Property owners in south India’s temple town – Madurai – have to pay Madurai Corporation Property Tax on their residential properties to the Madurai Municipal Corporation or the Madurai Corporation every year. The revenue generated by the Madurai Corporation from the collection of the Madurai corporation property tax is substantial and contributes to the town’s development. Spread across a total of 148 sq kms, Madurai Municipal Corporation has a total of 100 wards and is divided into four zones. Zone 1 of Madurai Corporation covers wards 1 to 23, Zone 2 of Madurai Corporation covers wards 24 to 49, Zone 3 of Madurai Corporation covers wards 50 to 74 and Zone 4 of Madurai Corporation covers wards 75 to 100. It is the responsibility of each property owner to pay the Madurai Corporation property tax so that the citizens can benefit from all the facilities and critical services provided by the Madurai Municipal Corporation.

This article outlines the process of paying the Madurai Corporation Property Tax. While both, online and offline methods, are available for paying the Madurai Corporation Property Tax, it is advisable to use the online way to save time and effort.

What are the factors based on which the Madurai Property Tax is calculated?

- Title deed of the property

- Permission for the building to be developed

- District

- Municipality/ Corporation name

- Locality name

- ULB

- Street name

- Zone

- Zone rate

- Total plot area

- Number of floors

- Building usage

- Type of building

- Plinth area

- Type of occupant

- Age of building

- Approved area

- Annual rental value (ARV)

How is the Madurai Property Tax calculated?

The Madurai Property Tax is calculated on the basis of annual rent value.

Annual rental value (ARV) = (Area x zone rate x factor indicator x building usage rate) x 12

You can use the property tax calculator available on the Tamil Nadu official website to calculate the approximate tax amount to be paid. To calculate the Madurai Property Tax, one has to enter the property address, building approval details, floor details and other such details asked.

How to use the Madurai Corporation Property Tax calculator?

Individuals can calculate the Madurai Corporation Property Tax based on the above mentioned using the Madurai Corporation Property Tax calculator. This calculator is available on the property tax Madurai website where citizens can self-assess and pay the property tax.

How to pay the Madurai Property Tax online?

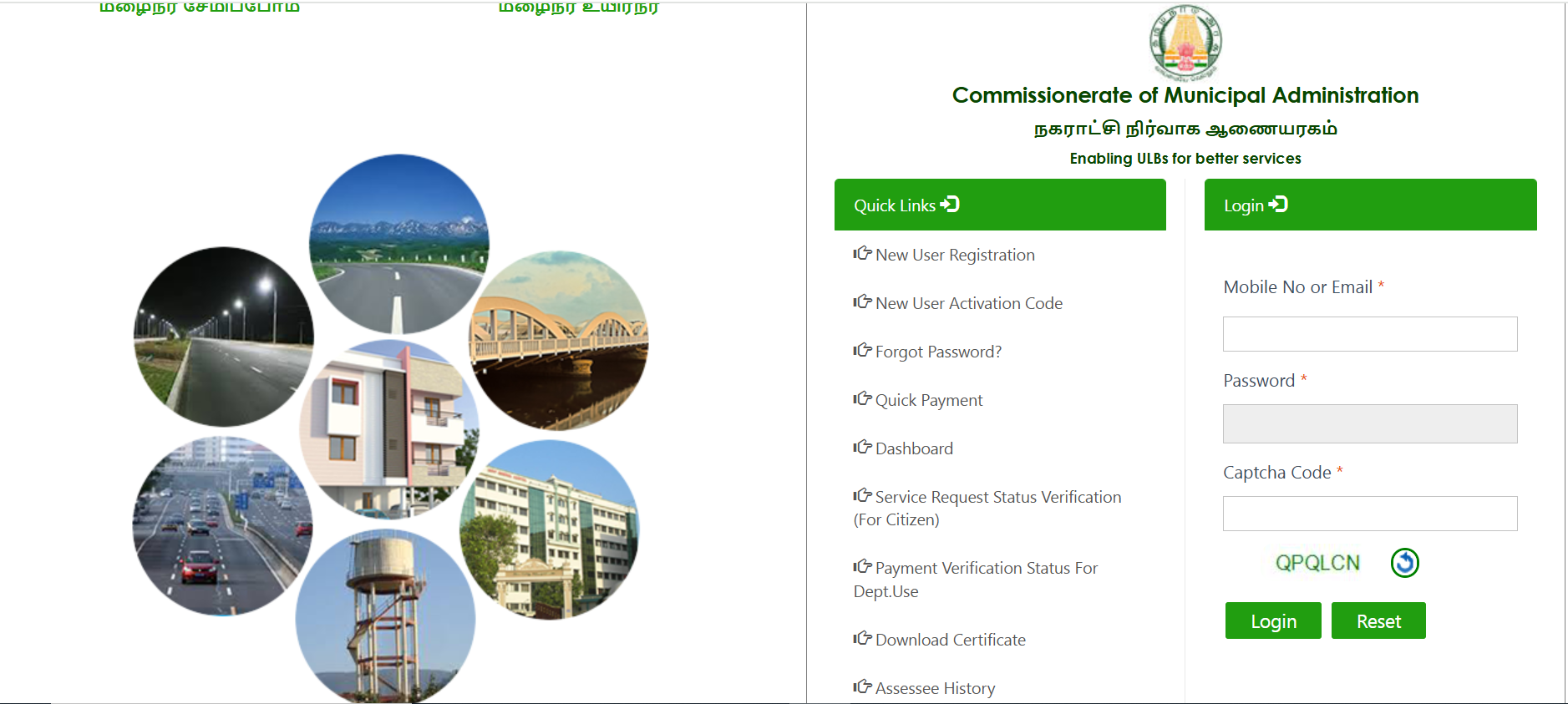

To pay the property tax online payment Madurai, citizens have to visit the website https://tnurbanepay.tn.gov.in/.

For house tax online payment Madurai, registered users can log in on the property tax Madurai website with their mobile number or email ID and password. First-time users will need to register themselves with the Madurai Municipal Corporation. Alternatively, to proceed with the property tax online payment Madurai without registration on the website, use the ‘Quick Pay’ option that will lead https://tnurbanepay.tn.gov.in/IntegratedPaymentNew1.aspx.

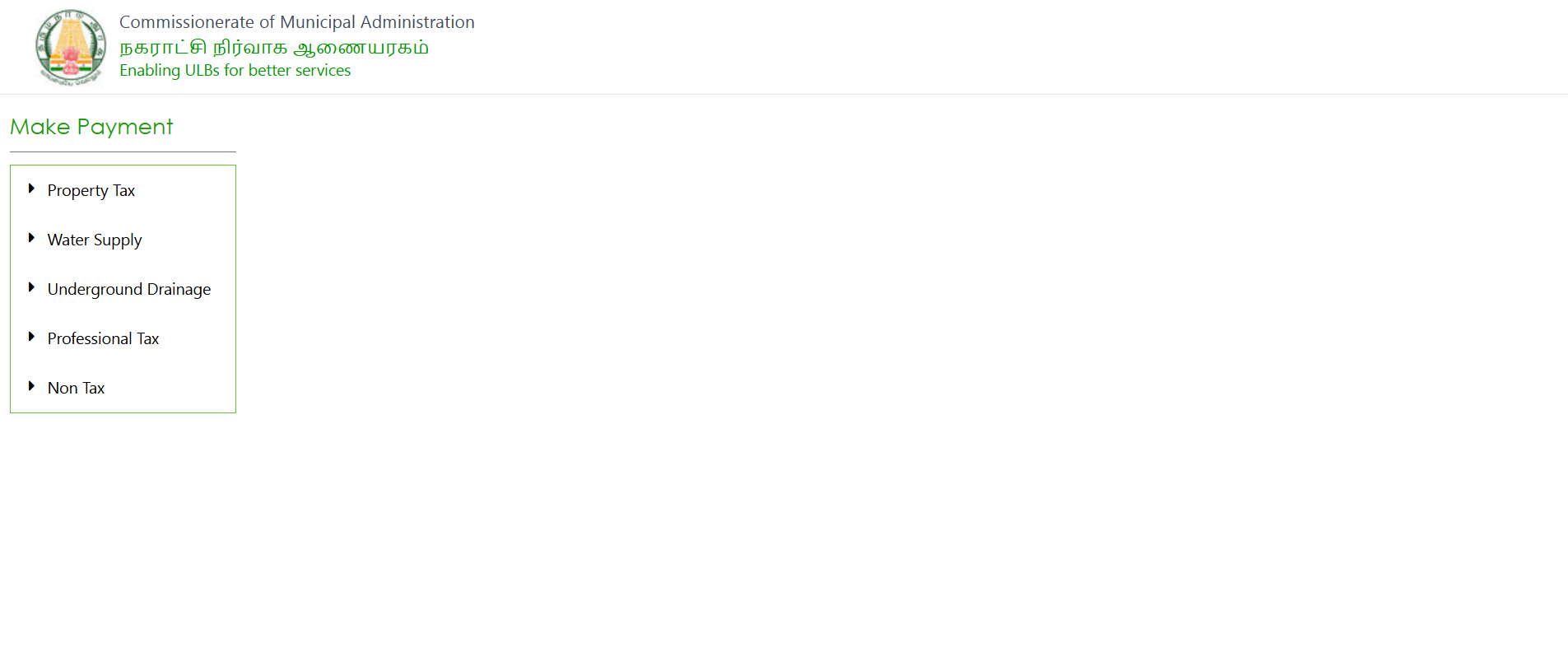

- Click on ‘Property Tax’ to reach the following page.

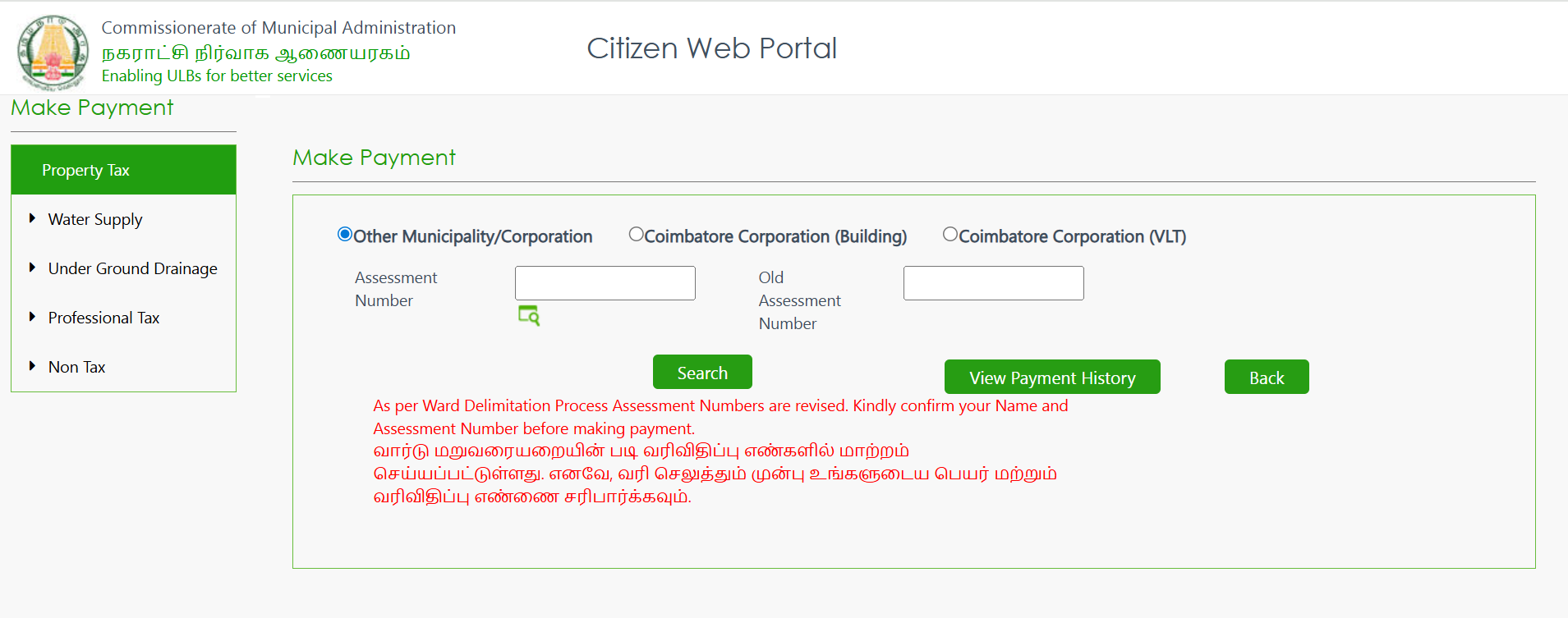

Note that as per ward delimitation process assessment numbers are revised. Kindly confirm your Name and Assessment Number before making payment.

For house tax online payment Madurai, on the new page, click on ‘Property Tax’ and other municipality corporation, enter the assessment number, old assessment number and click on search. The page will populate all the Madurai Corporation Property Tax payment details related to the entered Madurai Corporation Property Tax assessment number. Once assured that the correct details of the property tax online Madurai are being shown, click on ‘View Payment History’ to proceed with the payment.

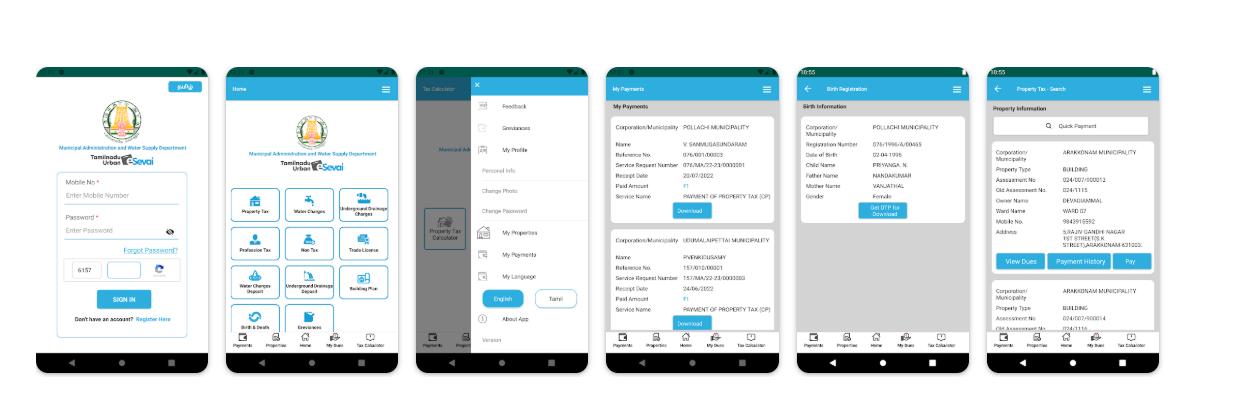

On the next page, click on the ‘My Properties’ section to check the property list, add assessment and delete properties. Click on the ‘My Tax’ section to calculate the property tax Madurai for your properties by using the ‘Tax Calculator’ option and filling in the required details.

Make the property tax online payment Madurai in the ‘Make Payment’ section through one of the available online payment options. Payments can be made through NEFT, net banking, UPI and cards. In case of any query, click on the ‘My Grievances’ section to register a complaint regarding their property tax Madurai. The ‘My Request’ section is for those who want to raise a service request or check the status of previous requests. Visitors can also check their Madurai property tax dues in this section.

How to check pending tax bill on Madurai Property Tax portal?

Click on Assessee History. You will reach

Select financial number, old/new assessment number, name of ULB and click on search.

Madurai Corporation Property Tax: How to monitor service request status?

Click on service request status and enter the details like service request number and you will get all details. You will have options to view or print.

How to download certificate on Madurai Corporation Property Tax portal?

Click on Download certificate. Enter service number and approval number and click on search. You can view or print the certificate.

How to pay Madurai Property Tax using mobile app?

Download the TN Urban Esevai mobile app form the Google Playstore.

Click on the property tax service and proceed with checking the property tax and paying the bill.

How to pay Madurai Property Tax offline?

Paying the Madurai Property Tax offline means physically visiting the office during working hours. You should carry a copy of all the supporting property documents that may be asked for property tax payment.

- Visit the ward office of Madurai City Municipal Corporation.

- Fill out the property tax payment form and attach the supporting documents.

- Pay the Madurai House Tax and collect the receipt.

What is the last date to pay the Madurai Property Tax?

The last date to pay property tax in Madurai is April 30 of every year. Failure to pay within this time will result in penalties. Most civic bodies charge around 1-2% as penalty for the time period that the property tax was not paid.

What is the rebate offered for paying Madurai Property Tax on or before time?

The Madurai Municipal Corporation offered a rebate capped at Rs 5,000 per tax payer for all who paid the Property Tax for the first half of FY2025-26 before April 30, 2025.

Why is necessary to follow mutation process?

By following the mutation process, the name of new owner comes into the records of the Madurai Municipal Corporation. This is important because the owner will be sent the bill for payment of property tax, utility services such as electricity, water etc.

How to change the name on the Madurai Property Tax records?

- One can change the name of the property owner by collecting the mutation form from the municipal office.

- Fill out the form, add supporting documents and submit.

- The name transfer order will be received within 20 days of the application.

- You can get the application receipt and annual rental value (ARV) certificate from the ACMC office within 3 days of application.

Common challenges in Madurai Property Tax and how to overcome them

Incomplete documentation: Ensure that there is no problem in the documents. Ensure timely documentation is done so that there is no problem while paying the property tax.

Discrepancies in records: Check the property tax record details in advance so that there is no mismatch in the records.

Delay in verification: Check with the office on a regular basis so that verification is done on time.

Ownership disputes: Settle all disputes before transfer of ownership of property.

Lack of awareness: It is recommended to be aware about all details about property tax Madurai. You can use experts like lawyers etc. for more clarity.

Which properties are exempted from paying Madurai Property Tax 2025?

Properties such as convents, charitable institutions, mosques, parsonages, churches and land, building and other property that are used directly and only for education, charitable and religious purposes are exempted from paying the Madurai Property Tax 2025.

Madurai Corporation property tax: Contact information

For any queries related to Madurai Corporation property tax, contact:

Commissioner Madurai Corporation

Phone No: 0452253521

WhatsApp number: 8428425000

Email id: commr.madurai@tn.gov.in

Housing.com POV

As a property owner, you would want your vicinity to be developed with the best of infrastructure and amenities. These are developed by the local body using the revenue generated by property tax. With the development of the area, the property prices and the rental yield surge, which works in favour of the property owner. Defaulting on tax is a punishable offence in India. Always pay the annual tax on time online or offline and benefit from the rebate offered by the Madurai Municipal Corporation.

FAQs

How to pay property tax online in Madurai?

You can pay the property tax online in Madurai by visiting the Madurai property tax homepage and click on Quick Links.

How to find old assessment number for property tax in Madurai?

Click on Assessee History to find the old assessment number for property tax in Madurai.

How can I check my property tax in Tamilnadu?

Check the Commissionerate of Municipal Administration, Tamilnadu website for knowing details about property tax.

How can I change my house tax name in Madurai?

You can visit the Chennai property tax page on the Greater Chennai corporation page to change the house tax name in Madurai. Click on Name transfer and proceed.

What are the other taxes that can be paid on the Madurai Municipal Corporation website?

In addition to the Madurai Corporation property tax, you can pay water supply bills, underground drainage, professional tax and non-tax revenues on the website.

Why is online payment for property tax recommended?

The online payment service is recommended as it is an end-to-end online service with no physical touchpoint required. It saves time and removes the need to stand in queues.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |