Property owners in Amritsar should pay an annual property tax to the Amritsar Municipal Corporation (AMC). Following are the rates at which property tax is charged in Amritsar, Punjab:

Property tax rate in Amritsar 2024

| Property type | Property tax rate |

| Residential property of up to 500 sqm | 0.5% of annual value at 5% of total unit value |

| Residential property of more than 500 sqm | 1% of annual value at 5% of total unit value |

| Commercial property | 5% of annual value at 5% of total unit value |

See also: How to pay property tax in Mohali?

Documents/details required to pay property tax online in Amritsar

Existing users

- Unique Property ID

- Existing Property ID

- Mobile

New users

Address proof

One of these documents is needed:

- Electricity bill

- Water bill

- Gas bill

- Aadhaar card

- Voter ID

- Driving license

- Passport

* In case of multiple/institutional applicants, please provide ID of primary or authorized person.

Identity proof

One of these documents is needed:

- Aadhaar card

- Voter ID

- Driving license

- Pan card

- Passport

* In case of multiple/institutional applicant, please provide ID of primary or authorized person.

Registration proof

One of these documents is needed:

- Sale deed

- Gift deed

- Patta certificate

- Registered will deed

- Partition deed

- Court decree

- Property auction

- Succession or death certificate

- Family settlement

- Unregistered will deed

* In case of multiple registrations, provide registration proof for all.

Usage proof

One of these documents is needed:

- Electricity bill

- Trade license

- Institution registration document

* In case of multiple floors/units please provide the usage proof of all floors/units.

Special category proof

One of these documents is needed:

- Service document

- Handicap certificate

- Below poverty line card

- Death certificate

* In case of multiple owners, please provide the special category proof of all owners (in case of special category).

Occupancy proof

* In case of multiple floors/units please provide the occupancy proof of all floors/units.

Construction proof

- BPA certificate

*In case of multiple floors/units, please provide the construction proof of all floors/units.

How to pay Amritsar property tax online?

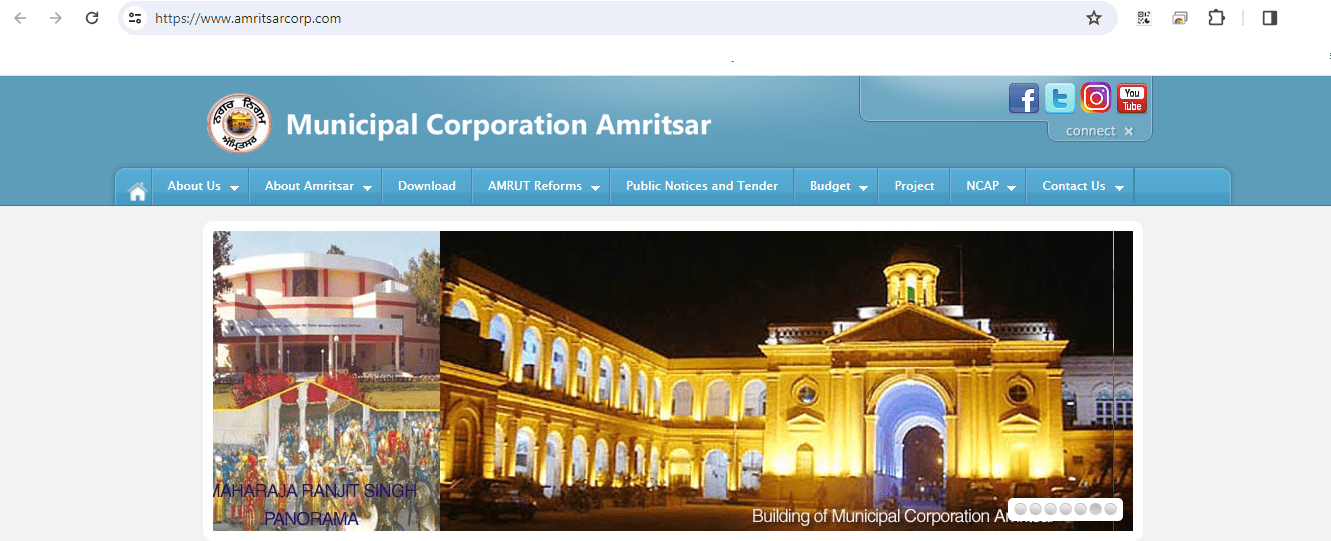

Step 1: Go to the Amritsar Municipal Corporation official website.

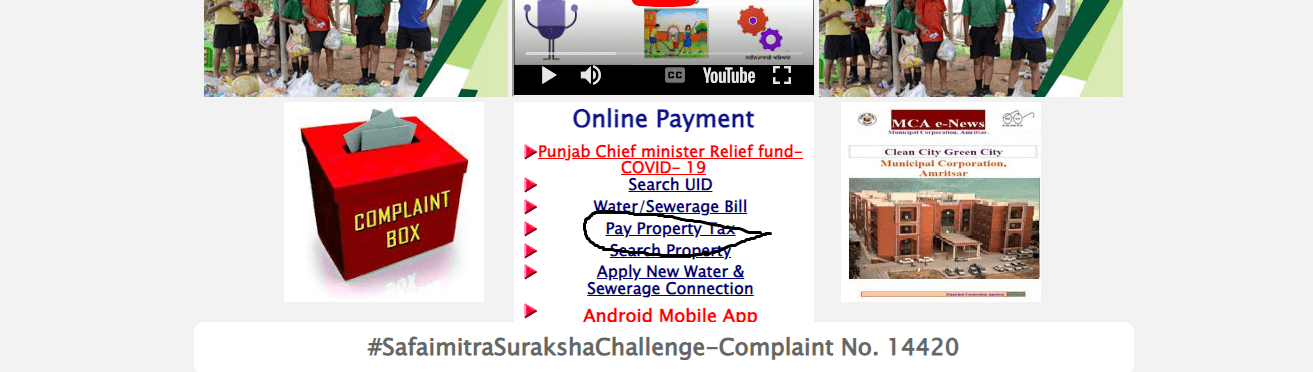

Step 2: Scroll down the page and you will find Pay Property Tax at the center of the page as shown in the image below.

Step 3: You will be redirected to a new page with an option to pay property tax. Click on it.

Step 4: You can choose the language between English and Punjabi.

Step 5: Provide your name and mobile number to proceed.

Step 6: You will receive an OTP on your mobile. Enter the OTP and click on ‘Continue’.

Step 7: On the next page, click on property tax.

Property tax payment for new users

Step 10: Click on Add New Property.

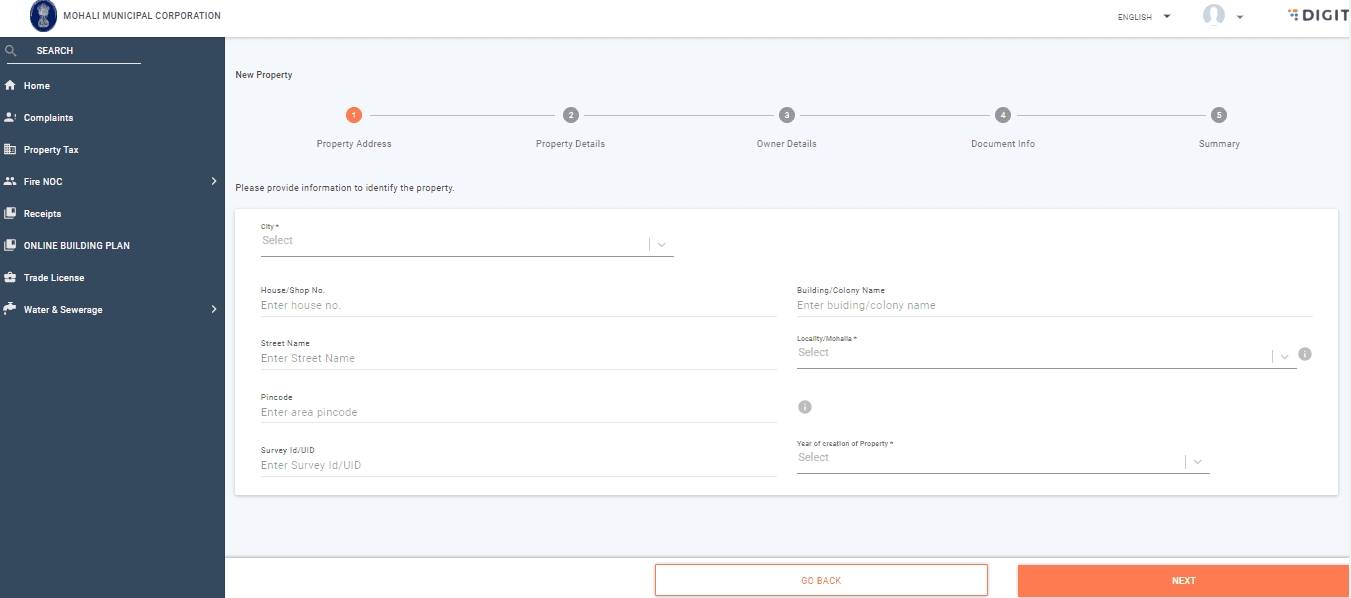

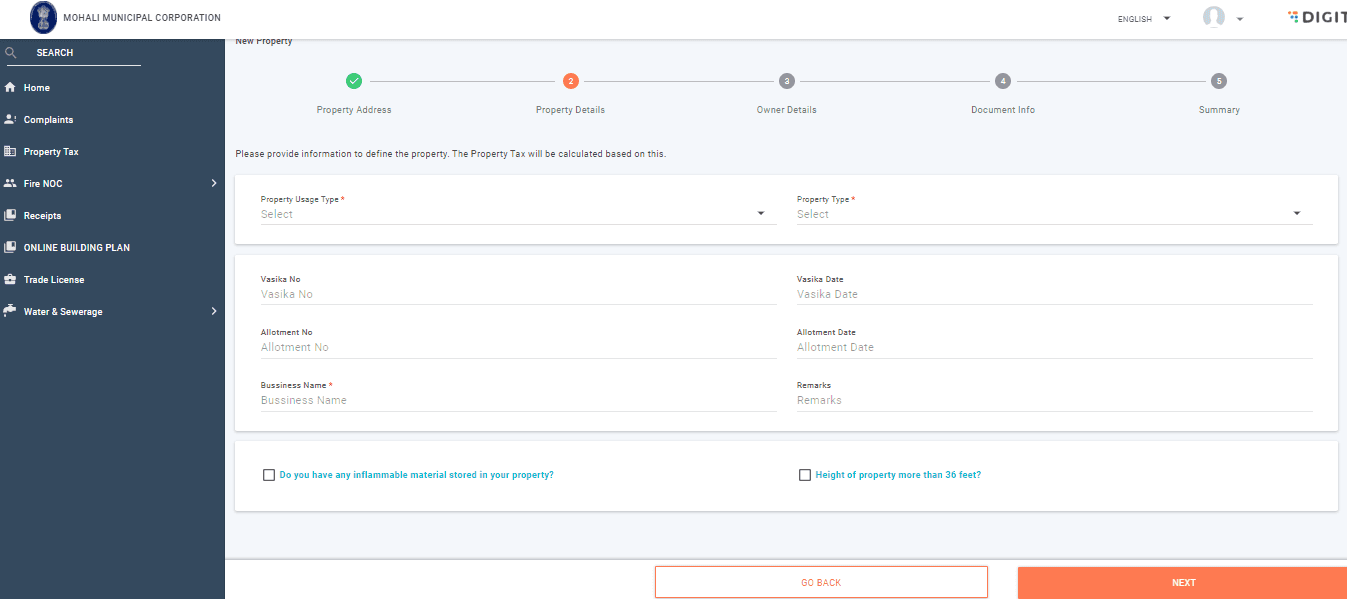

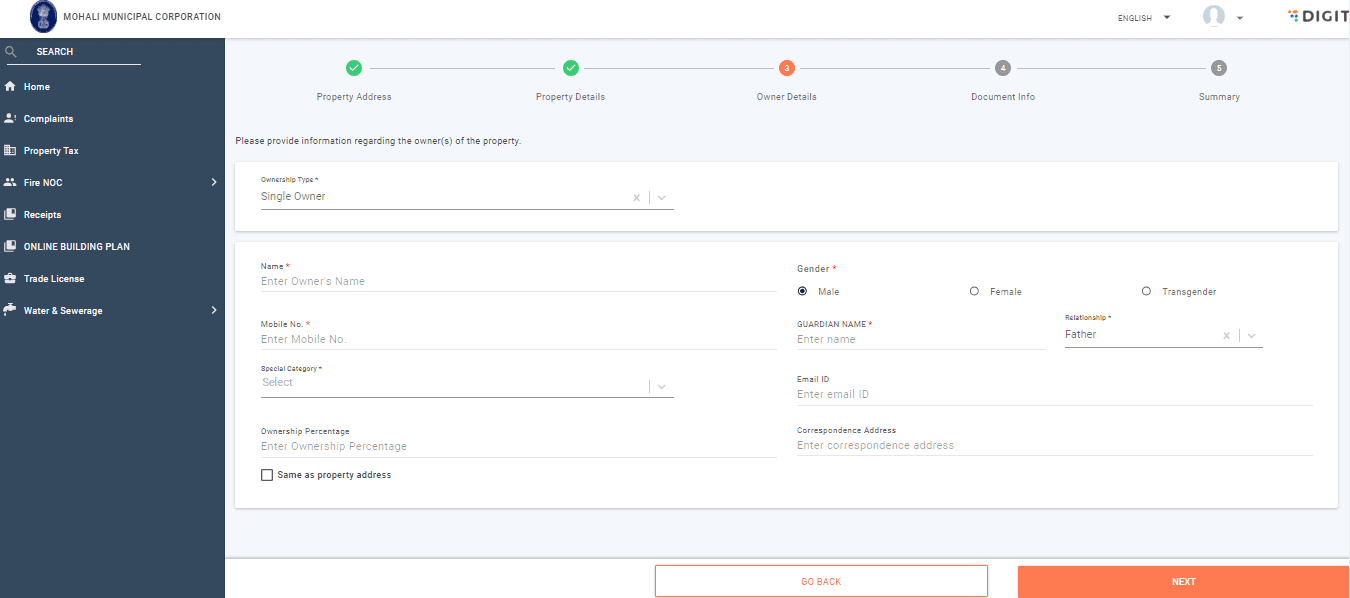

Step 11: You will have to fill detailed form divided in four sections:

Property Address

Assessment Information

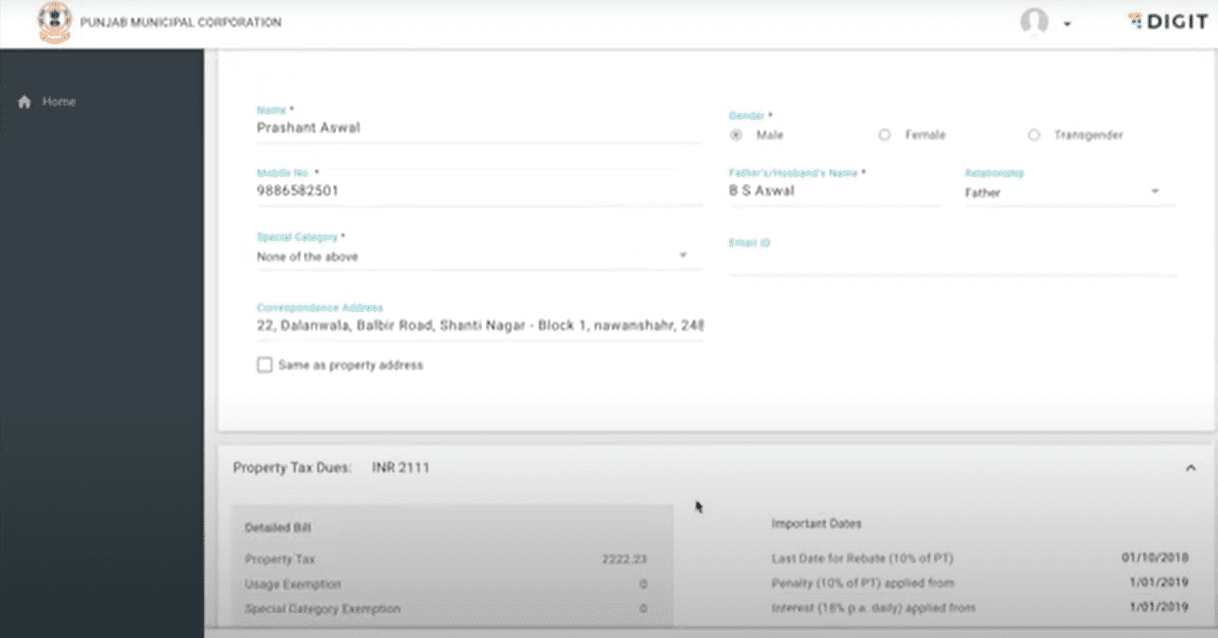

Owner Details

Review and Pay

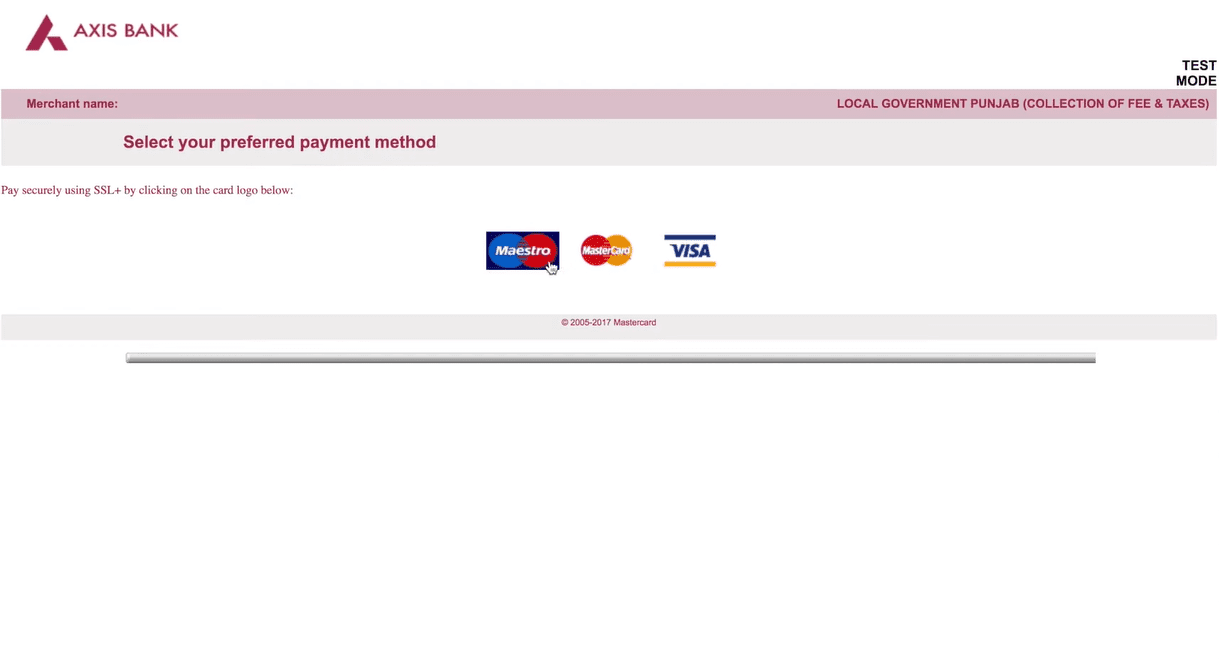

Step 12: Once all the details are filled, choose your payment method.

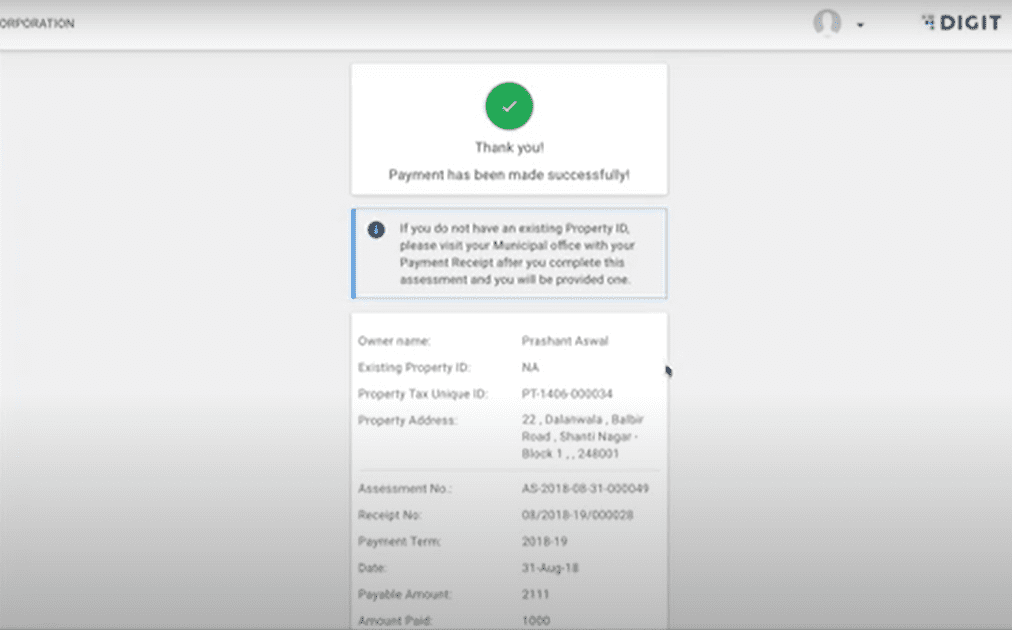

Step 13: Once the payment is made successfully, you will receive an acknowledgement receipt.

Faqs

What is a property tax?

Property tax is imposed by local bodies on property ownership.

How many times an owner should pay property tax in a year?

The owner must pay property tax once a year.

How do I pay my property tax in Amritsar?

You can pay your property tax by searching your property either with Unique Property ID/Old Property ID or with property details like mohalla, door number, and owner name, using credit/debit cards, net-banking to make an online payment.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]