Rajkot is a prominent city in Gujarat. The Rajkot Municipal Corporation is responsible for providing essential infrastructural facilities in the city. The various taxes, including property taxes, collected by the municipal authority are a major source of revenue. The amount is utilised for the development of various facilities for the citizens. All property owners in Rajkot are responsible for the payment of property tax. The Rajkot Municipal Corporation provides an official portal, offering various services, including payment of property tax in Rajkot.

Check how to pay Vadodara Municipal Corporation’s property tax online

Property Tax in Rajkot

Property tax in Rajkot is an annual tax imposed on the owners of residential and non-residential properties. The property tax rates for residential and non-residential properties are different, as determined by the Rajkot Municipal Corporation.

Property tax rate in Rajkot in 2024

| Property type | Property tax rate (Rs per square metre of carpet area) |

| Residential properties | Rs 11 |

| Non-residential properties | Rs 25 |

Source: Media reports

How to pay property tax in Rajkot online?

- Visit the official website of Rajkot Municipal Corporation at https://www.rmc.gov.in/.

- Click on ‘Online Services’ on the top menu bar of the homepage.

- Click on ‘Property Tax Payment’ under ‘Property Tax’.

- Click on ‘Property Tax Payment’ under the ‘Online Services’ tab.

- Provide ‘Old Property Number’ or ‘New Property Number’ in the given fields.

- Click on ‘Show Amount Payable’ to proceed with the property tax payment in Rajkot.

What is the property tax rebate in Rajkot?

The municipal authority provides a discount or rebate to citizens who pay advance tax. If a property owner pays property tax in Rajkot within the specified deadline, they can avail of a rebate equivalent to 10% on the amount payable and an additional 1% discount in case of online payment.

How is property tax calculated in Rajkot?

The authorities calculate the property tax based on several factors, such as:

- Property tax rate

- Carpet area of residential property

- Location

- Age

- Type of building

- Occupancy

Property tax in Rajkot is calculated based on the following formula:

Property tax = Carpet area of residential property X property tax rate X (location X age X type of building X occupancy)

How to change the name in the property tax in Rajkot?

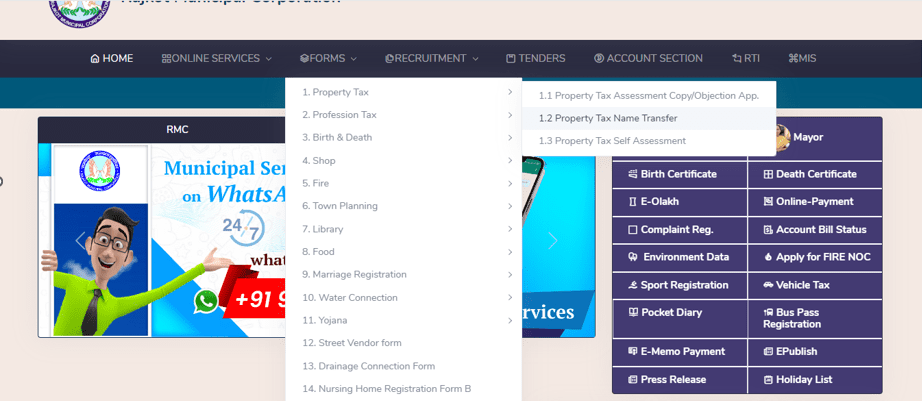

- Visit the official website of Rajkot Municipal Corporation at rmc.gov.in.

- Click on the ‘Forms’ link on the homepage.

- Click on the ‘Property Tax Name Transfer’ link under ‘Property tax’.

- A form will be displayed on the screen.

- Download the form and fill in the relevant details.

- Attach the required documents.

- Submit the form at the Rajkot Municipal Corporation office.

Property tax payment in Rajkot: Documents required

- Property tax bill (unique number for the property)

- Old property bill (previous number through which tax was paid)

- Property owner’s name

- Property address

- Aadhaar card

Property tax in Rajkot: Self-assessment

- Visit the official website of Rajkot Municipal Corporation at https://www.rmc.gov.in/.

- Click on the ‘Forms’ link on the homepage.

- Click on the ‘Property Tax Self Assessment’ link under ‘Property tax’.

- The self-assessment form will be displayed on the screen.

- Fill out the form and submit it to the Rajkot Municipal Corporation.

Advance property tax payment in Rajkot

The municipal authority determines the advance property tax payment deadline for paying property tax in Rajkot. Paying property tax in Rajkot on or before the due date makes the taxpayers eligible for a rebate of 10% on the property tax value and an additional 1% discount for online payment.

Property tax in Rajkot: Latest news and updates

Rajkot proposes an increase in water charges, property tax

According to media reports, the authorities have rejected the plan to increase the property tax from Rs 11 per sqm to Rs 13 per sqm. However, a proposal to increase the tax rates for non-residential properties from Rs 22 per sqm to Rs 25 per sqm has been approved. This will result in an overall increase of 13.64%.

FAQs

What is the last date for paying the property tax in Rajkot?

The last date to pay property tax in Rajkot is May 31 of the financial year. Timely payment of the property tax is essential to avoid penalties.

How to pay property tax in Rajkot online?

Property owners in Rajkot can pay their property taxes online through the official website of the Rajkot Municipal Corporation.

How to pay property tax in Rajkot offline?

Property owners in Rajkot can pay their property taxes by visiting the nearest CSC centre or the local municipal office.

What are the documents required for property tax payment in Rajkot?

One is required to submit documents, such as a property tax bill, old property bill and Aadhaar card, for property tax payment in Rajkot.

What are the property tax rates in Rajkot?

The property tax rates in Rajkot are Rs 11 per square metre for residential properties and Rs 25 per square metre for commercial properties.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |