Property tax is levied on property owners by the local municipal bodies annually. A major source of revenue for the government, this is a compulsory tax to be paid by all property holders. The revenue generated is used in developing facilities in the area that come under the jurisdiction of the municipality. Failure to pay property tax can lead to penalty, as well as attachment and auction of properties.

How to pay property tax offline in Panchkula?

You can pay property tax online or offline in Panchkula. If you want to pay offline, you can visit any ward office in your area and make payment.

How to pay property tax online in Panchkula?

You can also pay property tax online in Panchkula, an easy and convenient way, which is also a preferred way these days.

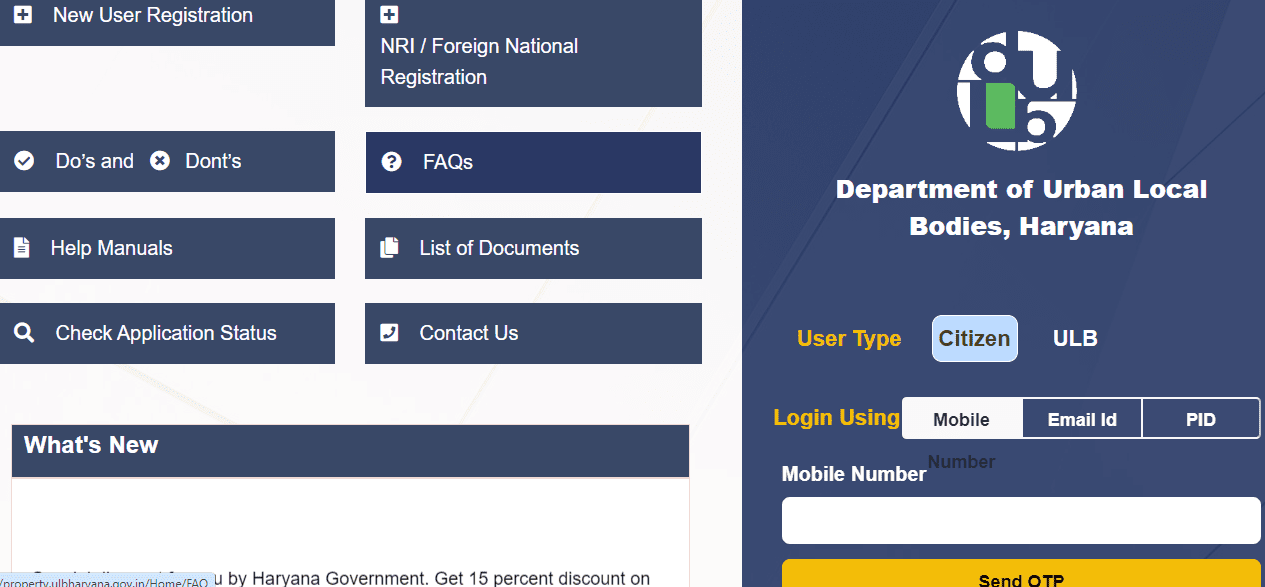

If you have created an account on the property tax portal, then you can login using your mobile number, email id, or PID.

In case you don’t have an account on the property tax Panchkula website, then click on new register and create an account.

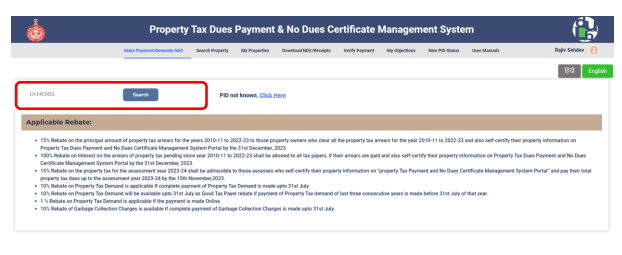

Once you login, and know your property ID number, click on Make Payment/Generate NDC.

Source: ULB Haryana

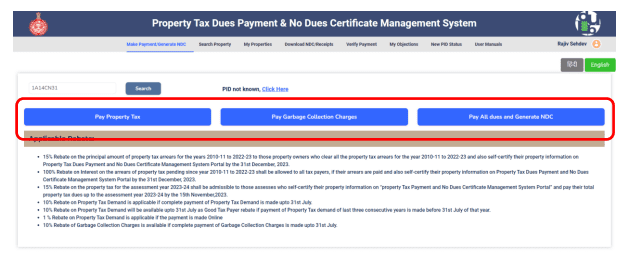

You will find below options:

- Pay property tax, where it can be paid.

- Pay all dues and generate NDC in which all pending payment can be done including property tax, garbage collection charges, and development charges.

Source: ULB Haryana

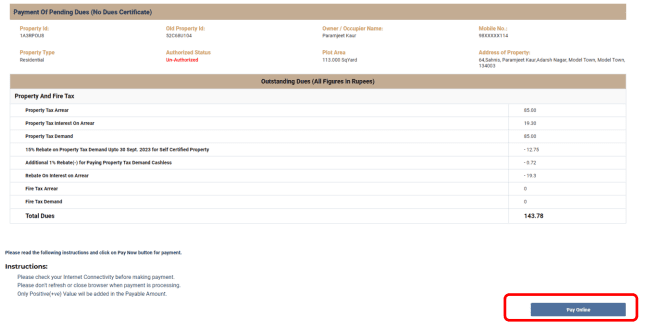

On selecting the right option, you will see the following page that will give split of the property tax and other details. You will see the total dues to be paid. Click on pay online button and proceed to make the online payment.

Source: ULB Haryana

Check your property tax and fire tax dues and pay your taxes only on the ULB official portal, or at the ULB office.

What are the documents required to create property ID number?

Identity proof of applicant:

- Aadhar card

- PAN card

- Parivar pehchaan patra

- Passport

- Driving licence

- Voter ID

Proof of ownership (Sale deed/Conveyance deed/Lease deed)

- Sale deed/conveyance deed

- Transfer deed/relinquishment deed/release deed/jamabandi/farad

- Allotment letter, re-allotment letter from any government or semi-government department or developer of licensed colony or developer of approved group housing

- Court decree (an affidavit or declaration regarding court decree, no court case is pending)

Site plan showing location

Building photograph

Additional documents for properties under Lal – Dora areas (any one of the following):

- In death case, legal heir certificate issued from the competent revenue authority/civil court

- Court decree registered with the revenue authorities

- Registry/sale deed

How to create a new property ID on the portal?

On the property portal Panchkula, search the property using your name, mobile number, or plot number. Alternatively, you can click on GIS map. Once found, click on please click here at the end of the page to create property ID. Accept terms and conditions and click on proceed.

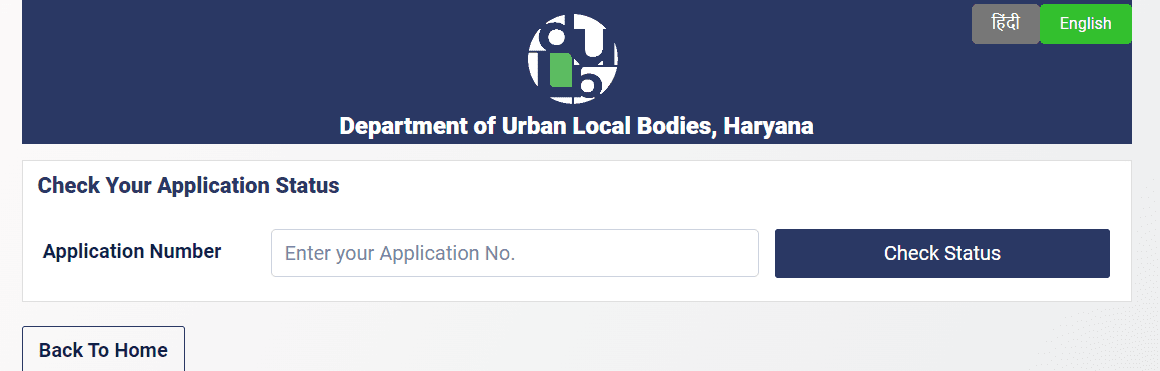

How to check application status on ULB?

To check application status, go to the following link:

https://property.ulbharyana.gov.in/Home/ApplicationStatus and enter application number and click on check status.

Source: ULB Haryana

How to self-certify your property ID on the portal?

On searching the property ID, click on view details. You will see all the property related details. Select ‘Yes’ if all property details are right and click on verify details. The property ID will be successfully self-authenticated.

Property tax Panchkula rebate

The Haryana government has announced a special discount of 15% percent on property tax for FY2023-24. People can take advantage of this rebate till February 29, 2024.

Also, a one-time rebate of 15% shall be allowed on the principal amount of property tax arrears from 2010-11 to 2022-23 to property owners who clear all the property tax arrears for 2010-11 to 2022-23. They should also self-certify their property information on ‘Property Tax Dues Payment and No Dues Certificate Management System Portal’ by February 29, 2024.

Also, a one-time waiver of 100% of interest on the arrears of property tax pending since 2010-11 to 2022-23 shall be allowed to all tax payers, if their arrears are paid and also self-certify their property information on ‘Property Tax Dues Payment and No Dues Certificate Management System Portal’ by February 29, 2024.

FAQs

What is the website for paying property tax online in Panchkula?

Login to https://property.ulbharyana.gov.in/ to pay property tax.

Is manual application required for applying no dues certificate?

No, manual application is not required for applying no dues certificate.

How to generate No Dues Certificate (NDC) from the portal?

You should pay all dues and generate the NDC. Once it’s generated, click on print. You can also generate it by entering the transaction number and mobile number under the 'Download NDC/Receipts' and clicking on 'Search'. You have to click on 'Action' and download the NDC.

How can I update my details in less than 10 working days on property tax portal Panchkula (Priority Service)?

Tatkal service can be done in two working days once the payment has been done successfully. The fees under the Tatkal scheme is Rs 2,500.

Can you pay property tax offline in Panchkula?

Yes, you can visit the ward office of the municipal corporation to pay property tax offline in Panchkula.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]