Mumbai continues to be the country’s most prominent Data Centre (DC) market, accounting for 52% of the total stock as of June 2023, according to the findings of CBRE South Asia’s report tilted ‘From Bytes to Business: India Data Centre Market Powering Progress in 2023’. The city is expected to lead the supply addition with a 46% share of the upcoming 500 MW capacity by the end of 2024, says the report. The presence of multiple cable landing stations, inclusive government initiatives and well-rooted entertainment and finance industries have established the city as a top destination for BFSI, media, cloud and OTT companies to locate their DC operations.

Maharashtra is among the top states that dominated the cumulative investment commitments in Data Centres, apart from Tamil Nadu, West Bengal and Uttar Pradesh. Incentives by the state government have provided a policy push to the DC segment with dedicated policies/incentives to attract operators and investors. Maharashtra is one of the states with the first-mover advantage to release state-specific incentives for the segment.

Thekey Maharashtra IT policy initiatives impacting the DC landscape are stamp duty exemption, development/FSI-related incentives, electricity duty exemption, power subsidy, infrastructure support, tax benefits, green incentives and ease of approvals.

On a pan-India basis, India’s Data Centre (DC) capacity is expected to cross approximately 1,300 MW by the end of 2024 from the current 880 MW as of June 2023. The DC segment growth is likely to continue over 2023-24, with nearly 500 MW currently under construction across several cities. Mumbai, Chennai and Bangalore will collectively dominate DC stock with an 80% share by the end of 2024. The Indian DC industry is witnessing a continuous uptrend owing to rapid digitalisation, enhanced tech infrastructure and the inclusion of advanced technologies such as 5G, Artificial Intelligence (AI), blockchain and cloud computing.

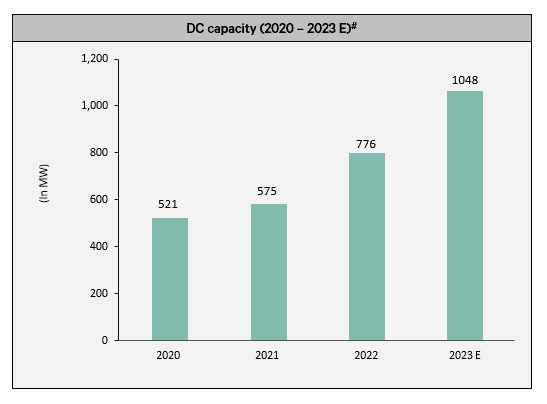

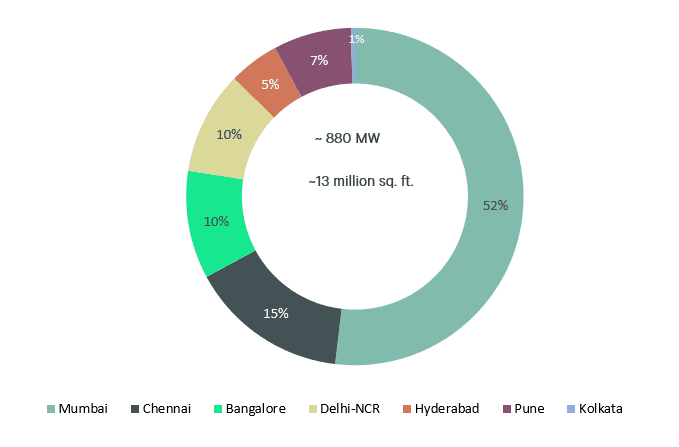

As per the report, India’s DC capacity has doubled over the last four-five years to reach approximately 880 MW as of June 2023 and is expected to increase further to touch around 1,048 MW by the end of 2023. During Jan-Jun 2023, the DC stock in the top 7 cities in India stood at approximately 880 MW capacity spanning over 13 million square foot (msf).

Mumbai, Chennai, Bangalore and Delhi-NCR accounted for about 87% of the country’s DC stock as of June 2023. Overall, DC occupancy levels in India stood at about 75-80% in Jan-Jun’23, which is likely to improve further by the end of the year. Chennai has also emerged as a key established Tier 1-DC market in India, accounting for 15% of the total stock in the top seven cities as of June 2023. The city is expected to account for a 21% share of the upcoming 500 MW supply by the end of 2024. Until June 2023, Bangalore and Delhi-NCR accounted for 10% of DC stock each.

Snapshot of the DC stock in India (as of H1 2023)

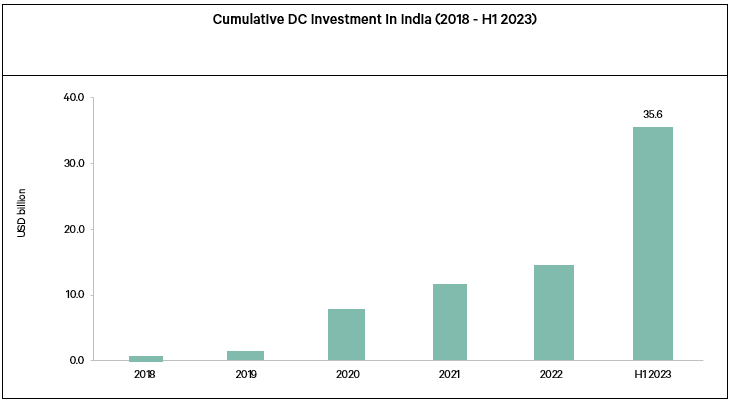

Further, the country’s growing digital infrastructure, increasing technology penetration and proactive regulatory push have made it an attractive destination for DC investments. During the 2018 – June 2023 period, the DC market in India attracted investment commitments of about $35 billion by both global and domestic investors, the report highlighted. Hyperscale DCs dominated most of the DC investments with a share of about 89%, while colocation DCs contributed to the rest of 11%. The top states that dominated the cumulative investment commitments include Maharashtra, Tamil Nadu, West Bengal and Uttar Pradesh.

Anshuman Magazine, chairman and CEO – India, South-East Asia, Middle East and Africa, CBRE, said, “Increasing population, enhanced use of technology, social media and online streaming platforms, rising need for data localisation and fast improving digital infrastructure would continue to boost demand for data centres in India. This, in turn, is likely to result in the country becoming one of the largest DC destinations across APAC over the next decade. We also anticipate heightened interest from investors looking to capitalize on DC’s attractiveness as a preferred alternate real estate option in the country. Multiple state governments in India have been giving an enormous push to the DC segment in the country, with dedicated policies/incentives introduced to attract both global and domestic investors. Most of the states have also declared DCs under essential services to ensure uninterrupted operations throughout the year.”

Ram Chandnani, managing director, advisory and transactions services, CBRE India, said, “Investor interest in the Indian DC market remains elevated despite the recent economic headwinds. Technology companies, along with corporates from sectors such as BFSI, cloud services and OTT platforms will continue to drive DC demand in India. Further, public sector undertakings and other key government enterprises are shifting to third-party colocation DCs due to an increased focus on digitization and e-governance to ease operations. Though the DC industry is witnessing an expansion in tier-I cities, leading hyperscalers and cloud service providers are also likely to expand to tier-II cities to capture the growing demand among BFSI firms and online streaming platforms to establish DC facilities closer to the consumption hubs.”

Outlook for data centres

- Technology firms, BFSI companies, cloud services and OTT platforms would continue to be key demand drivers for both colocation and hyperscale DC facilities.

- Several engineering and manufacturing firms and technology companies are also likely to set up DCs for R&D labs.

- The exponential growth in AI-generated data workload is expected to drive demand for high power density DC facilities ( more than 30kW/rack) as compared to traditional power density facilities (8-10kW/rack).

- PSUs and other government enterprises would continue to focus on the deployment of operations to third-party colocation DCs.

- Small- to medium-sized corporates would continue to gradually shift operations from enterprise to colocation DCs.

- DC operators are also likely to expand in tier-II DC markets to capture the growing demand among BFSI firms and online streaming platforms to establish DC facilities closer to the consumption hubs.

- Operators should provide tailor-made streamlined DC solutions along with scalability options to attract occupiers looking for flexibility/agility in the future.

- Increased focus on sustainability measures and minimising energy usage would achieve cost efficiencies.

- DC investors should continuously explore opportunities to upgrade facilities to increase efficiencies, reduce costs and support the environment through smart investments, IT strategies and energy management.

- ESG, machine learning and AI are likely to take centre stage in DC investments.

- In addition to power and infrastructure availability, regulatory hurdles in terms of land acquisition and delay in approvals are expected to be a key challenge for investors in select cities.

- Build-to-suit, acquisition and equity investments remain the preferred investment routes into the sector in India. Investors are also likely to form partnerships with experienced operators and developers to gain exposure to the sector. This approach enables investors to leverage their partner’s expertise in areas such as site selection, operations and regulatory compliance.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |