description:

- Scroll number of mode branch

- Scroll date

- Primary heading code with description

- Total amount paid

- Number of branches

- Number of challans

Furthermore, the data below can be accessible for every Nodal Branch Scroll Number:

- BSR Code

- Branch scroll number

- Branch scroll date

- Total amount paid

- Number of Challans

- Date of receipt by TIN

To keep track of challans deposited in banks, follow the below-given steps:

Step1: Visit https://tin.tin.nsdl.com/oltas/index.html.

Step 2: Choose the TAN-based view or the CIN (Challan Identification Number)-based perspective.

Step 3: To check the status, complete the necessary fields.

Step 4: To validate the challan entries made in the e-TDS/TCS statement, tax deductors may also obtain the challan information file for a chosen period using TAN-based display.

How to use TDS traces to determine income tax challan status?

- Visit the website at https://www.tdscpc.gov.in/app/login.xhtml.

- Navigate to the statement/payment tab.

- Click the status of a statement or challan.

- Fill out the information.

- For challan status, tap on ‘View claim status’ and hit “proceed.”

FAQs

What does OLTAS mean?

The Income Tax Department's project is called OLTAS, or Online Tax Accounting System. The posting of challan information was primarily done to keep track of taxes paid.

How can I check my challan number?

You will get a tax receipt after paying the tax with Challan 280. On the top right of the challan are displayed the BSR number and challan serial number.

Who is permitted to download the CSI file (Challan Status Inquiry)?

With TAN as the user ID, a CSI file can only be downloaded by TAN users.

Can a single challan be used for multiple FY for the payment of TDS?

Yes, tax deducted at source for diverse fiscal years could be paid using a single challan.