Shimla, the capital of Himachal Pradesh, is emerging as a preferred real estate destination. The Municipal Corporation of Shimla is responsible for delivering various civic services and developing the city’s infrastructure. The civic authority is responsible for collecting property taxes from the residents. Property owners in Shimla can pay their property taxes using the official portal of the Municipal Corporation Shimla or offline through cash or cheque. They are eligible for a property tax rebate of 10% by paying the tax within the deadline.

Property Tax Shimla: Overview

All property owners in Shimla are required to pay an annual property tax to the Municipal Corporation Shimla. The property tax rates are different for residential and non-residential properties. The civic authority has a user-friendly portal through which one can pay the property tax using their mobile number, bill number and other details.

Property tax rate in Shimla in 2024

The property tax rate in Shimla differs based on the property type. According to the official portal, the unit area rate of tax on lands and buildings within the municipal area ranges between 1-25% of the rateable value. This is determined by the authorities. The property tax in Shimla is levied on the net rateable value at 15% in Zone A and 10% in Zone B for lands and buildings as mentioned below:

| Zone | Property type and area | Property tax rate |

| A Zone | Self-occupied residential properties measuring 1-100 sq. mt. | 3% p.a. on the rateable value (RV) |

| Self-occupied residential properties measuring 101 sq. mt. and above. | 6% p.a. on the RV | |

| Non-residential properties | 10% p.a. on the RV | |

| B Zone | Self-occupied residential properties measuring 1-100 sq. mt. | 2% p.a. on the RV |

| Self-occupied residential properties measuring 101 sq. mt. and above | 4% p.a. on the RV | |

| Non-residential properties | 5% p.a. on the RV |

Source: Municipal Corporation Shimla, Himachal Pradesh

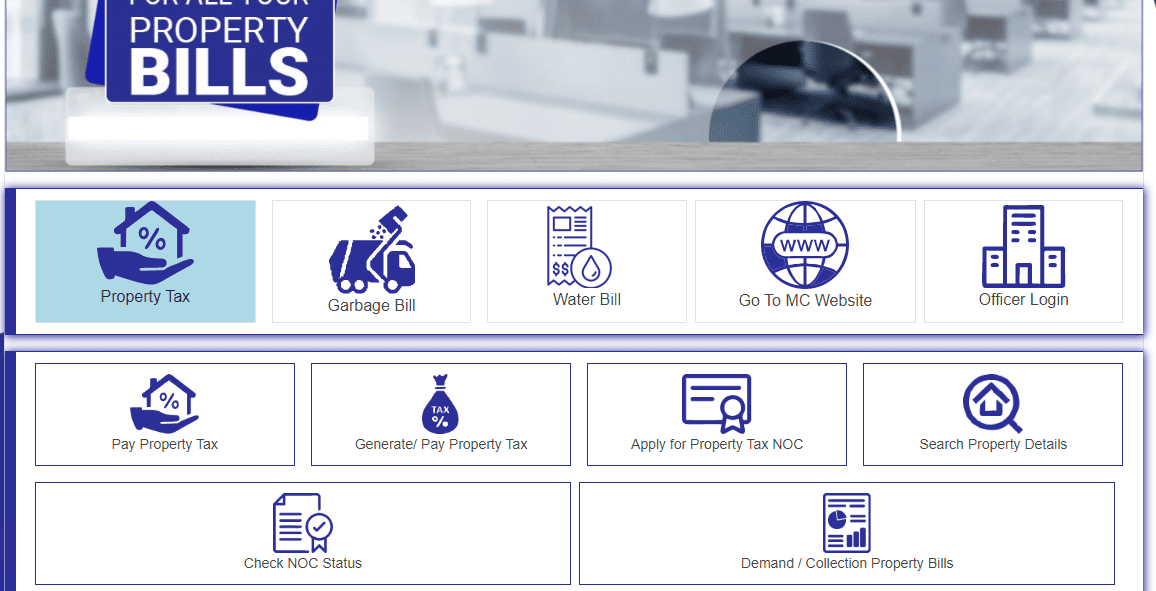

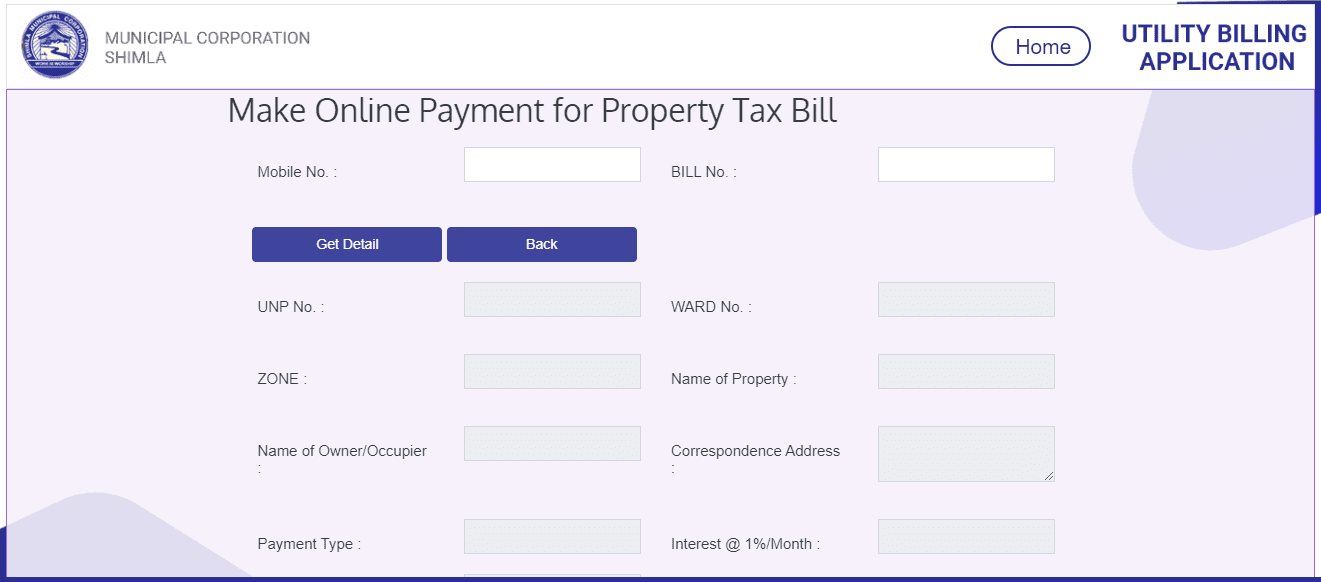

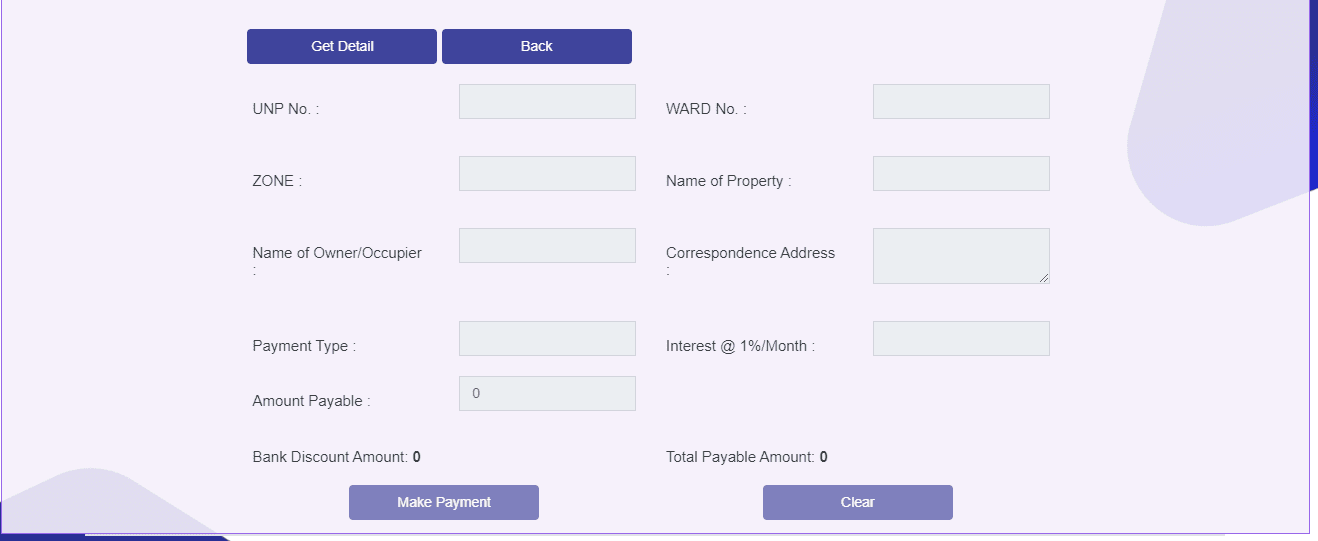

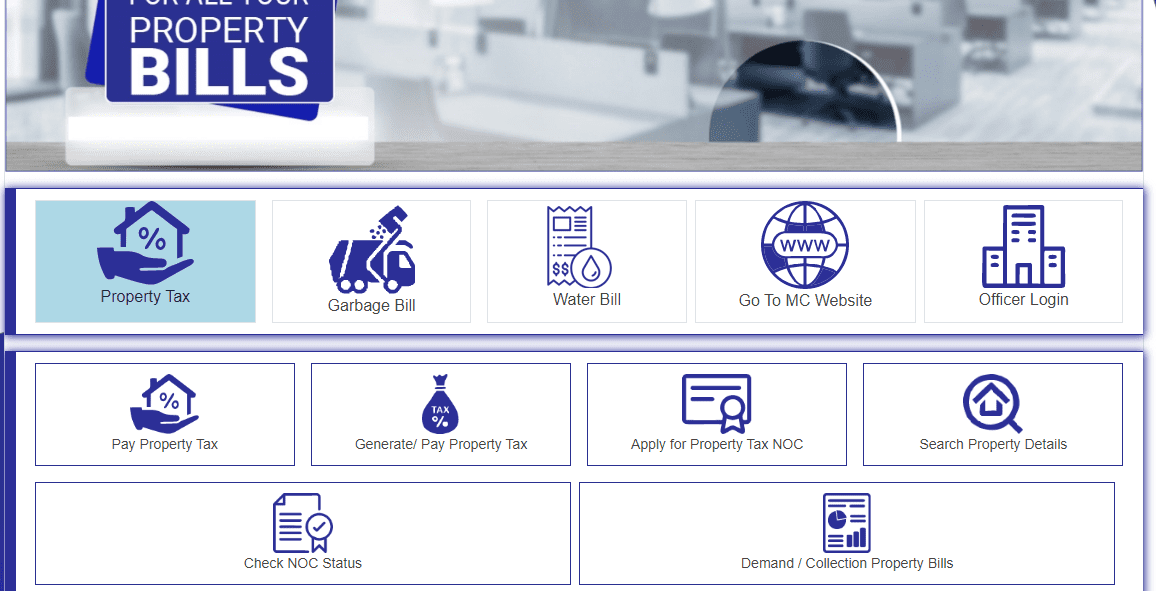

How to pay property tax in Shimla online?

- Visit the official website of Municipal Corporation Shimla at https://mybill.shimlamc.org/.

- Click on ‘Property tax’.

- Click on ‘Pay Property tax’.

- Provide all the required details.

- Click on ‘Make Payment’.

How to pay Shimla property tax offline?

Before proceeding to pay Shimla property tax offline, get the property assessed by the authority. One can contact the municipal office to know the property tax amount.

After getting the property assessment details, visit the municipal office and submit the details along with the required documents. The officer will verify the documents and confirm the amount to be paid.

Complete the payment using cash, DD or cheque. A receipt will be issued, which must be kept for future reference.

Shimla property tax payment: Documents required

- Form number based on assessment list for property tax (Unique number for the property)

- Old form number (previous number through which tax was paid)

- Property owner’s name

- Property address

- Aadhaar card

What is the property tax rebate in Shimla?

The Municipal Corporation of Shimla offers a property tax rebate for taxpayers who pay advance tax. Property owners who pay property tax in Shimla within 15 days are eligible for a 10% rebate on the overall tax amount.

If the property tax bill is issued by post, the payment can be made within 18 days from the date of sending the bill by post to avail of the 10% rebate. If payment is received after one month of the close of the financial year, interest of 1% per month will be charged up to the payment date.

Property tax calculator in Shimla

Property tax in Shimla is calculated based on several factors, based on different zones as determined by the municipal corporation:

- Property location

- Occupancy

- Type of structure

- Age of building

- Use of building

Advance property tax payment in Shimla

Advance property tax payment in Shimla enables property owners to pay their property tax before the last date. Payment of property tax in advance makes them eligible for a rebate of 10% on the overall tax value.

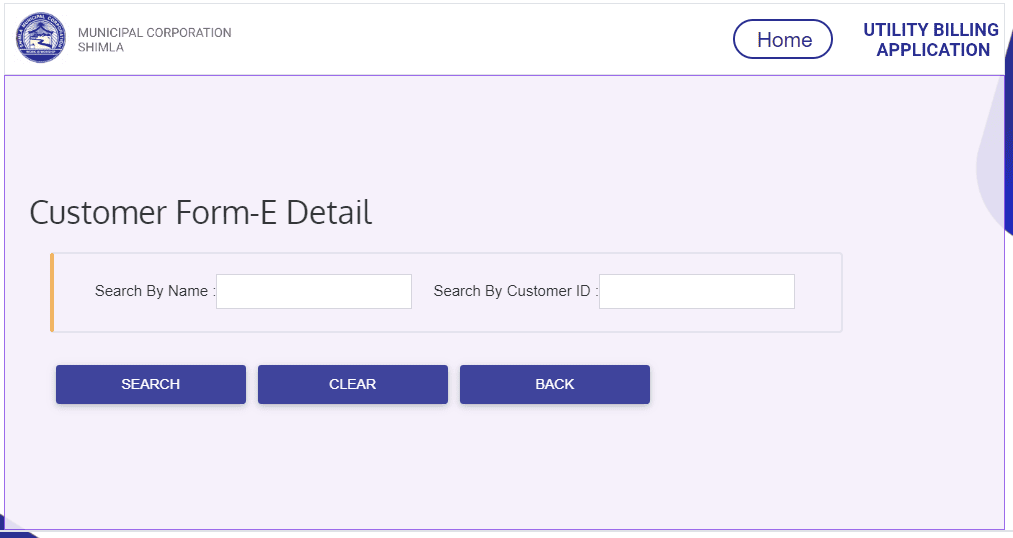

How to search property details in Shimla?

- Visit the official website of Municipal Corporation Shimla at https://mybill.shimlamc.org/.

- Click on ‘Property Tax’.

- Click on ‘Search property details’.

- Users have two options – Search by name or Search by customer ID

- Enter the relevant details and click on ‘Search’ to view the property tax details.

Housing.com News Viewpoint

The online facility provided by the Municipal Corporation of Shimla has simplified the process of property tax payment in the city. This replaces the offline process of visiting the municipal office. Property owners must pay their property taxes on time to avail of rebates.

FAQs

What is the last date to pay the property tax in Shimla?

The last date for property tax payment in Shimla was on or before October 31, 2023. A 5% penalty is levied if taxpayers do not pay their dues within the deadline.

What is the property tax rebate in Shimla?

By paying property tax in Shimla within the specified period, one can get a rebate of 10% of the overall tax value.

How to check property taxes online in Shimla?

Visit the official portal of the Municipal Corporation of Shimla at mybill.shimlamc.org to pay property taxes online.

How is property tax in Shimla calculated?

Area (in square metres) of a unit X value of relevant factors of unit area. The result obtained will be the net rateable value of the unit and property tax will be charged on that value at the rate of 15% in Zone A and 10% in Zone B for lands and buildings.

What is the demand for property tax?

Demand for property tax is raised annually by issuing a single property tax bill on Form B for each unit of property. The service of the bill is effected by hand, self-generation, SMS and by post under certificate of posting or by registered speed post.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at Jhumur Ghosh |

Harini is a content management professional with over 12 years of experience. She has contributed articles for various domains, including real estate, finance, health and travel insurance and e-governance. She has in-depth experience in writing well-researched articles on property trends, infrastructure, taxation, real estate projects and related topics. A Bachelor of Science with Honours in Physics, Harini prefers reading motivational books and keeping abreast of the latest developments in the real estate sector.