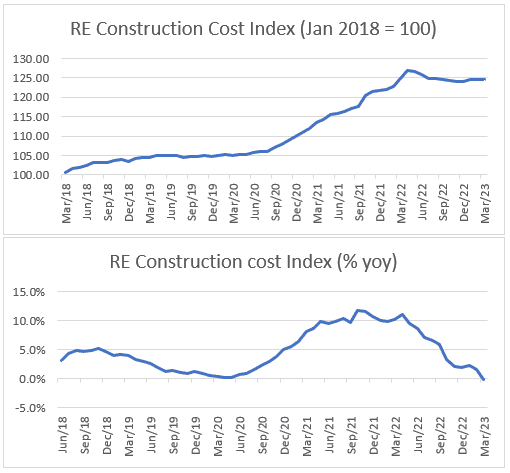

According to TruBoard Partners, a tech-focused asset monitoring solutions provider, construction costs increased by 5% YOY in FY23 Vs 10.2% in FY22. This is broadly in line with the actual cost escalations experienced by developers, according to an official release. The TruBoard Real Estate Construction Cost Index captures the monthly movement in construction cost and the trends in material and labour costs over a time.

Sangram Baviskar, MD-Real Estate Practice at TruBoard Partners, said “The major chunk of the construction costs comes from construction materials. Material costs increased significantly by around 12% in FY22 on account of COVID-19 related supply chain bottlenecks. As the economy and supply chains recovered commodity prices came off their COVID highs, resulting in material costs going up by only around 5% in FY23. Energy prices witnessed a spike in the first half of FY23, but eventually tapered off as concerns over global growth became dominant. Labour cost increases in FY23 have remained benign and at the same levels as last year.”

The cost index is constructed using monthly Wholesale Price Index (WPI) (2011-12 = 100) data released by the Central Statistics Office, Ministry of Statistics and Programme Implementation (MoSPI), and CPI-IW data by the Labour Bureau. Of the WPI data released for over 800 commodities, relevant commodities are filtered specifically for real estate construction. Weight to each commodity is assigned in proportion to its quantity used in construction. The final cost index is a weighted average of the individual commodity price indices and CPI-IW.

Source: TruBoard Partners

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at jhumur.ghosh1@housing.com |