Property tax in Latur is managed by the Latur City Municipal Corporation. The revenue obtained from this tax is allocated towards enhancing infrastructure and civic amenities within the municipal corporation’s jurisdiction. To facilitate easy payment, authorities have introduced a user-friendly portal where residents can calculate and pay their property tax. Taxpayers can settle their Latur Municipal Corporation property tax obligations through the official portal or the NagarMseva mobile application. Read on to understand how and when to pay property tax in Latur.

Check how to pay Solapur Property Tax 2024 online

Steps for Latur property tax online payment

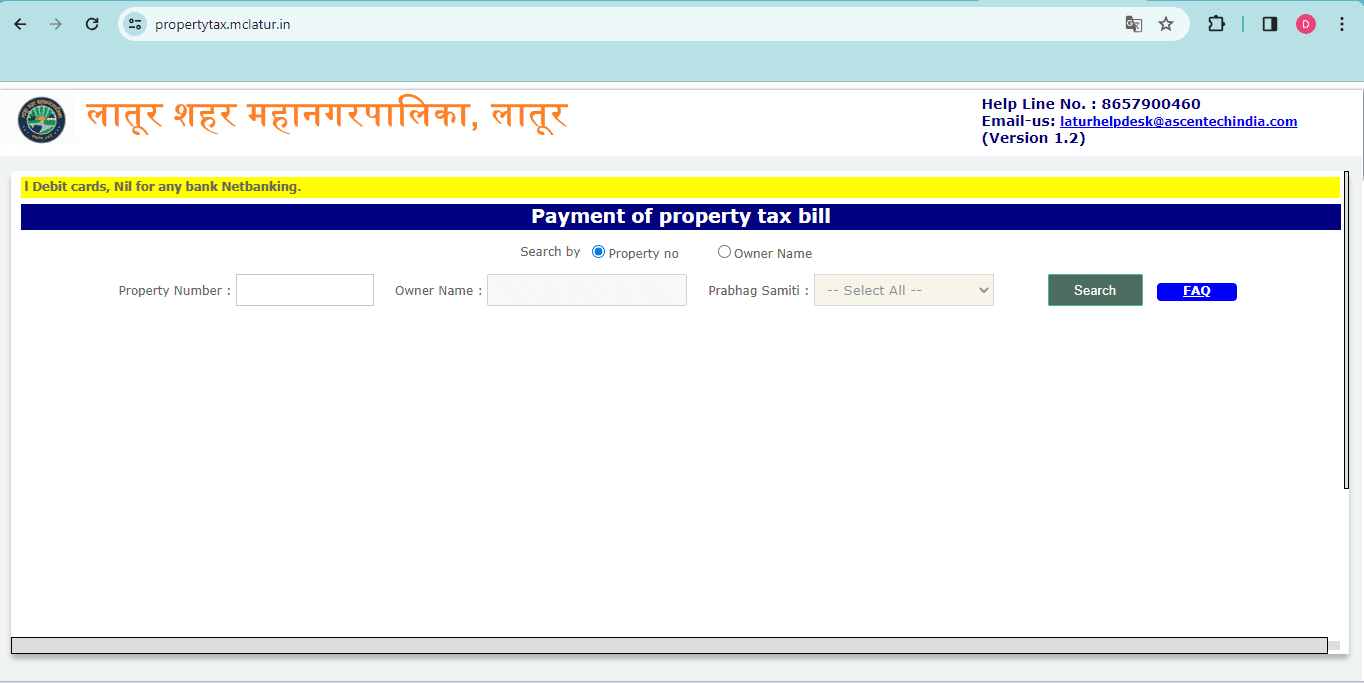

Paying property tax in Latur is hassle-free via the official Latur City Municipal Corporation website or the NagarMseva mobile application. You can settle your property tax by searching for your property details, either through the property number or the owner’s name. It is essential to have an email ID and mobile number while making the payment. Follow these steps to pay Latur Municipal Corporation property tax online:

- Visit the official Latur City Municipal Corporation website

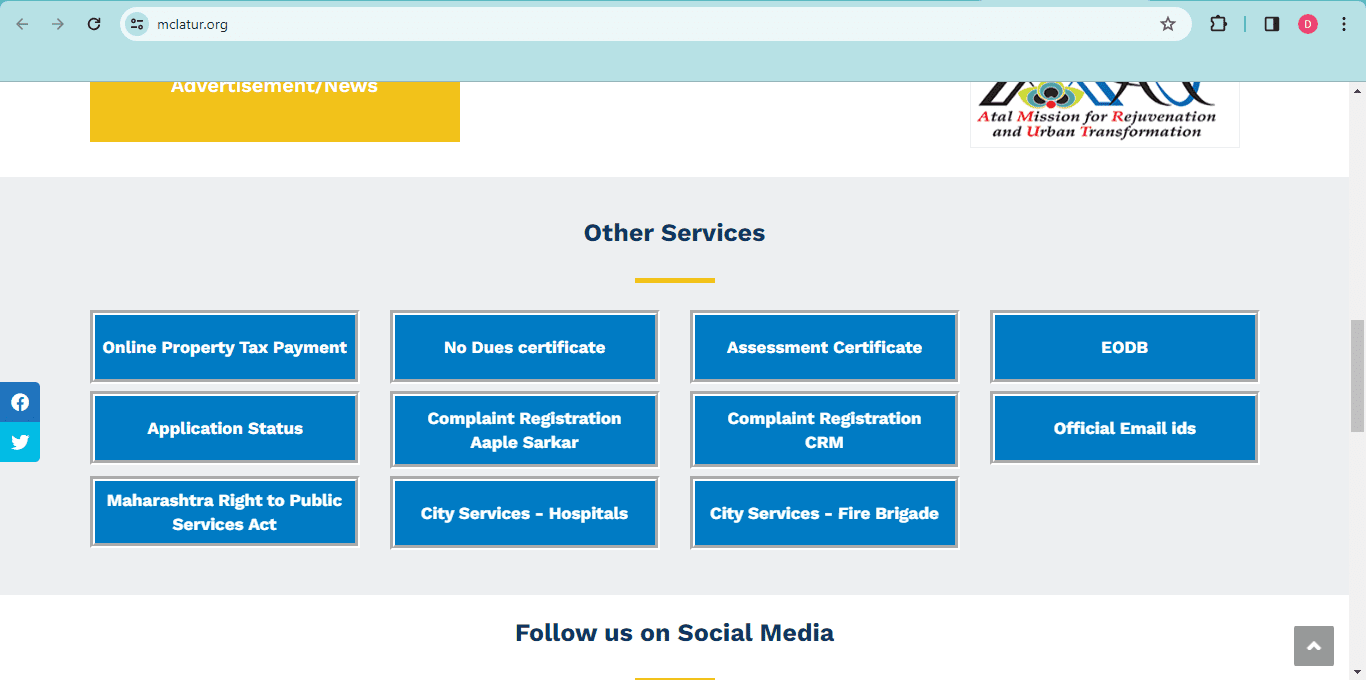

- Click on ‘Online Property Tax Payment’ under ‘Other Services’.

- Enter the property number, owner’s name and Prabhag Samiti. Click on ‘Search’.

- The property details will appear on the screen.

- Choose your preferred payment method: debit card, credit card, net banking or BBPS.

- After successfully paying the property tax, a confirmation message will be sent to your mobile number and the receipt will be sent to your registered email ID.

When to pay Latur Municipal Corporation property tax?

The deadline for paying property tax in Latur is 1 April and 1 October each financial year. These dates serve as the advance property tax payment deadline, allowing citizens to pay their taxes in semi-annual instalments, as mandated by the Maharashtra Municipal Corporation Act.

Penalty for not paying Latur Municipal Corporation property tax

Failure to pay property tax within the specified period will result in a penalty of 2% of the tax amount for every month or part thereof after the deadline. This penalty continues until the full amount is settled. If there is an approved increase in the tax rate during the billing period or if the annual taxable amount is elevated due to construction or change in usage, paying the additional amount becomes obligatory.

How to change the name of the property tax in Latur?

To change the name in property tax records in Latur, citizens need to visit the nearest Latur Municipal Corporation office. They must collect the application form and accurately fill in all the details. Attach all the necessary documents and pay the applicable fees to complete the submission process. Upon submission, municipal corporation officials will review the details. If the information provided is deemed valid, the application will be accepted and an acknowledgement receipt will be generated for future reference.

Conclusion

Managing property tax in Latur is crucial for the city’s development, overseen by the Latur City Municipal Corporation. Through the dedicated portal and mobile application, residents can fulfil their tax obligations. It is imperative to adhere to the deadlines to avoid penalties, as mandated by the Maharashtra Municipal Corporation Act Guidelines. Moreover, citizens can initiate name changes in property tax records by following a straightforward process at the municipal corporation office. This streamlined approach ensures transparency and accountability in property tax management, contributing to the city’s overall progress and well-being.

FAQs

How can I pay my property tax in Latur?

You can conveniently pay your property tax in Latur through the official Latur City Municipal Corporation website or the NagarMseva mobile application. Search for your property details, either with the property number or the owner’s name, and follow the steps to complete the payment using a debit card, credit card, net banking or BBPS.

When is the deadline for paying Latur Municipal Corporation property tax?

The deadline for property tax payments in Latur is 1 April and 1 October each financial year. These dates serve as the advance property tax payment deadline, allowing residents to pay their taxes in semi-annual instalments.

What happens if I miss the Latur Municipal Corporation property tax payment deadline?

Failure to pay property tax within the specified period will result in a penalty of 2% of the tax amount for every month or part thereof after the deadline. This penalty continues until the full amount is settled.

How can I change the name in the property tax records in Latur?

To change the name in property tax records, visit the nearest Latur Municipal Corporation office. Collect the application form, fill in the required details, attach the necessary documents and pay the applicable fees. Upon submission, municipal corporation officials will review the details and generate an acknowledgement receipt, if the information provided is valid.

Can I receive confirmation of my property tax payment in Latur?

Yes, after successfully paying the property tax, a confirmation message will be sent to your mobile number and the receipt will be emailed to your registered email ID. This ensures that you have a record of your payment for future reference.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Dhwani is a content management expert with over five years of professional experience. She has authored articles spanning diverse domains, including real estate, finance, business, health, taxation, education and more. Holding a Bachelor’s degree in Journalism and Mass Communication, Dhwani’s interests encompass reading and travelling. She is dedicated to staying updated on the latest real estate advancements in India.

Email: [email protected]