Salaried individuals in India are asked by their employers to give proof of previously declared investments before they go for tax deduction from their salaries. If you are living on rent and house rent allowance (HRA) is a part of your salary package, for example, you will have to submit rent receipt as proof of the expense to claim the tax deductions allowed to tenants under the Income Tax (IT) law in India.

Under Section 80GG and Section 10 (13A), you can claim the least of the following in lieu of the house rent they pay:

- Rs 5,000 per month or Rs 60,000 per annum

- 25% of gross total income

- Actual rent paid minus 10% of the gross total income

However, to get this benefit, submission of rent receipt is necessary. In this article, discussed in detail are the various components of rent receipts, also known as house rent receipt. We will also discuss the process to generate rent receipt PDF or House rent receipt PDF.

What is rent receipt?

Rent receipts act as a proof of the monthly rent you pay to your landlord. In most cases, you have to ask your landlord to provide you with rent receipt once you have made the payment.

Rent receipt format

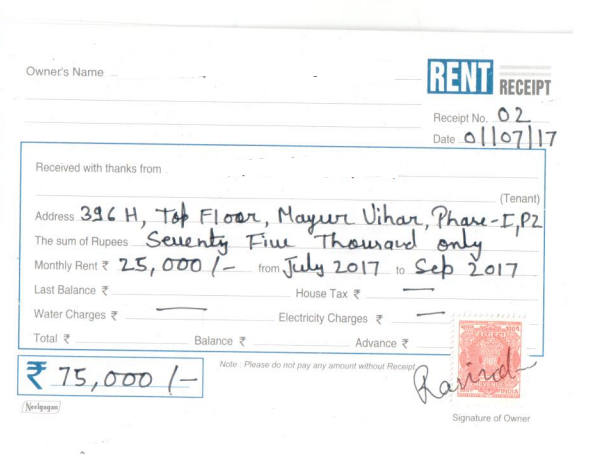

Here is the basic template of rent receipt.

Rent receipt format (filled)

See also: Know all about lease vs rent

Details in rent receipt

- Name of tenant

- Name of landlord

- Monthly/quarterly/yearly rent

- Signature of the tenant

- Signature of the landlord

- Address of the rented property

- Revenue stamp if the cash payment is more than Rs 5,000 per receipt

- PAN card of landlord, if your annual rent payment exceeds Rs 1 lakh or Rs 8,300 monthly

- Date

- Receipt number

- Period covered

Rent receipt: Why do you need them?

To allow you exemption on house rent allowance which is typically a part of one’s salary package, your employer will have to collect proof of rent payment from you. That is where a rent receipt comes into play. Rent receipts are the documentary proof that you have spent a certain amount from your salary, to bear the expense of living in a rental accommodation. Your final tax liability will be calculated, keeping in view your rent receipt. Your TDS will also be adjusted in a way that you do not have to pay tax on HRA.

See also: Know all about tax on rental income

Is it necessary to put revenue stamp on rent receipt?

If monthly rent is below Rs 5,000, there is no need for a revenue stamp even if the rent is paid in cash. But, if your monthly rent paid in cash and it is more than Rs 5,000, you have to affix a revenue stamp on the rent receipt and get it duly signed by the landlord. You also need not affix the revenue stamp on the rent receipt if the rent has been paid in cheque.

Rent receipt and HRA calculation

Your employer would demand rent receipt every financial year to calculate your tax liability and claim deductions on your behalf if HRA is part of your salary. Your employer will ask you to submit the rent receipts before the end of the financial year (March of that year). Even if you are paying your rent through credit card or other online money transfer channels, you need to procure rent receipts from your landlord and submit the same to your employer to claim HRA deductions.

Also read about the importance of revenue stamp on rent receipt

The tenant will have to share the rent receipts with his employer to claim HRA exemption, if he pays a monthly rent in the excess of Rs 3,000. In case of lower monthly rent, they need not submit the receipts. It is also pertinent to mention here that you do not have to submit the rent agreement, for claiming the HRA benefit, since the tax law does not state that specifically. However, the tenancy will not be valid, until a rent agreement has been signed and executed between the landlord and the tenant.

See also: Everything you need to know about rent agreements

What if you don’t submit the rent receipt?

Since rent receipts as a proof of the payment, non-submission will result in tax deduction from your salary.

Fake rent receipt

To save taxes, tenants sometimes resort to submitting fake rent receipts. This can however be extremely problematic, considering the taxmen in the recent years have increased scrutiny on income tax proofs. In case you submit fake rent receipts, the IT Department may send a notice seeking valid documents, initiate scrutiny, or cancel the HRA exemption. If the income is under-reported, the department can levy a penalty of up to 200% of the tax applicable on the income misreported.

What is HRA?The HRA is the tax concession given to employees for what they pay towards accommodation, every year. For the purpose of HRA claim, your salary will include only the basic salary and dearness allowance (DA) component.

Extent of HRA claimUnder Rule 2A of IT Act 1962, the HRA can be claimed as the minimum of HRA received from the employer or 50% of the salary for employees living in metros (40% elsewhere) or actual rent paid minus 10% of the salary.

HRA calculation exampleSuppose your basic salary is Rs 30,000 per month and you pay a rent of Rs 10,000 per month in Mumbai. Your employer offers you an HRA of Rs 15,000 per month. The tax benefit will be: * HRA = Rs 15,000 * Rent paid less 10% of basic salary = Rs 10,000 – 3,000 = Rs 7,000 * 50% of basic = Rs 15,000 Thus, the HRA will be Rs 7,000 and the remaining Rs 8,000 will be taxable. See also: All about HRA calculation & HRA exemption . Also read how to claims tax deduction under 80GG is HRA is not part of your salary.

|

See also: Know more about income tax on cooperative housing society

Who can claim HRA?

You can claim deductions if you live in a rented accommodation and HRA is part of your salary. Those living in rented accommodations can avail of HRA exemptions to save tax under Section 10 (13A) of the IT Act, if they are salaried individuals. Self-employed professionals are offered HRA tax deduction under Section 80GG of the law.

See also: Income tax benefits on house rent

Components of a valid rent receipt

Rents receipts must include these information to be valid:

- Name of the tenant

- Name of the landlord

- Address of the property

- Rent amount

- Rent period

- Medium of rent payment (cash, cheque, online payment)

- Signature of the landlord

- Signature of the tenant

- Revenue stamp, if the cash payment is more than Rs 5,000 per receipt.

- PAN details of the landlord, if your annual rent payment exceeds Rs 1 lakh or Rs 8,300 monthly.

Rent receipt: Period

Your employers would ask you to submit rent receipt in batches of three months.

Online rent receipt generators

Today, there are various virtual service providers like the Housing Edge platform that help your to generate rent receipt online free of cost. All you have to do is to visit these portals, provide the required information and generate free online rent receipts. In our next section, we would explain the step-wise manner in which you could generate an online rent receipt.

Steps to generate free rent receipt

Using online rent receipt generators on various platforms, tenants can generate online receipts for free by following these simple steps:

Step 1: Go to the desired platform. Click on the rent receipt generator tab. The first page that appears will ask you to provide the tenant’s name and the rent amount. Hit the ‘continue’ button to proceed.

Step 2: Now provide the landlord’s name, the full address of the rented property and the landlord’s PAN details (optional). Hit the ‘continue’ button to proceed.

Step 3: Fill in the period for which the receipts have to be generated. Hit the ‘continue’ button to proceed.

Rent receipt PDF

Step 4: The next page will give you a preview of the receipt. After ensuring that every detail in the preview is correct, you could hit the ‘print’ button to get copies of the rent receipts on the final screen. You can also download the rent receipt PDF to your device.

House rent receipt and HRA benefits: Key points to consider

Ownership: You should not be the owner, either sole or co-owner, of the property for which you are paying rent and claiming HRA. This is why those living in the homes of their parents are allowed to claim HRA benefits, as long as they are paying a rent to their parents and the same is reflected in their salary outgoing.

Period covered: To calculate the extent of the exemption that you can claim, your salary will only be considered for the period for which you have paid the rent. No HRA tax benefit can be claimed, if the rent paid does not exceed 10% of the salary for the relevant period.

Rent receipt period: Submitting rent receipts for each month is not mandatory. It could be done on a quarterly, half-yearly or an annual basis. However, the receipts for all the months for which you are claiming HRA must be submitted with the employer.

Rent payment mode: You can pay the rent through any medium, including cash payments, since there are no specifications on rent payments so far. You only have to collect the rent receipt from your landlord and submit it to the employer in the soft or the document form, depending on what policy they follow.

See also: Can I claim HRA for different city?

Rent receipt with revenue stamp

Affixation of revenue stamp on rent receipt

The tenant will have to affix a revenue stamp on each rent receipt, if he has paid more than Rs 5,000 per receipt. This requirement does not arise, if the payment has been made through a cheque.

PAN details of the landlord

Apart from his PAN details, you may also have to provide a copy of your landlord’s PAN card while filing your returns. This becomes mandatory, only when the annual rent amount is over Rs 1 lakh and exceeds Rs 8,300 monthly. In case you fail to do so, you will not be able to claim HRA and tax will be deducted accordingly.

Shared accommodation

In case you are sharing the property with another tenant who is also bearing the rental expenses, the HRA deduction for you would be provided only to the extent of your share in the rent and not for the entire amount.

Soft copies or hard proof

While soft copies of the rent receipts are also accepted by some employers, others might insist on actual receipts.

Misinformation

Any wrong information in the rent receipt would amount to it becoming null and void.

Direct HRA claim

You can claim HRA exemption directly from the IT department at the time of filing the IT returns, in case your employer fails to do so.

See also: All you need to know about the Draft Model Tenancy Act 2019

FAQs

What proof do I have to provide to claim HRA?

Rent receipts, which mention details including tenant/landlord details, address of the property, rent amount, payment schedule, signatures of the parties and the medium of transaction, act as the proof to claim HRA.

Do I have to give rent receipts for every month to claim HRA from my employer?

Rent receipts could be provided on a quarterly, half-yearly or an annual basis.

What if my landlord does not have a PAN card?

In case the landlord does not have a PAN card and charges over Rs 1 lakh as annual rent, he will have to provide a written declaration, along with the duly filled Form 60. The tenant can then submit these documents to his employer, to claim HRA deductions.

Should I include rent receipts while filing ITR?

Rent receipts must be submitted to the employer to claim a house rent allowance deduction.

What is the value of the revenue stamp used on the rent receipt?

Re 1 revenue stamp is used on each rent receipt.

Is giving landlord PAN necessary?

Only those tenants have to provide PAN of the landlord who are paying a monthly rent of Rs8,333 or Rs 1 lakh per year.

An alumna of the Indian Institute of Mass Communication, Dhenkanal, Sunita Mishra brings over 16 years of expertise to the fields of legal matters, financial insights, and property market trends. Recognised for her ability to elucidate complex topics, her articles serve as a go-to resource for home buyers navigating intricate subjects. Through her extensive career, she has been associated with esteemed organisations like the Financial Express, Hindustan Times, Network18, All India Radio, and Business Standard.

In addition to her professional accomplishments, Sunita holds an MA degree in Sanskrit, with a specialisation in Indian Philosophy, from Delhi University. Outside of her work schedule, she likes to unwind by practising Yoga, and pursues her passion for travel.

[email protected]