Rewari is a city in Rewari district located in the south-western part of Haryana. The city, with its proximity to the national capital Delhi and good connectivity, has been witnessing rapid development in recent years. This has also led to growth in its property market. If you are looking to buy a property in Rewari, it is important to know the process of property tax payment here. Owners of residential or commercial properties are required to pay property tax to the Municipal Council Rewari, Haryana. The civic authority is responsible for collecting tax and utilise the amount for the development of the city infrastructure and various public facilities. Through the official portal of Municipal Council Rewari, a property owner can pay his property tax online.

Check tax rates in Chandigarh and how to pay property tax online

Property tax in Rewari

Property tax in Rewari is an annual tax that all property owners must pay to the Municipal Council Rewari, Haryana. The property tax is determined based on factors, such as property type, location, age, etc. The authority also provides rebates on the overall tax amount.

How to pay property tax in Rewari?

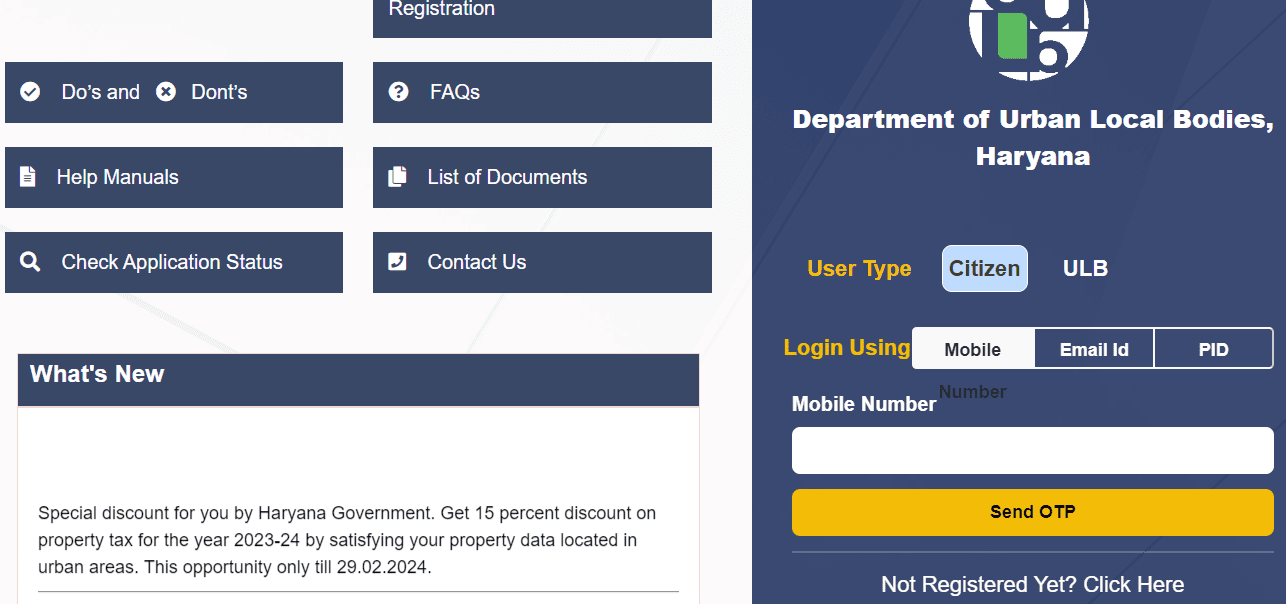

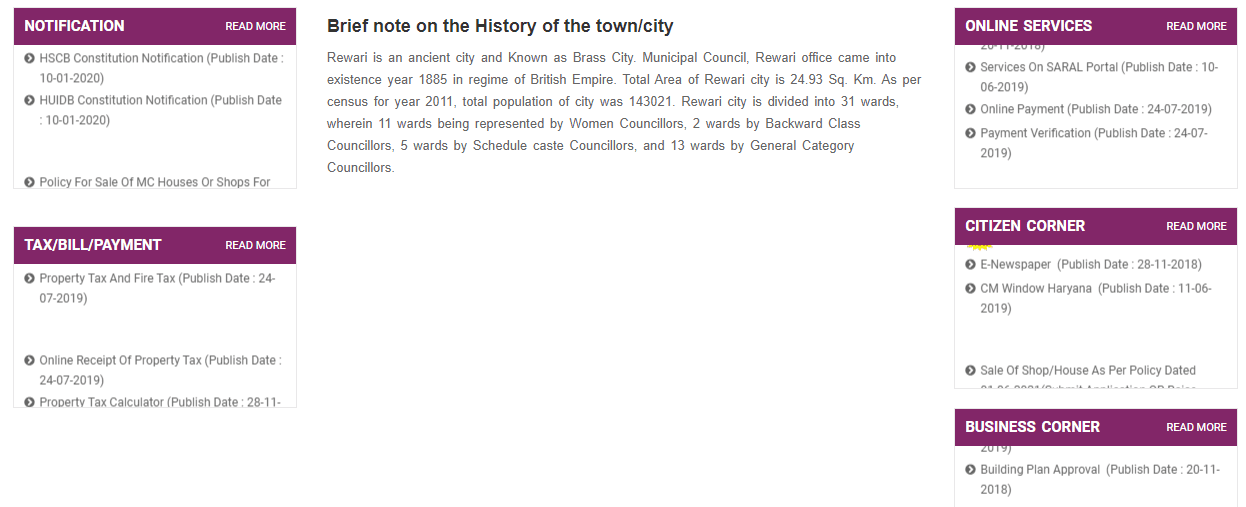

- Visit the official Municipal Council Rewari website at https://ulbharyana.gov.in/Rewari/557

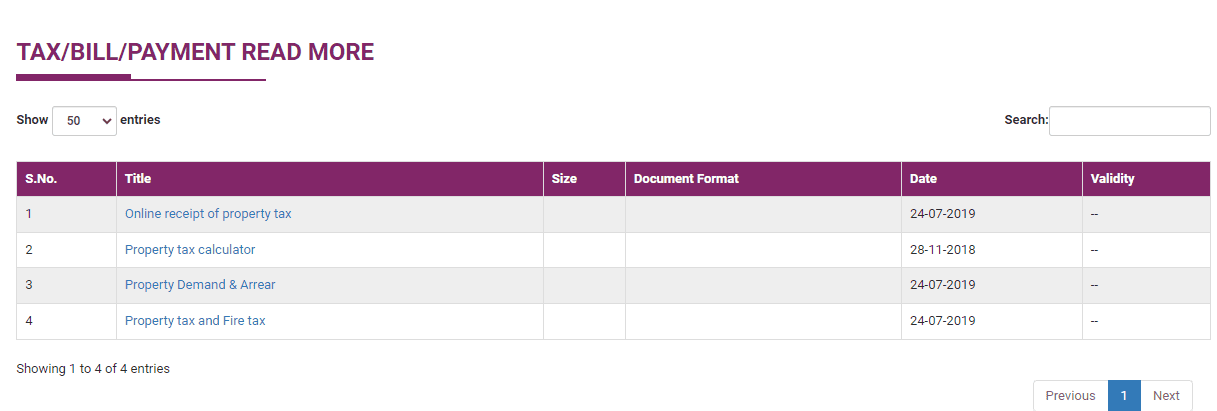

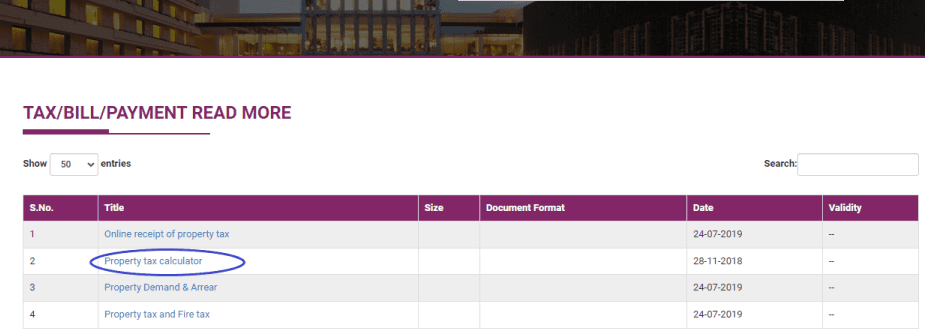

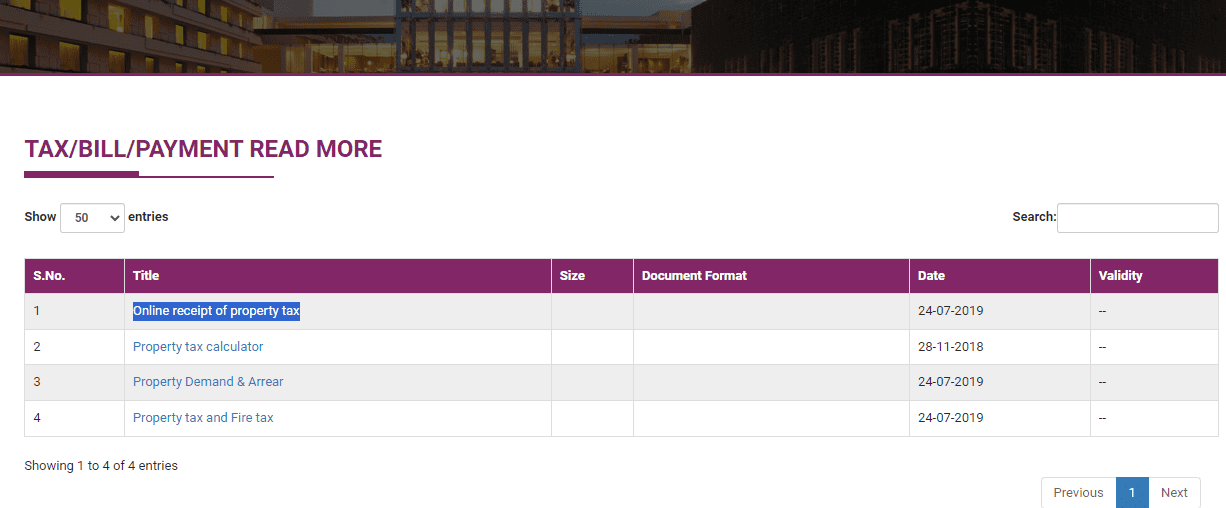

- Scroll down to the ‘Tax/Bill/Payment’ section on the homepage. Click on ‘Read More’ link.

- Click on ‘Property tax and Fire tax’ link.

- On the next page, click on the link ‘click here to view and pay property tax’.

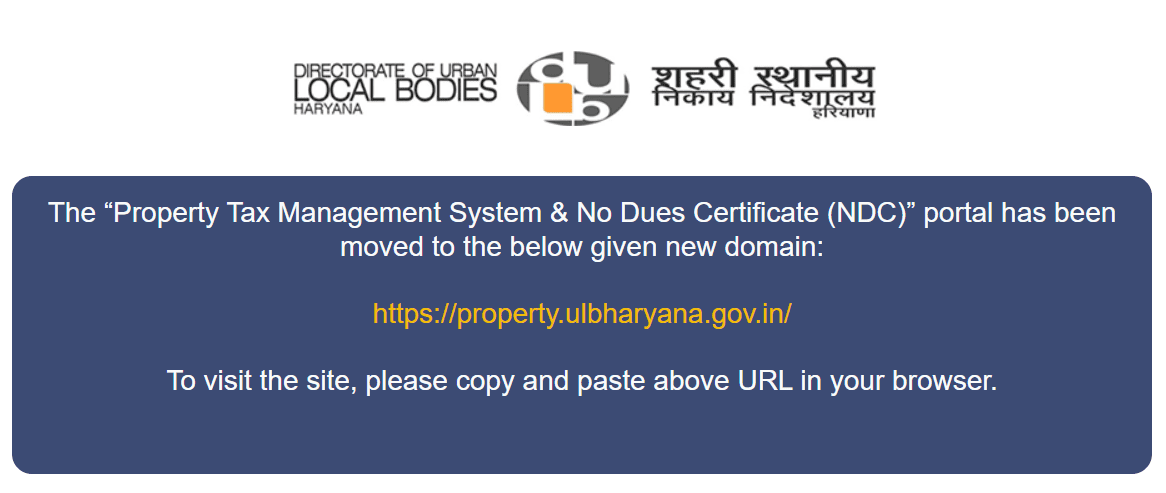

- Users will be directed to a new page at property.ulbharyana.gov.in.

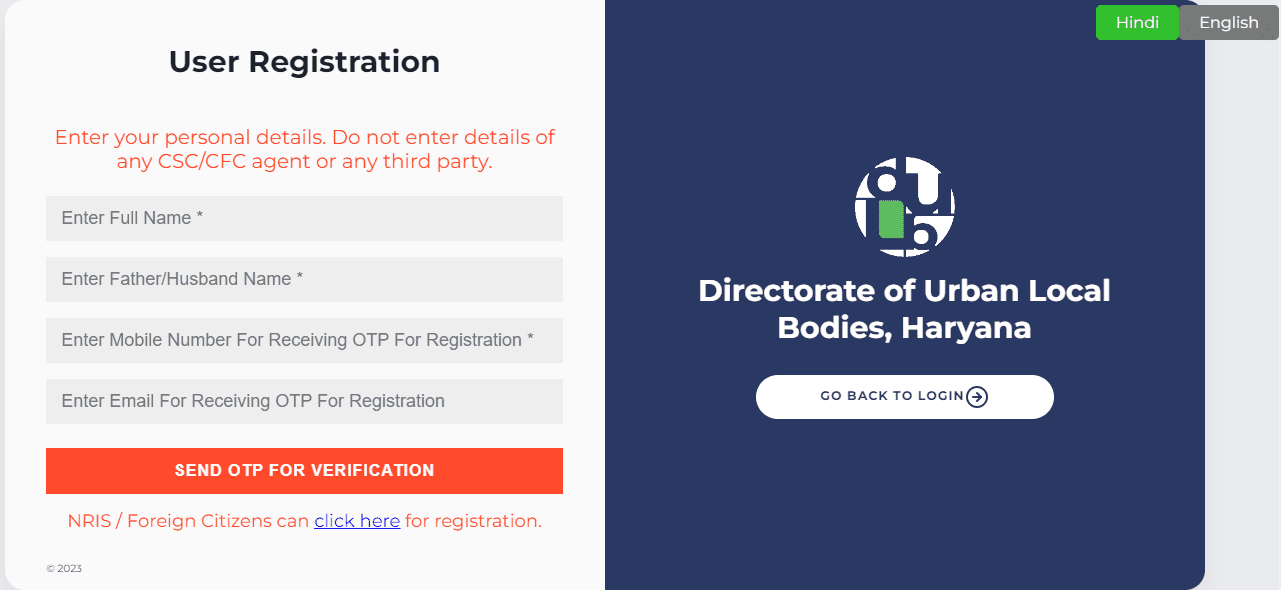

- On the next page, new users must click on ‘not registered yet? Click here’ link.

- Complete the registration by entering details, such as full name, father/husband name, mobile number, and e-mail ID to receive an OTP.

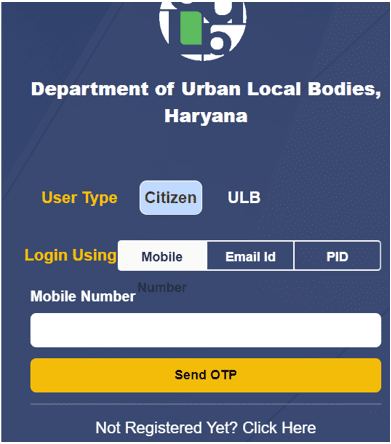

- After successful registration, go to the login page of property.ulbharyana.gov.in.

- Login using the registered mobile number, e-mail address, and property identification number (PID). Click on ‘Send OTP’.

After this, proceed to the next page to pay the property tax in Rewari.

Property tax rebate in Rewari

The Municipal Council in Rewari provides property tax rebates, which significantly reduce the tax burden for taxpayers and encourage them to pay property tax before the deadline. Property owners in Rewari can avail of a one-time rebate equivalent to 15% of the property tax till February 29, 2024.

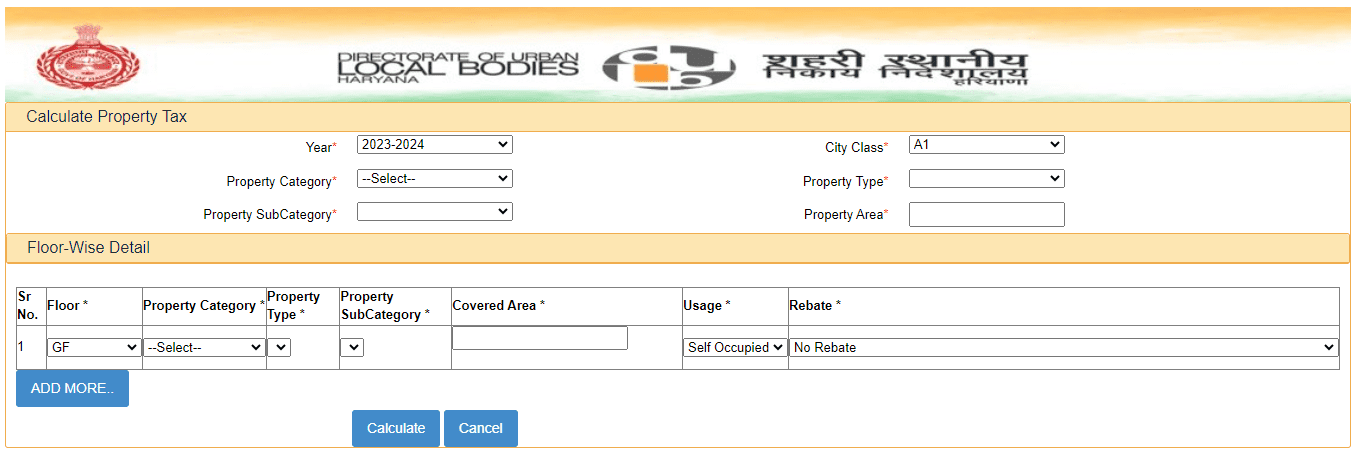

Property tax calculator in Rewari

The official portal of Municipal Council Rewari has a property tax calculator tool that enables taxpayers in Rewari to calculate their taxes. Here’s a step-by-step guide to calculate property tax in Rewari.

- Go to the official website of Municipal Council Rewari at ulbharyana.gov.in/Rewari.

- Scroll down to ‘Tax/Bill/Payment’ section on the homepage. Click on ‘Read More’.

- Click on ‘Property tax calculator’ link.

- Select year, city class, property category, property type, and property subcategory from the dropdown menu. Enter property area in the given field.

- Enter floor-wise details. Click on ‘Calculate’ to know property tax in Rewari.

Advance property tax payment in Rewari

Under advance property tax payment, property owners must pay property tax in Rewari within a specified deadline. Payment of property tax in Rewari on or before the due date allows taxpayers to avail of a one-time rebate of 15% on the overall tax value.

How to change name in property tax document in Rewari?

Property owners have the option to change their names in the property tax records. For this, they must adhere to the procedure as specified by the Haryana government.

- Applicants must apply to the municipality concerned.

- They must submit relevant documents, such as ID proof, ownership proof, and an affidavit, or undertaking certifying that the applicant is the rightful owner of the property.

- The authority will review the application. Once approved, the required fees or charges must be paid to the authority for implementing the name change.

The fees for changing the property owner’s name may differ for every municipality. After the successful payment of fees, the name is changed in the records.

How to find property ID in Rewari?

- Go to the official website https://property.ulbharyana.gov.in/ and login.

- Under ‘Search Property’ tab, choose name of the municipality from the dropdown menu.

- Search for property by entering any of the details, such as Colony, Property Category, Search by Plot Number, Property ID (eight characters), Old Property ID, Owner/Occupier Name or Mobile Number.

How to self-certify property ID in Rewari?

- After searching for property ID, click on ‘View Details’.

- Property details will be displayed on the screen.

- Under each sub-head, users will find a blue mark asking for correctness of the data to be verified by clicking ‘Yes’ or ‘No’.

- If all the data is correct, select ‘Yes’. Click on ‘Verify Details’.

- Property ID will be successfully self-authenticated.

How to create a new property ID in Rewari?

- Visit the official website https://property.ulbharyana.gov.in/.

- Search for a property using any of the following parameters: owner’s name, mobile number, or search by plot number.

- Users have the option to search on a GIS map by clicking on ‘Search on Map’ button.

- If users are unable to find their properties, click on ‘Please Click Here’ at the end of the page to create a new property ID.

- Read the terms and conditions. Check the box to agree. Click on ‘Click here to proceed’.

Online receipt of property tax in Rewari

- Go to the official website of Municipal Council Rewari at ulbharyana.gov.in/Rewari.

- Scroll down to ‘Tax/Bill/Payment’ section on the homepage. Click on ‘Read More’.

- Click on online receipt of property tax to proceed.

Property tax in Rewari: Latest news updates

Haryana government offers 15% discount to owners of urban properties

The Haryana government has announced 15% discount on property tax for 2023-24 for property owners of urban properties who make full payments of their taxes, provided the citizens self-verify their property data in urban areas before September 30, 2024.

Further, the government has allowed a one-time rebate of 15% to property owners who clear all property tax dues for 2010-11 to 2022-23 on the principal amount of property tax arrears for 2010-11 to 2022-23. With this, they should also self-certify their property details on the ‘Property Tax Dues Payment and No Dues Certificate Management System Portal’ by February 29, 2024.

The state government is also offering a one-time waiver of 100% interest on the property tax arrears pending from 2010-11 to 2022-23 to all taxpayers if their arrears are paid. They are required to self-certify their property deadline on the ‘Property Tax Dues Payment and No Dues Certificate Management System Portal’ on or before February 29, 2024.

FAQs

What is the last date to pay Rewari property tax?

The last date for property tax payment in Rewari is on or before February 29, 2024.

What are the charges for creating a new PID request?

No charges are applicable for creating a new PID request in normal mode.

How many days will it take for creating a new PID request?

It will take 10 working days for creating a new PID request.

How to pay property tax in Rewari offline?

Property tax in Rewari can be paid offline by visiting the nearest CSC centre.

How to pay Rewari property tax online?

Property tax in Rewari can be paid online through the official website of Municipal Council Rewari.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.