Property owners in Meerut have to pay an annual property tax. This tax is mandatory and is collected by the municipal body of Meerut known as the Meerut Nagar Nigam. With the property tax collected, the municipal body improves the social and infrastructural facilities in Meerut. Check out this guide for paying property tax in Meerut.

Check how to pay Nagar Nigam Gorakhpur house tax

How to calculate Meerut Property Tax?

The Meerut Property Tax is calculated based on the annual rental value (ARV) of the property. Other factors for calculating the Meerut Property Tax include:

- Total area ( ft.)

- Number of floors

- Circle rate

- Rebate rate

- Covered area ( ft.)

- Property type

- Construction type

- Carpet area (sq. ft.)

- Road width

- Property age

- Depreciation rate

What is the basis of the calculation of Meerut Property Tax?

Since most of the properties in the Meerut Cantt are used for residential purposes, they are assessed under section 73(b) of the Cantonments Act, 2006. As most of these properties are self-occupied, the ARV was fixed on a notional rent basis. Thereafter, upon every revision, nominal increases were made in the ARV in case there were no additions and alterations in the property. Properties used for commercial and other non-residential purposes are assessed on the merits of each case following the provisions of Section 73 of the Cantonments Act, 2006. The last revision was carried out in 2020-21. The overall increase was 13%. For residential purposes, the increase was 7-10% and for non-residential/commercial properties the increase was 15%.

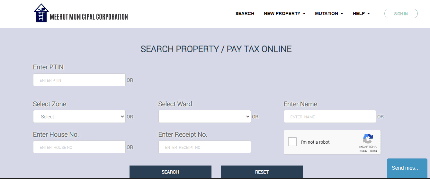

How to pay the Meerut Property Tax online?

- Visit the Meerut Municipal Corporation portal and click on ‘Online Property Tax’ under ‘Services’.

- Enter PTIN or other details and proceed to make the payment online.

How to pay the Meerut Property Tax offline?

- You can pay the Meerut Property Tax by visiting the nearby ward office.

- Fill out the application form and attach the supporting documents.

- Make the payment and get the acknowledgement for the Meerut Property Tax paid offline.

When is the last day to pay the Meerut Property Tax without penalty?

The last day to pay the Meerut Property Tax without penalty was January 31.

What is the penalty attached to non-payment or late payment of Meerut Property Tax?

The late payment fee is 2% of the entire duration for which the payment has not been made.

What is the rebate offered by the Meerut Municipal Corporation?

For people who pay their Meerut Municipal Corporation Tax on time, a rebate of 20% is offered on the total amount payable.

How to update the name of the new owner in Meerut Nagar Nigam Property Tax?

You can update the name of a new owner on the Meerut Municipal Corporation records through mutation.

- Visit the Meerut Municipal Corporation website.

- Click on ‘Online Mutation’ under ‘Services’.

- You will see the mutation form.

- Enter all the details and pay the mutation fees.

- Upload all the supporting documents.

Housing.com POV

Paying the Meerut Nagar Nigam house tax is compulsory. It is advisable to pay the tax on time to avoid penalties and benefit from rebates.

Meerut Nagar Nigam: Contact information

Near Ghanta Ghar, Kaiser Ganj Road, Meerut – 250002 Uttar Pradesh

Phone Number: 0121-2515133 (Officer’s contact numbers) Customer care: 1800 180 3090 / 5090

For any issues related to Meerut Property Tax email: [email protected]

FAQs

Who collects the Meerut Property Tax?

The Meerut Nagar Nigam collects the Meerut Property Tax.

What is the penalty for late payment of the Meerut Property Tax?

A penalty of 2% is levied on the pending amount. For non-payment, the municipal body first sends a notice. On not receiving a reply, it may attach the property and auction it.

How can you check house tax in UP?

Go to the UP revenue department and enter the property ID to check the pending house tax in UP.

Who pays the house tax in Meerut?

Residential property owners pay the Meerut House Tax.

How can you pay the Meerut Property Tax offline?

You can pay the Meerut Property Tax offline by visiting the nearby ward office.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]