An important aspect of a property transaction in Rajasthan is the payment of stamp duty and registration charges. This is controlled by Rajasthan Stamp Act of 1908 and is calculated as a percentage of the property’s value. The Rajasthan Registration Department oversees the collection and enforcement of these charges.

See also: All you need to know about Rajasthan Bhu Naksha

What is stamp duty in Rajasthan?

Stamp duty in Rajasthan is the compulsory tax that is levied by the government on legal documents to validate transactions related to property and other financial agreements. The stamp duty in Rajasthan serves as proof of ownership and has to be paid during property registration. It is calculated on the basis of the DLC Rate in Rajasthan. The stamp duty Rajasthan comes under the purview of E-Panjiyan, the registration and stamps department in Rajasthan. As per Section 10 of the Rajasthan Stamps Act, stamp duty in Rajasthan can be paid using adhesive stamps, impressed stamps, and franking machine.

See also: What is a title deed?

Stamp duty and registration charges in Rajasthan 2025

| Gender | Stamp duty | Registration charges | Total registry charges |

| Men | 6% + 20% (of 6%) labour cess | 1% | 8.2% |

| Women | 5% + 20% (of 5%) labour cess | 1% | 7% |

See also: All about DLC rate Rajasthan

Stamp duty Rajasthan 2025 for affordable housing units

- The Rajasthan government charges 0.5% of the consideration value for lease or sale deed of projects executed under the Pradhan Mantri Awas Yojana (PMAY) or the Chief Minister’s Awas Yojana.

- The Rajasthan stamp duty for low income housing will be 1% of the consideration value.

- The Rajasthan stamp duty on revalidated lease deeds has been revised. Post revalidation, the government will charge 120% of the stamp duty on original lease deed.

- The lease deeds executed by the state government or a public body will attract stamp duty that is as per rates under the Article 33 of the Rajasthan Stamp Act, 1998.

Factors on which stamp duty Rajasthan is based on

- Gender: Stamp duty Rajasthan differs based on the gender. Men in Rajasthan have to pay more stamp duty for the same property as compared to women.

- Age of the buyer: Age plays an important role in determining stamp duty. Senior citizens get a rebate on stamp duty.

- Age of the property: A new property may command more stamp duty as compared to an old property.

- Usage of property: Usage of property— residential, commercial or industrial plays an important role in calculating stamp duty of the property.

- Location of the property: A property located near the central area will command more stamp duty as compared to a property located in the periphery.

Stamp duty in Rajasthan for various transactions in 2025

| Document |

Stamp duty applicable | Stamp duty after rebate | Surcharge payable | Registration |

| Agreement to sale without possession | 3% of the total consideration | 0.5% of the consideration | Yes | Optional |

| Agreement to sale with possession (male) | 6% of the market value of the property | 6% | Yes | Compulsory |

| Agreement to sale with possession (female) | 6% of the market value | 5% | Yes | Compulsory |

| Agreement to sale with possession (female

SC/ST/BPL) |

6% of the market value of the property | 4% | Yes | Compulsory |

| Agreement to sale with possession (disabled) | 6% of the market value of the property | 5% | Yes | Compulsory |

| Agreement to sale executed between the developer and purchaser under Chief Minister Jan Aawas Yojna-2015 for sale of residential unit | 3% of the total consideration | 0.5% of the consideration | Yes | Optional |

| Certificate of sale | 6% of the total consideration or market value of the property, whichever is higher | 6% | Yes | Optional |

| Certificate of sale (Female SC/ST/BPL) | 6% of the total consideration or market value of the property, whichever is higher | 4% | Yes | Optional |

| Certificate of sale (Female other than SC/ST/BPL) | 6% of the total consideration or market value of the property, whichever is higher | 5% | Yes | Optional |

| Certificate of sale (disabled 40% or above) | 6% of the total consideration or market value of the property, whichever is higher | 5% | Yes | Optional |

| Gift deed stamp duty in Rajasthan in favour of father, mother, son, brother, sister, daughter-in-law, husband, son’s son, daughter’s son, son’s daughter, daughter’s daughter | 6% of the market value | 2.5% of the market value | Yes | Compulsory |

| Gift deed stamp duty in Rajasthan in favour of daughter | 6% of the market value | 1% or Rs 1 lakh, whichever is less | Yes | Compulsory |

| Gift deed stamp duty in Rajasthan in favour of wife, if executed up to March 31, 2022 | 6% of the market value | 0 | Yes | Compulsory |

| Gift deed stamp duty in Rajasthan in favour of wife, if executed after March 31, 2022 | 6% of the market value | 1% or Rs 1 lakh, whichever is less | Yes | Compulsory |

| Gift deed stamp duty in Rajasthan in favour of widow by her deceased husband’s mother, father, brother, or sister | 6% of the market value | 0 | Yes | Compulsory |

| Gift deed stamp duty in Rajasthan in favour of widow by her own mother, father, brother, sister, son or daughter | 6% of the market value | 0 | Yes | Compulsory |

| Gift deed stamp duty in Rajasthan regarding residential flat or house executed by any person private, in favour of the wife of the martyr, if the wife of the martyr is not alive, then in favour of either minor daughter or minor son and if the martyr was unmarried, then in favour of either father or mother. | 6% of the market value | 0 | Yes | Compulsory |

| Order of land use change under the Rajasthan Urban Areas (change of land use) Rules, 2010 or any other relevant rules | 6% of the market value | 6% of the amount of charge of land use change, minimum Rs 500 | Yes | Compulsory |

| Partition (non-ancestral property) | 6% of the market value | 3% of market value | Yes | Compulsory |

| Partition (ancestral property) | 6% of the market value of the separated share or shares | 0 | Yes | Compulsory |

| Partition deed of ancestral agricultural land | 6% of the market value | 0 | Yes | Compulsory |

* Note: The above-mentioned stamp duty is levied in the state since July 14, 2020.

Stamp duty in Rajasthan for power of attorney

| Condition | Stamp duty applicable after rebate |

| When given for consideration and authorising the attorney to sell any immovable property | 6% |

| When given for consideration and authorising the attorney to sell any immovable property (Female SC/ST/BPL) | 4% |

| When given for consideration and authorising the attorney to sell any immovable property (Female other than SC/ST/BPL) | 5% |

| When given for consideration and authorising the attorney to sell any immovable property (In case of disability of 40% and above) | 5% |

| When power of attorney is given without consideration to sell immovable property to – the father, mother, brother, sister, wife, husband, son, daughter, grandson or granddaughter of the executant | Rs 2,000 |

Power of attorney is a document that allows a third person to execute the transaction and other issues on behalf of the owner. These are the stamp duty charges for a power of attorney (POA) or adhikar patra or mukhtarnama in Rajasthan.

See also: All about laws of property registration in India

Stamp duty in Rajasthan for agricultural land

One has to pay a stamp duty of 5% for agricultural land transactions in Rajasthan. The stamp duty rates of agricultural land are less than that of residential and commercial development.

Stamp Duty in Rajasthan for bank guarantee

A bank guarantee requires stamp duty. In Rajasthan, one has to pay a stamp duty of 0.5% on the guarantee amount. This is important so that the financial agreements remain valid.

Stamp Duty in Rajasthan for home loan agreement

In case a home buyer wants a home loan, he may have to execute a loan agreement for which he has to pay a stamp duty in Rajasthan. This range between 0.1% and 0.5% of the loan amount.

Lease deed registration charges in Rajasthan 2025

| Condition | Stamp duty charges |

| Lease deed below 1 year | 0.02% of the market value of the property |

| Lease deed of 1 year to 5 years | 0.1% of the market value of the property |

| Lease deed exceeding 5 years and up to 10 years | 0.5% of the market value of the property |

| Lease deed exceeding 10 years and up to 15 years | 1% of the market value of the property |

| Lease deed exceeding 15 years and up to 20 years | 2% of the market value of the property |

| Lease deed exceeding 20 years and up to 30 years | 4% of the market value of the property |

| Lease deed exceeding 30 years and perpetual | 6% (after rebate) |

| Lease deed exceeding 30 years and perpetual (Female other than SC/ST/BPL) | 5% (after rebate) |

| Lease deed exceeding 30 years and perpetual (Female SC/ST/BPL) | 3% (after rebate) |

| Lease deed exceeding 30 years and perpetual (In case of disability of 40% and above) | 5% (after rebate) |

Role of DLC Rate Rajasthan in calculating stamp duty on property

When it comes to calculating stamp duty in Rajasthan, it is done on the basis of the higher value between the property’s actual value and the DLC Rate in Rajasthan.

Case 1: When DLC Rate Rajasthan is lower than the actual sale price

Suppose Aarti Khandelwal is going to buy a residential property whose value is Rs 50 lakh. The DLC Rate of this property is Rs 40 lakh. As per the rules, Khandelwal will need to pay stamp duty on the higher value, which is on Rs 50 lakh.

Case 2: When DLC Rate Rajasthan is higher than actual sale price

Suppose Aarti Khandelwal buys a property worth Rs 50 lakh and the DLC Rate for this property is Rs 55 lakh. Therefore, Aarti Khandelwal will have to pay stamp duty on the higher of the two, which is at Rs 55 lakh.

How to calculate stamp duty in Rajasthan 2025?

If Ram buys a property worth Rs 50 lakh in Jaipur, Rajasthan, the calculation of the total property value that he has to finally pay including stamp duty and registration charges is as follows.

Property value: Rs 50 lakh

Stamp duty: Rs 3.6 lakh ( 7.2% of Rs 50 lakh)

Registration charges: Rs 50,000 (1% of 50 lakh)

Total amount of the property: Rs 54,10,000

Documents required for property registration

- Deed of exchange

- Partition deed

- Transfer instruments

- Reconveyance of mortgaged property

- Gift deed

- License agreement

- Tenancy agreement

- Lease deeds

- Power of attorney

See also: All you need to know about RERA Rajasthan

How to pay stamp duty in Rajasthan online?

- To pay the stamp duty in Rajasthan online, visit https://epanjiyan.rajasthan.gov.in/

- Pay the stamp duty charges using the payment gateway of the bank.

- One can also pay stamp duty by using the net banking facility offered by the bank.

Also read: Meaning, importance and how to calculate the Ready Reckoner Rate

How to pay stamp duty in Rajasthan offline?

- You can pay stamp duty and registration charges by going to the sub-registrar’s office.

- Ensure that you take along with you all documents so that the payment can be successfully made.

What is the house registration charges in Rajasthan?

- The registration charges for both men and women is 1% of the property value. So, if the value of the property is Rs 1 crore, then the registration charges to be paid is Rs 1 lakh.

- This is a one-time payment that has to be done.

- This registration charge is applicable on all types of properties- residential, commercial and industrial.

- This payment has to be done to ensure legal ownership of the property.

See also: All about franking charges

What are the tax benefits given for stamp duty payment in Rajasthan?

Under section 80 C of the IT Act, one can get benefits of up to Rs 1.50 lakh on paying stamp duty in Rajasthan. One can avail this benefit while filing their IT returns. However, note that this deduction can be availed only in the year of property purchase.

What is the penalty for failing to pay stamp duty in Rajasthan?

Under Indian Stamp Act 1899 and Registration Act 1908, it is mandatory to pay stamp duty and registration charges.

- One has to pay stamp duty in Rajasthan within 30 days of the property transaction. In case there is a delay in the payment of stamp duty of your property in Rajasthan, you’ll have to pay a 2% monthly penalty.

- If a person doesn’t pay stamp duty in Rajasthan, then he has to pay 8–20% of the stamp duty as penalty and also may face imprisonment.

How to apply for stamp duty refund in Rajasthan?

If you want to apply for stamp duty refund in Rajasthan, mentioned steps should be followed.

- Log on to https://epanjiyan.rajasthan.gov.in/Refund/onlinerefund.aspx

- From the drop-down box, select refund type – stamp duty, registration fees or both. Next, select reason and then district and click on Applicant Detail.

- You will see a pop-up box where you should fill in details such as applicant name, father/husband name, mobile number, applicant address and email, and click on Add and proceed with the process.

To track the stamp duty refund, click on Login (if already applied). Enter details such as refund token number, password, captcha code and click on Modify or View Status depending on your preference.

Challenges faced while paying stamp duty and registration charges in Rajasthan

The common challenges faced by people while paying the stamp duty and registration charges in Rajasthan are:

- Wrong calculation of stamp duty and registration charges to be paid that results in wrong budgeting of value of property. In case you pay insufficient stamp duty, you will have to pay the balance (sometimes with fine) before proceeding with registration. To avoid this, use the Rajasthan stamp duty calculator or professional services.

- Not getting the Rajasthan property documents on time

- Not knowing about any rebate that the Rajasthan government is offering.

Tips to remember before paying Rajasthan Stamp Duty 2025

- The stamp paper for Rajasthan stamp duty should only include name of the person involved in property transaction.

- All assets on which stamp duty Rajasthan is applicable should be stamped before registration date or next working day from the date of execution of the deed.

- Stamping can be done within three months if the deed is executed outside the specific territory.

- Date mentioned on stamp duty should not be more than six months from the date of transaction.

- Uploading all supporting documents on the e-Panjiyan portal on time.

- Fill correct property details, transaction value and other asked information.

- Pay the fees on time.

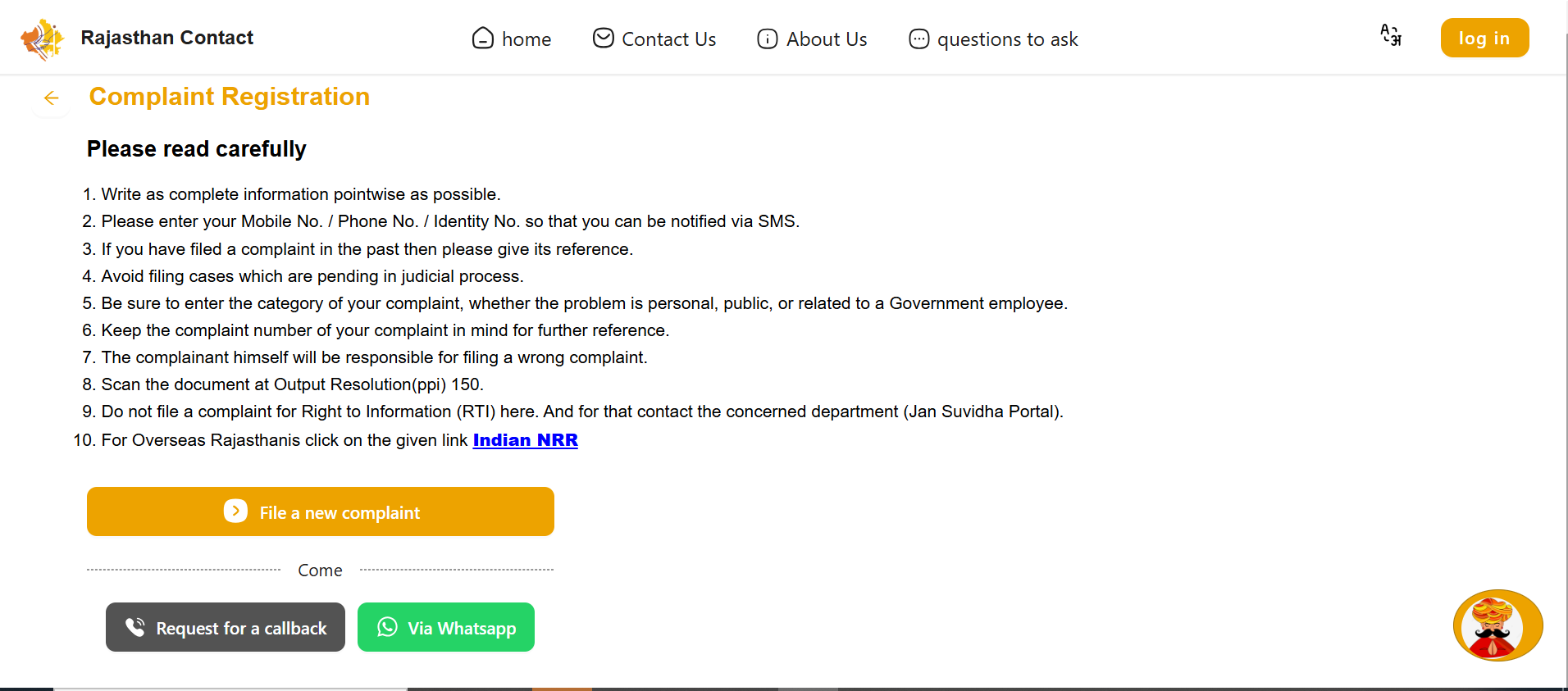

How to register complaints regarding stamp duty in Rajasthan 2025?

- To register a complaint with respect to stamp duty in Rajasthan, visit https://sampark.rajasthan.gov.in/

- Click on file a new complaint.

- You will reach a new page where you should login with your Username and Password.

- Once done, a complaint form will open under which you can write your complaint in detail and submit.

- You can also request for a callback or contact via WhatsApp

Stamp duty exemptions in Rajasthan

Rajasthan offers exemptions and concessions in stamp duty for the following:

- Transactions of rural lands for agricultural purposes are exempted from stamp duty.

- Transfer of property to immediate family members of martyrs are exempted from stamp duty.

- Stamp duty concessions are available for women, disabled people and senior citizens.

Stamp duty in Rajasthan vs stamp duty Gujarat

Gujarat and Rajasthan are neighbouring states. When you compare the stamp duty in Rajasthan with that Gujarat, you will see that the stamp duty for properties in urban areas of Gujarat are higher than that of Rajasthan. These range between 4% and 6% and there are also additional surcharges. Because of this property is more affordable in Rajasthan comparatively.

Impact of stamp duty on Rajasthan real estate

As per media reports, plots in Rajasthan have had a higher push towards sales because of the lower stamp duty they used to command as compared to stamp duty levied on flats. A small comparison between them suggests that while stamp duty, registration charges and tax for apartments is around 23%, it is close to only 3% for plots, seeing the demand move to the latter. Another trend that has been seen in the Rajasthan real estate market is that it offers a rebate of 1% on stamp duty for women as compared to that for men. Thus, there is an increase in registration of property in a woman’s name in the state.

Stamp duty in Rajasthan 2025: Contact details

2nd Floor, Kar Bhawan, Todarmal Marg, Ajmer, Rajasthan 305001

Phone: 0145 262 7590

Housing.com POV

Payment of stamp duty and registration charges is essential for a property transaction. These one-time charges are mandatory as they give your property an entry into the government legal records. You may use the online or the offline method to pay stamp duty. However, note that you do not skip payment as non-payment attracts penalty and also harsh punishment.

The stamp duty in Rajasthan for male is 6%, while for women it is 5%. This is one of the reasons why for a couple it may actually be a good idea to buy a property in the wife’s name in Rajasthan. For instance, suppose Vimesh is buying a property worth Rs 10 lakh, the stamp duty on real estate would come to Rs 60,000. In the case of a woman buyer, she would have to pay Rs 50,000 only. The difference becomes higher in case of properties priced higher.

FAQs

When was stamp duty in Rajasthan revised?

Stamp duty in Rajasthan was last revised in June-July 2020.

Where can I find the stamp vendor license form?

You can easily find the stamp vendor license form on the official website of the Registration and Stamps Department, government of Rajasthan.

Which toll free number can be called for grievances about the stamps department?

You can also call the toll free number 181.

How many times do you have to pay stamp duty and registration charges in Rajasthan for a property?

Stamp duty and registration charges in Rajasthan is a one-time charge.

What are the types of properties on which stamp duty is applicable?

Stamp duty Rajasthan is applicable on residential, commercial and industrial properties.

| Got any questions or point of view on our article? We would love to hear from you.Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |