Property tax is levied by the state government from a property owner. It should be paid to the local government or the municipal corporation in the area where property is located. The amount received adds to the municipal corporation’s revenue.

Agartala Property Tax

Agartala Property Tax is imposed by the Agartala Municipal Corporation. If your property falls under the jurisdiction of the Agartala Municipal Corporation, you should pay the property tax by June 30 every year. This is one of the biggest sources of income for the municipal corporation and used in providing facilities including supply of water, electricity, and social infrastructure, such as parks, public gyms, senior citizen libraries, etc.

Who should not pay the Agartala Property Tax?

Recognised educational institutions should not pay the Agartala Property Tax. Freedom fighters are also exempted from paying the property tax. Additionally, a 10% rebate will be offered to families of ex-servicemen, defence person, and freedom fighters.

How is the Agartala Property Tax calculated?

The Agartala Property Tax is calculated based on the following factors:

- Building type — residential, commercial, or industrial

- Locality

- Age of the building

- Basement area

- Area of the building

- Occupancy type

- Market price of the property

Agartala Property Tax: Formula

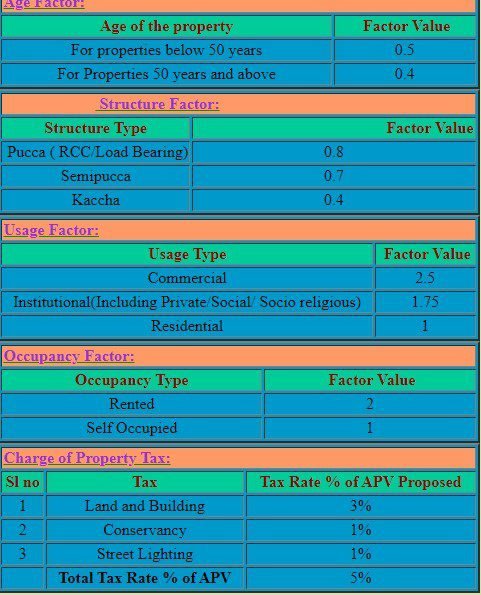

Agartala Property Tax that should be paid every year is 5% of the annual property value (APV).

APV = Plinth area (sq ft) X unit area value (Rs) X age factor X structural factor X occupancy factor X usage factor.

Agartala Property Tax: Calculator

You can access the property tax by using the Agartala Property Tax calculator available on the Agartala Property Tax portal. On https://agartalacity.tripura.gov.in/online_service, click on Citizen Corner, followed by property tax. You will reach

Click on property tax calculator.

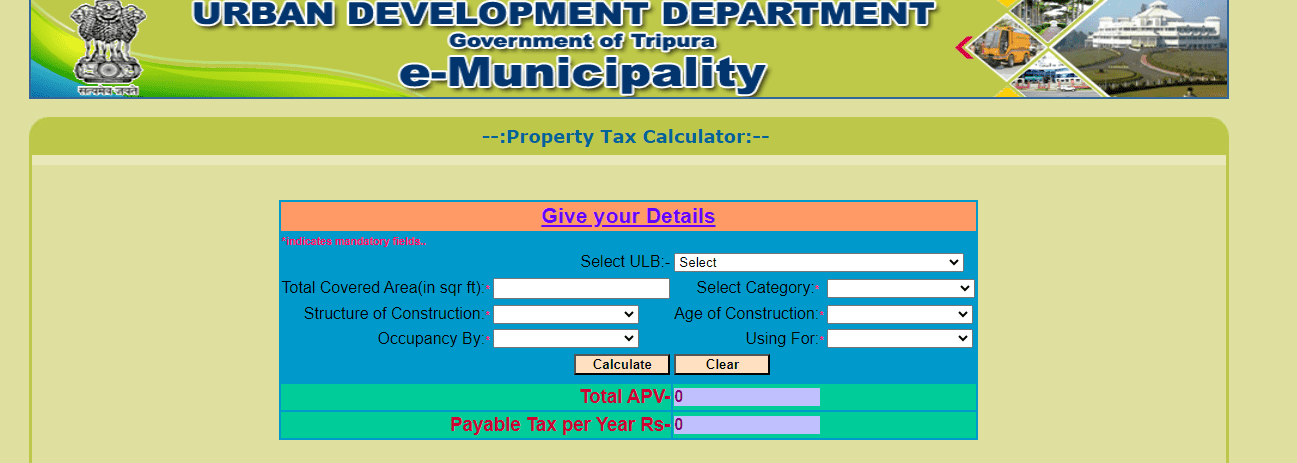

You will reach

Enter details, such as select the ULB, total covered area, category, structure of construction, age of construction, occupancy by, using for, and then click on calculate.

Multiplication factor

Agartala Property Tax: Rates

Building Type: M building

For residential: Rs. 0.60 psqf

For commercial: Rs. 1.80 psqf

Building Type: S P building

For residential: Rs. 0.50 psqf

For commercial: Rs. 1.50 psqf

Building Type: Fraim building

For residential: Rs. 0.40 psqf

For commercial: Rs. 1.20 psqf

Building Type: Katcha building

For residential: Rs. 0.30 psqf

For commercial: Rs. 0.90 psqf

How to pay the Agartala Property Tax online?

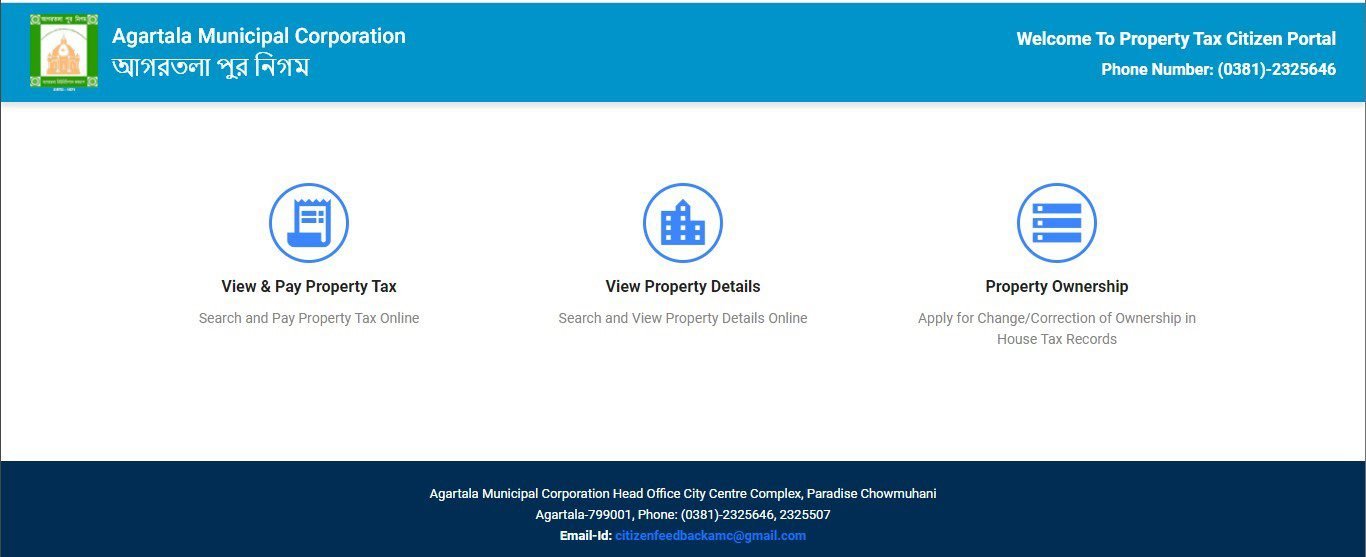

Log on to the Agartala Municipal Corporation website.

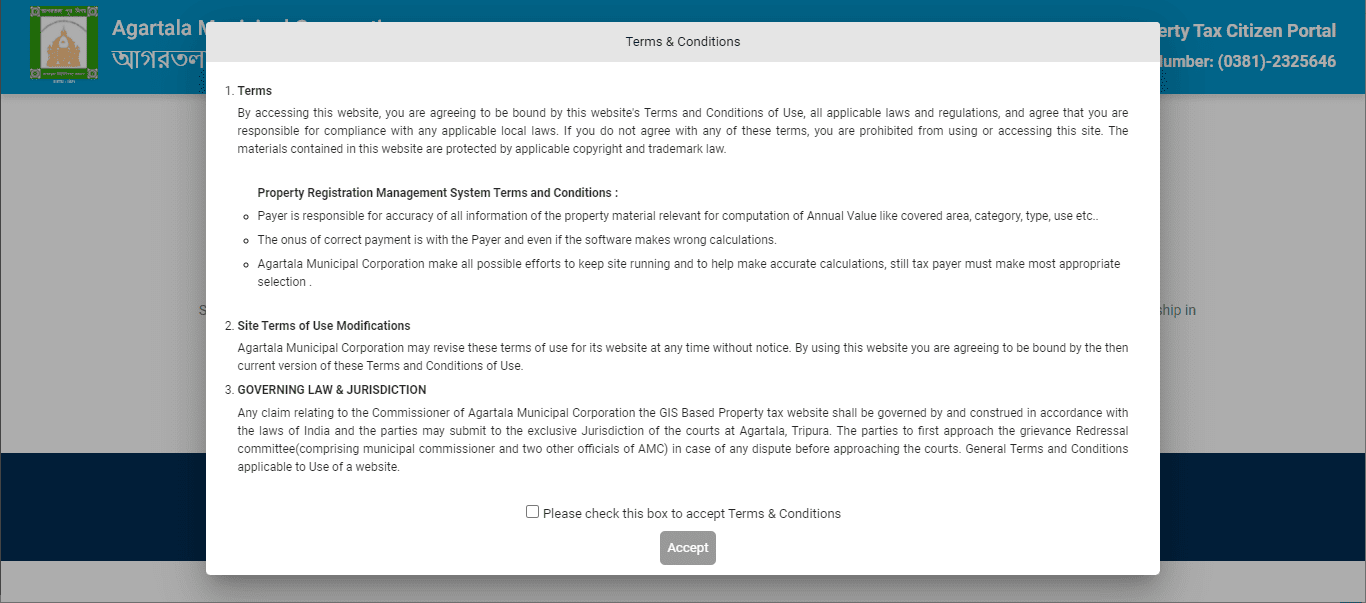

Under online services tab, click on ‘Property Tax Online Payment’ and you will reach this page.

Read terms and conditions and accept them by ticking on the box and clicking accept.

You will reach

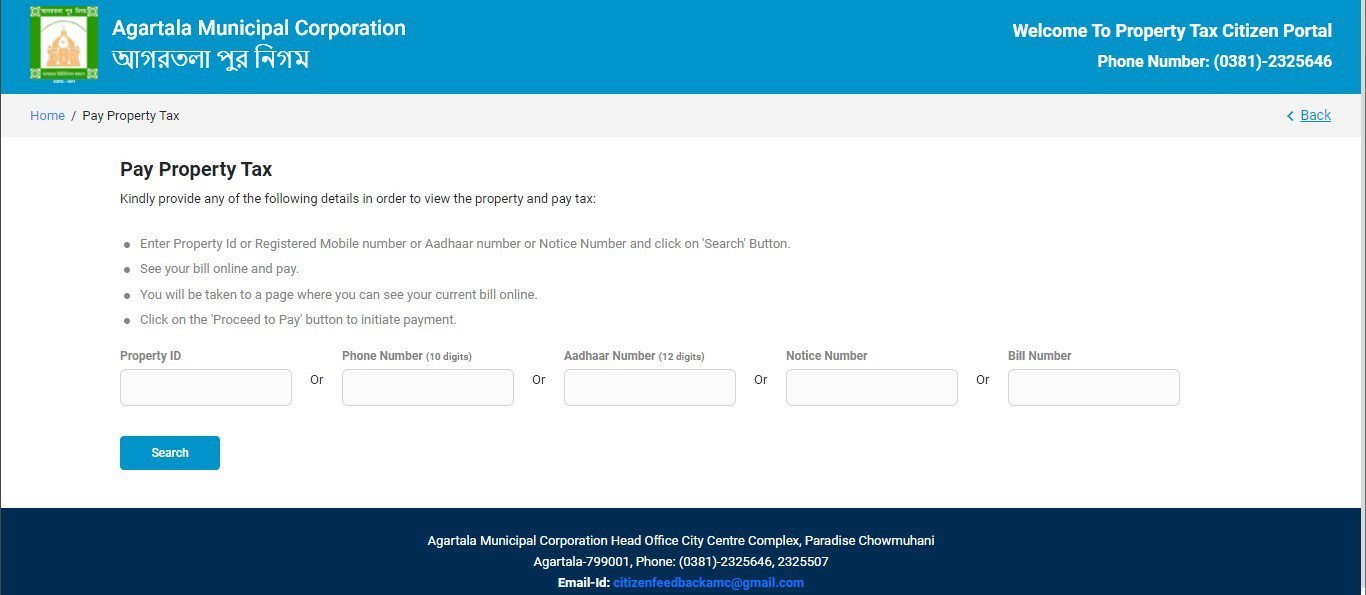

Click on View and Pay Property Tax. You will reach the following page. Enter property ID or phone number or Aadhaar number or mobile number or bill number and click on search.

You will see the Agartala Property Tax online bill. You can proceed to do the online payment.

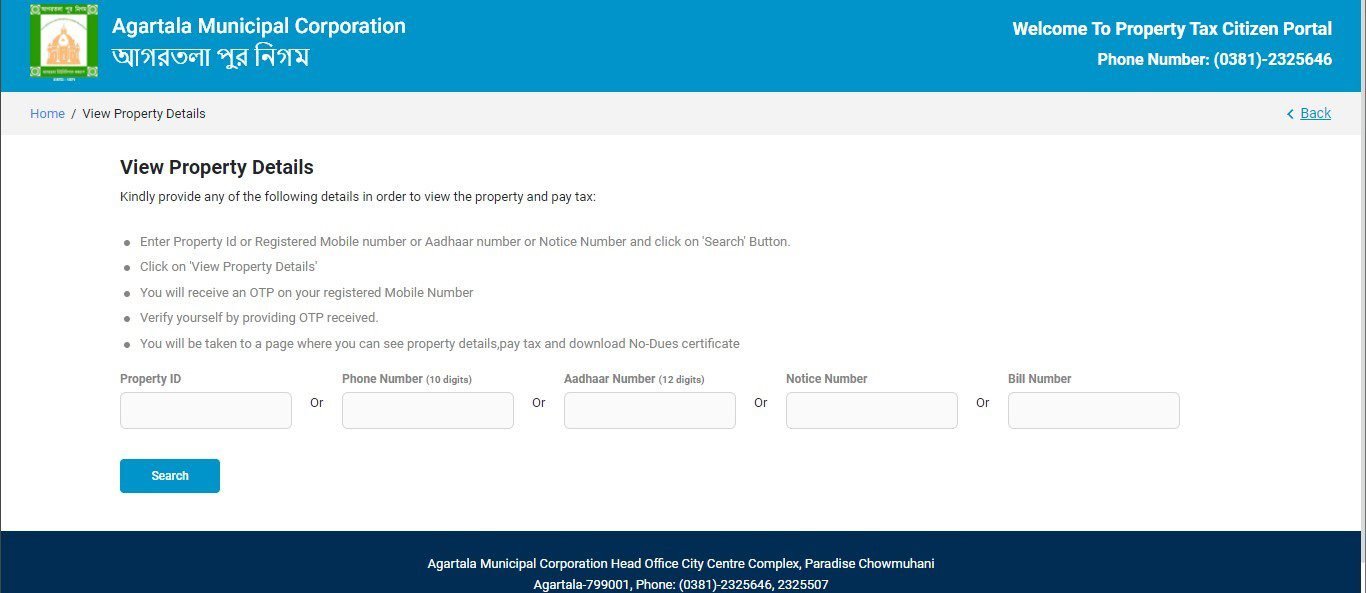

How to view property details on Agartala Property Tax?

- Enter property ID or phone number or Aadhaar number or mobile number or bill number and click on search.

- You will receive an OTP on your registered mobile number.

- Verify the OTP.

- You will reach the page, where you can see property details, pay tax, and download the no-dues certificate.

What is needed for making the Agartala Property Tax payment?

- Property identification number (PID), this number can be found in the previous property receipts.

- Ward, street, and house numbers are needed.

What are the advantages of paying Agartala Property Tax online?

- Agartala Property Tax portal is user-friendly and processes the payment as soon as it is done.

- Once the payment is made, you can also track it by checking the payment history and get all details instantly.

- Agartala Property Tax portal is end-to-end encrypted and thus the financial transaction will be safe and secure.

- You can pay Agartala Property Tax from anywhere, anytime. Also, you can avoid standing in queues in front of ward offices to make the property tax payment.

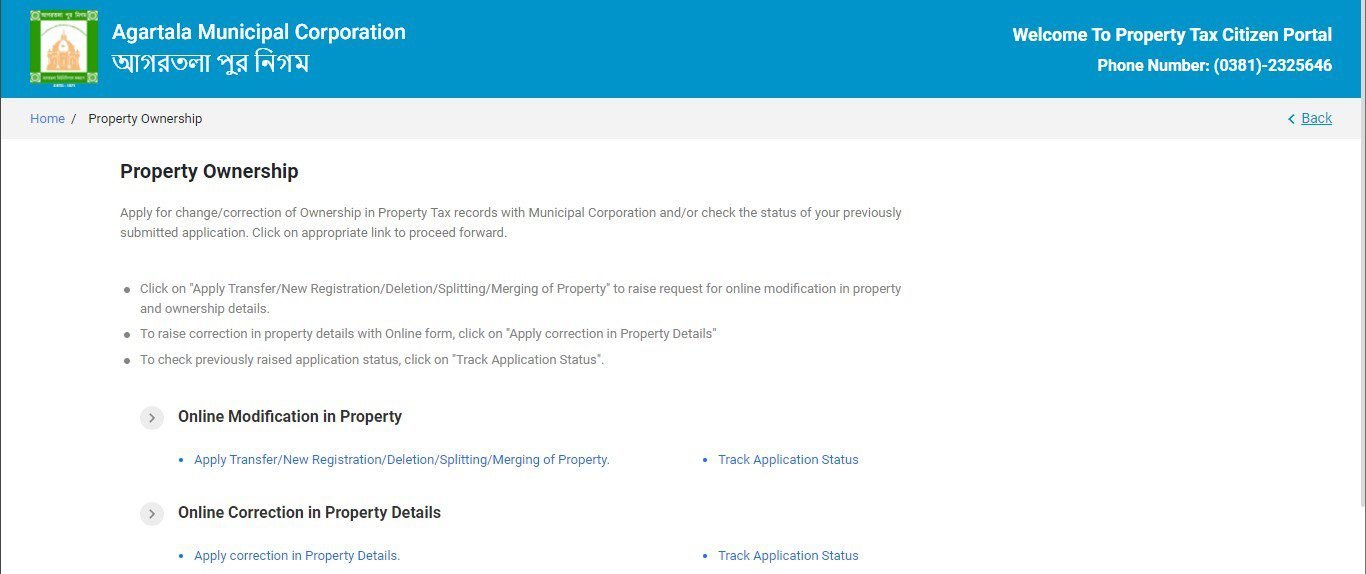

Agartala Property Tax: Change/correction in property ownership

If you want to make changes regarding the ownership in the property tax records, click on Property Ownership.

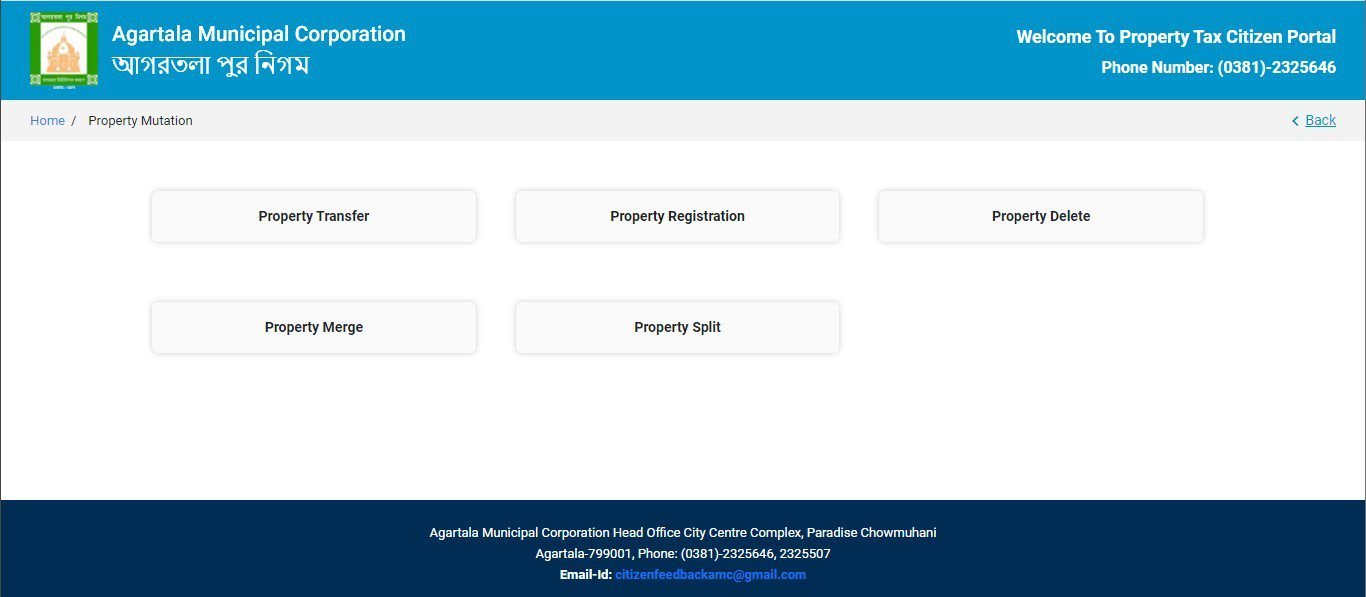

For online modification in property click on — apply transfer/new registration/deletion/splitting/merging, or property.

You will reach the following page. Click on the required service and proceed.

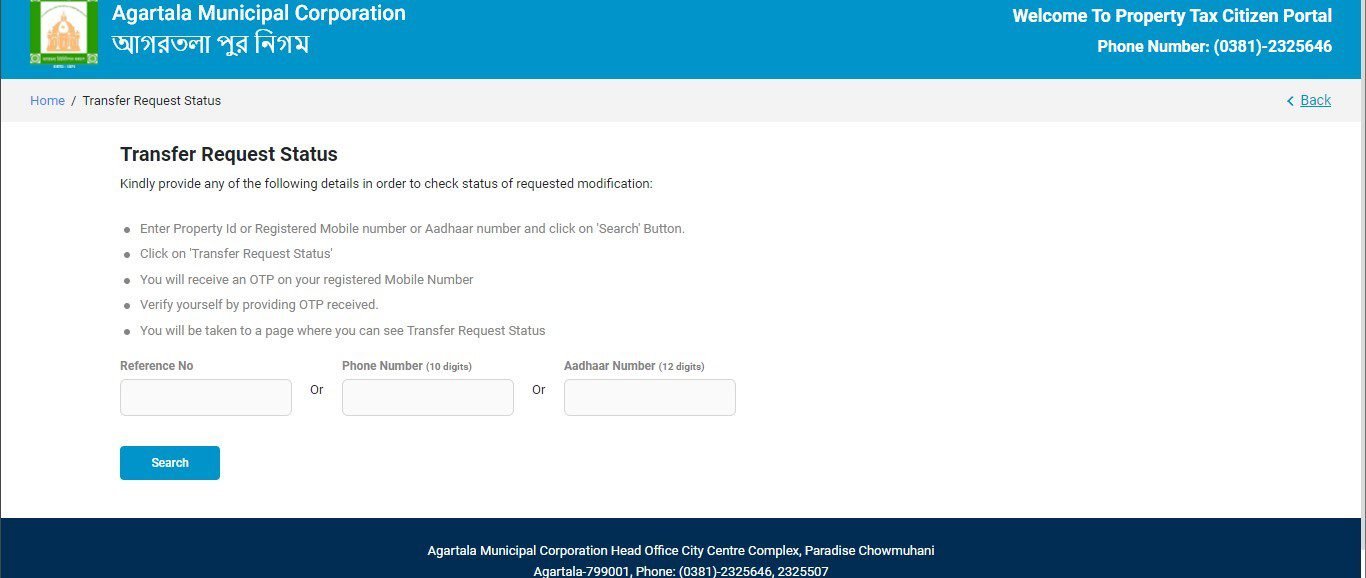

You can also track the status of the changes made by clicking on track application status and select the service required. You can enter details and track status. For example, if you have to check transfer request status, enter the reference number or phone number or Aadhaar number and click on search.

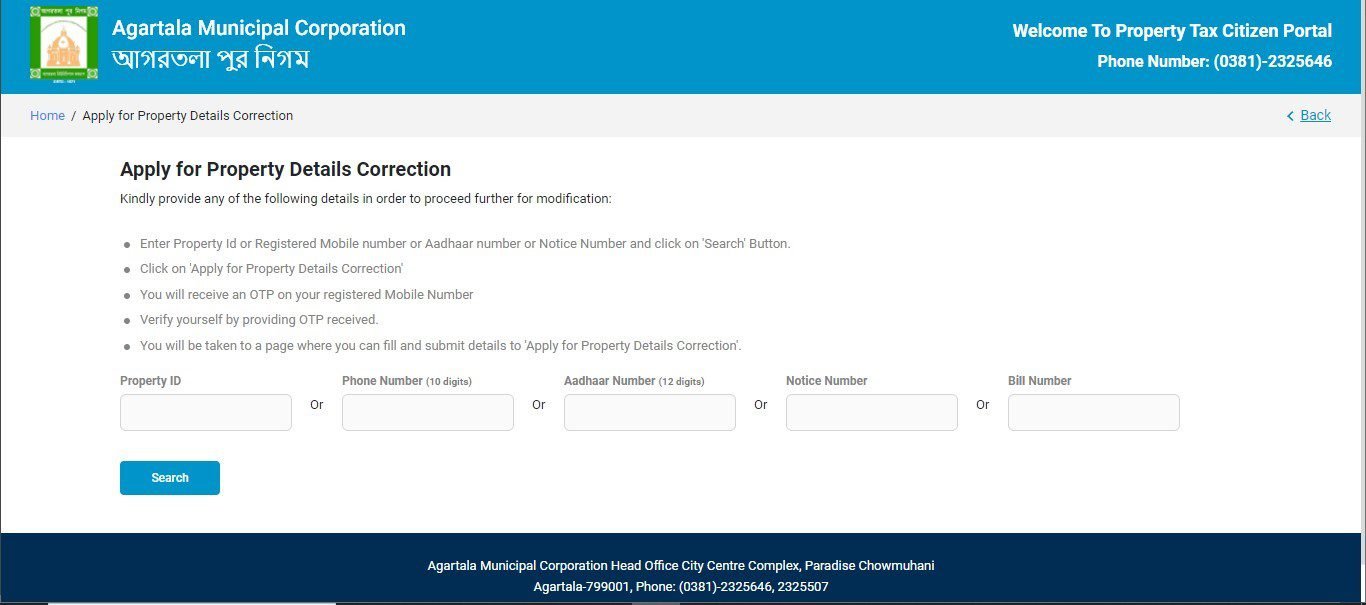

For online correction in property details click on ‘apply correction’ in property details. You will reach the following page on which by entering the details asked, you can proceed with making the correction.

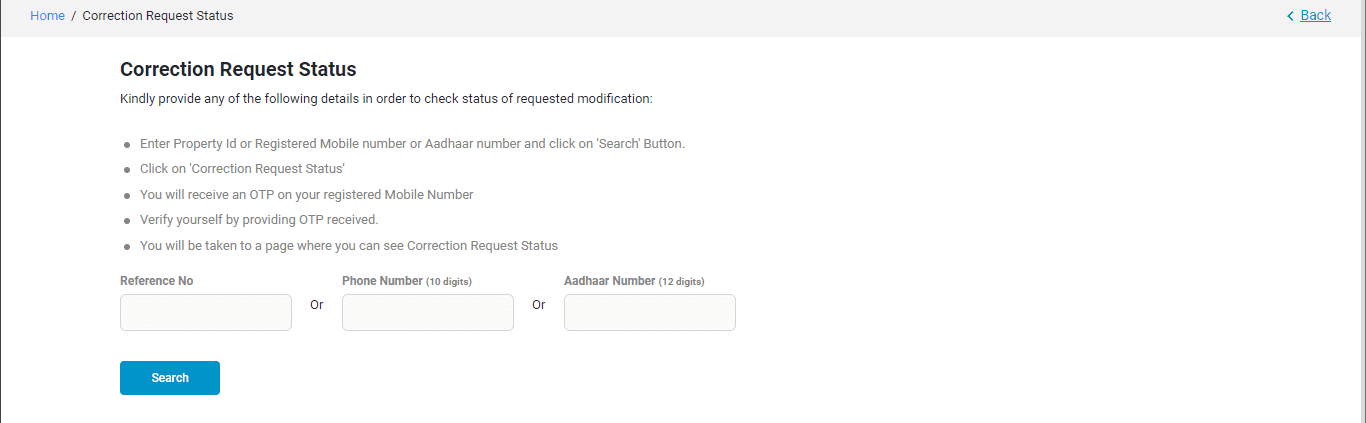

You can also check the status by clicking on ‘Track Application Status’ and entering details.

How to pay Agartala Property Tax offline?

- Visit the Agartala Municipal Corporation ward office and get Form E.

- Enter all details.

- Make the payment.

- Get the receipt for the payment made.

What is the penalty for not paying Agartala Property Tax?

Failure to pay the Agartala Property Tax will result in paying an interest of 10% per month on the property tax pending.

Agartala Property Tax: Contact Details

Agartala Municipal Corporation

Head Office

City Centre Complex

Paradise Chowmuhani

Agartala-799001

Phone: (0381)-2325646, 2325507

Email-Id: [email protected]

Agartala Real Estate

According to Housing.com, the properties in Agartala start from around Rs 500 per sqft and the average price of properties in Agartala is around Rs 6,113 per sqft. Based on these price trends, experts believe that both buying and selling properties here will beneficial. Check out property rates in detail in Agartala here.

FAQs

What are the various ways to pay the Agartala Property Tax?

You can pay Agartala Property Tax online and offline.

Who are exempted from paying the Agartala Property Tax?

Certain educational institutions and freedom fighters are exempted from paying the Agartala Property Tax.

What is the rebate offered on property tax for families of servicemen, defence person, and freedom fighters?

A rebate of 10% is offered to families of servicemen, defence person, and freedom fighters.

Should you pay the Agartala Property Tax annually?

Yes, you should pay the Agartala Property Tax annually. It has to be paid by June 30 every year.

What is the rate of property tax in Agartala?

Agartala Property Tax rates depend on the type of building; it ranges between Rs 0.3 per sqft to Rs 1.80 per sqft.

| Got any questions or point of view on our article? We would love to hear from you. Write to our Editor-in-Chief Jhumur Ghosh at [email protected] |

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: [email protected]