House rent allowance (HRA) is typically a part of an employee’s salary. This salary component is taxable under income tax laws in India even though tax deduction to a certain limit is offered. To save tax on the HRA component of your salary, you have to provide recent receipts as the proof to your employer every year. This is true if a tenant is paying more than Rs 3,000 as monthly rent.

Therefore, your employer insists that you produce the documentary proof of paying the rent every quarter, failing which a high amount of tax is deducted from your salary.

Is providing rent receipt mandatory to claim HRA exemption?

Yes, according to the government, “though for purposes of grant of house rent allowance, a rent receipt may not be insisted upon by government, it is necessary for granting the exemption under Section 10(13A) that the employee should have actually incurred the expenditure on rent”.

“For purposes of deduction of tax, the disbursing officer should ensure that the employee concerned has in fact incurred the expenditure on rent. The payment of rent should be verified through rent receipts in the cases of all employees,” a circular issued by the income tax department says.

Rent receipt format

Rent receipt format is based on identification details of the landlord and tenant, monthly rent amount and address of the rented property.

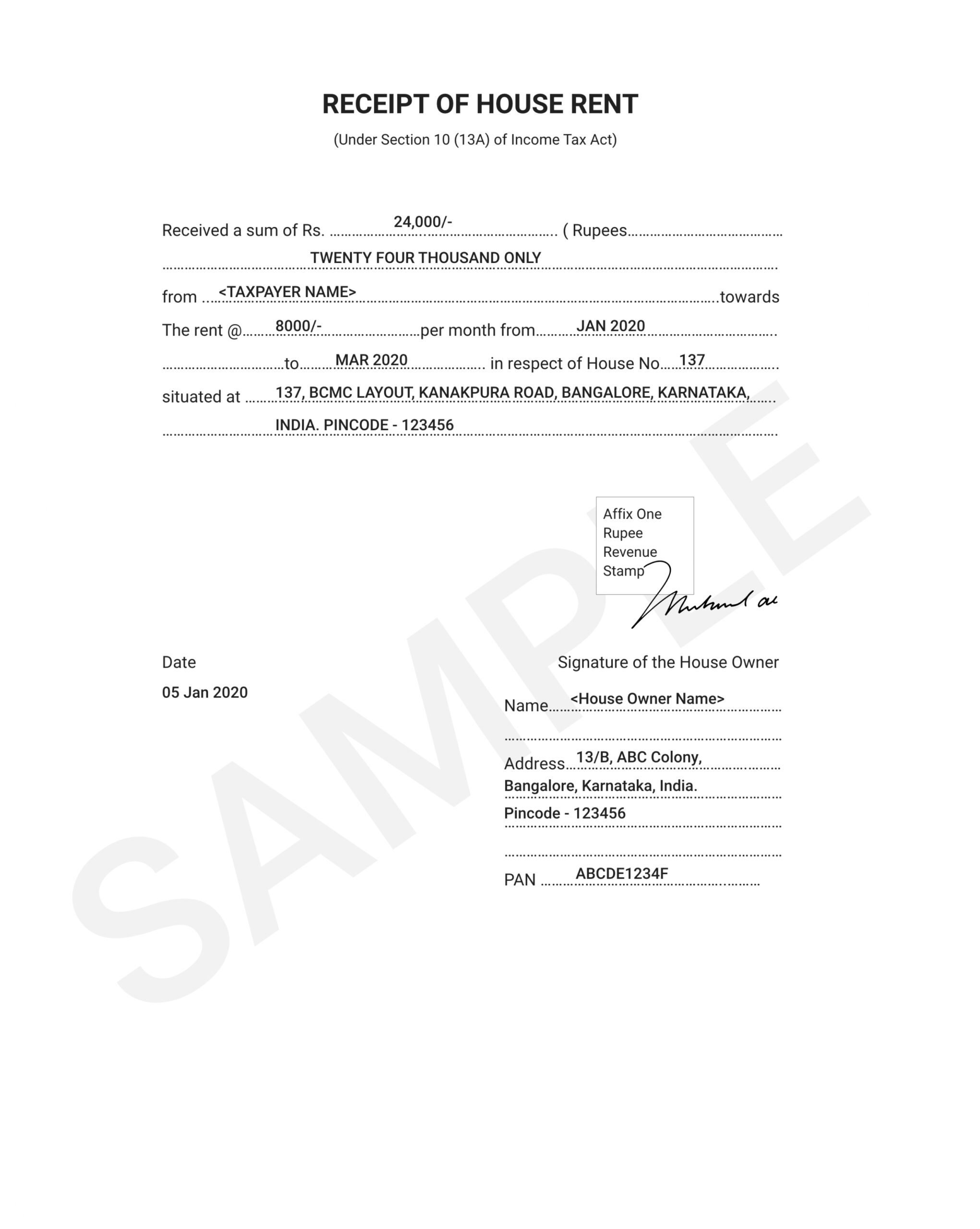

Receipt of house rent format

Customisable rent receipt templates

Rent receipt format

(Under Section 1 (13-A) of Income Tax Act)

Received a sum of Rs. (in figure)____________________________ (Rupees_________(in Numbers)_______ ________________________________________________________________________

Towards the rent @____________________ per month from ___________________ to __________________ in respect of House No.____________________________ _________________________________________________ situated at ____________

_______________________________________________________________________

(Affix Revenue Stamp of Rs.1/-)

Date: Signature of the House Owner

Name:

Address: _____________________

______________________________

______________________________

Read more about rent receipt and HRA exemption

Rent receipt sample

Here is the basic template of rent receipt.

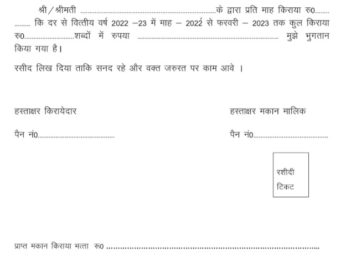

Rent receipt Hindi sample

Here is the basic template of rent receipt in Hindi:

Click here to download rent receipt sample PDF

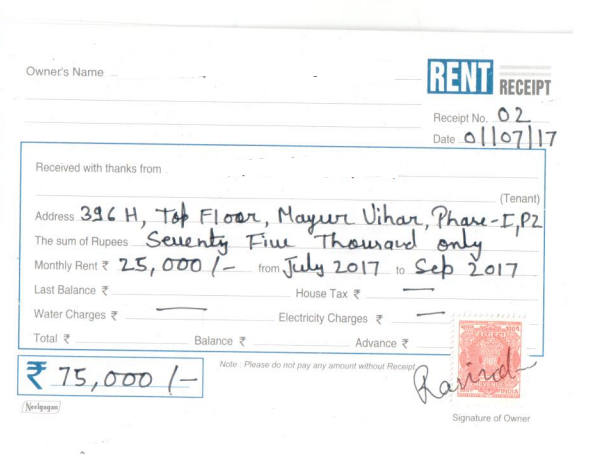

Rent receipt format (filled)

Also read about rent receipt and tax benefits

Details in rent receipt

- Name of tenant

- Name of landlord

- Monthly/quarterly/yearly rent

- Signature of the tenant

- Signature of the landlord

- Address of the rented property

- Revenue stamp if the cash payment is more than Rs 5,000 per receipt

- PAN card of landlord, if your annual rent payment exceeds Rs 1 lakh or Rs 8,300 monthly

- Date

- Receipt number

- Period covered

When is rent receipt needed?

It is mandatory to provide the rent receipt to your employer if you want to claim HRA for rental accommodation with a monthly rent payment of over Rs 3,000. Those paying rent to their parents must also provide rent receipts as proof of payment in order to claim HRA deduction.

What is the value of the revenue stamp used on the rent receipt?

Re 1 revenue stamp is used on each rent receipt.

Rs 1 revenue stamp for rent receipt

Is giving landlord’s PAN necessary?

Only those tenants have to provide PAN of the landlord who are paying a monthly rent of Rs 8,333 or Rs 1 lakh per year.

Is giving PAN card photocopy necessary?

Yes, aside from quoting the landlord’s PAN, you will also have to provide a self-attested copy of his PAN along with the rent receipt.

When do I have to submit rent receipt?

Your employer will ask you to submit the rent receipts before the end of the financial year, typically between January and March. Even if you are paying your rent through credit card or other online money transfer channels, you need to procure rent receipts from your landlord and submit the same to your employer to claim HRA deductions.

Are monthly rent receipts needed?

No, rent receipts can be submitted for an entire quarter i.e. for 3 month period, for half-yearly period or for an annual period according to the financial year. Remember that for income tax purposes, expenses are considered on a financial year basis and not the calendar year basis.

What if I fail to submit rent receipts to my employer?

In case you fail to submit rent receipts on time, your employer will deduct the entire amount taxable as TDS according to your tax slab. However, you can claim HRA exemption in your ITR. For this, you will need to calculate the exempt HRA amount manually.

Digital rent receipts for easy record-keeping

Tenants don’t have to go the old way to buy rent receipts from vendors. These days, online service providers offer the facility to generate digital rent receipts online. Using the Housing Edge app, for instance, landlords and tenants can easily generate rent receipts free of cost.

Automated rent receipt generation

To save time and energy, tenants can opt for automated rent receipts on online platforms like Housing Edge. All you have to do is provide the basic details and the rent receipt will be generated in a matter of minutes.

Eco-friendly paperless rent receipts

Your little efforts go a long way in saving the planet. With digital rent receipts, you are helping save the trees by not wasting paper.

Mobile app for rent receipt management

Housing.com app is among the opt used online rent receipt generating platforms in India. Using this facility, you can generate rent receipts in minutes.

FAQs

Can rent receipt be generated online?

Yes, tenants can generate receipts online for free, using online rent receipt generators on various platforms

Are online copies of rent receipt valid?

Yes, if the rent receipt carries all the information and signature of the landlord, it can be submitted to the employer as a soft copy.

What to include in a rent receipt?

Rent amount: The exact amount of rent must be mentioned. Rental period: The time period (e.g., month and year) that the payment covers. Date of payment: The date when the rent payment was received. Tenant name: The full name of the tenant who made the payment. Landlord’s name or property manager’s details: The name of the landlord or the managing agent who receives the payment. Payment method: How the payment was made (e.g., cash, check, transfer). Property address: The address of the rental property. Receipt number: A unique identifier for the receipt, useful for record-keeping. Signature of the receiver: The signature of the landlord or the person who received the payment.

What if the landlord refuses to give a rent receipt?

Doing so would amount to violation of tenant rights. Tenants should first request the receipt in writing and cite local laws if necessary. If the issue persists, legal advice might be needed.

Do rent receipts need to be notarised?

No, rent receipts do not need to be notarised.

| Got any questions or point of view on our article? We would love to hear from you.Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]