The GHMC property tax is an expense that all property owners in Hyderabad have to bear. GHMC property tax amount is used for betterment and maintenance of amenities and facilities and for infrastructure development in the area.

See also: Everything about property tax Nagpur

GHMC property tax payment

Property owners in Hyderabad pay property tax to the Greater Hyderabad Municipal Corporation (GHMC). All property owners in Hyderabad are legally obliged to make the GHMC property tax payment once a year, unless they enjoy GHMC property tax exemption, because they belong to a specific category of owners.

Discussed in this article are aspects such as GHMC property tax online payment, property tax slab, liability and steps to pay your property tax in Hyderabad.

See also: All about the BBMP property tax

See also: Know how to do KMC assessee no search by name

GHMC property tax: Calculation

To calculate GHMC property tax, the GHMC uses the annual rental system for calculation of property tax on residential, as well as commercial buildings. Even if the building is not actually earning any rent, the municipal body levies property tax, based on its potential to generate rent. Depending on the value attached to the property, a specific tax rate is applied. To find out the annual rental value of your property, you could use the GHMC property tax calculator online.

See also: All about the property tax calculator Delhi

GHMC property tax: Rates

| Monthly rental value of property | Tax rate* |

| Rs 50 | Nil |

| Rs 51-100 | 17% |

| Rs 101-200 | 19% |

| Rs 201-300 | 22% |

| More than Rs 300 | 30% |

*Rates are inclusive of lighting, drainage and conservancy tax.

See also: All about e panchayat Telangana

How to calculate GHMC property tax?

The GHMC conducts surveys of every area under its purview and fixes a monthly rent on the plinth area per sq ft. Plinth area is the entire built-up area of your building, including balconies, parking, lawns, etc. You could click here to find out the monthly rent on the plinth area per sq ft on your building.

Check out property rates in Hyderabad

GHMC property tax calculation example

How the monthly rental value is decided

You could arrive at the monthly rent by multiplying the plinth area with the state-notified monthly rent value.

In case of a 500 sq ft home, its monthly value would be Rs 2,500, assuming the monthly value per sq ft is Rs 5. By now multiplying the amount by 12, one can arrive at the annual value of the property – Rs 30,000 in this case.

The annual value of the property must be divided in two equal parts – i.e., between the land value and the building value, as has been prescribed by the Hyderabad municipal body. This is done to decide the age of the building and extend rebate on tax payment.

See also: How to find property UID number in Raipur

In our example, thus, the annual value of the property would thus be:

Rs 15,000 in case of land, and

Rs 15,000 in case of building

See also: All about the MCGM property tax

Age rebate on building

| 0-25 years | 10% |

| 26-40 years | 20% |

| More than 40 years | 30% |

Let us assume that a 10% depreciation is allowed on our building value, as it is 15 years old.

The annual rental value of the property would thus be:

Rs 15,000+Rs 13,500 (after reducing 10% or Rs 1,500 from the building value)= Rs 28,000

So, our total net annual rental value would be Rs 28,000.

Since the monthly value of the property exceeds Rs 300, the 30% tax slab would be applicable. On this value, a library cess of 8% has to be applied.

Property tax would be: 30% of Rs 28,000 = Rs 8,400

On the value, we have now reached, 8% library cess has to be imposed.

8% of Rs 8,400= Rs 672

Total property tax for the year: Rs 8,400+672 = Rs 9,072

See also: All about e Panachayat Telangana

How to generate PTIN to pay GHMC property tax?

Before starting the process, the taxpayer should be ready with his 10-digit Property Tax Identification Number (PTIN). In case of old properties, the GHMC allots a 14-digit PTIN.

See also: Know how to pay Ahmedabad Municipal Corporation property tax

How to generate PTIN

Owners of new properties have to get a PTIN generated, by giving an application to the city deputy commissioner along with copies of their sale deed and occupancy certificate. After physically verifying the property and all the legal documents, a PTIN and house number is issued to the owner by the authority.

See also: GWMC House Tax: Know all about paying property tax in Warangal

How to generate PTIN online

The PTIN could also be generated through ‘Online Self Assessment Scheme’ introduced by the GHMC.

Go to https://www.ghmc.gov.in/Propertytax.aspx, and click on ‘Online Services’ to land on ‘Self Assessment of Property’.

Now, provide all personal and property details, including locality, building permission number, occupancy certificate number, nature of the building, usage, plinth area, etc. After you key in the details, the approximate annual property tax will be displayed on the screen.

The online application will now be forwarded to the deputy commissioner. The official concerned will visit the premises and a PTIN number will be issued to the owner.

Info. regarding: Flats for rent in Hyderabad

What if you have forgotten your PTIN?

In case you have forgotten your PTIN, log on to the GHMC website and click on the ‘Enquiry’ section. Under this section, you will find the sub-section ‘Property Tax’. On clicking this, you will reach the page ‘Search Your PTIN’.

On the page that appears, you will have to key in your circle number, name, village name and door number and click ‘submit’ to get your PTIN.

After this, you can proceed to pay your GHMC property tax.

See also: All about Telangana’s TS-bPASS building permission rules

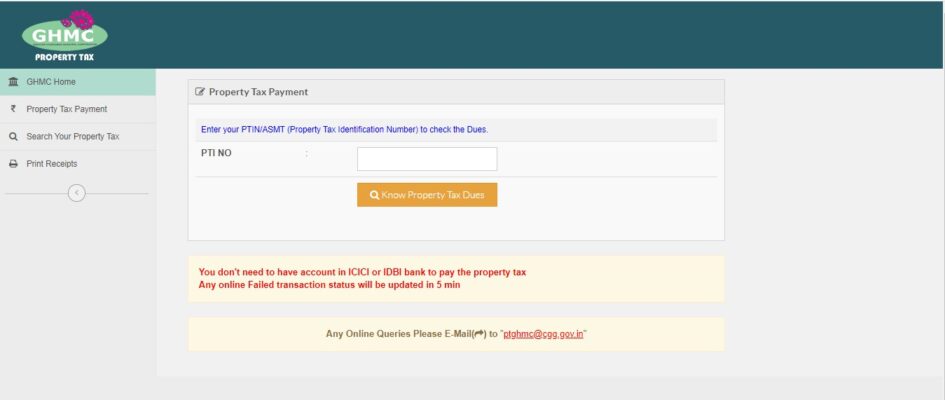

GHMC property tax online payment steps

Step 1: Log on to the GHMC website. Go to ‘Online Payments’ and select the ‘Property Tax’ option.

Step 2: Enter your PTIN and click on ‘Know Property Tax Dues’.

Step 3: On the page that now appears, verify the details, including arrears, interest on arrears, adjustments, property tax amount, etc.

Step 4: Select your mode of payment. You could use your net banking or debit card or credit card, to make the payment.

Step 5: After the payment is made, you will get a receipt for your payment. You could print a copy of the receipt using your PTIN. Note here that you cannot generate the online receipt for tax paid offline.

Know about: Rent a flat in Hyderabad

How to pay GHMC property tax offline?

The GHMC property tax can be paid offline, by visiting a MeeSeva counter, Citizen Service Centre, bill collectors or any branch of State Bank of Hyderabad. You will have to carry the following documents to make the payment:

- Sale deed.

- Occupancy certificate.

- Copy of the building plan.

- Cheque or demand draft drawn in favour of the GHMC commissioner.

Know about: Sale of Independent houses in Hyderabad

When to pay GHMC property tax?

The last date for half-yearly GHMC property tax payment is July 31 and October 15 of every year.

Penalty on late payment of GHMC property tax

The tax payer has to pay a penal interest of 2% per month on the outstanding amount, in case of delay beyond the GHMC property tax due dates.

Concession/ exemption from paying GHMC property tax

|

Looking for a house for sale in Hyderabad? Check here

GHMC property tax FAQs

How to calculate GHMC property tax Hyderabad for shops?

The GHMC fixes a monthly rental value to a commercial property for taxation purposes, based on its exact location, usage, type and construction. Below is the formula to calculate property tax on your commercial property: Annual property tax = 3.5 x plinth area in sq ft x monthly rental value in Rs/sq ft.

How to find out my PTIN to pay property tax in Hyderabad?

Log on to the GHMC website https://www.ghmc.gov.in/Propertytax.aspx and click on the ‘Search Your Property Tax’ tab under the section ‘Quick Links’.